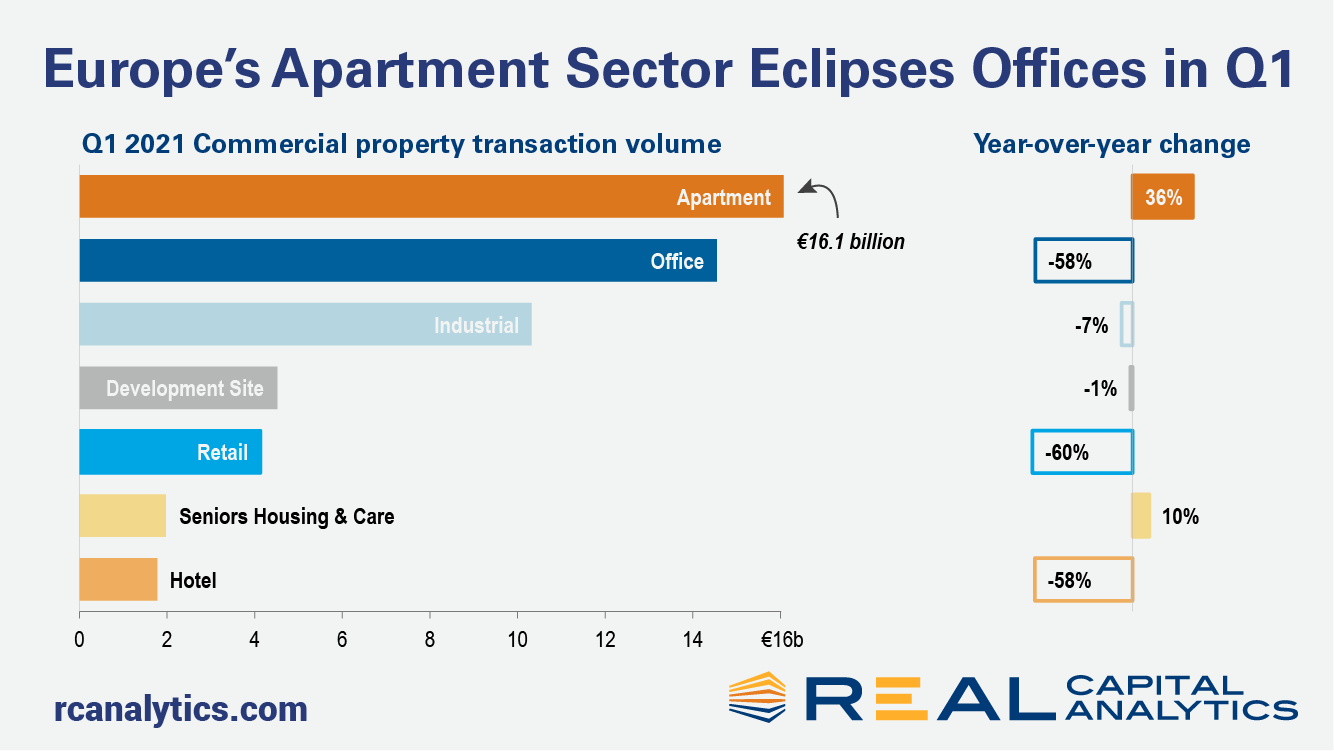

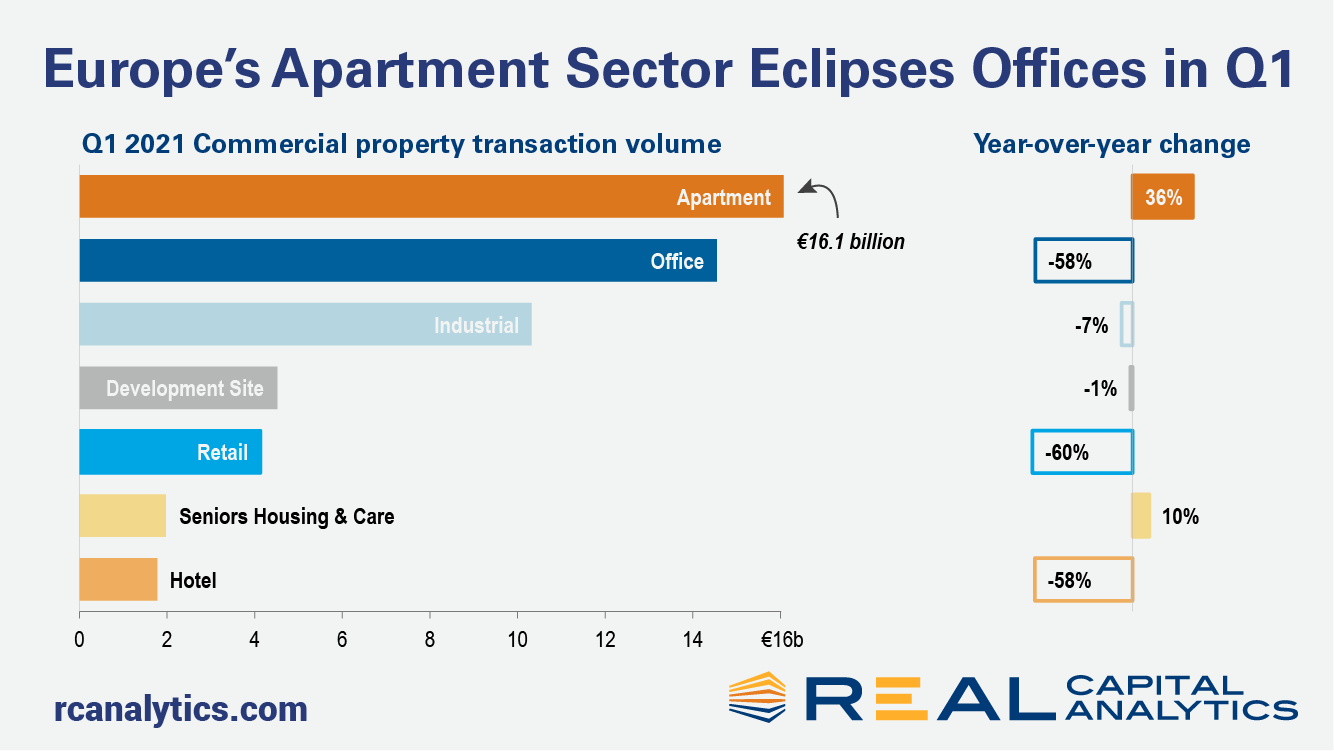

European commercial property sales sales slowed again at the start of 2021, the fourth consecutive quarter that Covid challenges have restrained the region’s largest markets, the latest edition of Europe Capital Trends shows. However, the picture for the sectors was not uniform as investors continued to plow capital into the apartment sector, which surpassed offices in quarterly deal volume.

Investment volume across all property types dropped 32% in the first quarter compared to a year ago. The apartment sector bucked the trend, with activity increasing 36% year-over-year. The industrial sector slipped just 7% while acquisitions of office and retail properties tumbled by more than 50%.

Office transaction volume comprised just 27% of the quarterly deal total, the lowest proportion on record. Together, apartment and industrial investment took their largest share of acquisition volume, Real Capital Analytics data shows.

Germany was the number one market for apartments, followed by the U.K., France and Denmark. Spending on the multihousing sector helped lift Denmark to become the fourth most active commercial property market in Europe during the first quarter, with total investment doubling from a year prior.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.