Relative to other European markets, the Danish market has boomed through the pandemic.

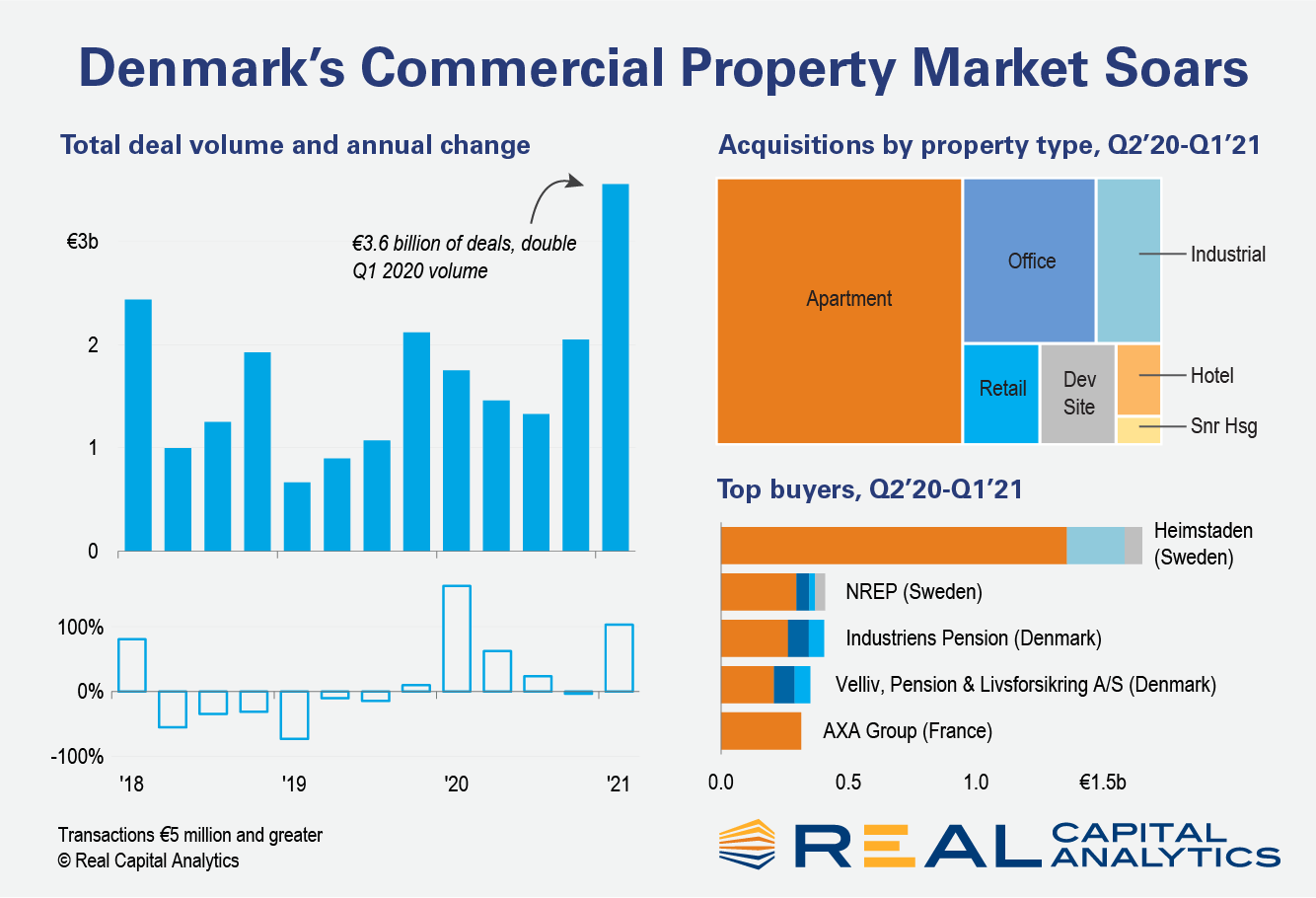

Transaction volume increased 44% year-over-year in the 12 months through Q1 2021, and at a shade under €8.4 billion ($10.2 billion) eclipsed the market’s annual record high for transactions of 2017. Moreover, first quarter deals topped €3.5 billion, which makes the start of 2021 one of the best three-month periods for the market on record, catapulting the market to become the fourth most active in Europe at the start of the year.

This performance sits in sharp contrast to some of Europe’s largest markets, which have recorded substantial slowdowns during the pandemic: transaction levels in Germany fell 27% year-over-year and in France by 41%. (See RCA’s Europe Capital Trends.)

Dependence on overseas capital was one factor in how markets fared over the Covid era: on average, those with a higher dependence on cross-border investors did worse than those with a dominant domestic investor base. However, Denmark is the exception that proves the rule and 62% of all transactions in the 12 months through March involved an overseas buyer. Much of this activity was focused on the apartment sector – approximately 60% over the same period. Overseas players from Sweden, the U.K. and the U.S. have been prominent.

Denmark appeared to manage the Covid-19 outbreak better than other European countries and had a lower average level of lockdown stringency (as measured by the Blavatnik School of Government’s Lockdown Stringency Index). This may have helped the market, but the opportunities in the apartment sector are perhaps the driver that really helped push up transaction volumes. This is amid a wider pivot towards the living sector across Europe, with most of the big institutions very focused on adding to their apartment portfolios.

The biggest deal of the first quarter was by Sweden’s Heimstaden. The firm acquired a mixed but predominantly apartment portfolio from NIAM for €1.6 billion. The second largest transaction was Starwood’s purchase of the First Hotel Skt. Petri in Copenhagen for €200 million. This is the third highest-priced European hotel transaction in the last 12 months and is one of the few large hotel trades to have completed during the pandemic.

The latest Real Capital Analytics data shows almost €1 billion of deals across all property major types completed in April. This is exceptional in itself and well above the long-term average, and bodes well for a strong 2021 for the Danish market after a very strong 2020.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.