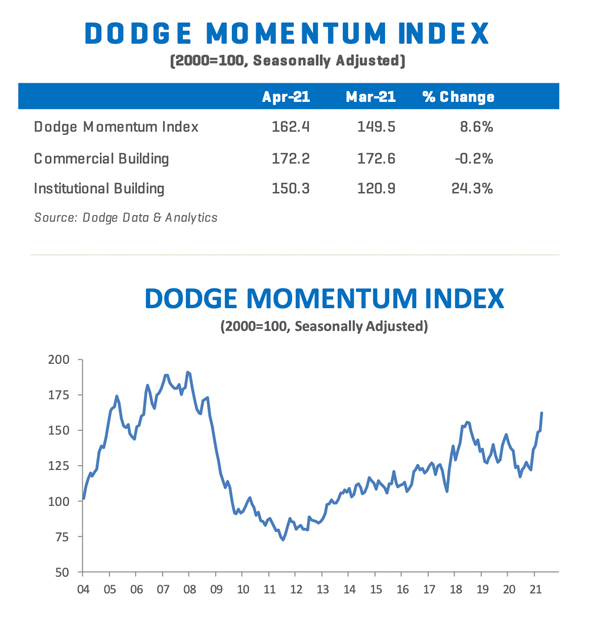

The Dodge Momentum Index posted an 8.6% gain in April, climbing to 162.4 (2000=100) from the revised reading of 149.5 in March. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. April’s gain marks the fifth consecutive monthly increase, and similar to February and March, was due to a large increase in institutional buildings entering the planning stage while commercial planning eased by less than one percent.

Since hitting its nine-year low in January, institutional planning has rebounded substantially, climbing 77% over the last three months. Healthcare and laboratory projects continue to dominate the sector, pushing institutional planning 50% higher on a year-over-year basis. Conversely, the commercial component has slipped in recent months as fewer warehouse projects have entered planning, though the sector is 21% higher than in April 2020. Overall, the Momentum Index is 31% higher than last April, which was the first full month of COVID-19 shutdowns.

There were 13 projects with a value of $100 million or more that entered planning within April. The leading commercial projects were a $400 million mixed-use office project in San Francisco CA and a $250 million warehouse project in Mesa AZ. The leading institutional projects were the $300 million first phase of The Cove JC laboratory and education facility in Jersey City NJ and a $175 million laboratory project in Boston MA.

April’s data highlights the nascent recovery underway in institutional building. However, given the average length of time between planning and project start, this rise will likely not impact construction starts until late 2021 or early 2022.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.