The UK has experienced a fresh wave of Covid-19 infections in recent weeks. Figures from the JHU show that cases peaked on July 20th and have since fallen. The NHS’ Covid-19 app sent a record 607,486 contact tracing alerts in the week ending July 14th. The IHS Markit/CIPS composite PMI fell 4.5% from June to July. Some suggest that high alert-levels are having an adverse effect on the economy as workers and shoppers stay home. The moniker for this new feature of the crisis is the ‘Pingdemic’.

Huq sought to investigate the link between alerts and the impact on economic activity. The NHS provides weekly alert statistics by local authority. Huq’s mobility data allows for analysis of footfall and retail store visits by local authority. Our research team produced indices for both measures and compared the June – July change. The most recent data available is for the seven days leading to July 14th.

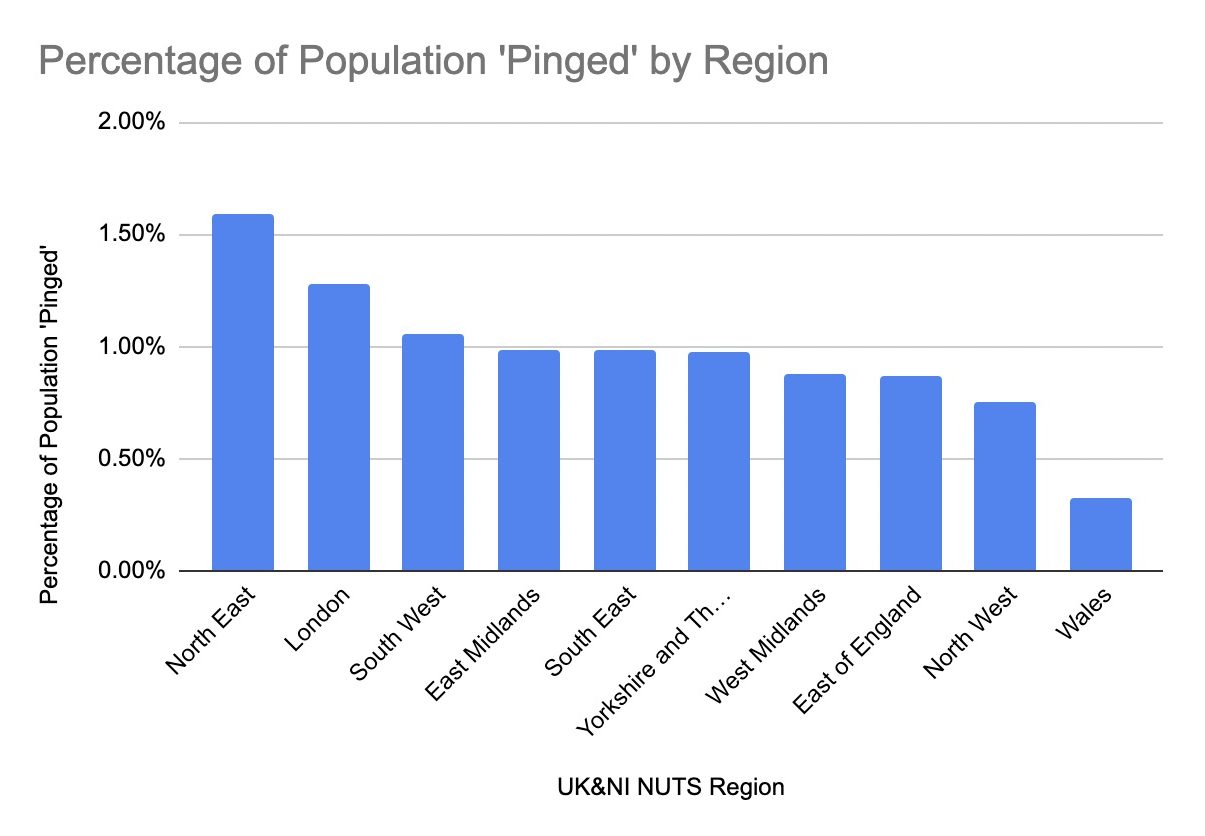

Across the UK, retail store visits have fallen by 2.8% despite the final lifting of restrictions. The average distance travelled in a day for any purpose has also decreased 5.5%. But by either of these metrics, the picture across the country is uneven. In the North East, weekly alerts sent by the NHS app have affected up to 1.6% of the population in July. The same figure for Wales is just 0.3%. The national average is 0.97%.

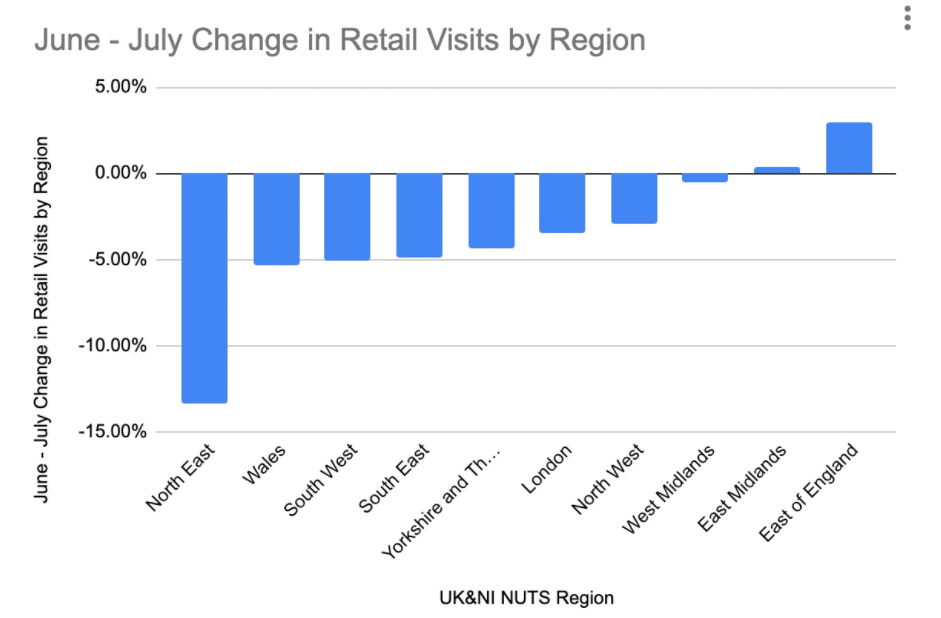

The North East shows the greatest fall in movement with levels running 10.13% under those seen in June. The region also leads the rank of most alerts sent, with 1.6% of residents advised to isolate per week in July. London comes second, with weekly alerts sent to 1.28% of the population. The response here has been different, with daily movement falling just 0.87% – the least of all regions. In the round there is a loose correlation (~0.2) between alerts sent and the reduction in movement.

How movement translates into retail store visits is also significant. The July – July comparison shows a wider spread. This suggests that this measure is more sensitive to Covid alert notifications. Again the North East – the region with the highest proportion of residents ‘pinged’ – shows the largest fall (-13.4%). The East Midlands – the only region to show positive change – is up just 0.4% on June levels. Wales, the region with the lowest alerts per capita sent (0.3%) comes second in this rank with a 5.4% decline in store visits. The mean across all local authorities in the UK is -2.8%.

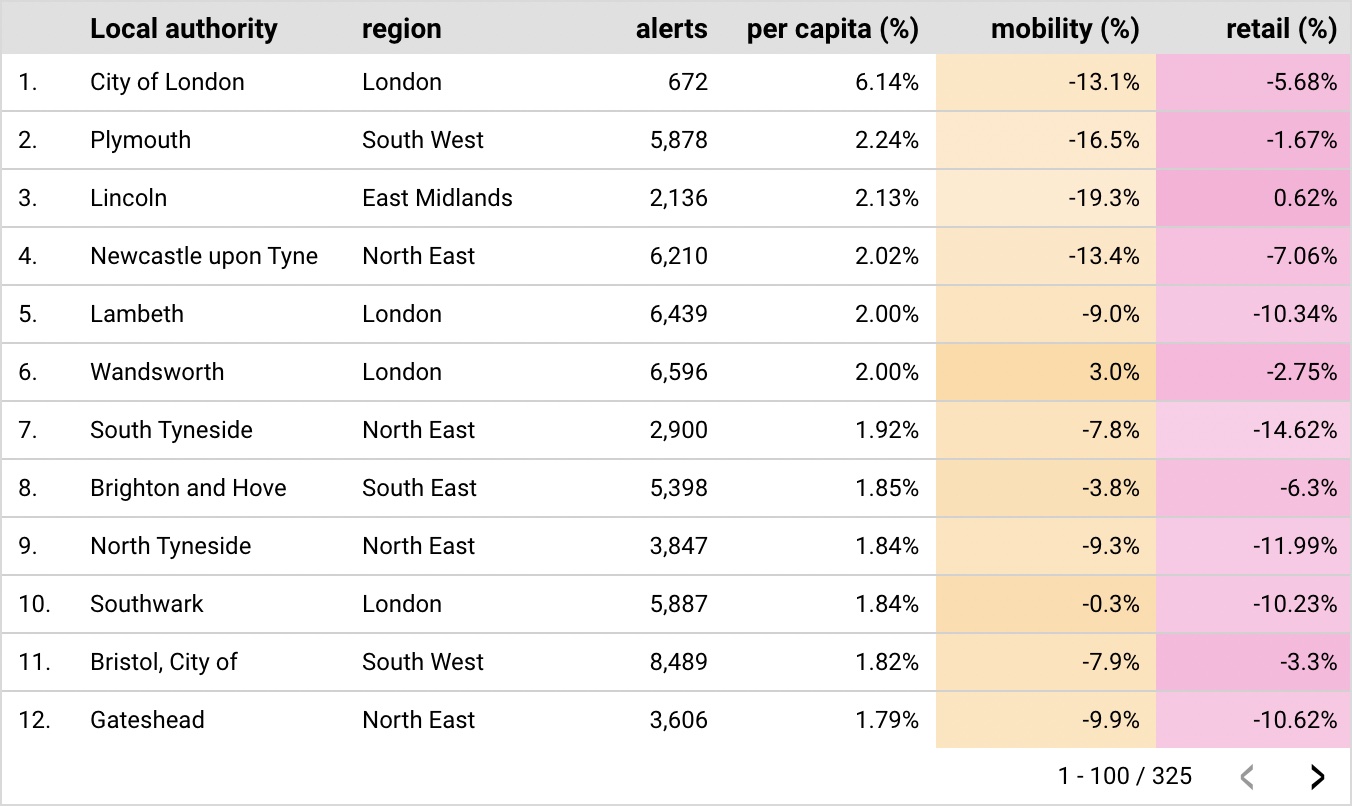

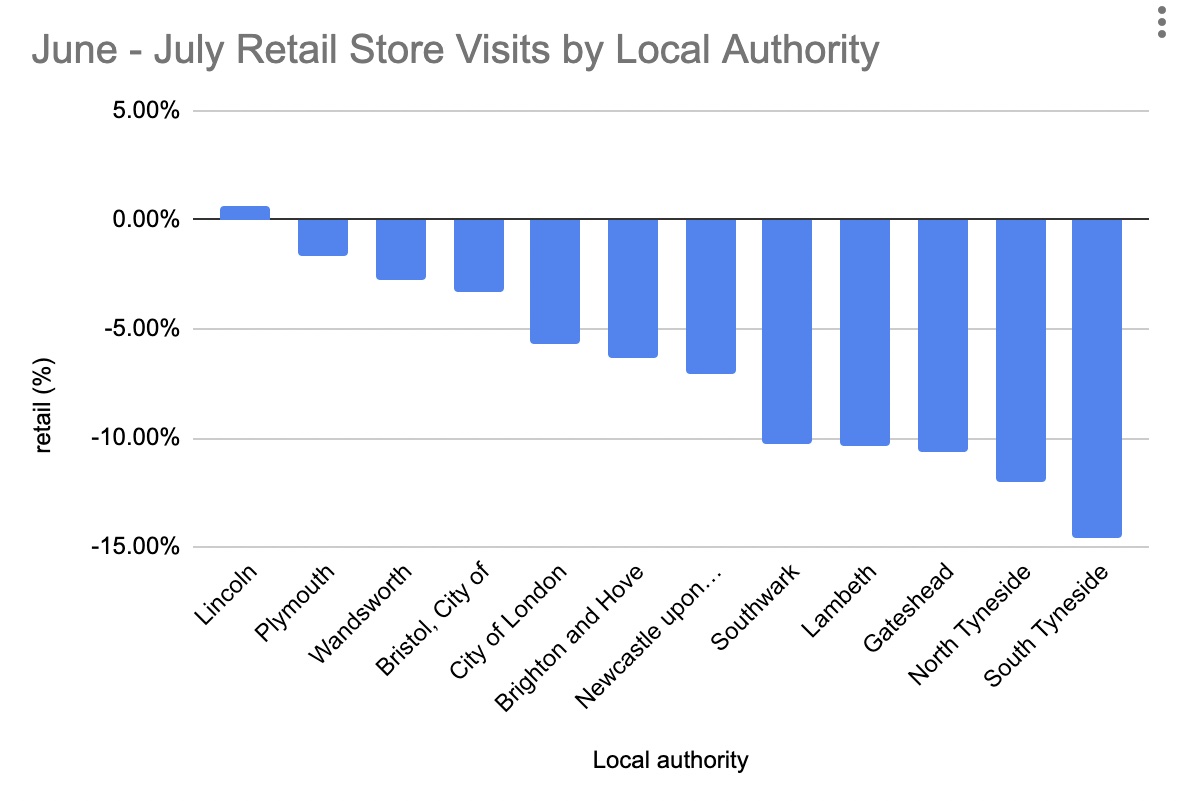

Huq’s analysis of the link between alerts and mobility is available by local authority. The top twelve, ranked by weekly alerts per capita in July, is as follows:

The dominant regions are London, The North East and South East where 2.3% of residents were ‘pinged’ each week in July. Across the top 12, residents have reduced their daily movement by 8.9% and retail activity by 7.0%. The sharpest reduction in mobility is seen in Lincoln, with a fall of almost 20%. Retail visits in South Tyneside show the greatest decline at 14.6%. Others showing a significant fall in retail store visits include North Tyneside (12%), Gateshead (10.6%), Lambeth (10.3%) and Southwark (10.2%).

Conrad Poulson, chief executive officer at Huq Industries, comments:

“The pingdemic has led to more people self-isolating, which in turn means fewer shopping trips and less moving around. On the one hand, it’s good to see that many people are following the app’s guidance to stay at home if they’ve been pinged, but on the other it’s also impacting the UK’s ability to recover from the pandemic.“

“If the number of pings continues to rise, we could well see an even larger effect on retail footfall. The Government will have to tread a fine line between keeping people safe and sparking a genuine economic recovery.”

To learn more about the data behind this article and what Huq has to offer, visit https://huq.io/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.