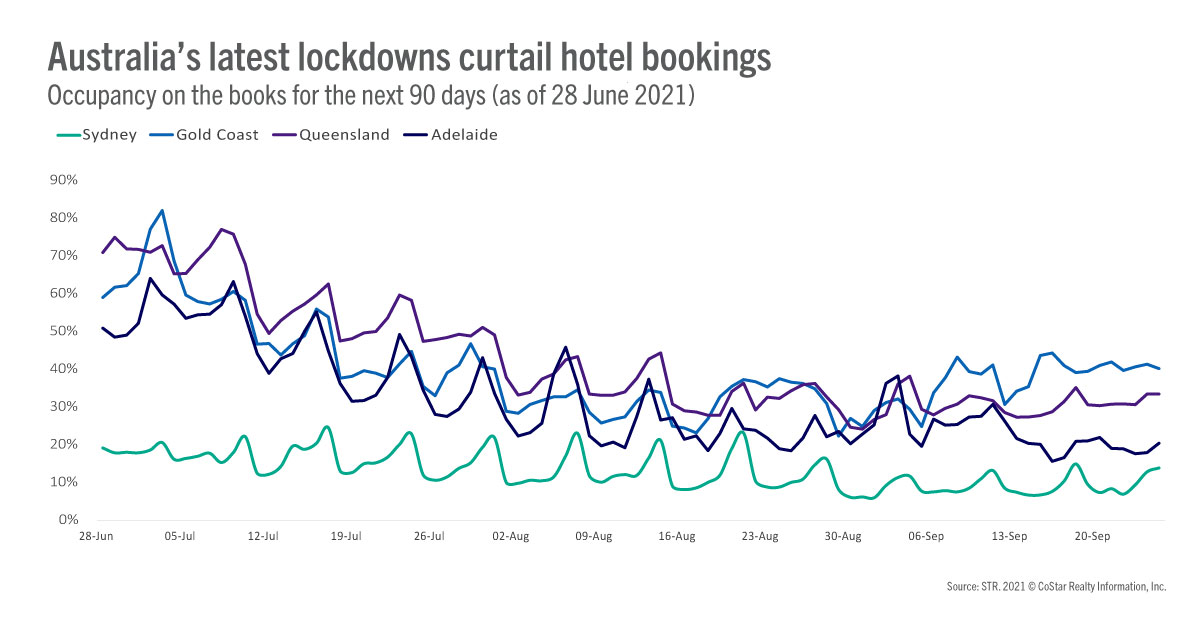

Australia has been one of the highest performing hotel occupancy markets with improving midweek demand alongside continued strength across weekends. Amid recent COVID-19 outbreaks and lockdowns, however, key markets in the country are showing noticeably lower levels of occupancy on the books for the coming weeks.

When comparing the Forward STAR data updates of 28 June 2021 vs. 21 June 2021, Sydney’s average decline in occupancy on the books for the coming weeks and months was 13.8%. For the week of 27 June-3 July, Sydney’s hotel occupancy was not expected to exceed 20%, which would be a greater than 50% drop from previous weeks.

The Gold Coast was not yet in lockdown at time of processing the 28 June Forward STAR data, but because the Sydney basin is a large source market, the Gold Coast too saw more cancellations than new bookings for the coming two weeks. North Queensland has been affected three straight weeks with cancellations outweighing new bookings even though this is peak season as people escape north to find the warmer weather. Occupancy on the books for July is presently at 77% but isn’t likely to be as strong as expected a month ago because of cancellations.

To date, the silver lining is that cancellations seem to be isolated to the next two weeks. For now, if there are bookings beyond the next two weeks, consumers appear to be holding them, hoping that their travel won’t be impacted. But if restrictions are extended, it will show through in more cancellations. The immediate impact is clear but there is a tail.

The typical booking pace for the next month has slowed dramatically across all markets, and therefore, will have a lagging and sustained impact on future actualized occupancies. For example, on a weekly basis, Adelaide had been experiencing an average nightly pickup for the next seven days at 15%. During the week of 20-26 June, pickup (change in bookings levels from one data collection to the next) was just 3.4%. This means that while Adelaide isn’t in lockdown, the uncertainty and lockdowns in other parts of the country have affected all markets.

Year to date through May 2021, Australia’s RevPAR performance was 74% recovered to 2019 levels. However, since the second week of June, as the Delta strain of COVID-19 emerged in the community, lockdowns in Victoria, New South Wales, Queensland, Northern Territory and Western Australia has curtailed occupancy. This has been particularly damaging for what was expected to be a rise in demand entering a strong leisure period with winter school holidays.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.