Stock market values have risen more than home prices, but are more volatile too

This month marks the 125th anniversary of the Dow Jones Industrial Average, a stock-value metric for 30 blue-chip U.S. companies. There are very few assets that have such a long valuation history, and fortunately single-family housing is one such asset. To commemorate the quasquicentennial, let’s compare how stock and home prices have fared over time.

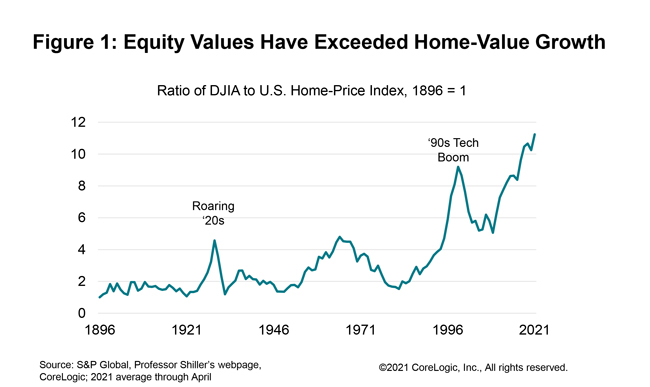

From the Dow’s inception in 1896 through 1946, the Dow and average home prices tended to move together, except during the Roaring ‘20s. Since 1946, stock market valuations have generally outpaced home price growth. (Figure 1)

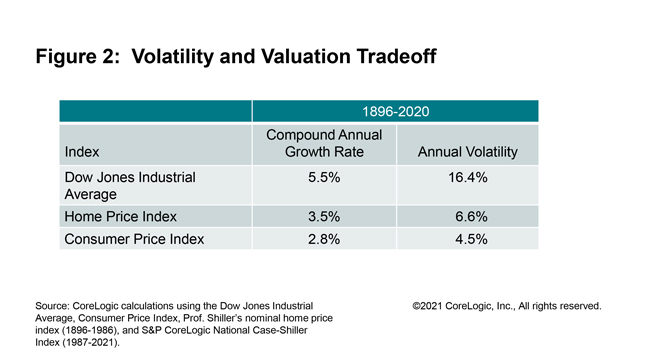

The stock market and home price trends reflect a risk and return tradeoff: assets that entail greater risk also offer the potential for greater return. Comparing the growth rate in the Dow, U.S. home prices, and the Consumer Price Index show that over long periods of time, the growth in the Dow has exceeded that of home prices, and home prices have outpaced inflation. However, the annual growth rate of the Dow has also been more volatile. The Dow has averaged at least two percentage points faster annual growth than U.S. home prices but with more than double the volatility. (Figure 2)

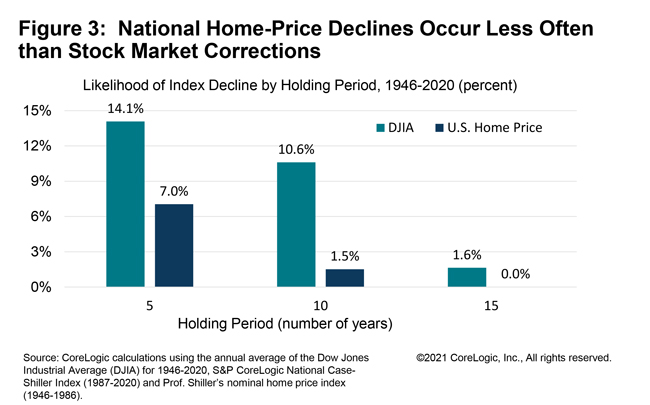

Greater volatility is reflected in larger swings up and down in the Dow compared with average U.S. home prices. The upside potential is reflected in the faster overall growth in the Dow. We can calculate value change over, say, successive 10-year time frames since 1946 to illustrate the downside risk. Ten years happens to be the median tenure of homeowners during the last generation.[1] If you owned stock for 10 consecutive years in the 30 companies that made up the Dow, based on the Dow’s experience since 1946 you have a 10.6% chance of experiencing a loss. In contrast, the odds that a U.S. home-price index would have fallen after 10 years is 1.5%. (Figure 3)

While past performance may not be a gauge of future returns, at least two outcomes are likely over the next 125 years: first, equity values will likely grow more than home prices but with more volatility, and second, housing will generally be a good inflation hedge for owners with long holding periods.

Summary:

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.