Global office transaction volumes plummeted in the 12 months through March. Real Capital Analytics data shows that office investment dropped 49% in the Americas, 44% in Europe, the Middle East and Africa (EMEA) and by a more moderate 14% in the Asia Pacific region.

A slowdown in transactions across all asset classes was inevitable following the lockdown restrictions employed to slow the spread of Covid-19. However, offices have been one of the worse affected sectors. Buyers remain wary as the pandemic looks to have prompted a shift to a more flexible and agile working culture, which has the potential to negatively affect occupancy rates across many major markets.

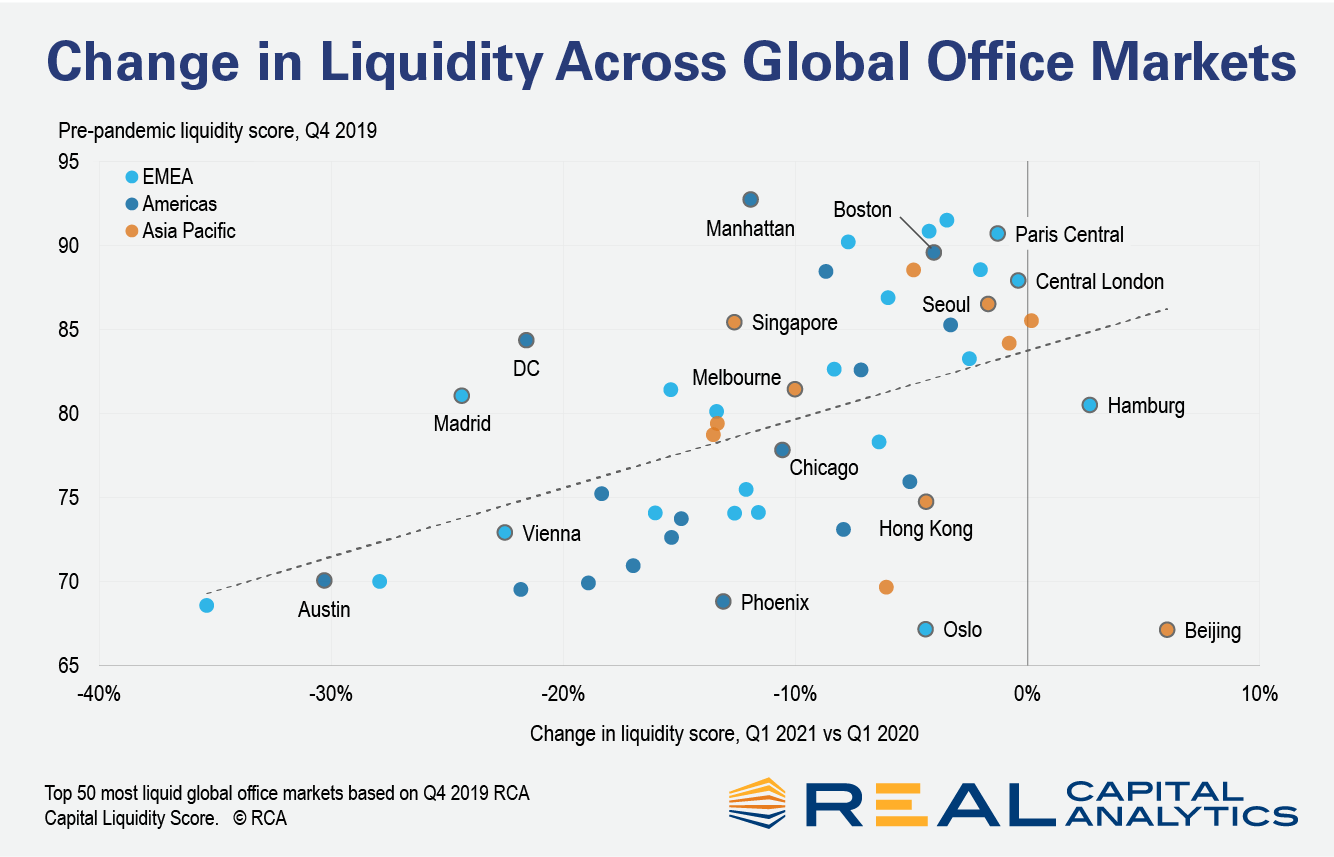

This lean away from office investments is reflected in the RCA Capital Liquidity Scores, which fell by 11% on aggregate across the 50 most liquid office markets going into the pandemic (as ranked at Q4 2019). However, the picture is not uniform across those top 50, and, on average, higher ranking markets held up better than those which had lower scores.

This pattern is not a surprise perhaps, but it does bear out the old adage that buyers retreat to core at times of greater stress. The emphasis on core properties in core markets is supporting pricing across many of the world’s major office markets, with RCA’s CPPI data showing that prices actually increased by 8.5% in Central Paris, 4.3% in Central London and 2.7% in Boston in the 12 months through March.

It should also be noted there are some regional variations and the relationship is stronger for the EMEA and Americas markets. For the Asia Pacific region the pre-pandemic score has less of a predictive value, which reflects some of the local differences in how the virus was managed and its effects on the local market, especially in China. However, the region’s top three markets — Sydney, Seoul and Tokyo — were still much more resilient than the average.

Notable also is the drop in Manhattan, Washington DC and Singapore, all of which recorded double-digit falls in liquidity despite being among the highest ranking markets pre-pandemic.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.