With U.S. COVID cases receding and travel increasing once more, rental car firms are seeing demand sharply increase. However, having sold a larger portion of their fleets last year to generate cash, the lack of supply is now driving customer prices to record highs.

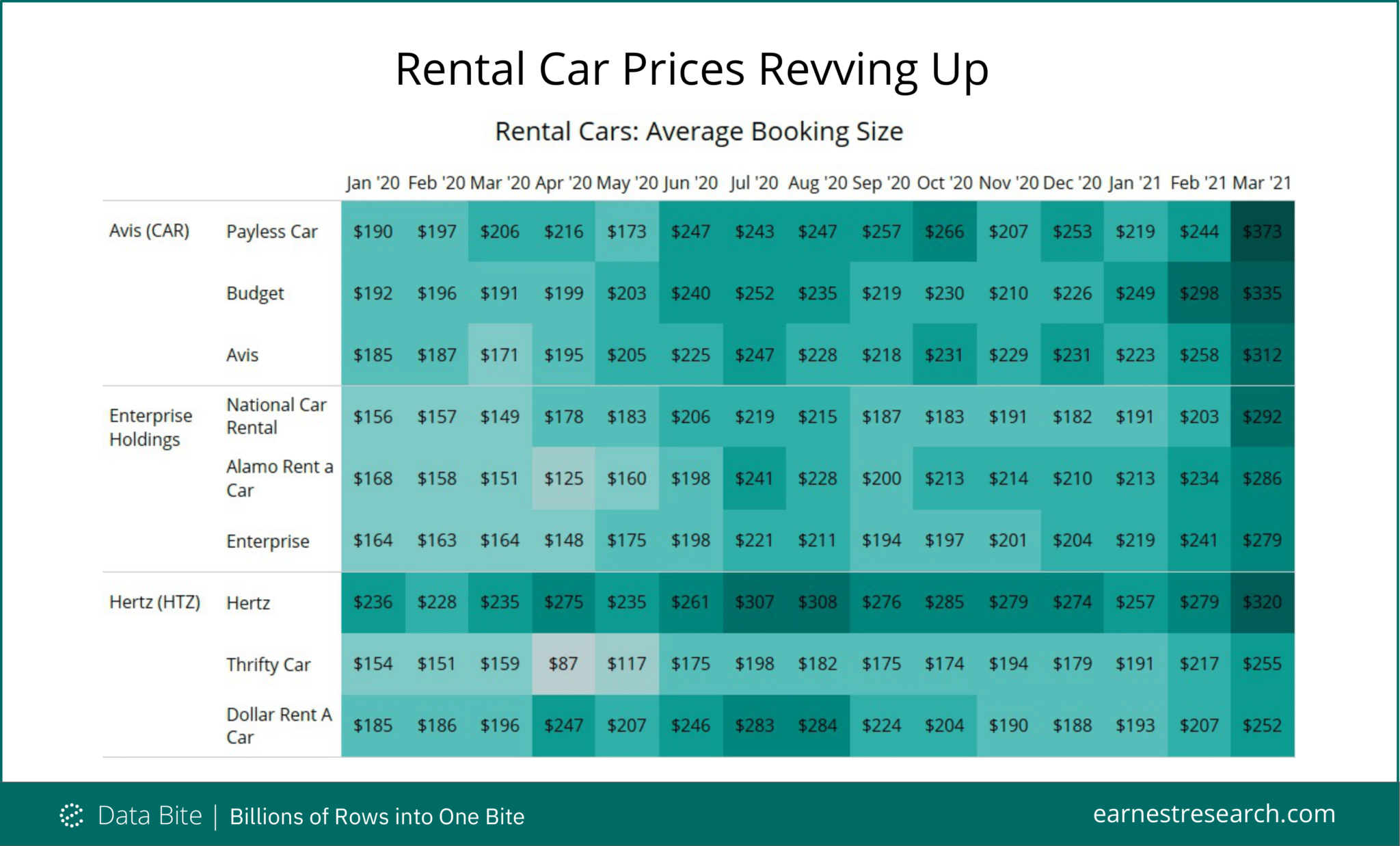

Looking at the average booking size since the beginning of last year, March this year had the highest prices we’ve seen, higher even than those seen in the peak summer months, and 30% to 80% higher than typical for this time of year.

Despite the name, Avis’s Payless Car concept saw the highest rates at $373, followed by their Budget and namesake brands $335 and $312, respectively. All three of Enterprise Holdings concepts: Enterprise, National Car Rental, and Alamo Rent a Car, each saw prices peak just shy of $300 in March. Meanwhile, Hertz’s premium namesake brand hit $320, while Thrifty Car and Dollar Rent a Car rose to ~$250.

As car manufacturers struggle with chip shortages crimping production, and with constraints in the auction markets, it will be interesting to see how these rental car companies cope as we move to peak summer driving on the open road.

Note: Data includes spend at the above car rental agencies, and does not include rental car bookings via the online travel agencies or corporate accounts/cards.

[Tickers included in this analysis: $CAR, $HTZ]

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.