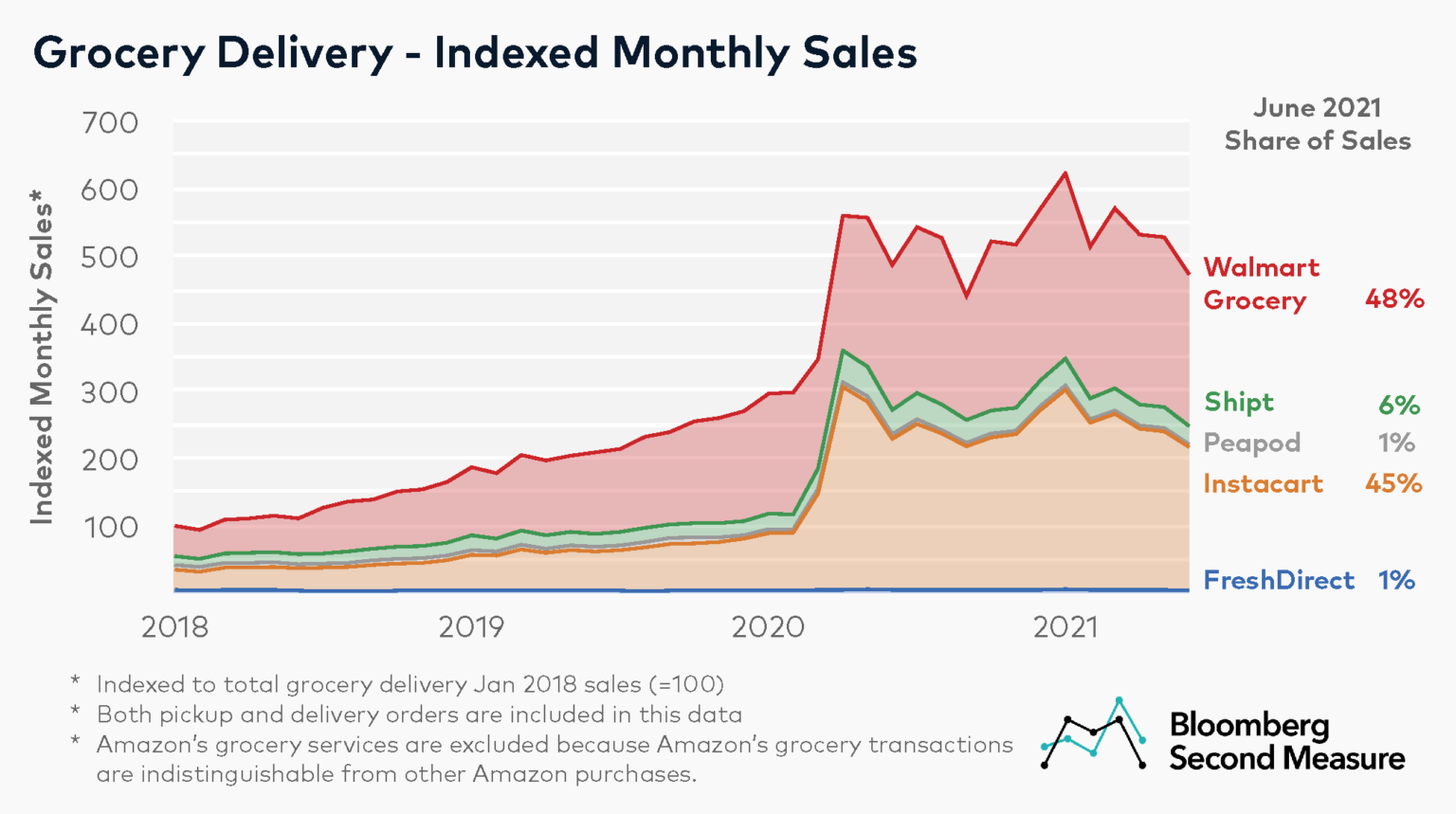

Grocery delivery sales skyrocketed early in the pandemic, as shelter-in-place orders went into effect and many consumers avoided going into brick-and-mortar grocery stores. Between March 2020 and April 2020, total sales among a select set of grocery delivery competitors–Instacart, Walmart Grocery, Shipt, Peapod, and FreshDirect–grew 62 percent. While demand for grocery delivery still exceeds pre-pandemic levels, sales have been gradually declining in 2021. Through all of the expansion and contraction over the past few years, Instacart and Walmart Grocery continue to be leaders in the grocery delivery space.

Grocery delivery peaked in January 2021, with sales volumes being double that of January 2020 and sixfold that of January 2018. However, overall industry sales declined 24 percent between January 2021 and June 2021. June 2021 sales also experienced a 3 percent decrease year-over-year.

Share of sales among this chosen competitive set has also shifted over the past few years. As of June 2021, Walmart Grocery holds 48 percent of sales. Walmart Grocery dominated grocery delivery sales prior to the pandemic, though its market share was eclipsed by Instacart during the first few months of shelter-in-place orders in 2020. As of June 2021, Walmart Grocery has the highest share of sales among the selected companies.

Instacart represented 45 percent of observed grocery delivery sales in June 2021. In July, Instacart announced that Facebook’s Fidji Simo would succeed co-founder Apoorva Mehta as the company’s new CEO and will direct its efforts to go public.

Six percent of observed grocery delivery sales in June 2021 came from Shipt, the same-day grocery delivery service owned by Target. Bloomberg Second Measure does not observe Shipt orders that originate on Target.com or in the Target app.

Peapod and FreshDirect each accounted for 1 percent of grocery delivery sales in June 2021. Both of these companies operate regionally, while their larger competitors offer service nationwide. FreshDirect primarily serves the greater New York City, Philadelphia, and Washington, DC metropolitan areas. In February 2020, Peapod ended its operations in the Midwest and now serves the East Coast.

It is worth noting that Amazon’s grocery services are excluded from this analysis because Amazon’s grocery transactions are indistinguishable from other Amazon purchases.

Additionally, Shipt and FreshDirect offer only delivery services, while the others offer pickup and delivery services. Both types of orders are included in this data.

Meal delivery services such as Doordash and Uber Eats have also introduced grocery delivery into their platforms. Grocery delivery sales for Doordash and Uber Eats are indistinguishable from meal delivery sales in Bloomberg Second Measure’s transaction data and are therefore not included in this analysis.

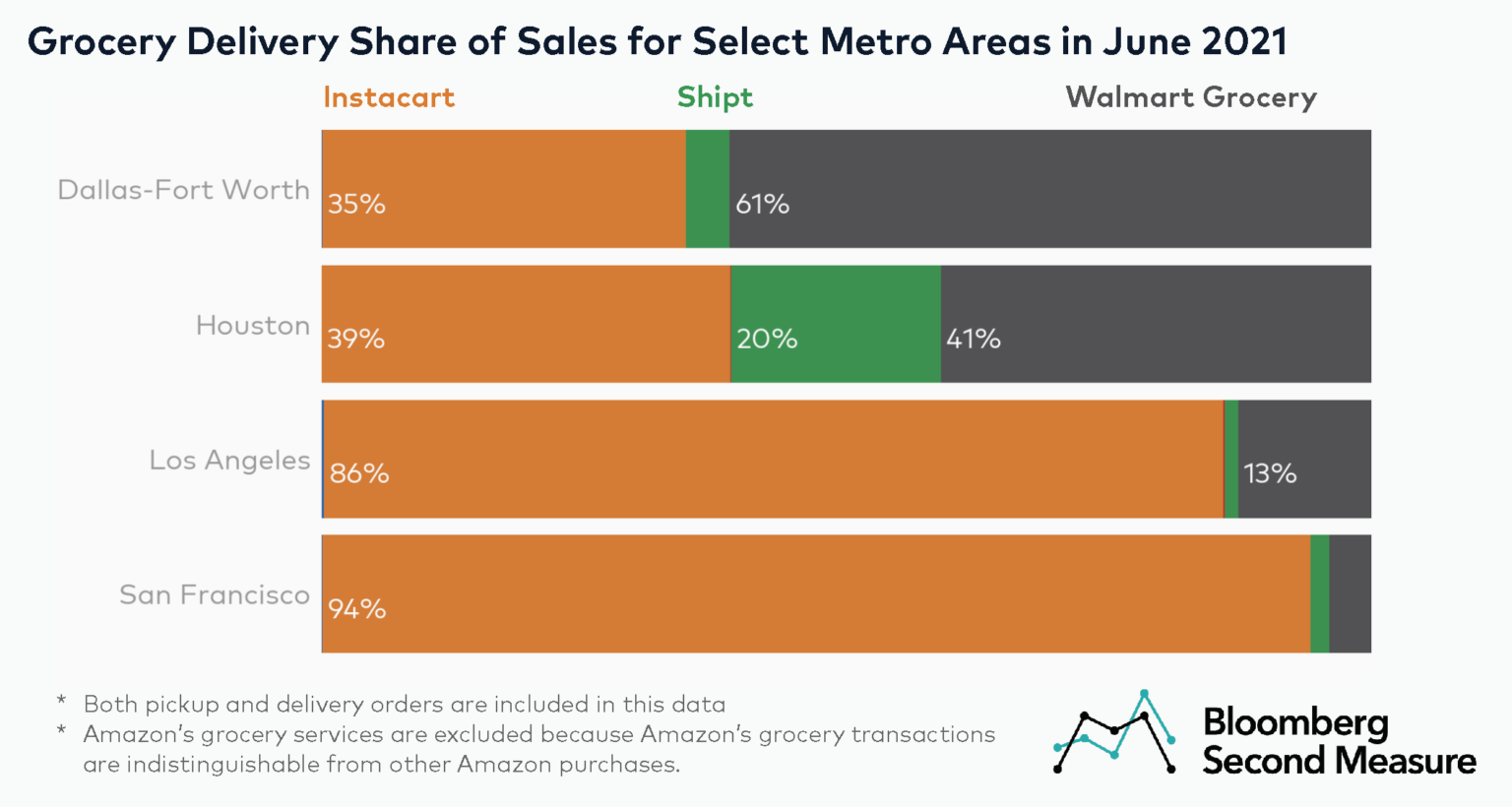

Instacart outperforms competitors in California metro areas while Walmart Grocery outperforms in Texas

Share of sales among select grocery delivery players also varies by metro area. Instacart is particularly popular in large California cities, accounting for 94 percent of grocery delivery sales in San Francisco and 86 percent in Los Angeles. On the other hand, Walmart Grocery accounts for the highest share of sales in two of the main Texas metro areas, Dallas-Fort Worth and Houston, with 61 percent and 41 percent, respectively.

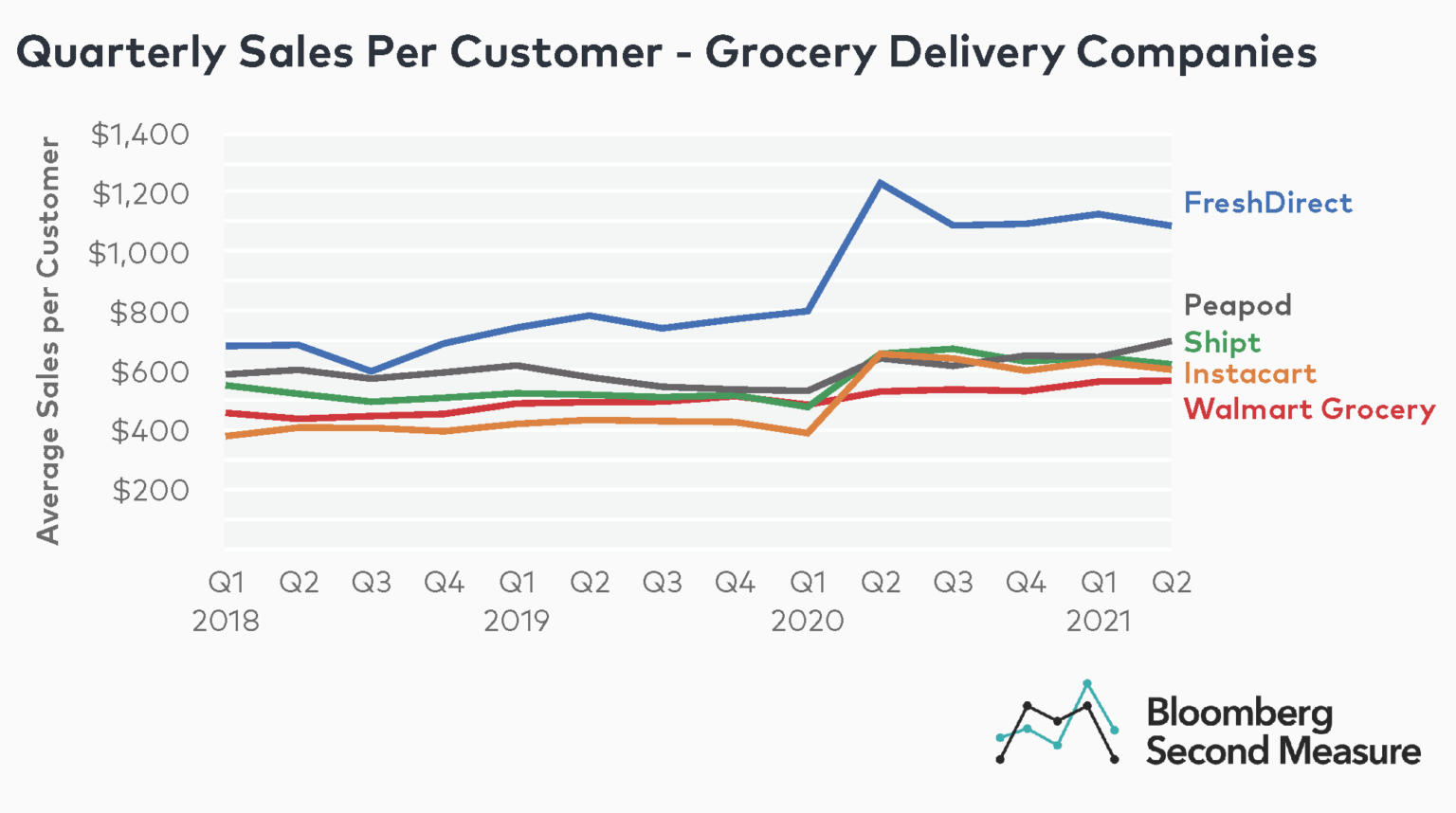

FreshDirect has the highest sales per customer

FreshDirect has the highest sales per customer among the chosen competitive set. In Q2 2021, customers spent an average of $1,087 with FreshDirect, nearly twice the average for Walmart Grocery. A few potential factors that may affect each company’s average sales per customer are the minimum delivery amounts per order, whether the service offers pickup or delivery, and different delivery and service fees. Some platforms also offer subscription services that offer free or discounted delivery. Another potential reason for FreshDirect’s higher sales per customer is that its operations are limited to a few areas in the Northeast, including New York, where groceries tend to be more expensive. New York was also a hotspot early on in the pandemic. By contrast, most of the other grocery delivery companies operate nationwide.

Prior to Q2 2020, Instacart had the lowest quarterly sales per customer among its competitors. However, Walmart Grocery has had the lowest quarterly sales per customer since Q2 2020. Between Q1 2020 and Q2 2020, Instacart’s sales per customer increased 69 percent while Walmart’s only increased 9 percent. But Walmart is quickly closing the gap. In Q2 2021, Instacart’s average sales per customer was $602 while Walmart’s was $565.

Other DTC companies are filling niche grocery delivery demand

Aside from grocery delivery and meal delivery companies, consumers have been turning to other direct-to-consumer (DTC) brands to fill their food and beverage needs during the pandemic. For example, alcohol delivery and wine subscription sales experienced a boost during the pandemic. Drizly, one of the top alcohol delivery companies, was acquired by Uber earlier this year.

Meal kits such as Marley Spoon and HelloFresh also experienced a resurgence in 2020. Even more specialized grocery delivery services, such as smoothie kits like Daily Harvest and meat delivery companies like ButcherBox, have similarly grown in popularity.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.