Source: https://www.advan.us/blog.php

Office properties and office leasing companies like WeWork are watching very closely the speed with which employees return to the office. The question at large remains: is the work from home (WFH) phenomenon here to stay, or will it prove to be only temporary for most?

Using Advan’s mobile phone location data, these questions can be answered. Our platform tags every device to a home and work location each month, providing insight on whether or not employees work from home or at a separate office location.

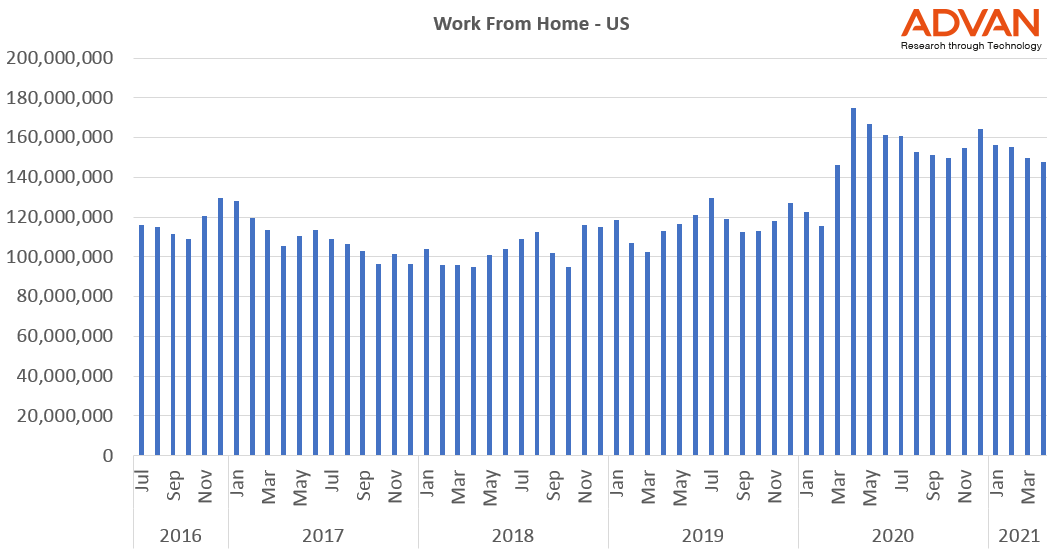

As expected, we have seen a massive uptick in professionals working from home since the start of the pandemic in March 2020.

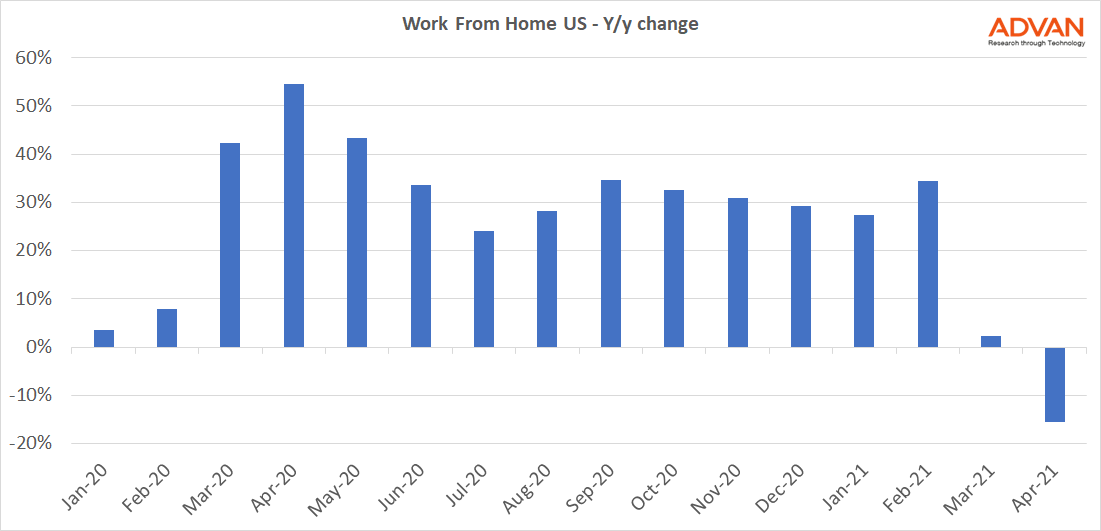

This recent trend is visualized in the above graph. The most dramatic increase in working from home (WFH) numbers were seen in the earliest months of the pandemic, averaging +40% between March and May. Summer 2020 saw this trend begin to stabilize at roughly +30%. As the US sees a rise in vaccinations and a drop in COVID cases, recovery may be on the rise as businesses return to the office. As of April 2021, 15% fewer people are currently working from home than in April 2020, which was the peak of lockdown for much of the US.

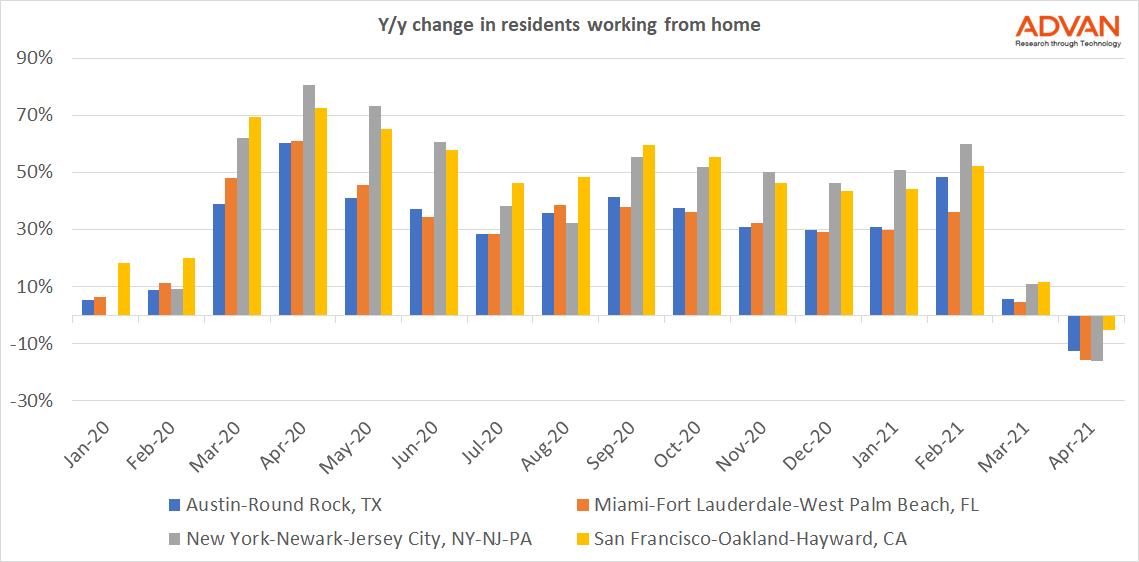

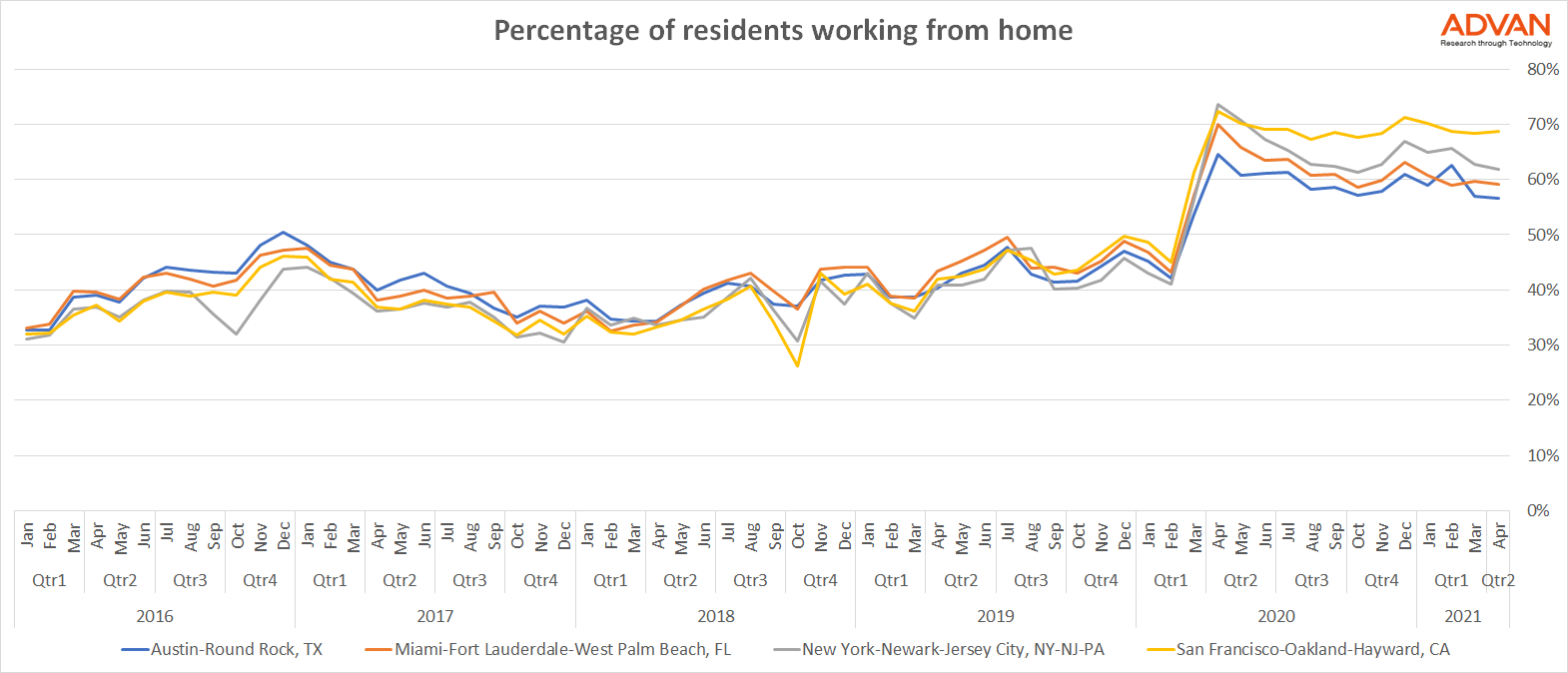

Despite the overall trend in WFH, several US metro areas saw different patterns of behavior. Comparing the metro areas of Austin, Miami, New York and San Francisco, we see that San Francisco and New York have led the increase in residents working from home throughout the pandemic. However, New York, Austin and Miami are currently returning to in-office work at a faster pace than San Francisco. If this trend continues, we expect to see a larger impact on office space occupancy and rentals in San Francisco than other large metro areas.

The below graph presents a broader historical view beginning in 2016, showing the overall impact of the pandemic on WFH across metro areas compared to pre-COVID patterns:

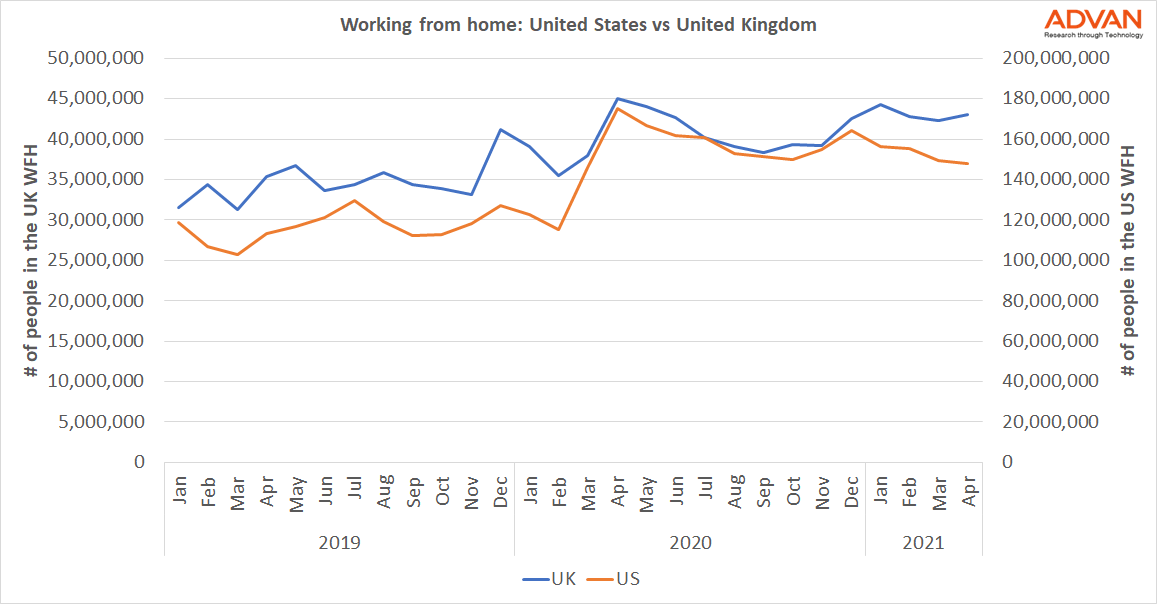

Looking outside the US, we see that the UK’s second COVID lockdown extended beyond that of the US. Based on the data below, we anticipate a much slower return to in-office work in the UK than the US.

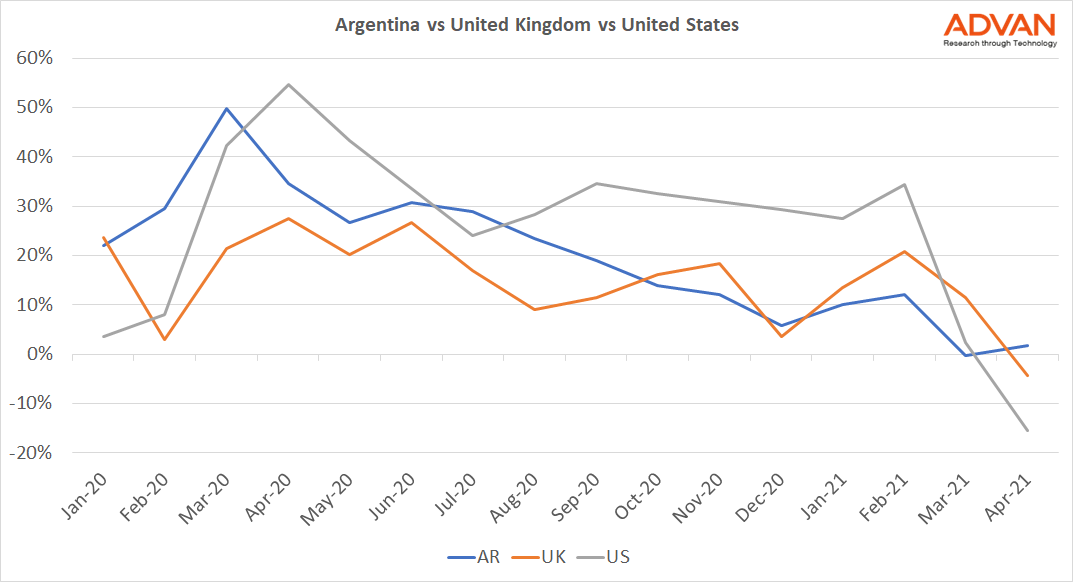

By visualizing the same data on a year-over-year change basis, the differences are easier to see. The graph below overlays data from the US, UK and Argentina . We can see the US leading the way in returning to the office, followed by the UK then Argentina.

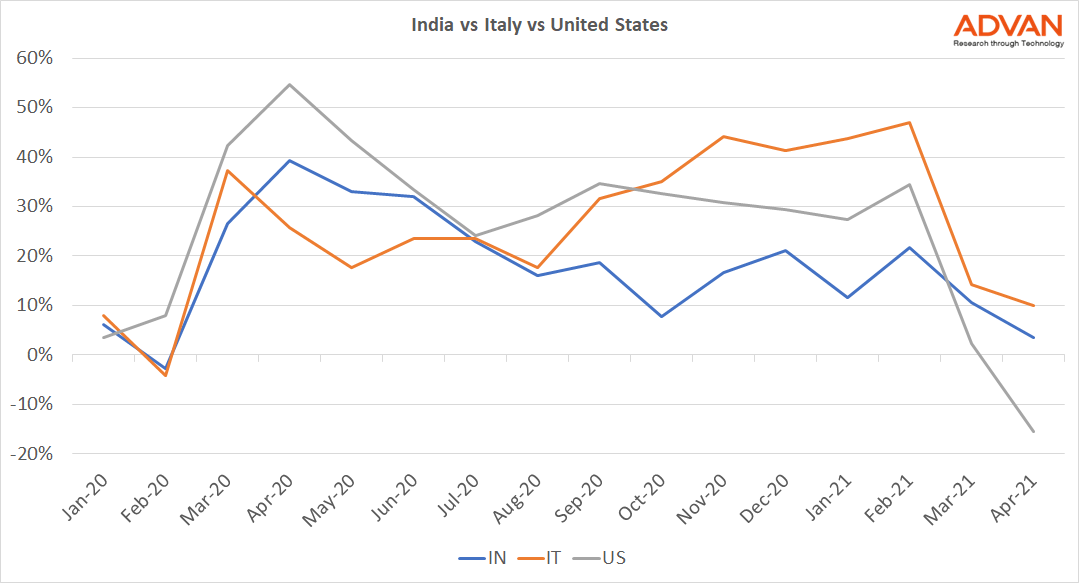

The contrast in returning to pre-COVID trends is even sharper when comparing the data of India and Italy, countries that have both seen a severe number of infections throughout the pandemic. Both countries currently have more people working from home now than in April 2020, implying a longer timeline to returning to the office.

The granularity of Advan’s location data allows us to compute how many people work from home on any geographical or statistical area, such as a Census Block Group, a City or a County.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.