Memorial Day, with its requisite retail sales, came and went in late May. For many brands, it signalled some very positive recovery signs.

Comparing to 2019

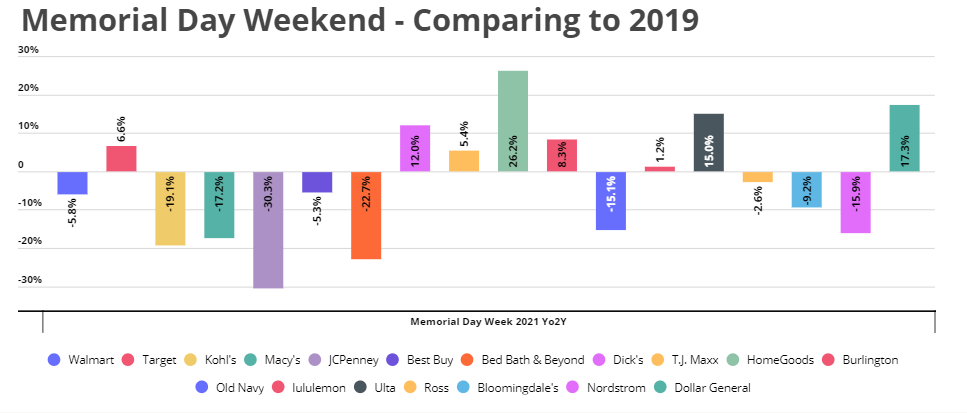

The fuller period from Thursday May 27th though Monday May 31st saw several brands driving growth, with others experiencing limited relative declines. Target, Ulta, and Burlington continued their strong recovery with visits over the five day period up 6.6%, 15.0% and 8.3% respectively when compared to the equivalent five day Memorial Day weekend period in 2019.

But the relatively small declines delivered by harder hit retailers is as important as the strength shown by Dick’s Sporting Goods, HomeGoods and others. Macy’s and Nordstrom saw visits down just 17.2% and 15.9% respectively when they had seen visits down double that number in the period preceding the weekend. These figures serve as an indication that many brands may be far better positioned than expected ahead of an increasingly critical Back to School season. And all these sales are taking place while stores are still limited by lingering restrictions in key states like California and New York.

Important Differences

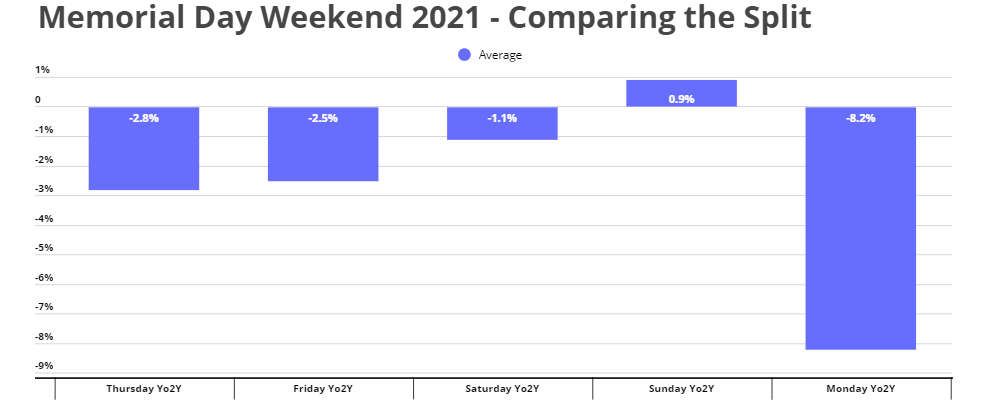

When comparing the average declines across a group of 20 retailers with data from 2019, another interesting trend emerges. Visits on the Thursday and Friday of Memorial Day weekend were down an average of 2.8% and 2.5%, respectively, for the group. On Saturday, that decline dropped to 1.1% with Sunday actually seeing a 0.9% lift heading into a larger Monday gap of 8.2%. The shifts suggest that certain pandemic driven adjustments are lingering and having ‘difficult to predict’ impacts on retail foot traffic and performance. This unexpected foot traffic pattern serves as an important reminder that while some trends can be effectively spotted, others are likely to provide a more diverse range of outcomes.

Ongoing Improvements

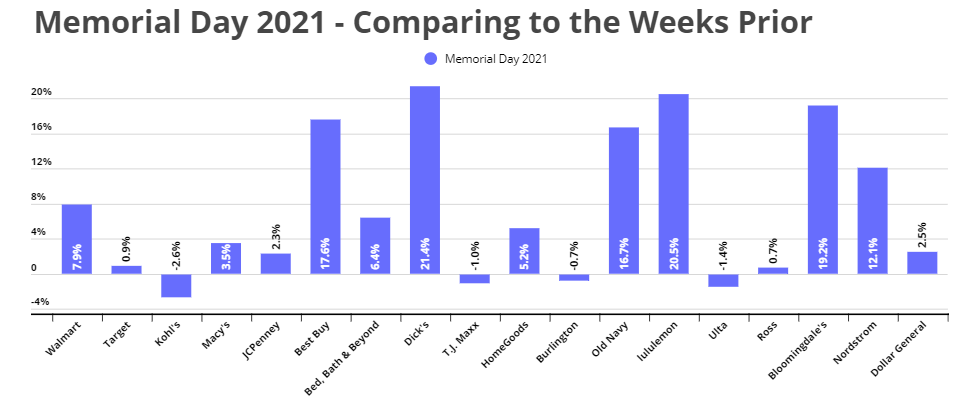

Yet, the strongest takeaway may come from comparing visits on the Friday, Saturday, and Sunday of Memorial Day weekend to the equivalent three-day periods that preceded it in May. Most brands saw a marked improvement when comparing the average visits across those three days for the three weeks prior with the results from Memorial Day weekend. While overperforming brands like T.J. Maxx and Burlington saw slight dips, Nordstrom and Bloomingdale’s saw increases of 12.1% and 19.2% respectively.

These results are a further testament to the heavy dependency that many of these mall-based retailers have on key shopping days and periods. As normalcy returns to day-to-day retail, it also restores the emphasis on the forms of ‘destination shopping’ that drive visits for brands like those mentioned above. Should these patterns continue to return, the results could be significant in August, due to the huge surge in back to school shopping.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.