Home Price Gains Were at a 15-Year High in March

Home Price Index Highlights: March 2021

Overall HPI Growth

National home prices increased 11.3% year over year in March 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The March 2021 HPI gain was up from the March 2020 gain of 4.6% and was the highest year-over-year gain since March 2006. Low mortgage rates and low for-sale inventory drove the increase in home prices. A pick-up in construction and an increase in for-sale listings as more homeowners get vaccinated may help moderate surging home price growth.

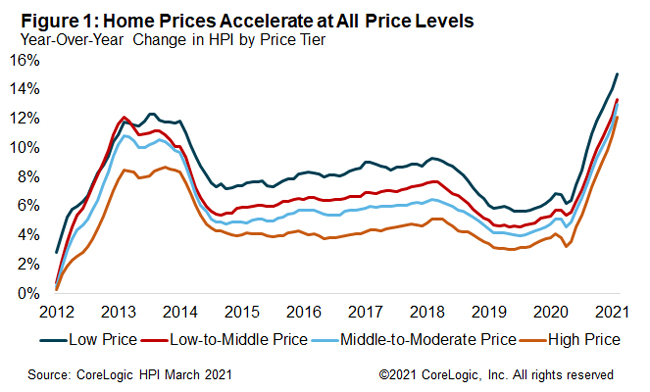

HPI Growth by Price Tier

CoreLogic analyzes four individual home-price tiers that are calculated relative to the median national home sale price[1]. Home price growth accelerated for all four price tiers to the highest rates since 2005 for the low-price tier and since 2006 for the other three price tiers. The lowest price tier increased 15.1% year over year in March 2021, compared with 13.3% for the low- to middle-price tier, 13% for the middle- to moderate-price tier, and 12.2% for the high-price tier. While in short supply, entry-level homes are in high demand by first-time buyers, leading to affordability pressures for these buyers.

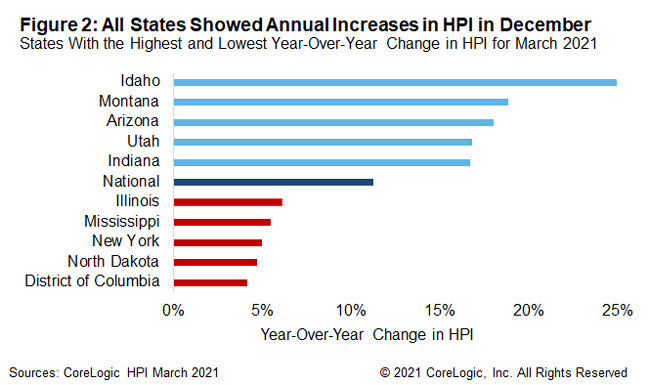

State-Level Results

Figure 2 shows the year-over-year HPI growth in March 2021 for the 5 highest- and lowest-appreciating states. All states showed annual increases in HPI in March, and Idaho was the clear leader with appreciation of 25%, double the rate of appreciation from a year earlier. Population growth and strong employment growth have been factors in the surge in home price appreciation in Idaho.

At the low end, Washington, D.C., saw a home price increase of 4.1%. The surge in home price appreciation was felt across the country, with all states showing higher appreciation in March 2021 than in March 2020.

Connecticut and Montana had the biggest acceleration in home price growth from March 2020 to March 2021. Connecticut is notable because prices increased by just 0.8% in this state in March 2020 but increased by 15.2% in March 2021. This turnaround can be partly attributed to an influx of buyers from metropolitan areas in nearby states.

Home price gains in March 2021 were the highest in 15 years, and strong gains are expected to persist for much of this year. A supply shortage of homes for sale is a major factor in the surge in HPI growth. Increases in construction and for-sale listings expected this year may moderate home price increases by early 2022. For more information on home price insights and trends, check out our latest HPI Report.

© 2021 CoreLogic, Inc. All rights reserved

[1] The four price tiers are based on the median sale price and are as follows: homes priced at 75% or less of the median (low price), homes priced between 75% and 100% of the median (low-to-middle price), homes priced between 100% and 125% of the median (middle-to-moderate price) and homes priced greater than 125% of the median (high price).

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.