As the opening ceremony of the Tokyo Olympics draws near, we examine commercial property transaction volumes across Asia Pacific to see which country is on track for the gold medal in 2021.

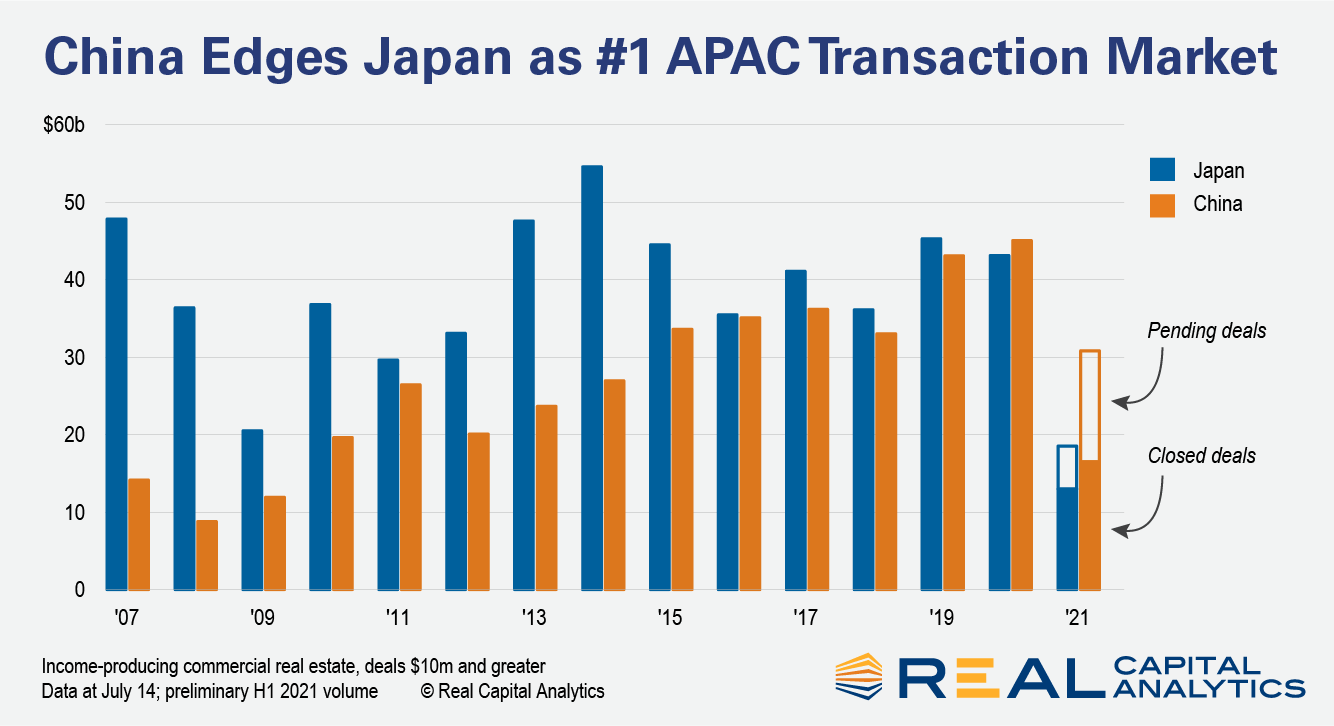

Japan had an unbroken record of 13 consecutive annual number one rankings from 2007, when Real Capital Analytics started comprehensively collecting data across the region. However, Japan comes into the delayed Tokyo Games on the back of a second-place finish, with China standing at the top of the podium in 2020.

The two markets have been in close competition since 2016. The story here is not so much about Japan falling back – transaction volumes have been reasonably stable in recent years – but more about China’s seemingly unstoppable growth trajectory. For 2021, a significant number of sizeable transactions have already closed in China or are due to close before the end of the year.

Normally we tend to look at the buy side for clues about what drives sales volume, but in China it is the sell side that does the talking. Chinese firms, enamored of real estate, will not let go of it until they must. That is what happened after the clampdown on shadow banking. Chinese investors were pressured to sell, and cross-border investors poured into the country in 2019, boosting volumes to a then-record.

Even as commercial property investment shrank in most major economies globally last year, in China investment volume grew. The imposition of China’s “three red lines” policy in October 2020 – the harshest measure for heavily indebted developers so far – has prompted sales of once untouchable assets. Blackstone has been at the center of some of the juiciest deals: a billion-dollar logistics park last year, and a multibillion-dollar transaction for the privatization of developer Soho China this year.

While some domestic players have scaled back, a new wave of other, well-capitalized investors have stepped in. Insurer Ping An is a good example. Amidst the sell-off, the firm went on the offensive, acquiring over $5 billion worth of office and retail assets from CapitaLand in a deal announced last month.

Other North American players, too, have become more prominent in China the last 18 months, in contrast to European and APAC players who have slashed their allocations. Brookfield spent $1.4 billion on a mall portfolio, helping China’s retail sector become one of the largest retail markets globally so far in 2021.

Will this boost from U.S. and Canadian players get China’s commercial real estate market to the number one position ahead of Japan? The Tokyo Games finish August 8; the final reckoning for the region’s two largest markets, a little further down the road.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.