In this Placer Bytes we dove into the QSR and sit-down sectors to analyze Bloomin’ and Yum! Brands.

Monthly Momentum for both Sectors

In order to effectively analyze the true recovery of brands from both groups, we looked at month over month data from November 2020 to March 2021 in order to break down the wider trend of recovery. And both Yum! Brands and Boomin’ Brands are certainly on strong trajectories to a rebound.

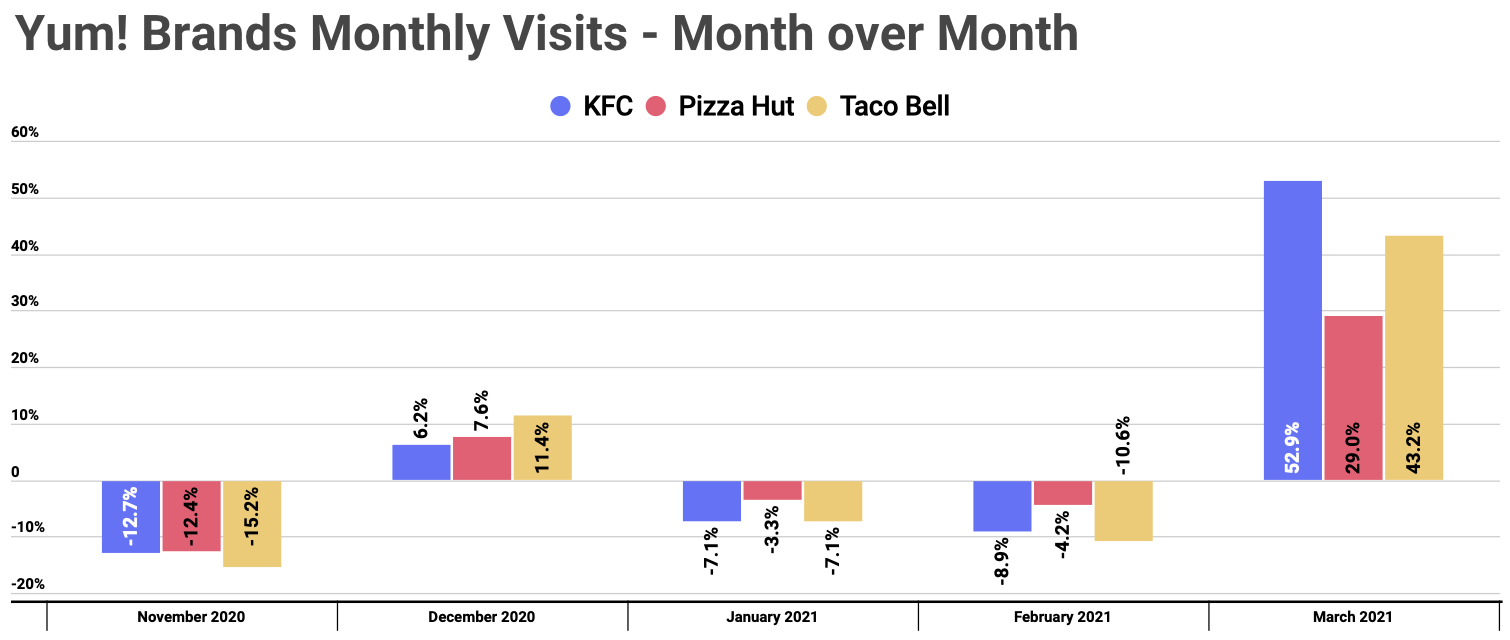

Visits for each restaurant in the Yum! Brands’s portfolio, including KFC, Pizza Hut and Taco Bell, saw month-over-month traffic rise in December before dipping in January and February. Yet, as states began to open up, visits skyrocketed in March, with KFC showing the most impressive growth at nearly 53%. The combination of improved weather and re-opening retail drove a clear and significant boost.

While these restaurants were lucky enough to remain open through a majority of the pandemic with their drive-thru and takeaway services, the massive jump in monthly traffic certainly speaks to the pent up consumer demand and the strength of the portfolio.

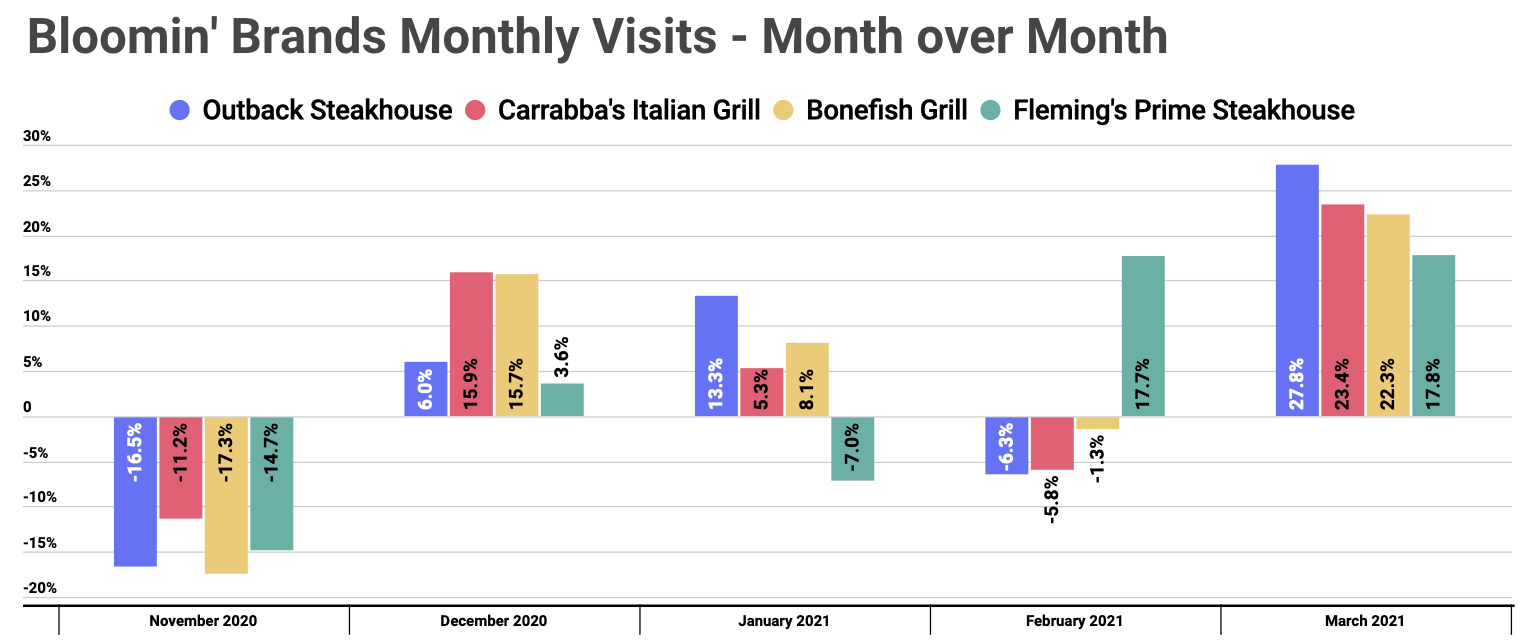

This same positive pattern held true for Bloomin’ Brands. Outback Steakhouse, arguably the most popular of the restaurants within the portfolio saw visits jump an impressive 27.8% up in March. Carrabba’s, Bonefish Grill and Fleming’s all followed suit with month-over-month growth of 23.4%, 22.3% and 17.8%, respectively.

And while this positive trajectory is important, the depths from which these brands are recovering still requires context.

Comparing to 2019

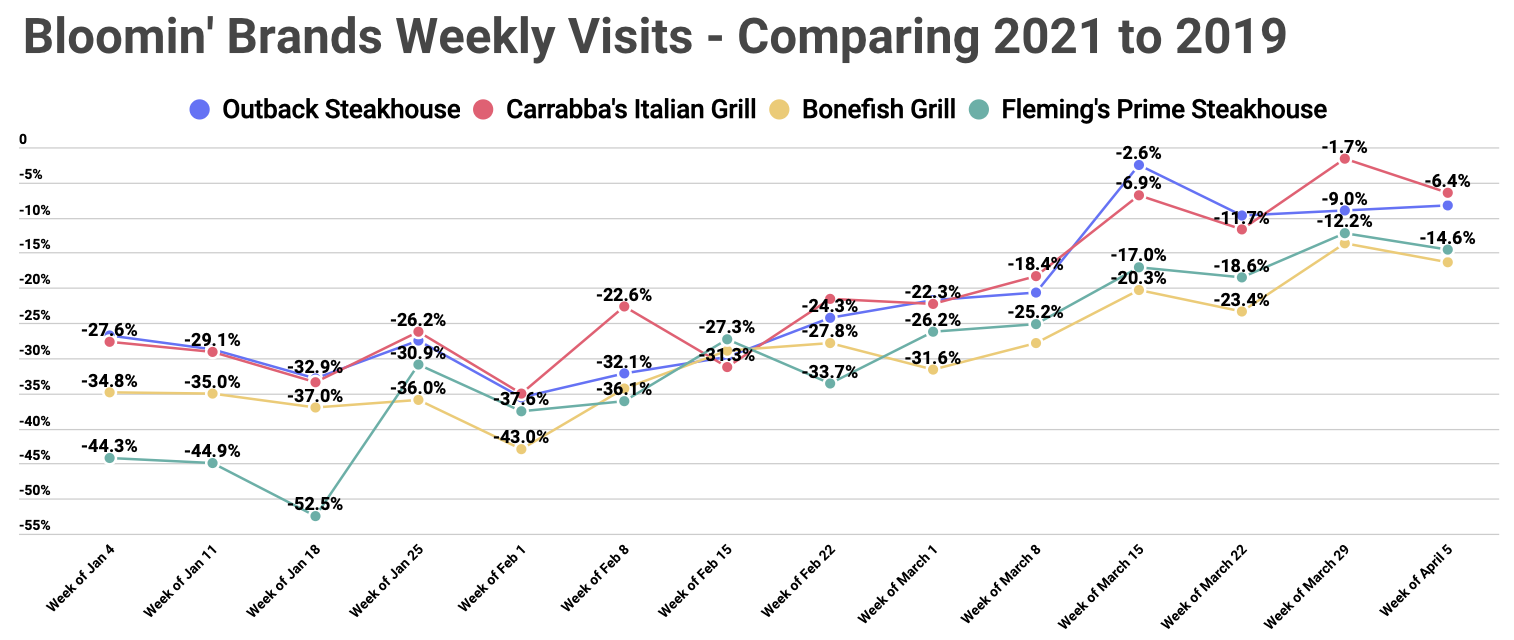

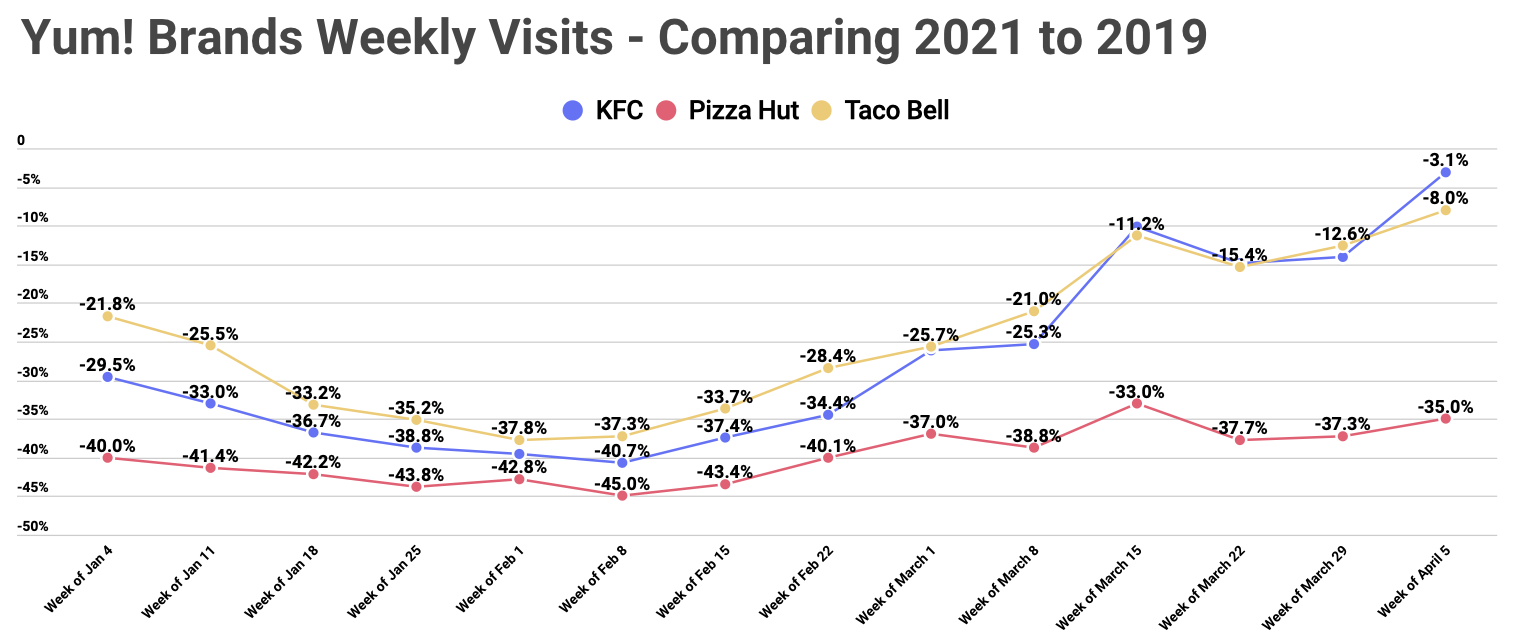

Comparing 2021 to 2019, looking at 2020 is problematic because of the depth hit, shows that the monthly boosts are truly part of a wider recovery.

Looking at the Bloomin’ Brands’s portfolio, we see that key brands were within striking distance of 2019 numbers since mid-March. Analyzing weekly visits compared to the equivalent weeks in 2019 shows that since mid-March there has been a marked and impressive decline in the visit gap. While the entire portfolio neared pre-COVID levels, Carrabba’s reached closest to growth on the equivalent week in 2019 with visits down just 1.7% for the week of March 29th and 6.4% for the week of April 5th.

And, there’s positive momentum for each brand within Yum! Brands’s portfolio, as well. KFC and Taco Bell neared pre-COVID levels with visits down just 3.1% and 8.0%, respectively for the week of April 5th, compared to the equivalent week in 2019 – jumping significantly from the week before. Traffic for Pizza Hut remained behind the other two restaurants – however this is more related to the pizza model, and even with Pizza Hut there is a positive trend moving into April.

Can these brands keep up this pace throughout 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.