How have booking windows shifted during the pandemic? Are the shifts momentary blips or the new norm?

In this article, we use case studies and market-specific snapshots to answer those questions and discuss considerations for hotels competing for short-lead business.

A dramatic shift

Booking windows have significantly decreased since the beginning of the pandemic. Let’s start with Dublin as an example:

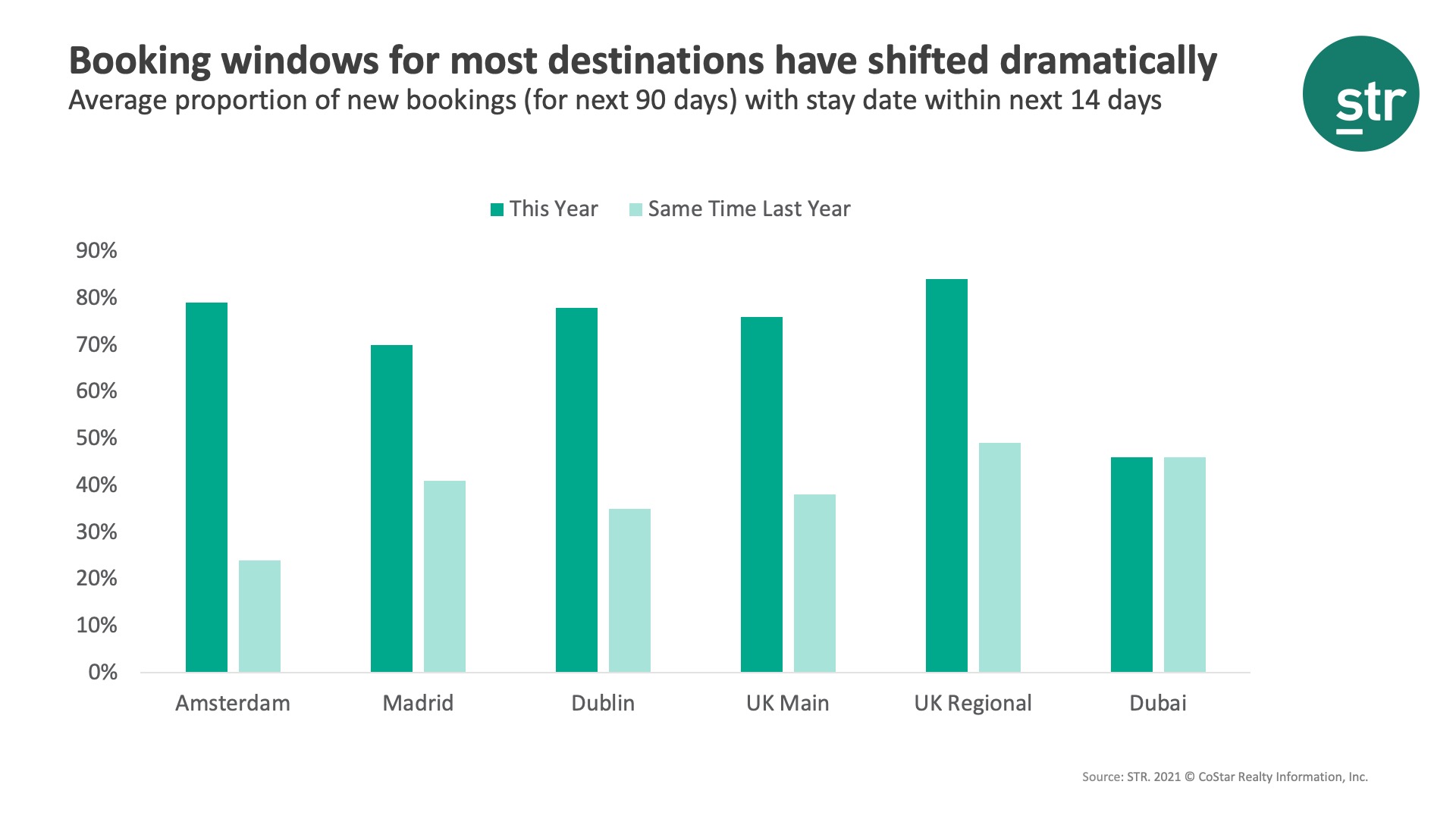

The dramatic shift in average booking windows was far outside traditional patterns for Dublin. The story is similar in other markets as well.

Using the same comparison for the STR-defined U.K. regional market, for instance, out of all new bookings for the next 90 days the proportion of those falling in a stay date within 14 days of booking increased from 49 to 84 on average—almost double.

In destinations like Amsterdam, the proportion has been nearly quadrupled.

There were outliers, however, like Dubai. Using the same time comparison, Dubai didn’t show a significant variation in booking windows. Market dynamics in the Middle East had already been leading to shorter booking windows, and that hasn’t changed much because of the pandemic.

A new normal?

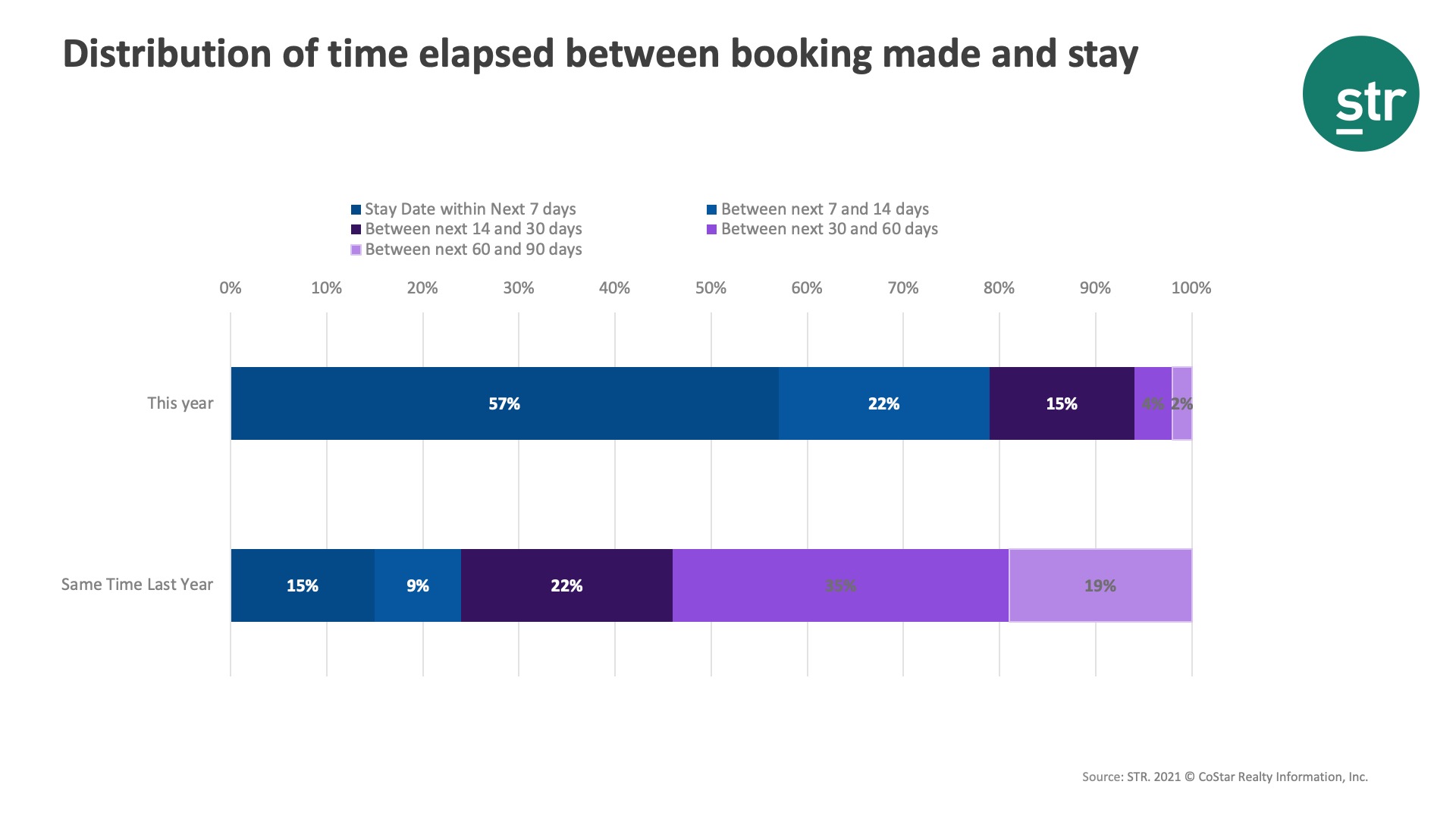

When using Amsterdam as a case study, the market shows a “new normal” where in one week, just two of 100 rooms picked up show a stay date that is 60 to 90 days out. This makes medium term planning incredibly challenging.

As seen in the graph below, most bookings are happening with a more immediate stay date. On average, 57% of bookings show a stay date within the next 7 days while 22% reflect stay dates in the coming 7-14 days. Each average was up significantly from the same time last year.

Unfortunately, these shorter booking windows don’t directly translate to improved performance. Proportionately, the dynamics have shifted, but the absolute number of bookings coming in are still down—and can go even lower when late cancellations are outweighing new bookings.

Competing for shorter leads

As mentioned during a session from our recent Hotel Data Conference: Global Edition, more space available in key cities is being accompanied by shorter lead times. A lack of long lead business will result in a fiercer battle for that shorter lead transient market and ultimately contribute to the trend.

Managing that period from “on the day” to 30 days from arrival will become even more critical as this is where the most significant gains will be had. This could be an issue for the next 12-18 months, and perhaps beyond, with success being determined in a much shorter window.

It is important for hotels to be perceived as “easy to do business with.” Less barriers, an easier booking journey and greater flexibility—for both short and long-term lead business—will aid in this effort.

Whilst booking windows will continue to evolve as vaccine rollout continues, restrictions begin to ease and travel begins to emerge again, this article presents a good overview of how ever-changing the hotel booking landscape can be.

We were excited to share more in-depth findings during our recent full Hotel Data Conference: Global Edition, which was a 13-hour event that covered APAC, Middle East & Africa, Europe, Central & South America and North America. Purchase access to the Attendee Hub to watch more than 50 sessions and view PDFs of the presentations <strong>here</strong>. All recordings will be available through 23 June 2021.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.