The wholesale club sector experienced several fundamental disruptions during the pandemic that offered the potential to redefine the space. Brands like BJ’s Wholesale Club surged with 13.0% visit growth in 2020 compared to 2019, while Sam’s Club saw a 4.3% increase in visits year over year. And these jumps were given added weight as industry leader Costco, saw a near impossible to imagine 2.1% decline in visits in 2020.

But, customer behavior data offered the possibility that Costco’s declines were less a product of weakness than shifts in the ways shoppers were visiting. This makes the recovery all the more important from an analysis perspective in order to determine whether the changes in the last year indicate a shift in the wholesale club balance of power.

The Recovery Trend

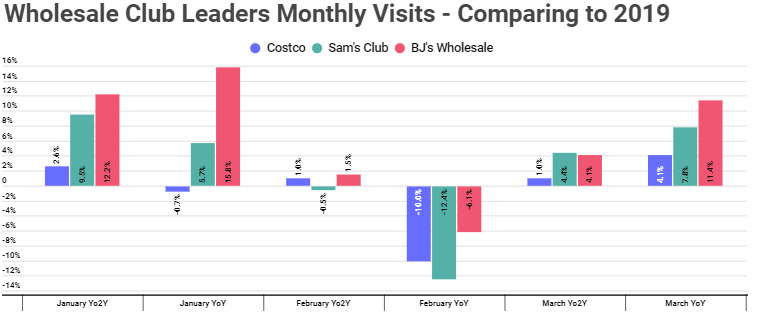

Costco, Sam’s Club and BJ’s Wholesale Club all saw strength in Q1 of 2021. In March 2021, Costco saw visits up 1.0% when compared to 2019 and 4.1% when compared to March 2020. Sam’s Club and BJ’s both saw strength during this month as well with visits up 4.4% and 4.1% over 2019 respectively, and up 7.8% and 11.4% year over year.

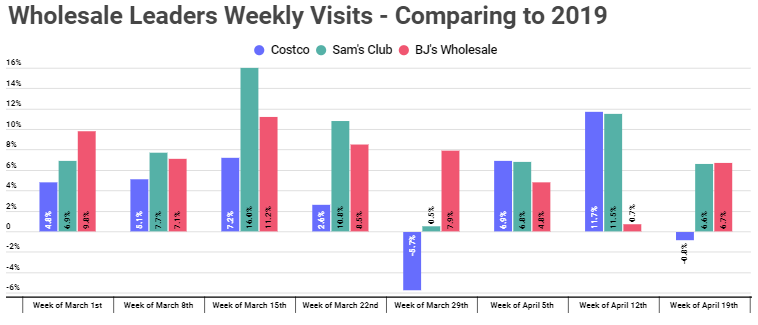

And the strength is seen even more when looking at weekly visits. Costco has seen visit growth when comparing to 2019 in all but two weeks since the start of March. Sam’s Club and BJ’s Wholesale saw visit growth each week, yet the comparison was a bit easier considering the lesser strength these brands displayed during that period in 2019.

A Rising Tide

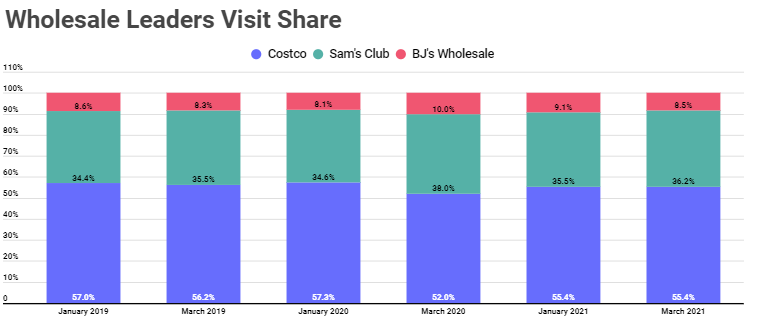

The question then becomes whether there was a shift in the balance of power, or if the pandemic created a tide that lifted all wholesale boats. And the answer appears to be the latter. Looking at the shift in visit share shows that while March 2020 showed a more marked change, by March 2021 the numbers were in line with ‘normal’ distributions.

The resulting conclusion is that wholesale club leaders didn’t just see individual success, but a wider bump for the whole sector. The pre-pandemic popularity of these brands likely got a boost from the need to stock up on essentials in the early days of the pandemic, the value orientation they present and their ability to effectively align with mission driven shopping. And this is further supported by cross shopping data. In April 2020, 7.7% of Costco shoppers also visited a Sam’s Club location during the month, but that number grew to 8.9% in April 2021. This means that more people were shopping at both brands, as overall visits were rising for both.

Costco’s Return to Dominance

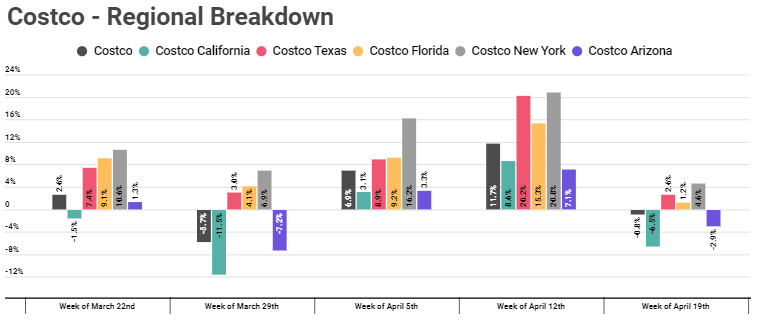

And Costco, specifically, may be positioned for an even stronger result in the coming months. While the brand saw visits up in several key regions, California still lags behind the nationwide benchmark. This is very important as California is the single largest state for Costco locations with over 20% of the company’s overall footprint. So, while the brand is already deep into its recovery, a second surge in visits could be just around the corner.

Additionally, and perhaps most importantly, Costco is experiencing the strength as customer behavior normalizes. Median duration dropped 2.7% in Q1 2021 compared to Q4, and while the metric stayed flat between March and April 2021, it was down 12.2% year over year in April. Looking at April year over year, morning visit percentage declined sharply between 6 and 9 am, and 9 am and 12 pm. In exchange, evening visits between 6 and 9 pm increased.

Even More Wholesale Strength?

So where is the sector going?

The examined wholesale leaders seem to be among the best positioned companies in all of retail. First, they are well aligned with the environment of economic uncertainty many expect to define the coming months. Second, they have a proven capacity to evolve alongside consumer behavior shifts. If shoppers want to venture out less, they purchase more with each trip, and if they want to venture out more, they purchase slightly less. However you add it up, shoppers still come and they still convert. Third, the model is sticky. Data indicates that Costco added many new members in the last year, and that factor is only going to incentivize more visits and purchases in the coming years. Fourth, Costco still hasn’t seen its post pandemic ceiling, and with California increasingly reopening, that ceiling could be even higher than previously expected.

The end result is a likely scenario where BJ’s Wholesale Club and Sam’s Club continue to grow even as Costco maintains its dominant position. In short, a powerful tide lifting several powerful boats.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.