Although Grocery has been one of the slowest industries to move online, Meal Kit companies have carved out a niche in both the US and UK by taking the planning out of meal prep. In today’s Insight Flash, we examine the growth trajectories across the two continents, focusing on overall spend growth, order size growth, and how the market leaders have changed.

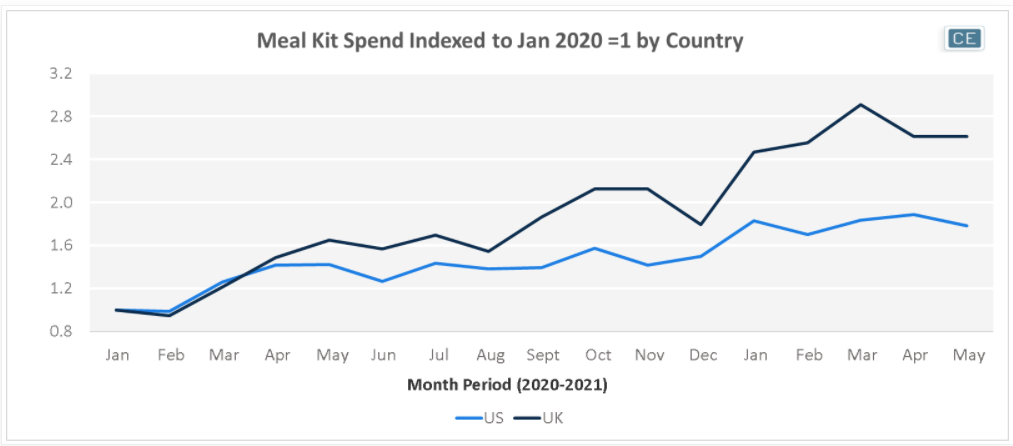

Meal Kit growth in the UK has outpaced growth in the US over the last year and a half, with May 2021 spend 2.6x that of January 2020. In the US, May 2021 spend was a still-strong 1.8x January 2020 levels. Although both countries saw an increase in spend due to the COVID pandemic, New Year’s resolutions to eat healthier in January appear to have also played a big role in driving growth.

Subindustry Growth

Although more people have been buying meal kits, order size growth has played a part as well in the US. The average order size grew 18% between January 2020 and May 2021, from $55 to $65. In the UK, order sizes peaked in April 2020 as the pandemic set in, and May 2021 order sizes are on par with January 2020.

Average Order Size

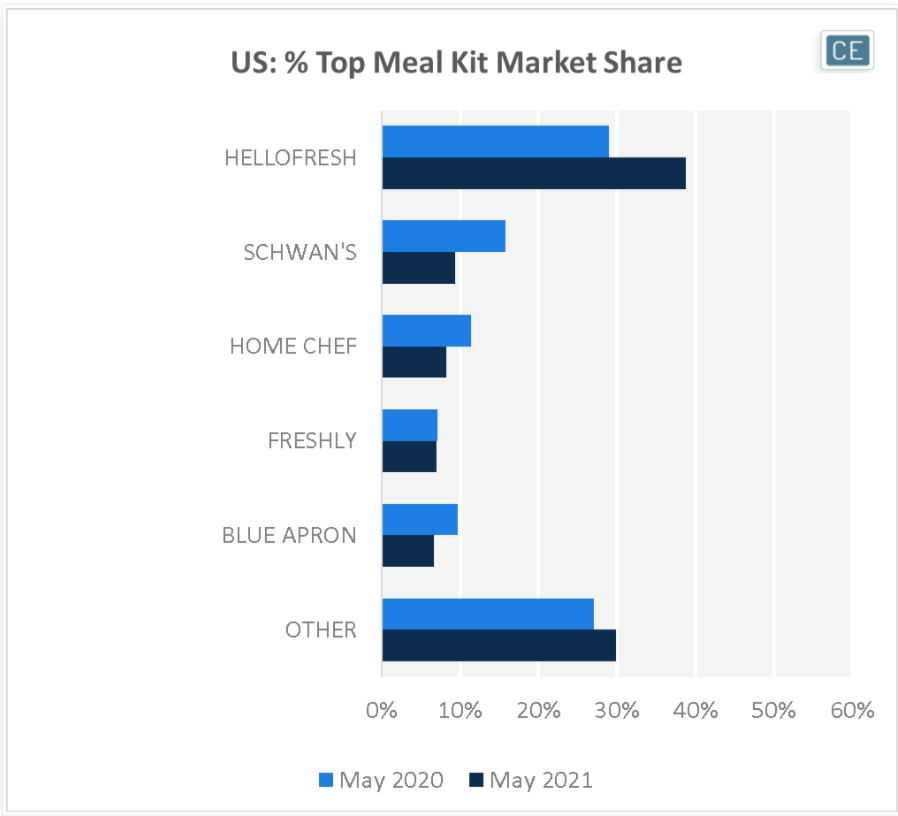

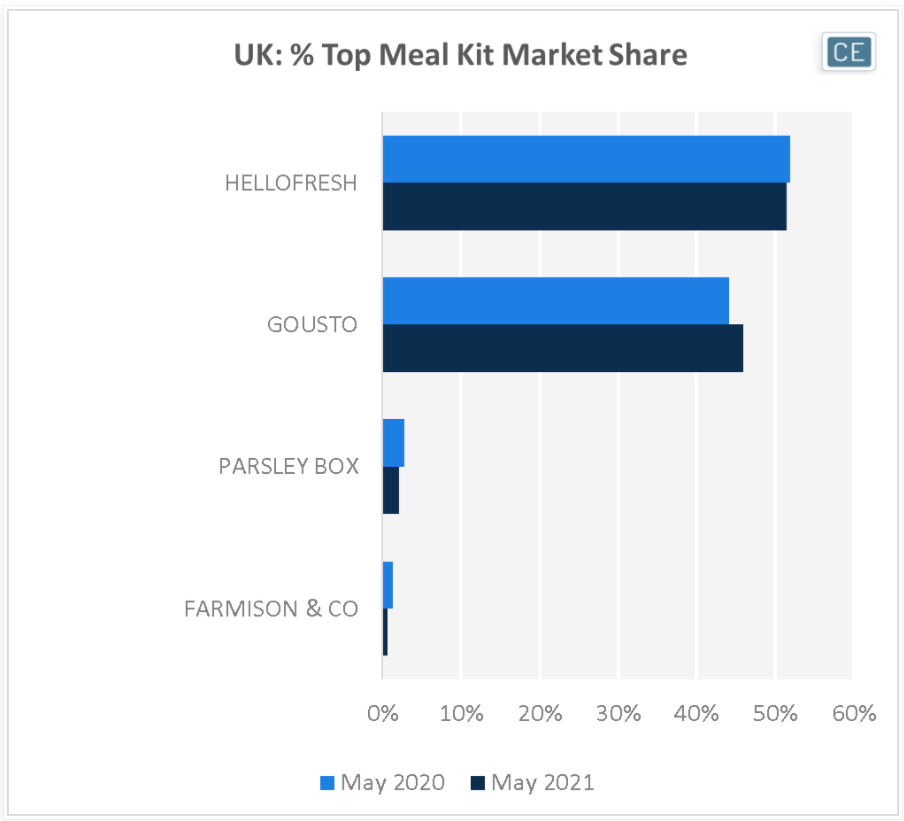

HelloFresh has been a dominant brand in both the US and UK markets. In the UK, spend among tracked brands is highly concentrated. While HelloFresh leads with over 50% of spend in the Meal Kit subindustry, Gousto is not far behind with over 40% share. In the US, spend is more fragmented. Brands beyond the top five make up roughly 30% of tracked Meal Kit spend. HelloFresh not only lead competitors with almost 40% market share in May, but has been gaining ground – this was a 10% share increase from the year prior. This came largely at the expense of other top players.

Market Share

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.