Earlier this month (June 2), Amazon announced that its annual Prime Day will take place June 21 – 22. Prime Day 2021 will feature over 2 million deals worldwide, the most ever offered in the event’s seven-year history! Although the impact of the pandemic makes it particularly difficult for brands to develop 2021 strategies, we’ll use Similarweb Shopper Intelligence to make actionable, Amazon Prime Day predictions by comparing this year with last and describing top consumer trends we foresee impacting this year’s shopping event.

Prime Day 2020 vs. 2021

Last year’s Prime Day sales made history:

Key factors contributing to last year’s record sales relate to the pandemic, including physical store closures and fears of shopping indoors.

Now, with over 52% of Americans having received at least one dose of the COVID-19 vaccine, safety is less of a concern for in-store shopping and consumers want to go back! Even in January, before the mass vaccination roll-out, Radiant’s consumer report showed that 46% of consumers prefer in-store shopping.

Amazon customers that have returned to in-store shopping may be less likely to gravitate to Prime Day deals, but, those who started shopping online due to the pandemic will balance out this customer loss. In fact, Prime membership grew 25% in less than one and a half years. In January 2020, pre-pandemic, Amazon reported 150 million Prime members but grew to 200 million in April 2021, according to Jeff Bezos’ annual shareholder’s report April 15.

This growth means a more loyal customer community ready to take advantage of Prime Day discounts. While we do not expect a 60% (YoY) increase in revenue, like 2020, we do expect revenue as a whole to increase compared to last year.

We’ll use Shopper Intelligence, our Amazon insights tool for retailers and CPG brands, to compare purchase and consumer behavior from Prime Day 2020 to the period leading up to the event this year. Here’s the consumer trends fueling our Prime Day predictions.

1. Consumers are eager to spend

With consumer confidence soaring 19.3 points to 109.7 in March, and analysts expecting spending power to increase this quarter, we suspect revenue for both Amazon and competitor retailers to increase from last year. Stimulus checks, tax refunds, and lower unemployment rates also give shoppers more money to burn.

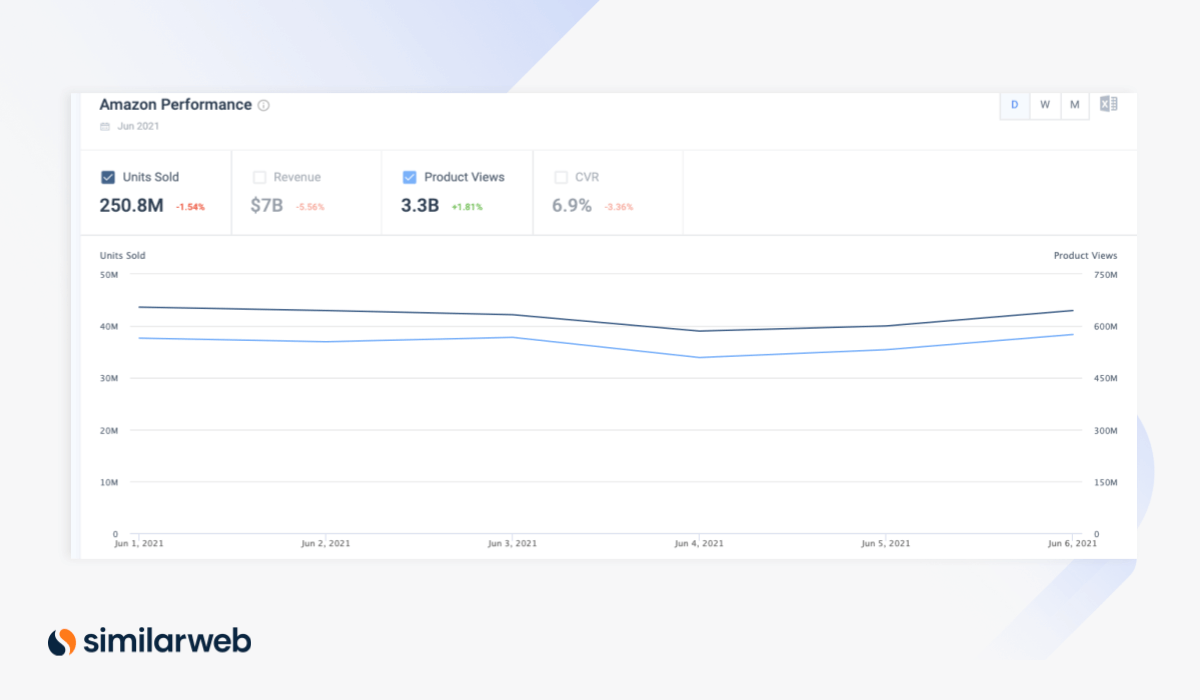

As an indicator, Amazon’s day-over-day (DoD) revenue is more after the announcement of Prime Day 2021 on June 2, than it was after the announcement of Prime Day 2020, on Sept. 27. June 2 – June 6 DoD revenue hovered around $1.2 billion. Last year, DoD revenue for the thirteen days leading to Prime Day stayed under $1 billion.

Higher DoD conversion rates and revenue in 2021, (via Shopper Intelligence)

DoD revenue in October under $1 billion, for the most part, prior to Prime Day 2020 (via Shopper Intelligence)

Consumer browsing is also turning into more purchases. Shopper Intelligence data shows that the conversion rate (CVR) in May (6.6%) is higher than in September 2020 (6.2%). However, we suspect that shoppers’ need for essentials like N95 masks, a top on-site search term, pushed 2020’s CVR higher than it otherwise would be.

2. Tired of practicality

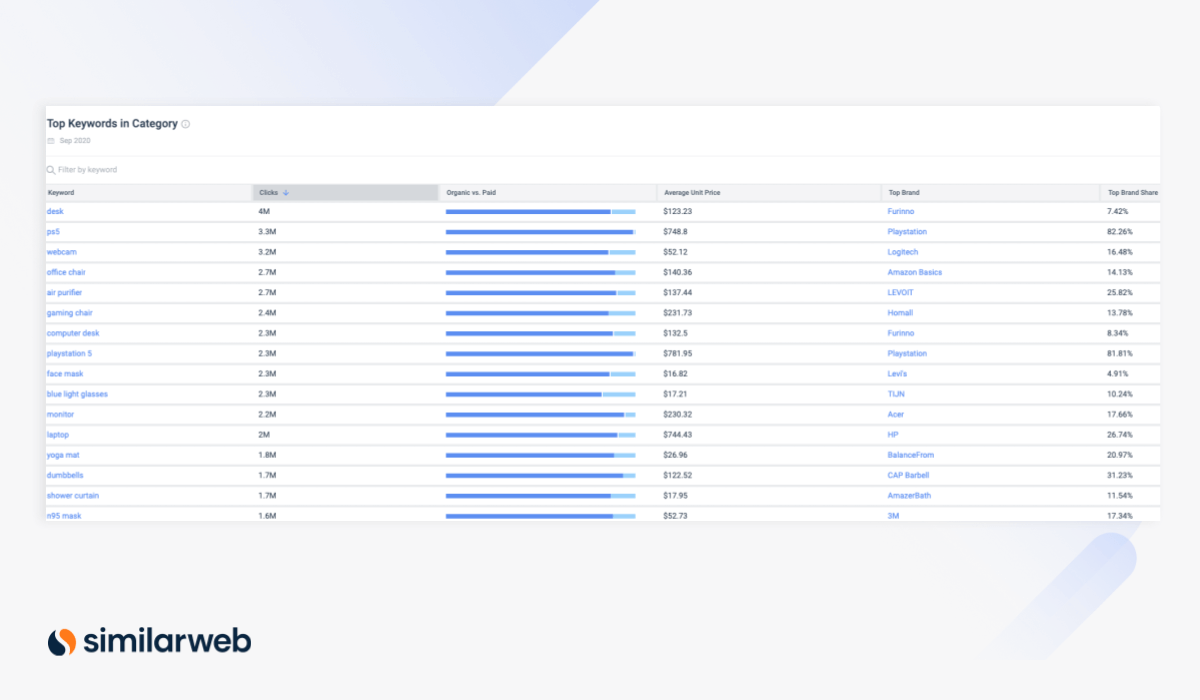

Last year Amazon on-site search was highest for practical electronics and COVID-related items. Desk, webcam, office chair, and air purifier made up four of the top five keywords across Amazon.com. With some of best prime day deals compared to other retailers, Amazon’s electronics category generally performs well (Amazon devices, Samsung products, android, Airpod pro, and audible have been top sellers), however, this year we are not so sure.

In 2020, keywords related to electronics and remote office/learning ranked among Amazon’s top 20 (via Shopper Intelligence)

3. Out of the house and want to look the part

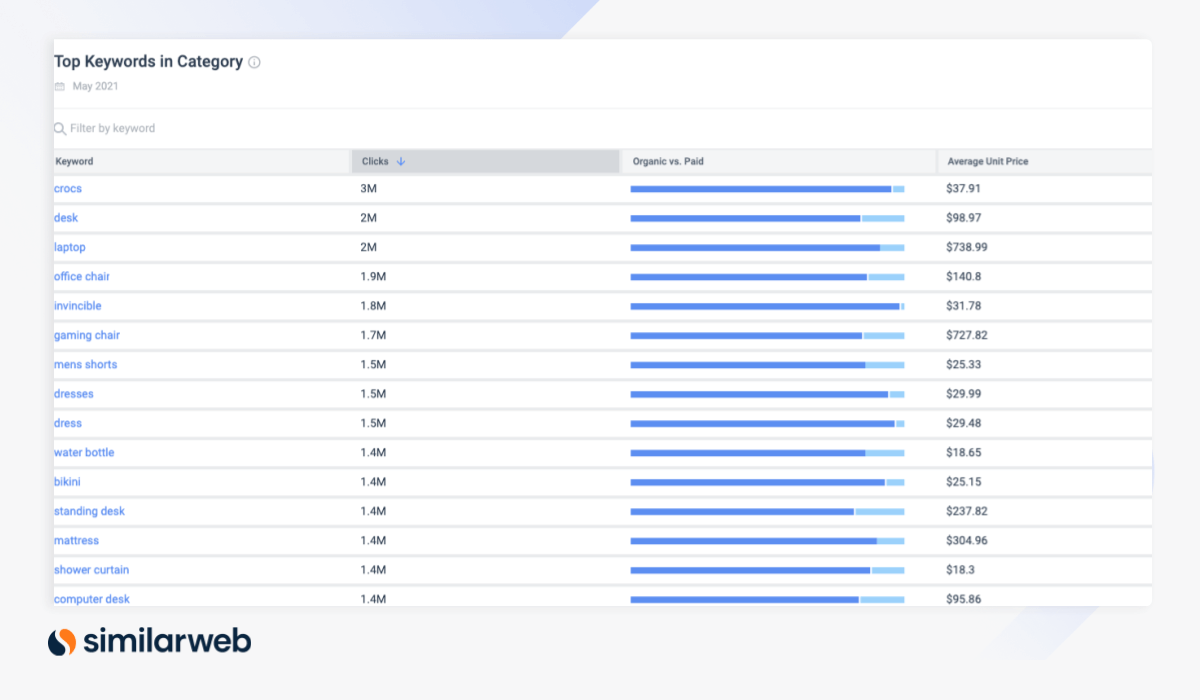

In September 2020, zero keywords related to fashion and apparel ranked among the top 15. This May nearly one-third made up the top 11 on-site search terms. Shoe brand/style “crocs,” ranked number one. Other top terms included “mens shorts,” “dresses,” “dress” and “bikini”. Consumers want to emerge from their house and look fashionable doing it!

Unlike pre-Prime Day 2020, shoes and clothing make up the bulk of keywords this year

Differences in unit sales for fashion and apparel also show that consumers are ready to purchase to look the part. Last September, the ’“clothing, shoes, and jewelry” category sold 68 million units bringing $1.6 billion in revenue, and 2.4 billion product views. This year, in May, the same category sold 86 million units, brought in $2.1 million billion revenue, and 2.8 billion product views.

The return of events, reopening of restaurants, and increased travel to vacation destinations mean that people are paying attention to shopping categories that make them look good, many of which were stagnant in 2020.

4. Readiness to shop online, even if it’s not Amazon.com

In a “halo effect,” after Amazon’s Prime Day announcement, retailers have started offering competing Prime Day sales and promos, gearing consumers up even more to shop online on Prime Day. Brands need to ensure that their products are visible on all relevant sites.

Competing sales this year already announced include:

In the past Best Buy, Home Depot, Bed Bath and Beyond have also offered sales.

5. Incentives enticing consumers to shop at small businesses

n an effort to support small businesses hit hard by the pandemic, some of the best Amazon Prime Day perks this year support shopping “small.” Shoppers that spend on the website’s small business section can receive: 1) a $10 credit for every $10 spent 2)10% in additional rewards earnings for Amazon credit and store cardholders.

Indicators from last year show that this greater focus on small businesses may have promise. For instance, growth in the Arts & Crafts category (+116%), highlights success in areas where Amazon promoted small and medium businesses.

Prime next steps: upcoming webinar

This year’s shopping trends will be somewhat of a surprise given changes to the entire eCommerce landscape over the past year-and-a-half, and the current pandemic-recovery mode that we are in. To be among the first to access insights from this year’s Prime Day to help you create the best eCommerce strategies, be sure to sign up for our upcoming Amazon Prime Day 2021 Insights Webinar led by our Director of CPG and Retail on June 28.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.