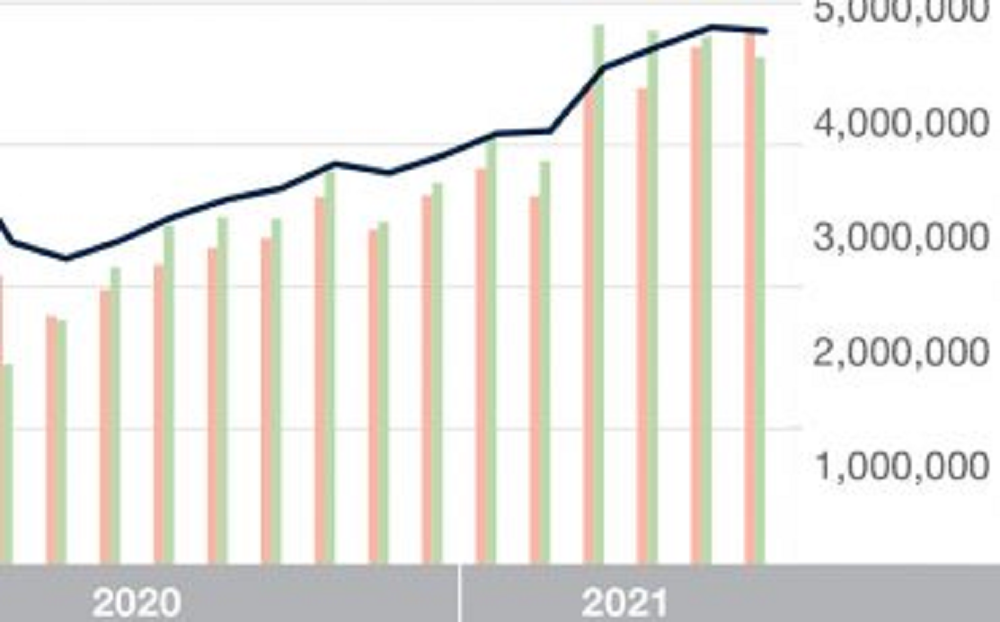

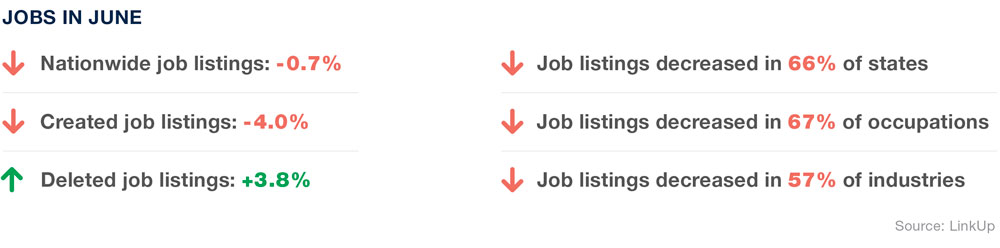

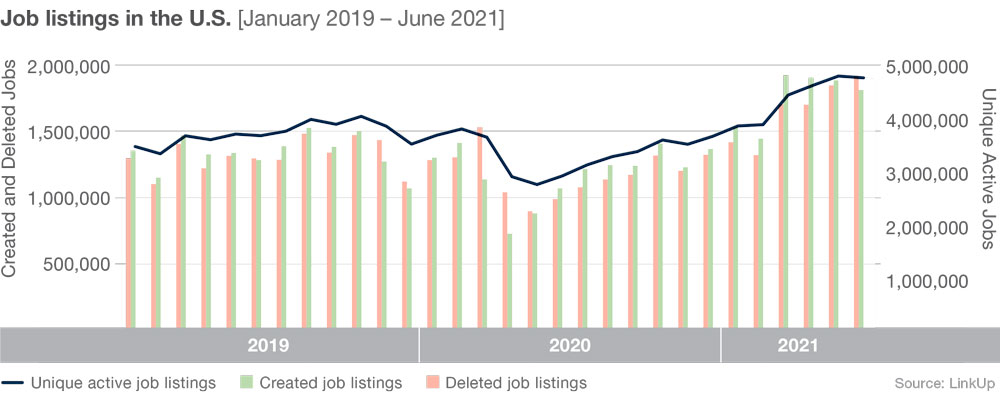

Looking back at the month of June, we see growth has slowed and the labor market appears to be leveling off. The month brought the first signs that the job market is cooling down. It’s not quite a summer slump, but maybe, just maybe, this slowdown signifies things could be (dare we say it?!?) returning to “normal.”

While more than half of industries saw decline, several did see strong job growth last month. Topping the list are Real Estate and Rental and Leasing (+7.3%), Finance and Insurance (+6.8%), Information (+5.4%), and Professional, Scientific, and Technical Services (+6.8%).

Only 33% of occupations saw increasing jobs in June though. Those at the top of the list include Arts, Design, Entertainment, Sports, and Media Occupations (+7.4%), Personal Care and Service Occupations (+4.8%), and Computer and Mathematical Occupations (+2.6%)

June’s most significant changes came at the state level, where we saw major downward shifts from the previous months.

66% of states saw job listings decrease in June, compared to the increases that 98% of states saw in May. States with the most change in June: Maine (+7.2%), Vermont (+4.5%), and Delaware (+4.2%), and on the bottom: Wyoming (-5.6%), South Dakota (-5.2%), and Iowa (-5.1%).

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.