With the travel industry among the hardest hit in the last year, this year’s rebound has given hope to many firms. However, much of the surge is taking place in rebooked spend, so our CE Transact Credit Card data and CE Web hotel booking data are telling a different story. In today’s Insight Flash, see how new travel spend in the last month has differed among US and UK cardholders, which continent is seeing the biggest rebound in bookings, and where property inventory has been coming back.

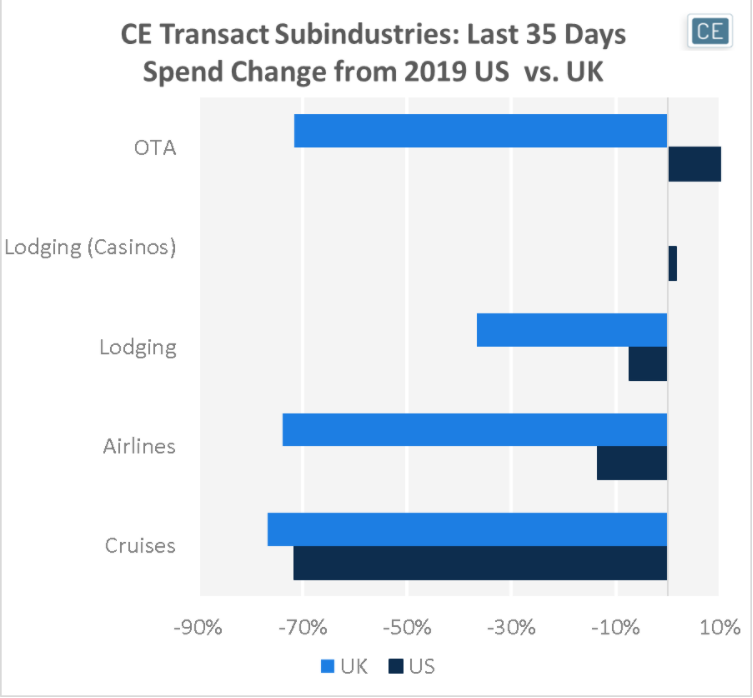

In general, lighter restrictions mean that US cardholders have seen more positive trends in travel reservation spend versus UK cardholders over the past 35 days. Compared to similar periods in 2019, spend at Online Travel Agencies (OTAs) was up 28.3%, and spend at Casino Lodging was up 1.6%. In comparison, spend at OTAs was still down -71.6% in the UK. In the UK, Lodging fared the best of the tracked travel subindustries, with spend down only -36.6% versus 2019. Yet, even here the US trends were more positive, down a mere -7.6%. Cruises were the weakest in both geographies, with spend down –71.7% in the US and -76.8% in the UK versus 2019.

Subindustry Growth

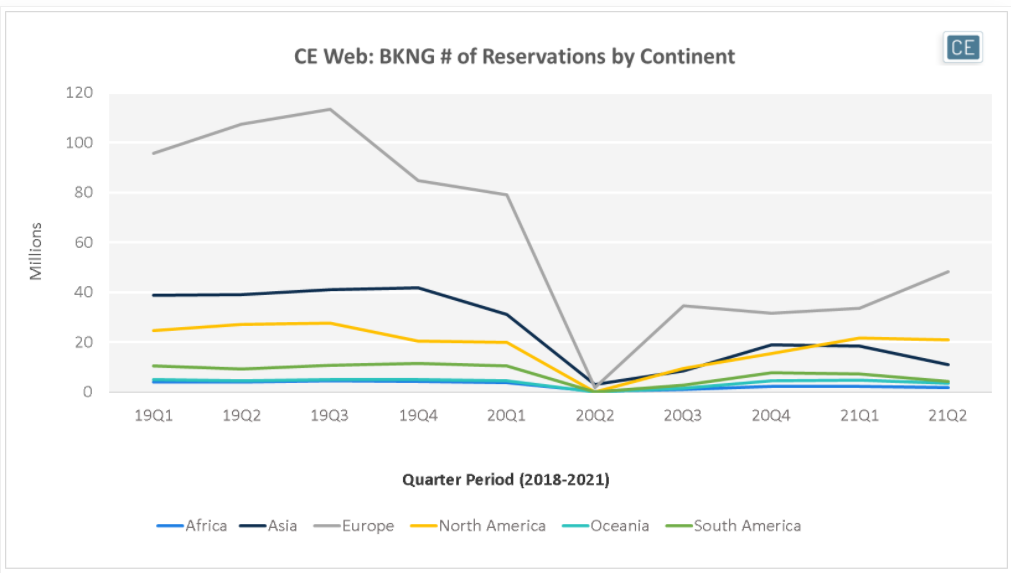

Our CE Web data allows us to see not only where people are booking travel from, but also where they are going to. For BKNG, the largest percentage of lodging properties booked in 2021Q2-to-date has been in Europe, with 53% of overall bookings on the continent. This is similar to the 56% of bookings the continent received in 2019Q2. The biggest decline in booking share was for Asia, which went from 20% of property bookings in 2019Q2 to only 12% in 2021Q2-to-date. This was largely to the benefit of North American properties, which went from 14% of total bookings to 23%.

Property Bookings

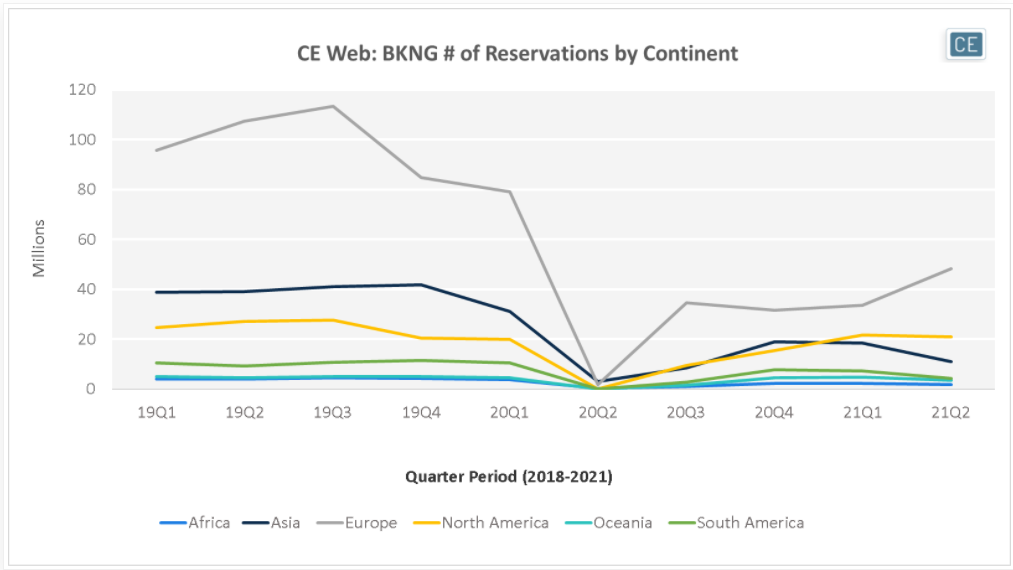

Of course, the number of open properties plays a role in where people choose to travel. Our CE Web data tracks property inventory in addition to bookings across several travel sites. In the case of BKNG, the inventory trends track very closely to where people are making reservations. BKNG has seen the fastest recovery in European property inventory, which in May was almost flat versus 2020. Asia is still seeing the largest decline at -24%.

Property Inventory by Continent

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.