Spring Break 2021 didn’t just dive in, it made a cannonball-sized splash for Florida hotels and other U.S. destinations.

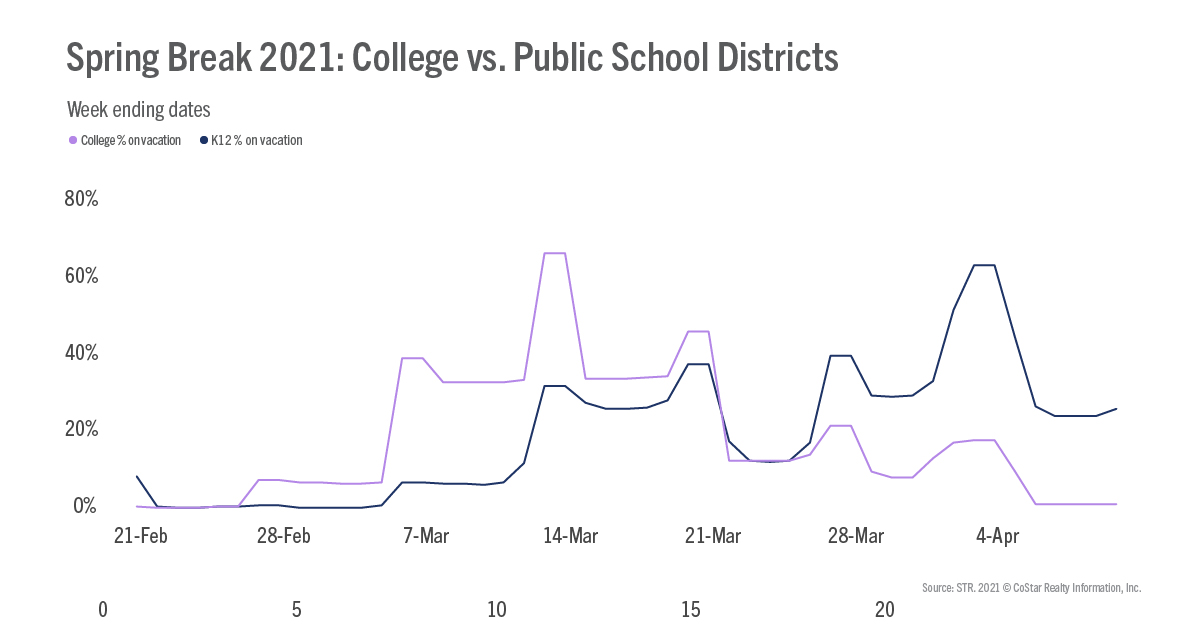

When looking at STR’s School Break Report, 39% of college students and just 7% of K-12 students were on break beginning 6 March. Despite this slightly low percentage, all signs pointed to a strong spring break period right out of the gate. The STR-defined Florida Keys market, at that point, was the only U.S. market to reach an 80% occupancy level—at 85.9% for the opening week of March. Other markets, such as Sarasota (75.4%), Fort Lauderdale (72.5%) and McAllen/Brownsville, TX (70.5%), were lower but all above the 70% mark.

The following week provided a similar percentage of students on break, but Saturday, 13 March and Sunday, 14 March, is when things really began to heat up. Those dates showed the highest percentage of college students on break at one time (66%). Concurrently, roughly 32% of K-12 students were on break for the respective dates. During the second week of March, the Florida Keys market was once again on top in terms of occupancy (88.0%), followed by Daytona Beach (86.1%).

A hotel occupancy heatwave

The week ending 20 March is when the Florida markets reached the peak of spring break. The Florida Keys once again had something to brag about—a 95.5% occupancy level. In comparison, the 2020 level for the comparable week was just 52.6%. While that might not be viewed as an achievement because last year was pandemic-affected, how about this? The 2019 level for the comparable week was 92.5%. That’s right—the market achieved a greater occupancy level than what was seen pre-pandemic. For the week ending 20 March, occupancy indexed at 103, meaning that occupancy was 103% of what it was in 2019. This is what STR defines as “Peak” when discussing recovery. The second-highest occupancy market for the week, Sarasota (91.8%), reached the same indexed comparison of 103.

The heightened occupancy and pre-pandemic milestone were surely lifted by the percentage of students on spring break for the week—college (roughly 34%) and K-12 (roughly 25%) between 15-19 March. Combine those stats with 20 March, where roughly 46% of college students and 38% of K-12 students were on break, and you have a brewing recipe for success. An added ingredient is that a large amount of both Florida college and K-12 students were on break during the period.

The short-lived, back-to-school blues

The back-to school blues, while only lasting a mere 7 days, came during the week ending 27 March when the amount of college and K-12 students on break was cut in half. This spring breaker downsize was slightly felt in both the Florida Keys and Sarasota, where occupancy came in at 91.7% and 85.7%, respectively. Florida markets still reigned supreme, as nine of the top 10 U.S. occupancy markets for the week were all within the state.

A new contender sneaks its way to the top

A new week brings new visitors, and while college spring break was dwindling, K-12 was about to reach its peak. While the college break typically falls in line with the same period each year (mid-late March), many K-12 districts follow the Easter holiday which is why we see a heightened shift later in the period.

With all eyes on Florida during spring break, an unlikely market was slowly creeping its way to the top week after week—proving that you shouldn’t put all your eggs in one basket.

Let’s begin the week ending 3 April with the obvious—the Florida Keys. After a slight decrease in occupancy, the market crept back up to a 93.8% occupancy level, followed by Sarasota (90.6%). Throughout the week, the number of K-12 students on break shifted upwards, remaining in the 30% range, but by the end of the week, the K-12 percentage hit 63%.

Now onto the next news—the third-place hotel occupancy winner. At this point, the markets had fluctuated week over week by a few percentage points and between a handful of markets. While the third-place market itself was not an unusual destination, the place it held on the occupancy charts the previous weeks made it especially noteworthy. During the week ending 13 March, Gatlinburg/Pigeon Forge, TN, held the 71st occupancy spot at 54.1%, jumping to the 15th spot during the week ending 27 March (73.4%). By the week ending 3 April, Gatlinburg/Pigeon Forge had surpassed markets that had continuously been leaders throughout the spring break period, taking over the third spot at 88.8%. By this point, the number of students on break in Tennessee had faded out, but surrounding states such as North Carolina, South Carolina, Georgia, and West Virginia were in the thick of break—showing that drive-to destinations remain a popular option among travelers.

What’s especially noteworthy is that, like previously seen in the Florida Keys and Sarasota, Gatlinburg/Pigeon Forge reached “Peak” recovery during the week of 28 March through 4 April. During the comparable week in 2019, occupancy in the market was just 77.9%. This means that when indexed to 2019, Gatlinburg/Pigeon Forge’s occupancy was 114% of what it was in 2019.

By the following week, Gatlinburg/Pigeon Forge had climbed to the second-highest occupancy spot among U.S. markets—reaching 92.3%. The market came in behind, you guessed it, the Florida Keys (93.9%). This was the last week where the School Break Report noted a significant percentage of students on break.

If this past year has taught us anything, it’s that events such as spring break can majorly impact a market—even those you might not expect, and weekend leisure trips are still a popular choice among travelers even during a pandemic. With increased vaccinations across the U.S., we are likely to see ramped up hotel performance, especially during the summer months. After drive-to destinations held the top spots during summer 2020, it will be interesting to see which markets take the crown for summer 2021.

About the School Break Report

The School Break Report features 2020-2021 calendar data for most public-school districts and traditional college students across the U.S. This report also features several innovative data visualizations which aggregate academic calendar patterns for the country as well as individual states.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.