Residential Mobility Has Been Declining For Decades, Until Now

According to the Census Bureau, the United States’ annual mover rate (the percentage of people who change residence each year) had been declining since the mid-1980s, and reached its lowest point just before the COVID-19 pandemic.1 This trend may have continued if not for the sudden and rapid adoption of remote work. Remote work was gaining popularity before COVID,2 but the pandemic accelerated the trend. Our latest research shows that even after the pandemic subsides, the economy will contain significantly more remote jobs than ever before. And this newfound flexibility is getting people moving again.

To understand these new dynamics, we analyze data from Apartment List’s recent remote work survey,3 in which we asked full-time workers about changes to their working and living arrangements since the start of the pandemic. We contextualize the results by comparing them to analogous census data from years prior. We find a major spike in residential migration during the 12 months since April 2020, particularly among higher-income workers4 who have historically been least likely to move but now (thanks to the remote work revolution) are moving in droves.

High-Earners Have Long Been The Least Likely To Move

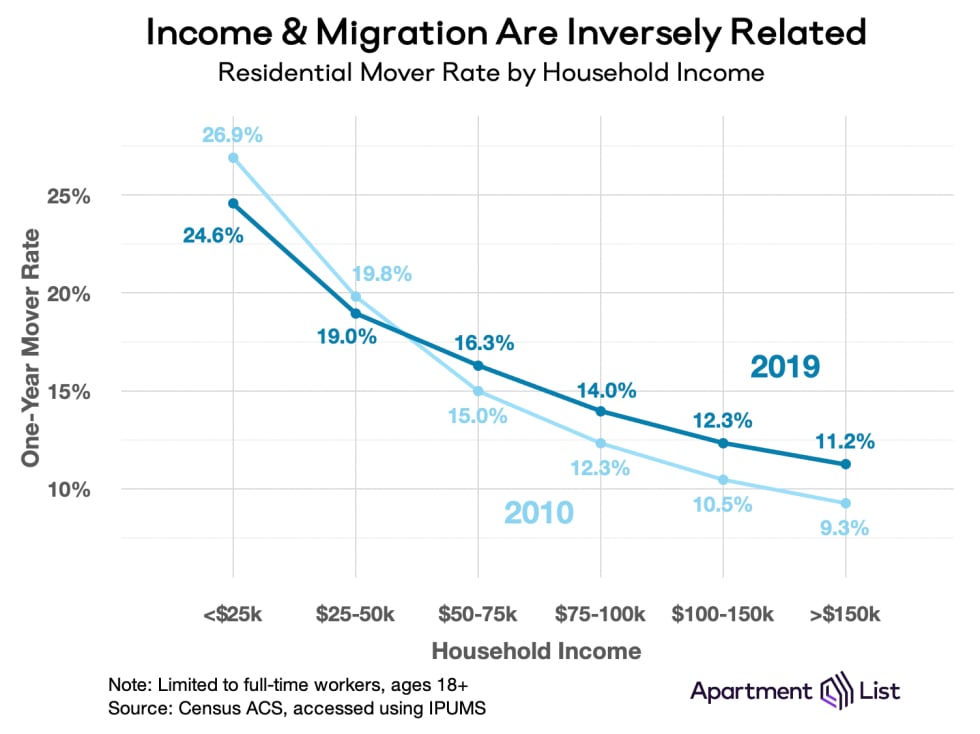

Not all Americans move at the same rate; some socioeconomic strata move more than others. Data from the Census Bureau show a strong inverse relationship between moving and income: lower-earners move more frequently than higher-earners. In 2010 the mover rate was 27 percent among workers living in households earning less than $25,000 and only 9 percent for those in households earning $150,000 or more.

But over time, this relationship has weakened. Since 2010 as the national moving rate slowed, the drop has been concentrated in lower-income workers. Wealthier Americans, on the other hand, are now moving more frequently. One driver is that over this same time period high-earners are increasingly choosing to rent instead of own homes, providing more moving flexibility.5 And more broadly, the fact that younger and wealthier Americans are delaying other major life events that typically coincide with settling down in a permanent location could be a factor here. The longer someone goes without buying a house, getting married, or having children, the more flexibility they will have to move.

COVID Encouraged A Jump In Residential Migration, Especially among High-Wage & Remote Workers

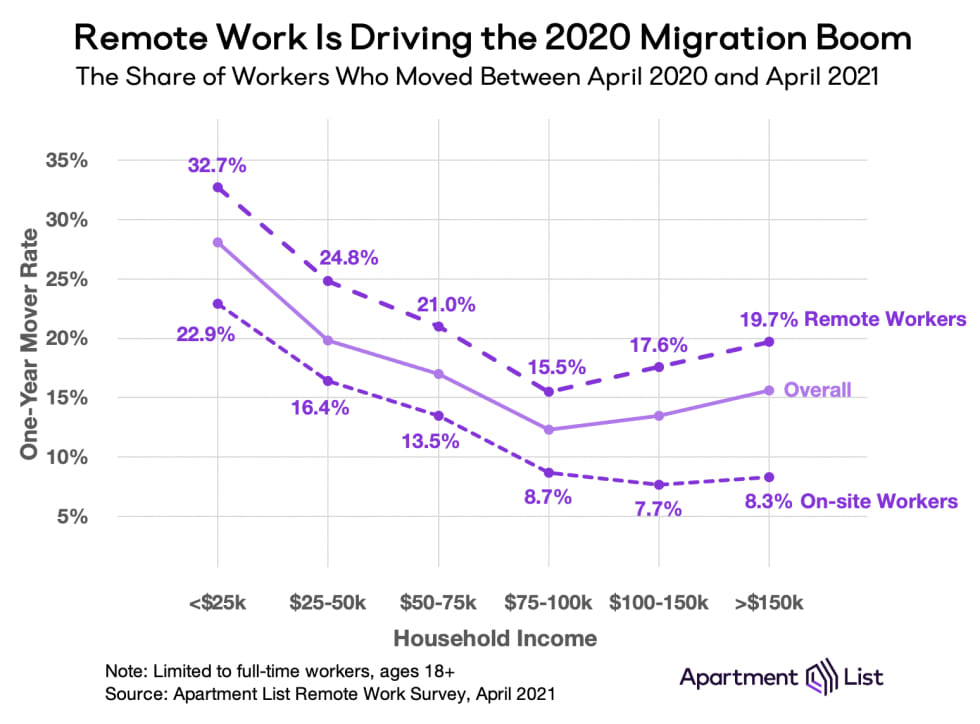

2020 is the year that residential migration bounced back, in a big way. Our survey tells of major spikes at both ends of the income spectrum, suggesting that pandemic-related disruptions to low- and high-paying jobs are at the root of this pivot.

Last year, our team discussed how the nascent COVID pandemic would disproportionately burden lower-wage workers. This may have contributed to the higher mobility we see today, as low-earners facing income insecurity move in search of more affordable living arrangements. Within households earning less than $25,000 annually, 28 percent in our survey moved between April 2020 and April 2021, higher than the annual mover rate in that bracket in each of the last ten years.

At the other end of the income distribution, our survey uncovers a dramatic surge in high-income moves, accelerating the trend that had been simmering for the past decade. In households making over $150,000 annually, 16 percent of workers moved in the past year, a 39 percent increase above the Census Bureau’s estimate in 2019. Slightly down the income distribution, a similar but less dramatic increase took place among households earning between $100,000 and $150,000.

Remote work is catalyzing this new wave of residential mobility. No longer tied by work to any specific city, remote workers earn higher wages6 and can take those wages across the country in search of desirable housing. Specifically among the remote workers in the highest income bracket, the one-year mover rate jumps to 20 percent, more than twice that of on-site workers earning similar wages. But the effect is felt across the income distribution. Even within lower-wage households, mobility is greater among those with remote flexibility than those without.

Leveraging higher pay and greater mobility, the types of moves made by wealthier workers look different than those earning lower wages. If we compare movers from six-figure households to movers from households earning less than $50,000, the higher-income group was

Conclusion: Remote Work Will Have A Lasting Impact

Should remote work stick (as our survey respondents suggest it will), it will be a feature of the post-pandemic economy that promotes more residential migration. Over half of the workers in our survey said that despite the pandemic they continue to work on-site, whether it be at an office, a school, a store, or some other physical location. We asked this group if going remote would encourage them to move, and nearly 48 percent said that it would. This year’s burst of moving activity has already created wild swings in the cost of housing across the country. Additional moves have the potential to further redistribute wealth if high-paying jobs are no longer concentrated in the nation’s largest, most expensive cities.

To learn more about the data behind this article and what Apartment List has to offer, visit https://www.apartmentlist.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.