In light of recent IPO announcements, we’re pleased to present reports from our Spring Emerging Technology Study for several of these soon-to-be-public vendors. This survey saw participation from a record high 1,000+ IT Decision-Makers, capturing over $400B in anticipated total annual IT spend.

Monday.com

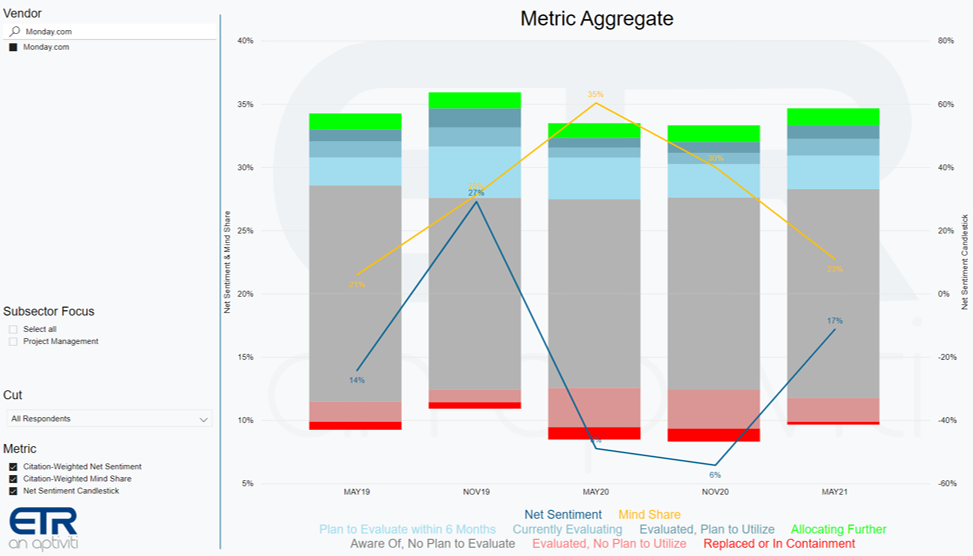

Monday.com’s Net Sentiment score is showing signs of recovery from 2020 studies, driven by a reduction in churn indications. Evaluation and utilization rates are slightly improved versus ETR’s NOV20 Study. Mind share within the Project Management space has shrunk since this time last year.

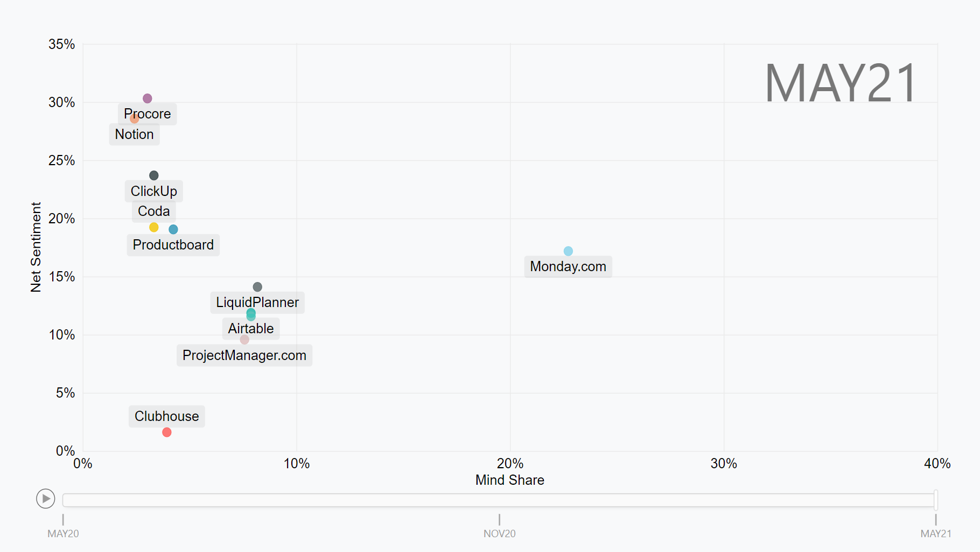

Monday.com holds a considerable, albeit compressing, mind share lead over emerging peers, while its Net sentiment sits middle of the pack. Monday.com shares less than 10% overlap with organizations indicating 2021 plans to decrease spend on or replace one or multiple of the following competitors (per Monday.com’s S-1): Smartsheet, Asana, Wrike, Citrix, Zendesk, Freshworks, SugarCRM, Zoho, Atlassian, Hootsuite, and Adobe.

WalkMe

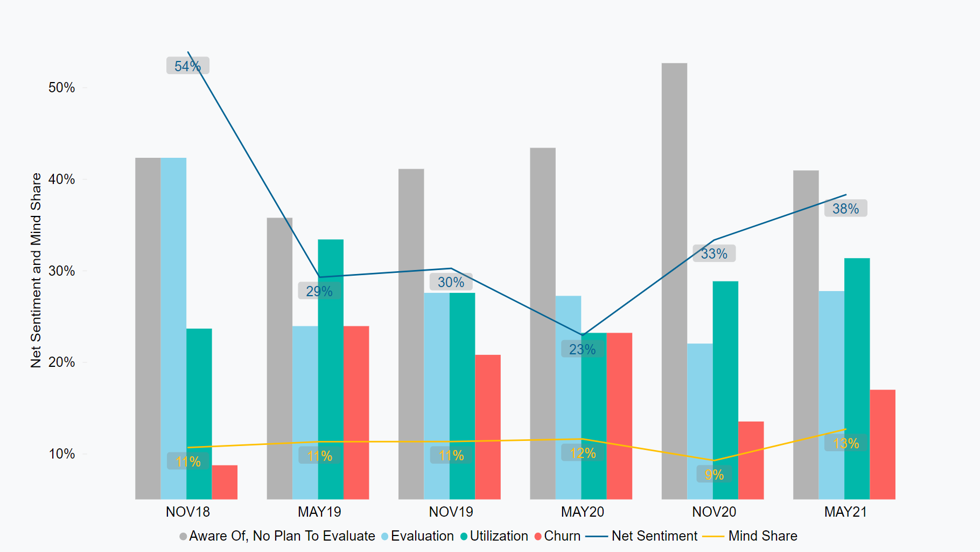

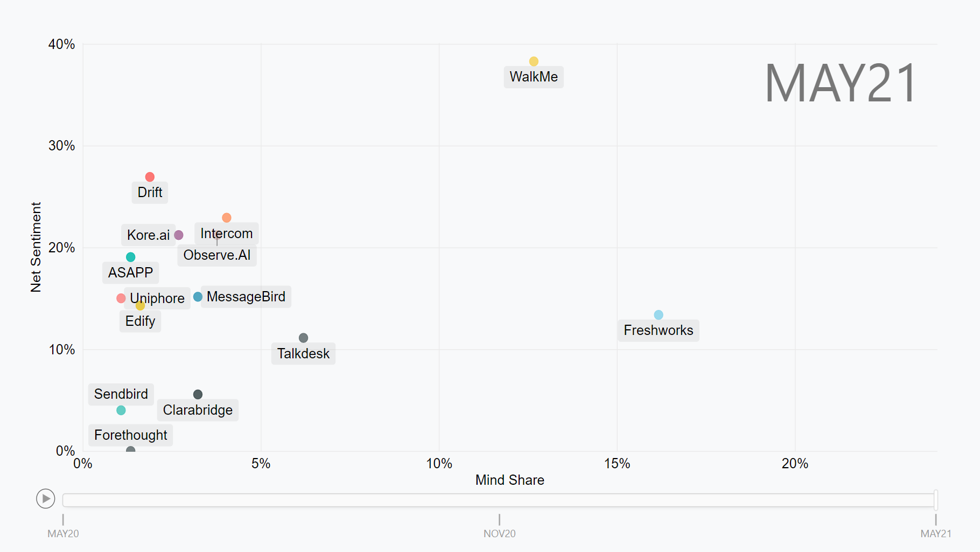

WalkMe saw a substantial improvement in Net Sentiment over the past year as the proportion of organizations evaluating and utilizing the vendor has grown. Churn rates have shrunk y/y, as well as the proportion of organizations that are aware of WalkMe but have no plan to evaluate the vendor.

Given its high evaluation and utilization rates, WalkMe leads emerging customer support software peers with the highest Net sentiment by a considerable margin and only trails Freshworks in mind share.

To learn more about the data behind this article and what ETR Research has to offer, visit https://etr.plus/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.