Facebook is the leading social media platform by many counts—but when it comes to popularity among Gen Z users, Snapchat is overtaking the giant.

Gen Z is getting older and about to be a huge buying power. How are advertisers using the two platforms? And which brands spending big on Snapchat represent opportunities for other publishers?

Snapchat Appeals to Younger Consumers

Facebook performed exceptionally this past year and its revenue keeps climbing, but even the strongest of businesses can’t capture every consumer.

Facebook has had issues appealing to teenagers for years—but now Instagram is also struggling with their aging user base.

A recent study from financial firm Piper Sandler found that Snapchat and TikTok are now the two top platforms for teens and those in their early 20’s.

Snapchat’s number of daily active users keeps growing, which is attributed to their fun features like Lens Studio 2.0, Camera Kit, Snap Minis and Bitmoji for Games. CFO Derek Andersen has previously noted how Snap’s investment in original content is also a driver of growing ARPU.

While Snap builds out innovative features for consumers, they’re also creating new spaces for advertisers. Snap ads are full-screen, interactive and offer a wide variety of CTAs. It’s a much more visual experience for consumers, and brands are limited to one line of text.

Q1 2021 was an exceptionally strong quarter for Snap. The company outdid forecasts and generated positive free cash flow for the first time as a public company. Which type of advertisers are they attracting?

MediaRadar Insights

Before jumping into the Snapchat data, we’d like to add some context. We’ve recently started covering Facebook advertising and how their advertisers compare to other ad spaces, like broadcast TV. This leads us to comparing the two social platforms.

Facebook is a powerful tool for brands large and small, but a significant portion of their revenue comes from really niche brands using their platform for its hyper-targeting features.

When looking at April Snap data, we found that ad spend on Snapchat increased 24% year-over-year. And many of those advertisers weren’t on Facebook.

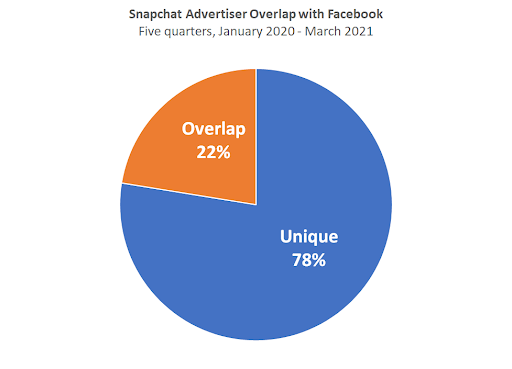

Typically, the overlap between the two platforms is fairly low—only 22%.

Facebook attracts a very wide selection of advertisers (21% of their advertisers were categorized as ‘Other’ because they didn’t make up more than 1% of a single category).

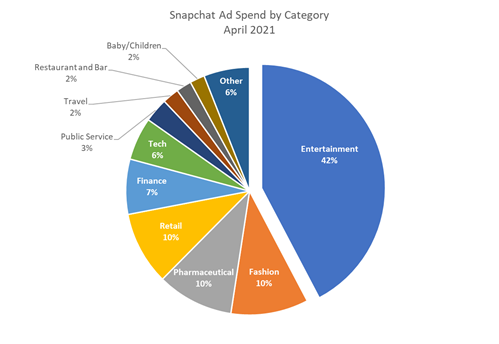

But Snap’s advertisers tend to fall into more distinguishable categories (only 6% are ‘Other’).

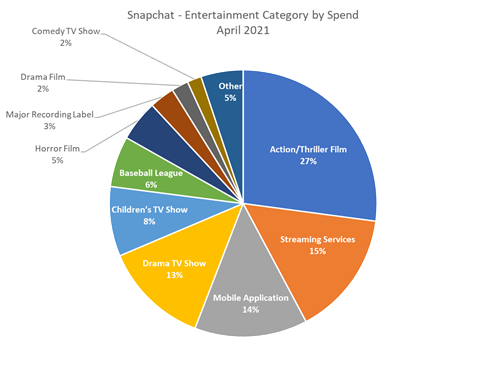

Entertainment makes up the biggest category of Snap’s advertising revenue. We’ll break down the biggest spenders in this category, but first we want to highlight streaming companies.

Streaming companies buy ads on both social platforms. Streaming services made up all 7% of all spend on Facebook last year.

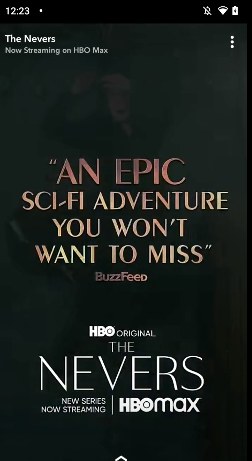

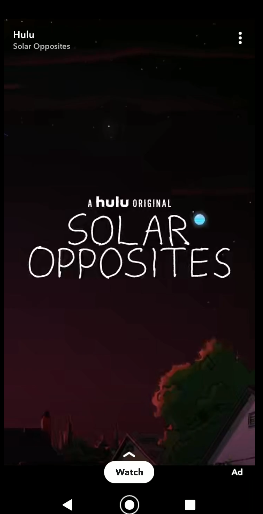

In April, streaming spend accounted for 6% of all ad spend on Snap. Advertising from HBOMax, Paramount+, BET+, Hulu and Amazon Prime totaled over $2.8mm.

Even though streaming accounted for significant advertising spend, Action/Thriller films spent even more on Snapchat.

The top spending Action/Thriller films include:

Together, they spent over $5 million.

Note: Fast & Furious 9 is one of the newest films to not feature both a theatrical and streaming release. Instead, Universal pushed out its release date to coincide with lifted pandemic restrictions.

Other top spending categories on Snapchat are:

Each of these categories make up roughly 10% of spend on Snapchat in the month of April.

For publishers looking for opportunities, top spending brands on Snapchat worth paying attention to are:

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.