Investors intent on not letting a crisis go to waste will need to see beyond the distressed investing playbook that was formulated during the Global Financial Crisis (GFC). A different kind of crisis warrants a different distressed investment strategy and those investors strictly playing by past rules are likely to miss out.

Distressed investing in the GFC era was about firms stepping in to help rebalance the capital stack. There were cash-flowing assets that simply had too high of a debt burden relative to income, and new, large sources of capital came in to set things in order using appropriate levels of debt. In doing so, these capital sources reaped tremendous gains.

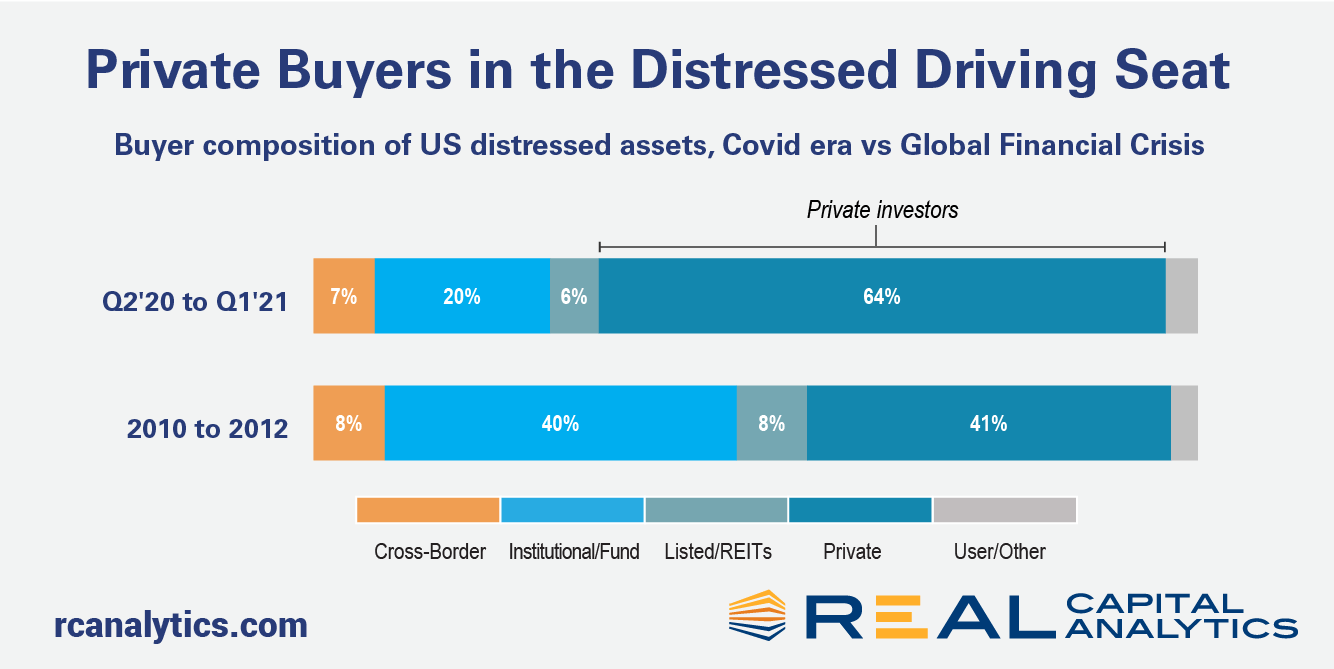

Well-funded institutional investors were properly positioned to take advantage of the distressed buying opportunities during the last crisis. Real Capital Analytics data shows that institutional capital was behind 40% of U.S. distressed purchases between 2010 and 2012. Equity funds were particularly well suited for this type of investing, accounting for just over a quarter of all distressed purchases over the same time frame.

The drivers of the current downturn are fundamentally different from the last. Rather than an overleveraging of assets, Covid-19 introduced a shock to demand that exposed underlying weakness, particularly in retail and hotel assets.

With most property owners well-capitalized before the crisis, the way to success in pandemic-era distressed investing is through the repositioning of assets that are currently lacking great income prospects. Preliminary RCA data shows that 12% of distressed assets purchased through the first five months of 2021 were acquired with the intent to redevelop. This is double the proportion of non-distressed sales slated for redevelopment over the same period.

The elbow grease required to convert distressed assets to their highest and best use has drawn notice from a different investor pool. Between the second quarter of 2020 and first quarter of 2021, private buyers — predominantly developers, owners and operators — accounted for 64% of all distressed asset purchases. By contrast, equity funds were behind only 12% of distressed purchases, with the broader institutional capital category taking only 20%.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.