The U.K. continues to lead Europe in hotel performance recovery, due almost exclusively to domestic demand.

In this latest piece, we take a quick look at the U.K.’s recent performance timeline as well as occupancy on the books for the coming months as the country further eases restrictions.

Green shoots as hotels reopen

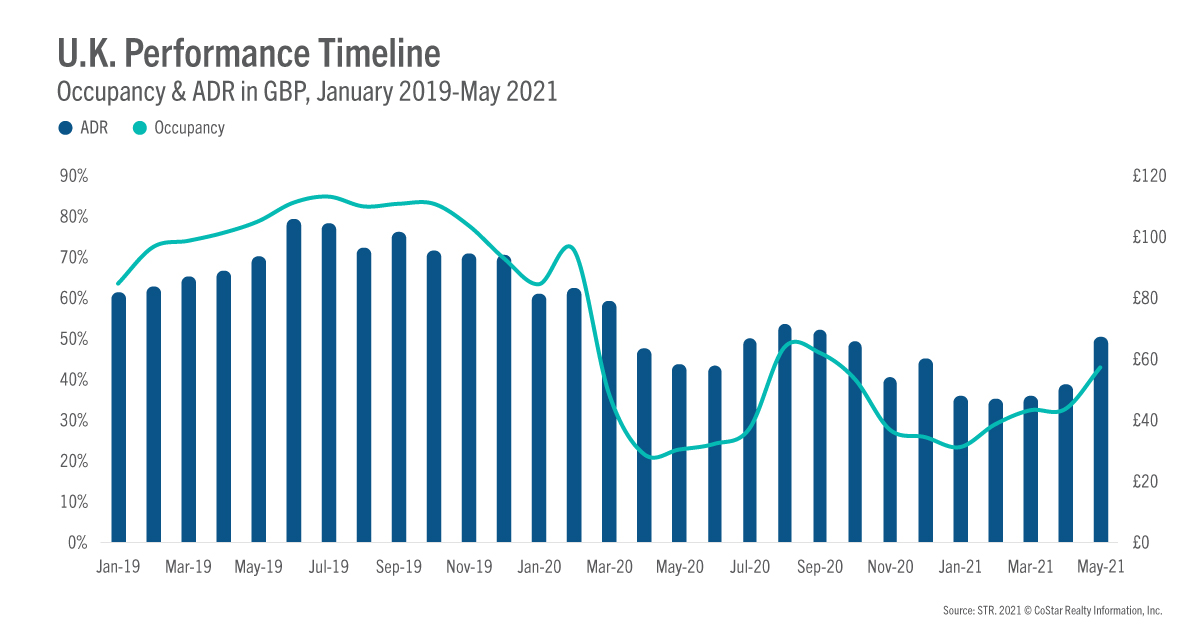

Due to reopening, along with an assist from the summer half-term holiday (31 May-4 June), U.K. hotel occupancy came in at 43.1% in May 2021. That was up from May 2020 (23.0%) but substantially below May 2019 (78.9%). Because of the pandemic impact on 2020 data, STR is using 2019 as the recovery benchmark. Average daily rate (ADR) was even further behind the pace at GBP67.33, up from GBP58.69 in May 2020 but down from GBP93.65 in May 2019. However, both the occupancy and ADR levels from May 2021 were the highest in the U.K. since September 2020.

Top market performers

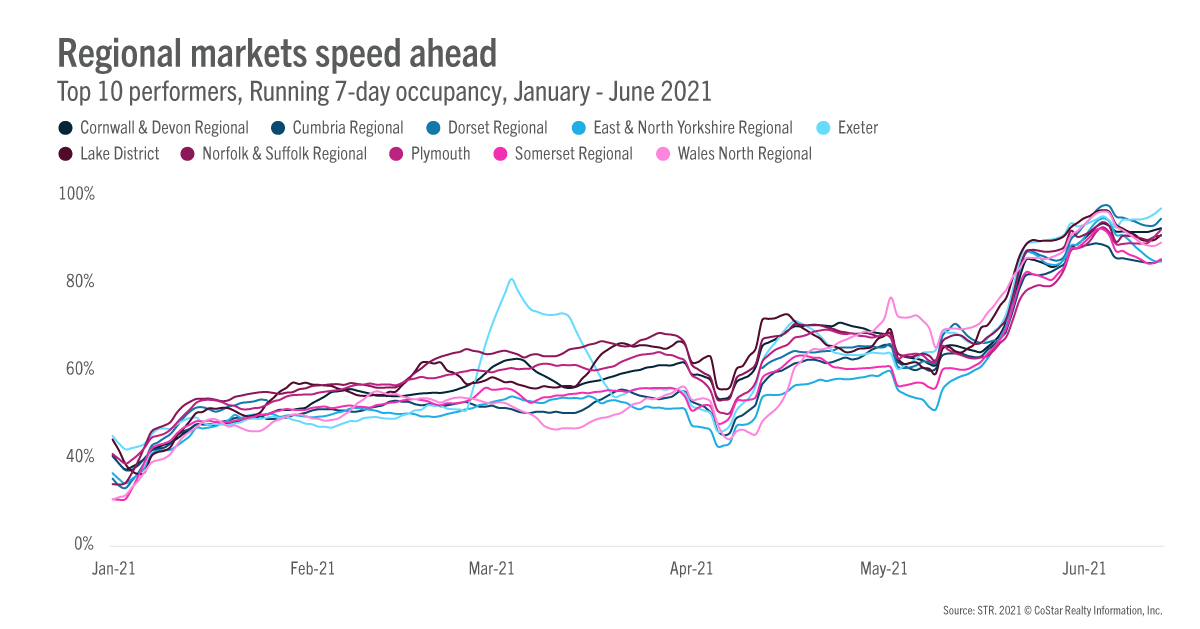

As demand remains predominantly domestic leisure driven, markets reliant on that segment are further ahead in the process.

While looking at daily data since the start of June, Dorset Regional has seen occupancy of more than 90%, reaching its highest level on 4 June (97.2%). The Like District and Norfolk & Suffolk Regional occupancy posted levels of more than 87%. There is no doubt that another summer full of staycations is a positive for these markets.

Summer holiday impact

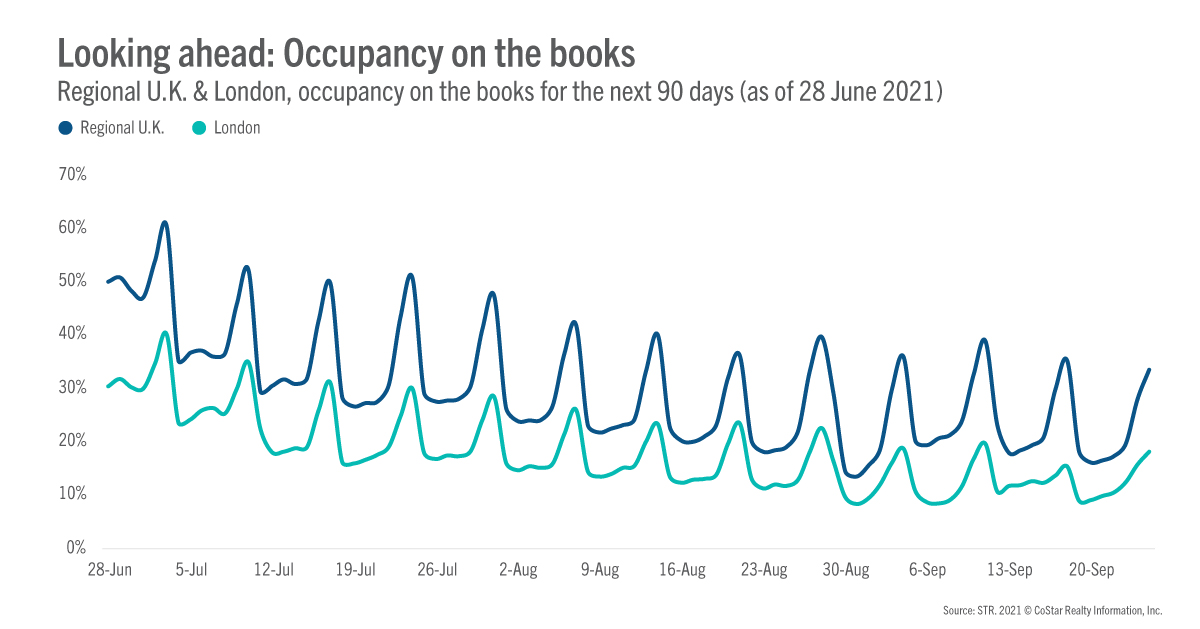

Although occupancy on the books remains low, Regional U.K. is still ahead of London for the coming weeks and months. Travelers are still awaiting confirmation of softened travel restrictions by 19 July, which should be followed by a sharp increase in demand.

For the next 90 days (as of 28 June), Regional U.K. occupancy on the books sat as high as 50.9% on 24 July (Saturday). Looking at weekday performance, Regional U.K. occupancy on the books trends between 14%- 35%

At the same time, London remains low because of a lack of its usual demand drivers, such as international travel and corporate demand. The market’s occupancy on the books is below 35.0% for the next 90 days due to guest tendency to book at the last minute. As we noted in a previous article, it is important to remember that the pandemic has shifted guest tendency toward shorter booking windows.

Occupancy-on-the-books intelligence will help pinpoint recovery and provide much-needed context.

Conclusion

While we should, of course, celebrate the improvement in performance, we also need to remain realistic that we are a way off from the performance we saw in 2019. Once travel restrictions are softened by 19 July, there should be more substantial recovery provided the pandemic situation remains controlled.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.