U.S. Single-Family Rents Up 5.3% Year Over Year in April

Overall Single-Family Rent Growth

U.S. single-family rent growth increased 5.3% in April 2021, the fastest increase since May 2006, according to the CoreLogic Single-Family Rent Index (SFRI). The index slowed in 2020, but even when compared with 2019, rent growth is running above pre-pandemic levels. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

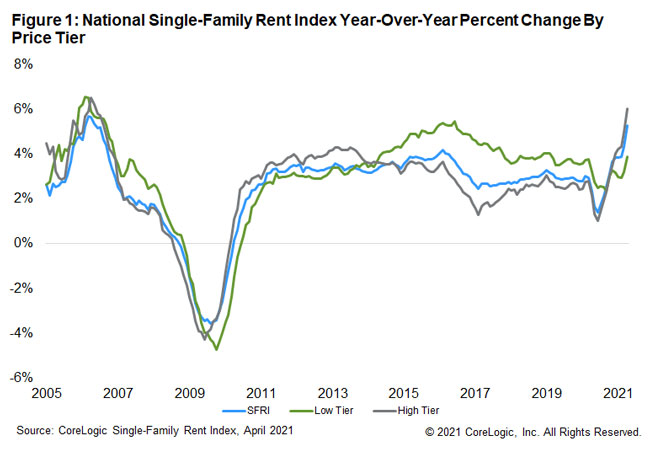

Single-Family Rent Growth by Price Tier

An uneven U.S. job recovery, sometimes called a “K-shaped” recovery, is reflected in the rent price growth of the low- and high-price rent tiers. The low-price tier is defined as properties with rent prices less than 75% of the regional median, and the high-price tier is defined as properties with rent prices greater than 125% of a region’s median rent (Figure 1).

While rent growth exceeded pre-pandemic rates across all price tiers, including low-end rentals for the first time, rent growth for lower-priced properties lagged behind that of higher-priced properties. Rent prices for the low-end tier increased 3.9% year over year in April 2021, up from 3.2% in April 2020. Meanwhile, higher-priced rentals increased 6.1% in April 2021, up from a gain of 2.2% in April 2020. This was the fastest increase in higher-price rents since May 2006.

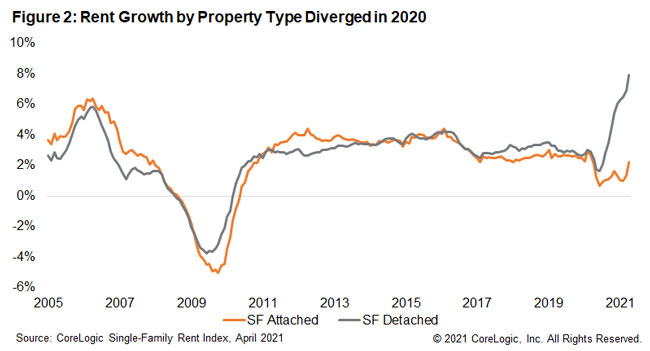

Single-Family Rent Growth by Property Type

Differences in rent growth by property type emerged after the pandemic as renters sought out standalone properties in lower density areas (Figure 2). The detached property type tier is defined as properties with a free-standing residential building, and the attached property type tier is defined as a single-family dwelling that is attached to other single-family dwellings, which includes duplexes, triplexes, quadplexes, townhouses, row-houses, condos and co-ops.

As demand for more space and outdoor amenities remains, detached rentals in particular are experiencing accelerated growth with a 7.9% year-over-year increase in April, compared to growth of 2.2% annually for attached rentals.

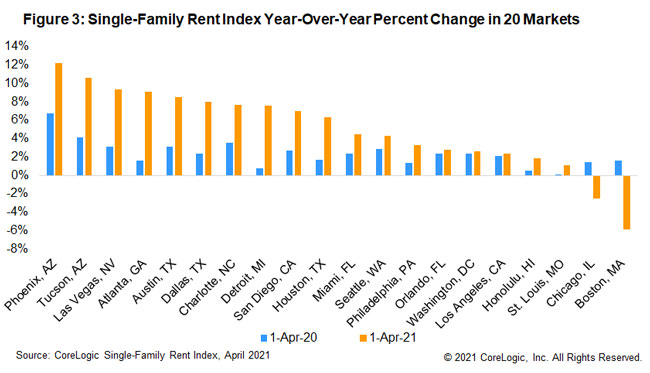

Metro-Level Results

Figure 3 shows the year-over-year change in the rental index for 20 large metropolitan areas in April 2021. Among the 20 metro areas shown, Phoenix stood out with the highest year-over-year rent growth in April as it has for most of the last three years, with an increase of 12.2%, followed by Tucson, Arizona (+10.6%) and Las Vegas, Nevada (+9.3%). Two metro areas experienced annual declines in rent prices: Boston (-5.9%) and Chicago (-2.6%).

Boston and Chicago were also the only 2 of the 20 metros shown in Figure 3 to have lower rent growth than a year ago with Boston showing a deceleration of 7.5 percentage points and Chicago showing a deceleration of 4 percentage points from April 2020.

The slowdown in Boston rent growth might be attributed to college students choosing not to return to Boston, but instead opting to continue virtual learning elsewhere. For Chicago, there were large differences in rents of attached versus detached properties. While rent prices of detached rentals in Chicago increased by 5.6%, attached rentals experienced a decrease of 4.1%.

While rent growth dipped significantly last April at the start of the pandemic, rising affordability issues and supply shortages in the for-sale housing market and ongoing demographic pressure from aging millennials have continued to place upward pressure on the single-family rental market — leading to the largest annual rent price increase in nearly 15 years in April 2021. These factors will persist in the near term, leading to strong rent growth this year.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.