Office investment across Europe has plummeted since the onset of the Covid-19 pandemic. Transaction volume fell by almost one-half in the year through March compared with the prior 12 months, and the number of traded assets fell to the lowest level since 2011.

Moreover, the continent’s biggest institutions are pivoting away from the office as they embrace residential and industrial. In Europe during 2020, institutional players deployed 40% of their capital on offices – the lowest ever proportion for a calendar year. Investors are clearly cognizant of the potential for a downsizing in corporate office footprints post-pandemic. Whether and to what extent that comes to pass is under debate, but the risk is sufficient to make buyers pause.

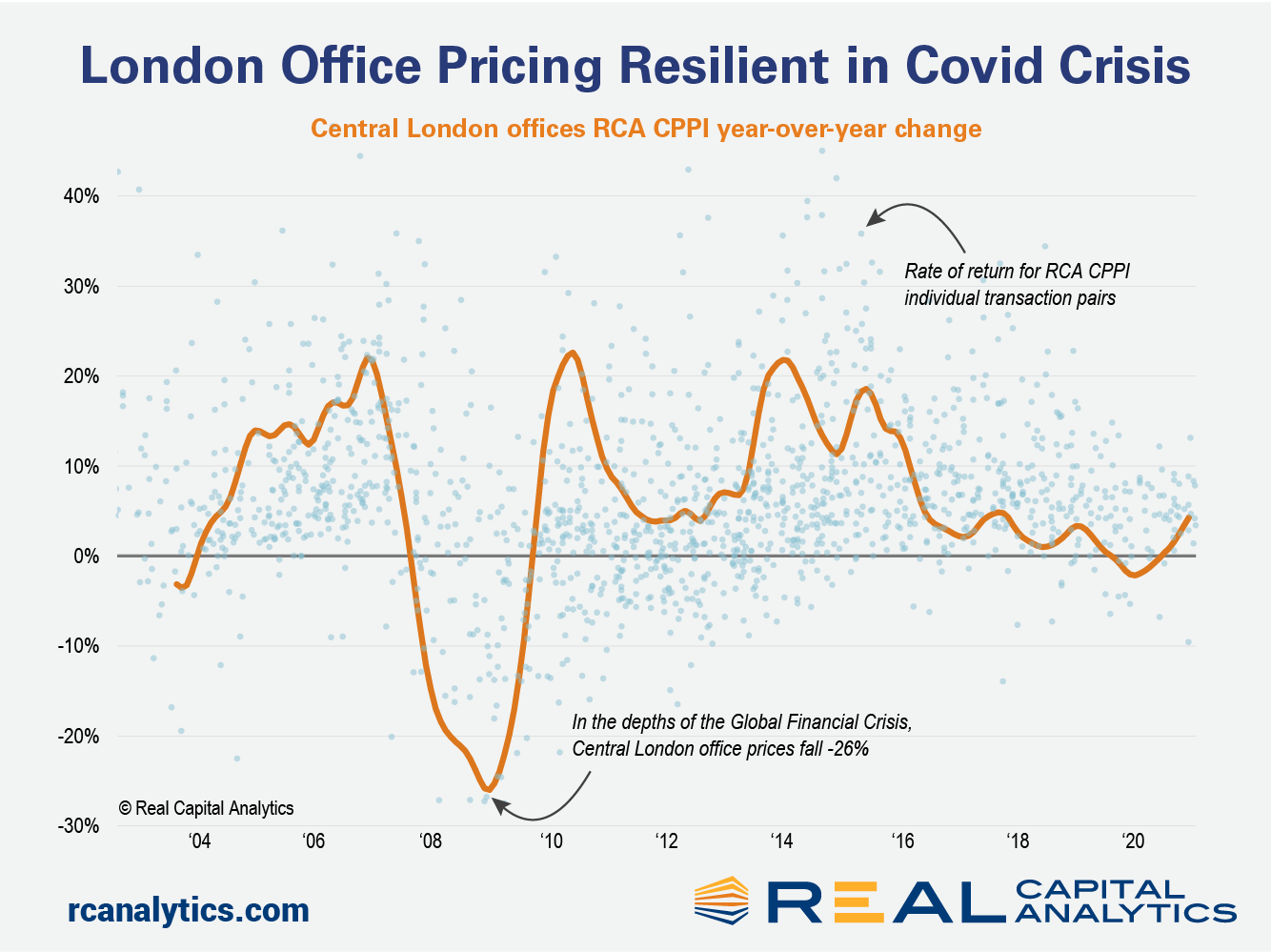

Despite this slump, prices as measured by RCA’s Commercial Property Prices Indices are still increasing. Central London office prices rose by 4.3% in the 12 months through March while the Central Paris index increased by 8.5%.

Central London and Paris are defensive markets that investors turn to in periods of economic upset, and these markets have maintained liquidity better than some of the second-tier cities during the current crisis. Still, in the context of double-digit declines in transaction volume, the pricing increase looks counterintuitive. However, it’s key to remember that the price indices are based on actual traded assets, not on valuations, sentiment or shifts in the price of listed property companies.

The buildings that are selling are those which fit investors’ criteria — best in class, with strong tenant covenants, and future-proofed — and those which do not fit the criteria are being left on the shelf. Broker BNP Paribas reported that in Paris, the world’s number one office market by transaction volume, some €3.5 billion ($4.3 billion) of offices went unsold last year.

There are few, if any, forced sellers of offices in the current market. Forced selling is often the trigger for a large-scale repricing of assets, as happened during the Global Financial Crisis. Analysis of the completed office sales of the last 12 months in Europe’s top markets shows that the vast majority are still achieving a positive capital return. In the chart above we show Central London as an example.

RCA’s price expectations analysis, which uses a model based on the same data set as the RCA CPPI, implies that prices will have to fall by 5-10% for volumes to move back towards their long-term average. But with little pressure to sell and risks in the sector still oriented to the downside, a likelier scenario is a two-tier market, with strong demand for the better quality buildings and a much slower market for those at risk of functional or technical obsolescence.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.