In this Placer Bytes we dive into three leading beauty brands – Ulta, Sephora and Bath & Body Works.

Recovery in Progress

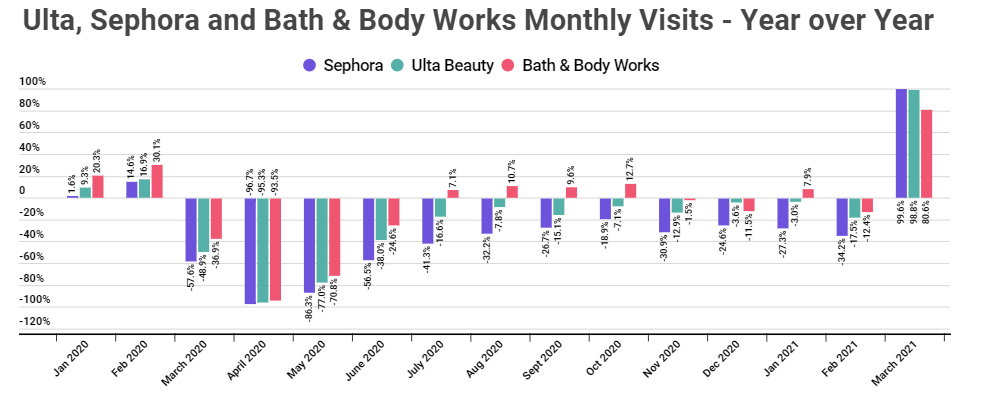

COVID-related restrictions certainly had a significant impact on visits to all three brands, yet they all have been in the midst of significant recoveries since the summer of 2020. In early 2021, Ulta saw the year-over-year visit gap drop to as low as 3.0% in January, with Sephora seeing a gap of just 27.3%. Bath & Body Works continued an impressive run with visits actually up 7.9% year over year in January. However, inclement weather in late January and early February in key regions limited this progress with significant year-over-year visit declines for each.

The deeper declines for Sephora are also important in that they signal some of the reasons the brand has pushed for different retail orientations of late. The heavily mall and urban based retailer saw those two formats hit especially hard limiting the full recovery ability.

Comparing to 2019

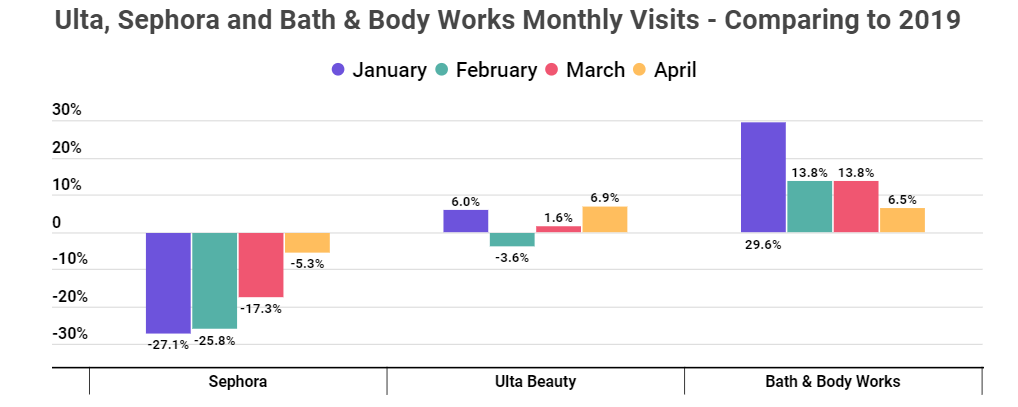

But to properly understand progress for March and April, comparing visits to 2020 is hardly a fair comparison since those months in 2020 were defined by full closures. Looking at 2021 visit rates in these months compared to 2019 presents a far more accurate picture of just how far these brands have come, and what the coming months might hold.

When compared to 2019, Bath & Body Works has seen consistent growth in each month of 2021 with April driving a 6.5% increase. Ulta saw a slightly more mixed, but equally impressive result with visits up over the equivalent months in 2019 every month but February. Traffic in April was up 6.9% on the equivalent month in 2019, indicating that the demand for in-store visits has remained strong for the retailer. And, critically, Ulta had shown significant strength in 2019 as well, making the 2021 growth compared to this standard all the more impressive.

The comparison also shows the rebound potential for Sephora which saw the visit gap drop to just 5.3% in April when compared to the equivalent months in 2019. The improvement here is also directly affected by recoveries in the major urban areas and malls that Sephora has chosen for locations.

Regional Differences

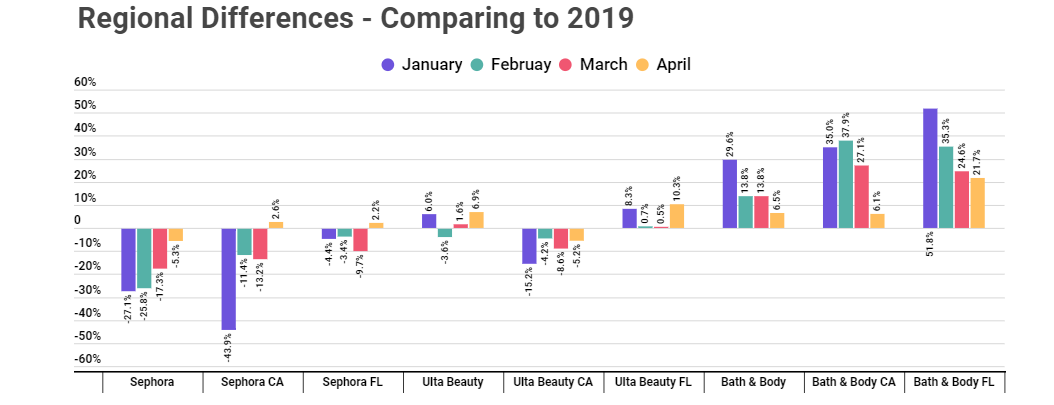

But breaking it down even further and looking at specific regions and/or states can provide additional context for these brands’ recoveries. Visits in states like Florida are expectedly seeing much faster recoveries than in California where limitations are still in place. Visits to Florida locations in April are well above the nationwide visit trend for each of the brands analyzed.

The key takeaway here being that as California increasingly opens up, the relative recoveries for these brands could see an added boost, especially considering the large relative footprint in these states.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.