China’s Labor Day holiday (1-5 May) stimulated travel demand and provided a noticeable boost to hotel performance. Thanks to an additional day during the holiday period, the rise in performance pushed levels beyond another recent holiday and even some 2019 comparables. The impact, however, was not even across all markets and hotel classes.

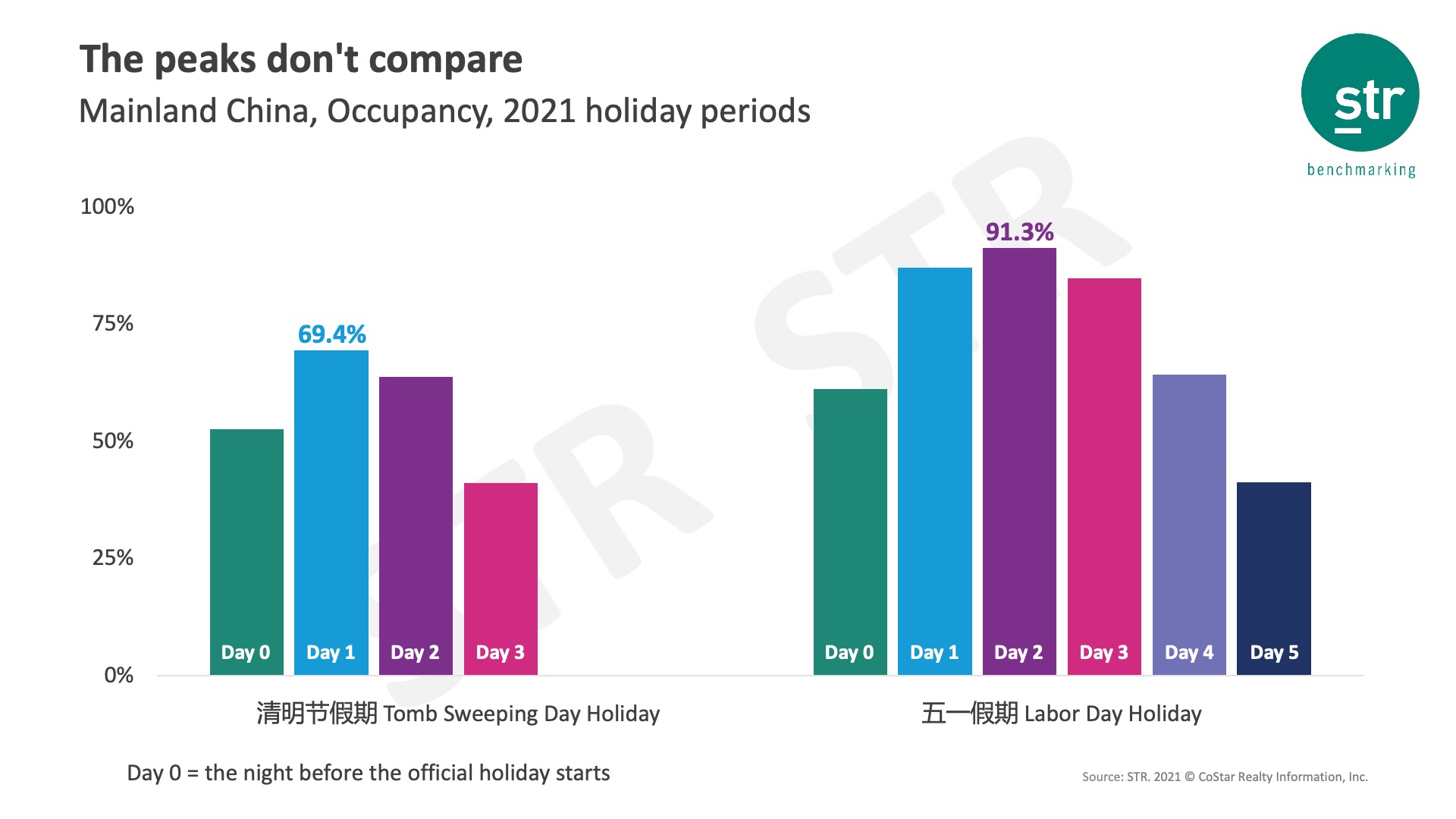

Bigger than the Qingming Festival holiday

The highest hotel occupancy point during the Labor Day period was day two, which reached 91.3%. That was nearly 22 percentage points higher than day two of the Qingming Festival holiday period during the first week of April. Interestingly though, occupancy on the last day of each holiday period was 41%.

National impact

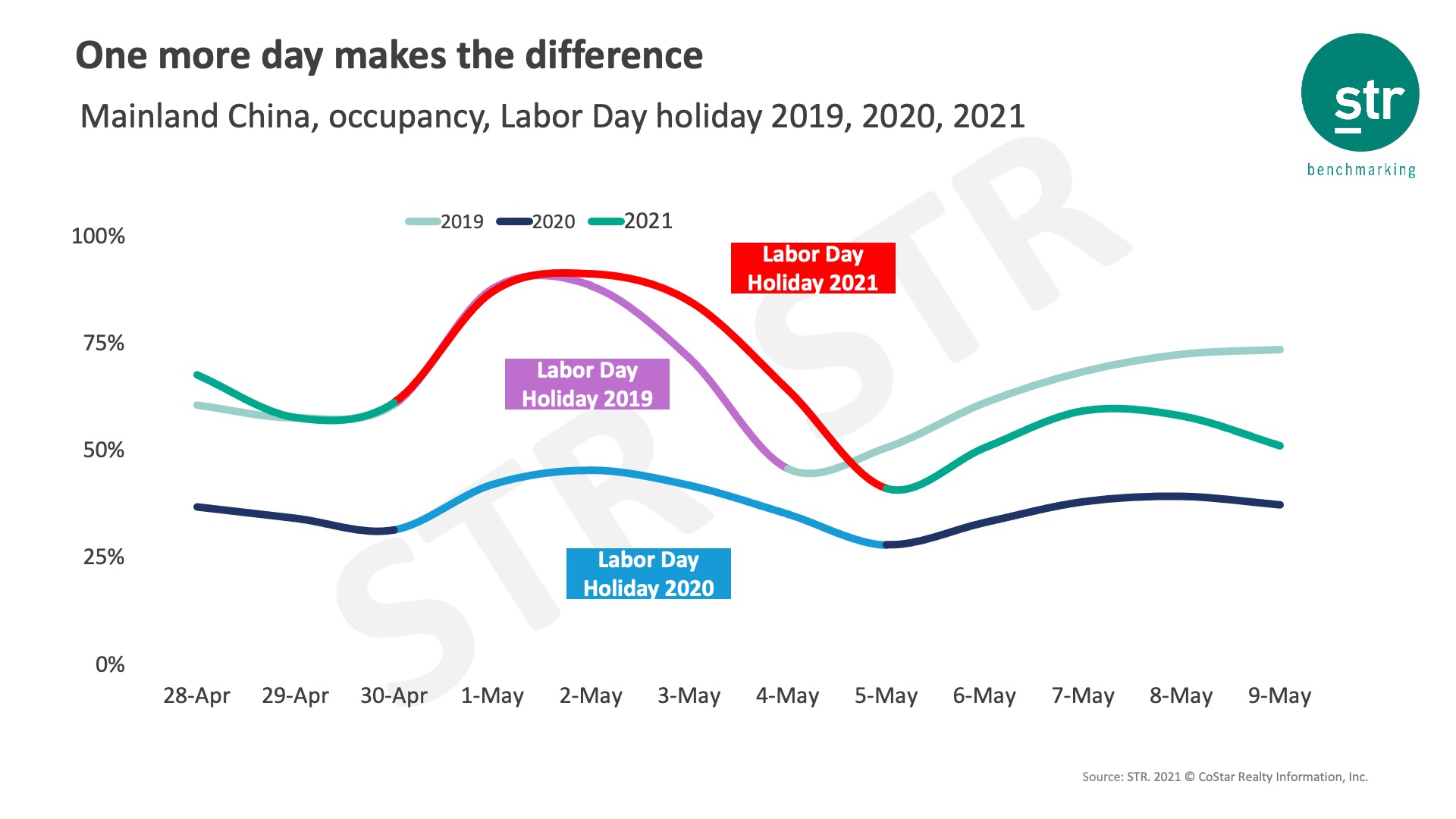

In the week before the Labor Day holiday, the national hotel occupancy rate exceeded 70%, but in the week after the holiday, the occupancy rate was below 60%, which was one area (post-holiday momentum) where 2021 did not reach 2019 levels. However, when comparing 2021 performance with the Labor Day holiday of the past three years, Mainland China reached full occupancy recovery to 2019 levels. Since the Labor Day holiday in 2021 was one day longer than in 2019, the peak period was relatively longer.

Regional Impact

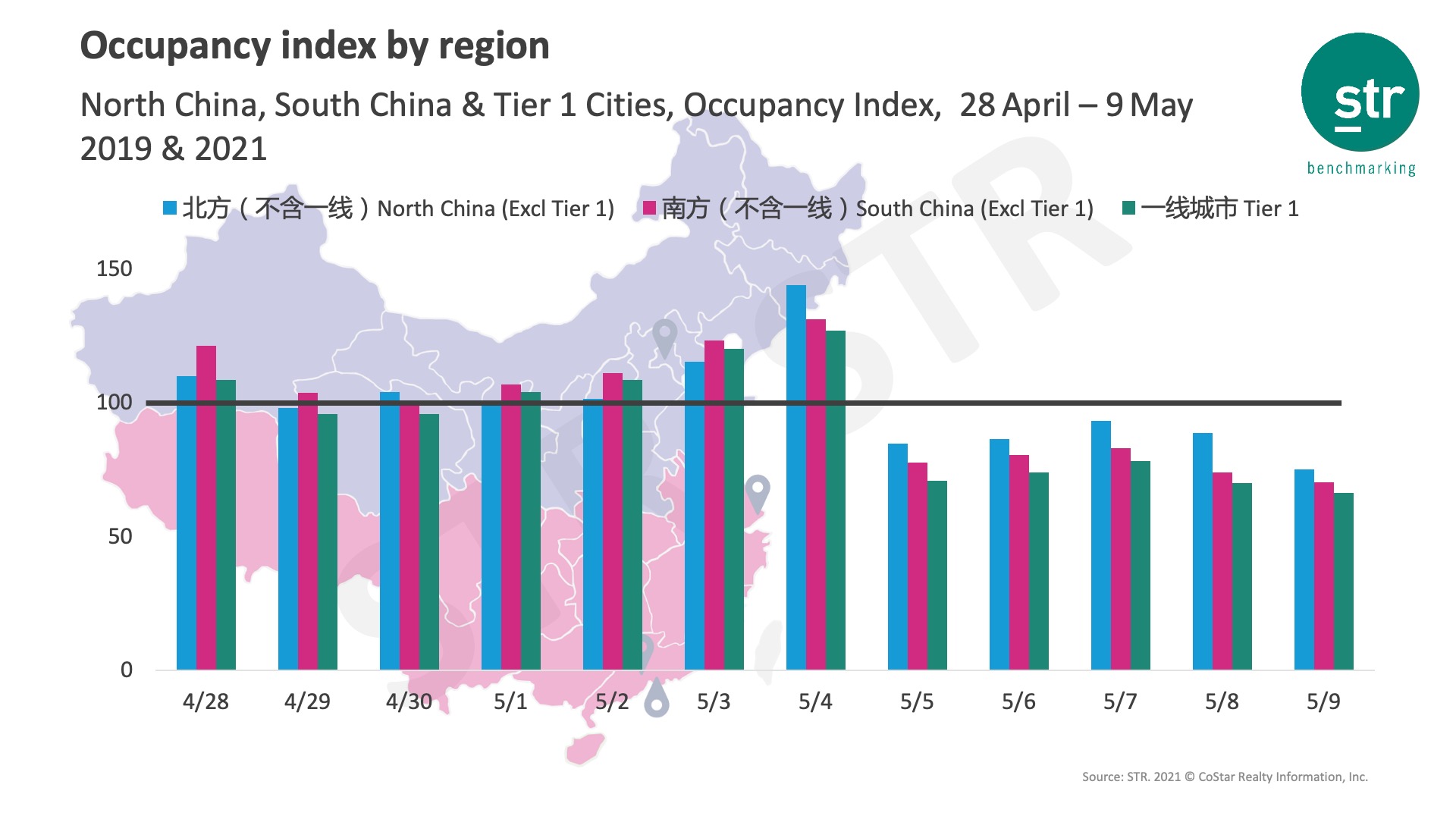

Using the line of the Qinling and Huaihe River as the boundary, Labor Day holiday occupancy trended at a similar pace—the difference was small, although the north was slightly higher than the south.

A few days after the holiday, first-tier cities became the leaders with hotel occupancy remaining above 55%. Business demand gradually lifted the market’s levels.

Looking at the occupancy rate index during the Labor Day period, the southern market and first-tier cities had four days that were better than the comparable period in 2019. The northern market had only three such days. Since the Labor Day holiday in 2019 was only four days, the largest positive difference occurred on 4 May 2021, with 2021 vs. 2019 increases of 144% in the north, 131% in the south, and 127% in first-tier cities. After the holiday, there was a big gap between all regions and the comparable period in 2019.

Main market impact

Compared with 2020, year-over-year occupancy growth for Mainland China was strong in the past month, averaging an increase of about 40%. The highest increase during the Labor Day period was +90%. Some hot markets such as Shanghai, Hangzhou, Suzhou, Xi’an, and Yunnan generally maintained a year-over-year growth rate of +30% to +50%.

Among those markets, Tibet was particularly prominent. Since the end of March, the market’s growth rate has reflected extreme optimism, even reaching +212% at the beginning of April. Even after the Qingming Festival, Tibet basically maintained a growth rate of +100%.

At the same time, the growth rate in Hainan during the Qingming Festival period reached +107% and held at more than +100% throughout the Labor Day holiday period. Growth in the market peaked to +184% on 4 May before falling back.

While some markets are booming, there are also some where performance was not satisfactory. Among them, the occupancy rates of Beijing, Fuzhou, Guizhou, and Guangxi only increased roughly 15% compared with 2020, which lags behind the average growth rate of Mainland China. The stimulus effect of Qingming Festival and the Labor Day holiday is relatively limited for these markets.

Inner Mongolia has become the only market in Mainland China that is not performing as well as 2020 levels. Except for the 5%-30% increase in the market’s occupancy rate during Labor Day holiday, year-over-year comparisons has been around -10% since the end of March.

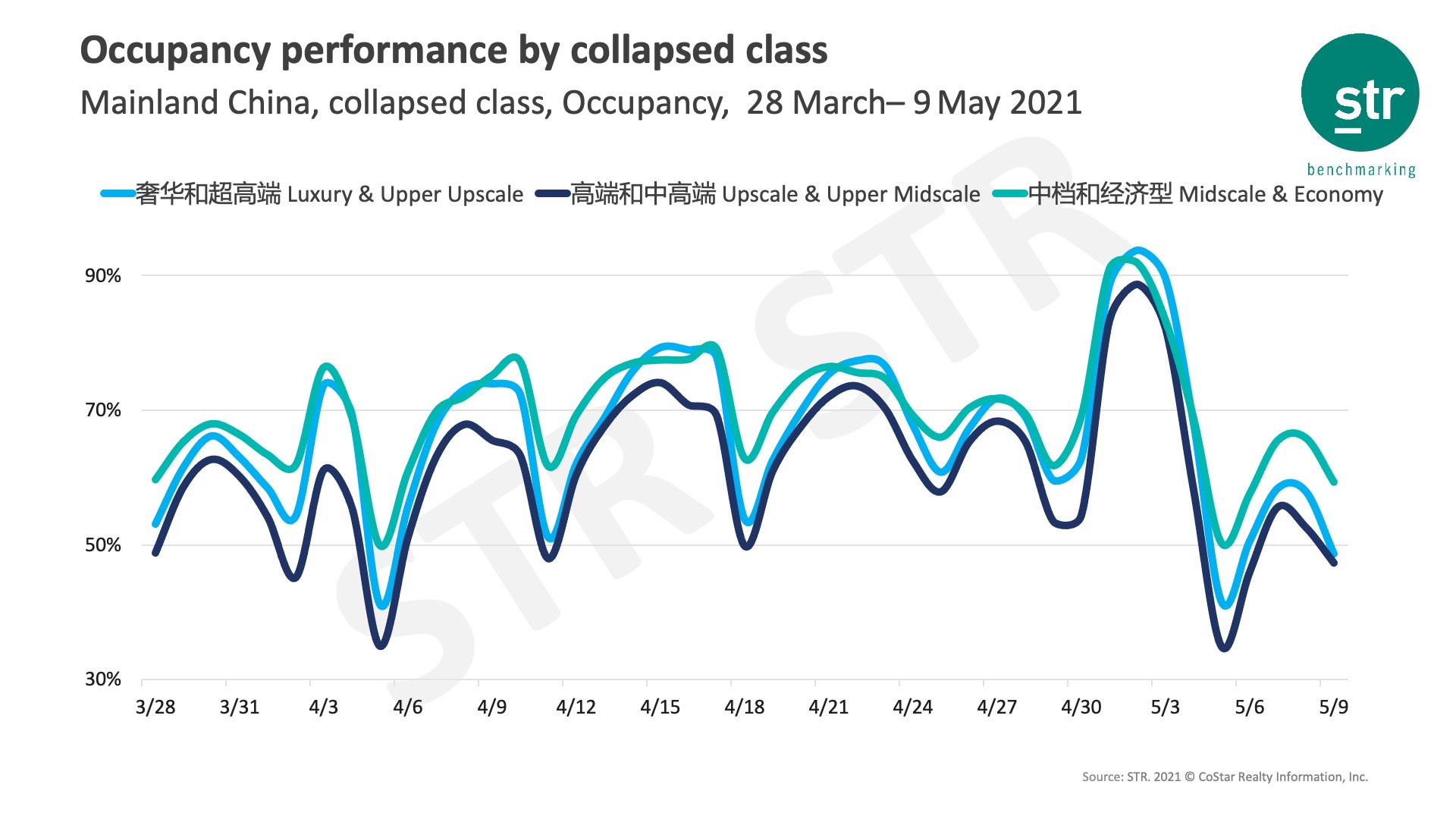

Hotel class impact

On weekends and holidays, the occupancy rates for Luxury and Upper Upscale hotels were comparable to those of Midscale and Economy hotels. At other times, the occupancy rates of Midscale and Economy hotels were significantly higher. Luxury and Upper Upscale occupancy during the Labor Day holiday reached 93%, while Upscale and Upper Midscale hotels lagged behind.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.