While large companies with capital reserves, the ability to issue debt, and e-commerce sites were able to weather the COVID pandemic, many small businesses did not fare as well. Our CE Macro data classifies payment card spend as tagged to one of the over 10,000 brands part of our Brand Universe of interest to corporate and investor clients, or untagged, which is a proxy for small business activity. In today’s Insight Flash, we look at the extent to which small businesses have taken part in the recovery, breaking down the data by geography to see if areas with stricter COVID restrictions are seeing a slower return to small business spend.

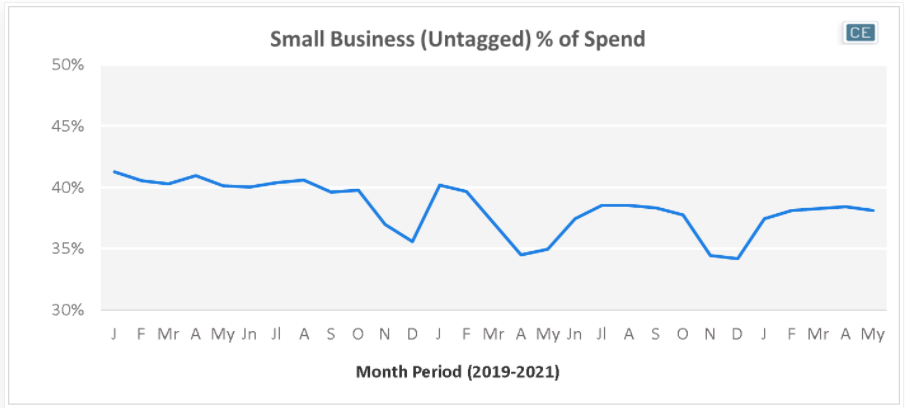

The negative impact of the pandemic on small business spend is clear in the data. In April and May of 2020, untagged spend was only a third of the total captured by transaction data, down from over 40% in 2019. The pace of small business recovery hasn’t allowed it to return to pre-pandemic levels – untagged spend in April and May 2021 was still 2% below 2019 levels.

Small Business Share

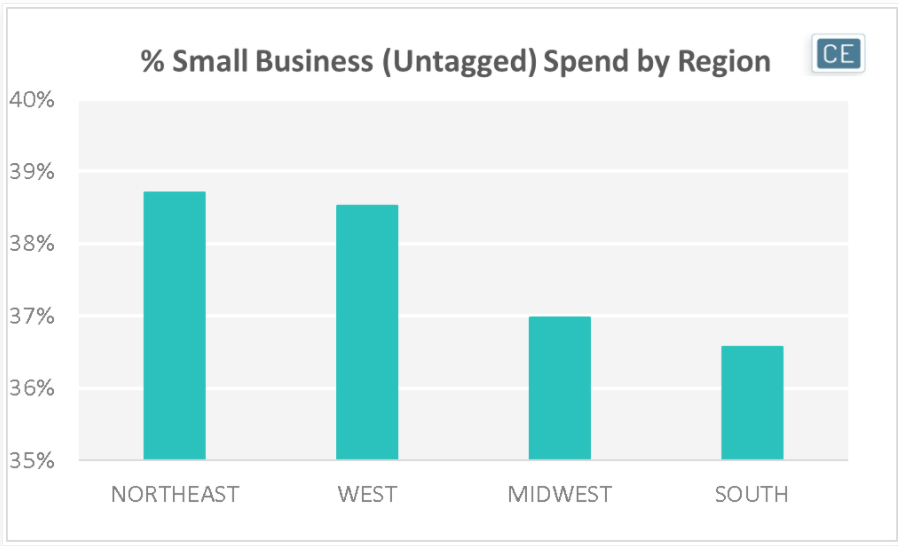

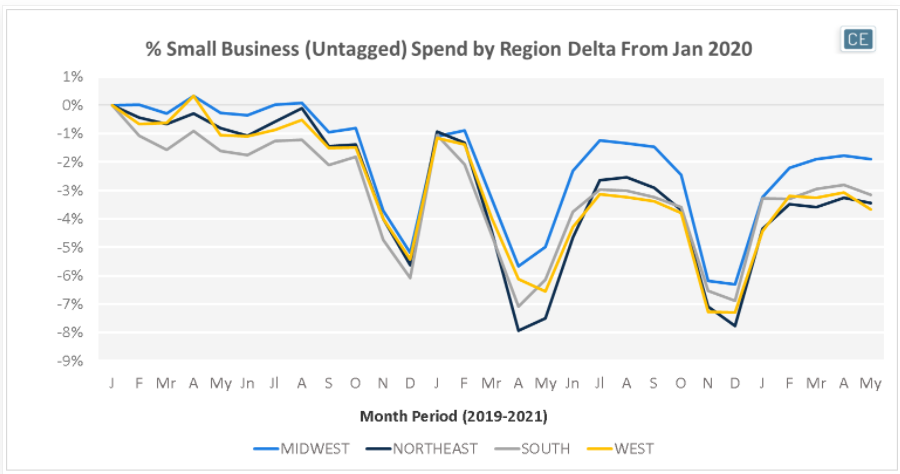

In general, small business spend in the US is fairly evenly dispersed. The Northeast has the highest percentage at 39%, but the South with lowest percentage isn’t far behind at 37%. Throughout 2019, all US regions saw a decline in small business spend as a percent of total. When the pandemic hit in April of 2020, the Northeast saw the largest small business impact with an -8% lower share of total spend than in January 2020. Midwest small businesses have held up the most through May 2021, with only a -2% lower share of spend than in January 2020. Small businesses in the West are lagging, with a -4% lower share of spend than in January 2020.

Geographic Trends

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.