The TV and streaming market is constantly being redefined.

The player moving quickest these days is AT&T, owner of HBO Max.

AT&T’s been working towards a merger between WarnerMedia and Discovery to create a new $150 billion content unit, Warner Bros. Discovery. And it launched HBO Max’s ad-supported tier earlier this month.

This is all against the backdrop of increasing competition among streaming platforms. We’re not referring to the number of players in the market—those days are gone. Instead we’re talking about their ability to meet consumers’ expectations of higher quality and fewer ads than linear TV, while delivering for advertisers.

OTT was largely an experiment for brands last year when we looked at how many brands were on OTT but not TV. But HBO Max is doing its own thing, which might impact which brands buy on OTT instead of TV.

Why the HBO Max With Ads matters in the AVOD landscape

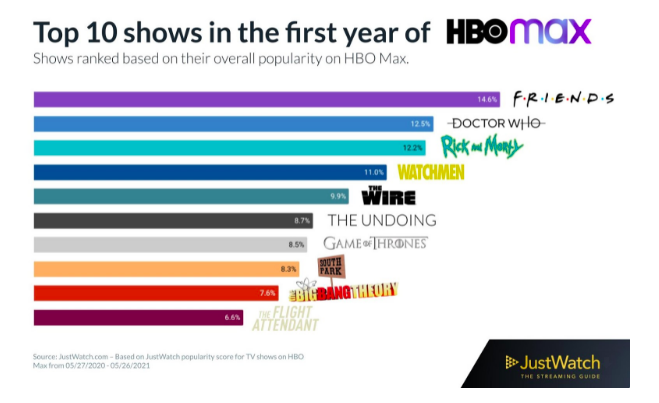

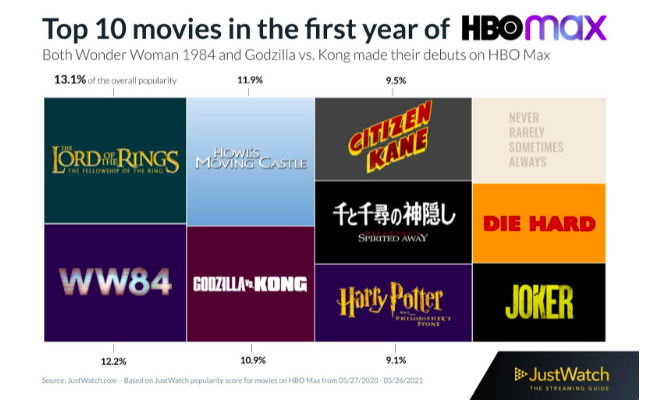

HBO Max has 10,000 hours of premium content to rival other AVOD contenders like Peacock and Hulu. Content ranges from HBO original content, Warner Bros. Studios films, Turner Classic Movies, DC’s Extended Universe and more.

Between household TV series to some of the most recognizable movie titles of all time, HBO Max has a staggering amount of content.

HBO Max currently has slightly more paid subscribers than Peacock and Hulu each (around 42 million). But its M&A activity, international expansion plans and new ad tier signal that it’s aggressively trying to scale to the size of Disney+ or potentially Netflix. By 2025 AT&T believes HBO Max will have over 120 million subscribers.

But, unlike Netflix and Disney+, it offers a AVOD tier with “a commitment to the lowest commercial ad load in the streaming industry.”

HBO Max is making OTT ad purchasing more accessible, but inventory is limited

HBO Max isn’t only contending for the best ad experience for consumers. It’s opening up options for more advertisers.

At first glance, it wouldn’t seem like it with its limited inventory.

HBO Max’s ad-supported tier limits inventory to four-minutes of ads per hour of showtime, roughly half that of Hulu’s, which could be five minutes per a half-hour show.

This “elegant” ad model is still slightly unclear to buyers, but the streaming service isn’t making exclusive deals with large sponsors (when Peacock went live, it had ten exclusive partners).

Instead, they’re open to the entire marketplace.

“They are actively going in a completely different direction,” said one media buyer to Adage. Others noted that upfront commitments were fairly modest.

Though the details remain unclear, it seems that HBO Max is selling to a more diverse set of partners than early AVOD businesses. (The irony here is that HBO via cable doesn’t sell ads aside from their content… it’s hard work to keep up with networks these days.)

This makes us wonder how this will impact the number of brands who advertise on both TV networks and their corresponding streaming service and how this new channel will impact the brands that exclusively advertise on OTT.

MediaRadar Insights

Streaming services are in a race to the fewest amount of ads of streaming. At the same time audiences are adding more streaming to their viewing diet.

This makes us ask how much ad inventory does that leave for brands? And how does TV ad spending compare to OTT?

While streaming viewership is increasing, we’re nowhere close to the fall of TV advertising.

Brands who don’t spend on television spent $55.8mm in OTT from January to May 2021.

The evolution of TV and streaming continues to unfold month-by-month. Premium advertising spots are opening up for more advertisers, but details are largely hazy when each service has its own processes and limited inventory options.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.