E-commerce and omnichannel shopping were not born out of the pandemic, but the arrival of COVID-19 accelerated these trends in ways that would have likely taken decades otherwise. The pandemic also didn’t conceive convenience, or inspire customers to demand it, but it did shine a light on how important it is in everyday life—particularly in a global health crisis. Now, as consumers resume many of their pre-pandemic activities, retailers need to remain focused on convenience—even as consumers leave the comfort of their homes.

Consumers’ everyday lives were busy well before the arrival of COVID-19. Brands and retailers were actively thinking about digital channels, e-commerce and true omnichannel shopping experiences. Now, after more than 16 months of consumer dependence on connectivity and omnichannel experiences, the baseline for convenience is higher than ever—and consumer expectations from retailers will be, too.

That does not mean that all commerce will remain online. It means that retailers need to meet consumers where they are—and offer experiences that provide unilateral convenience. That will require a true blending of on- and offline tactics rather than a reliance on one over the other.

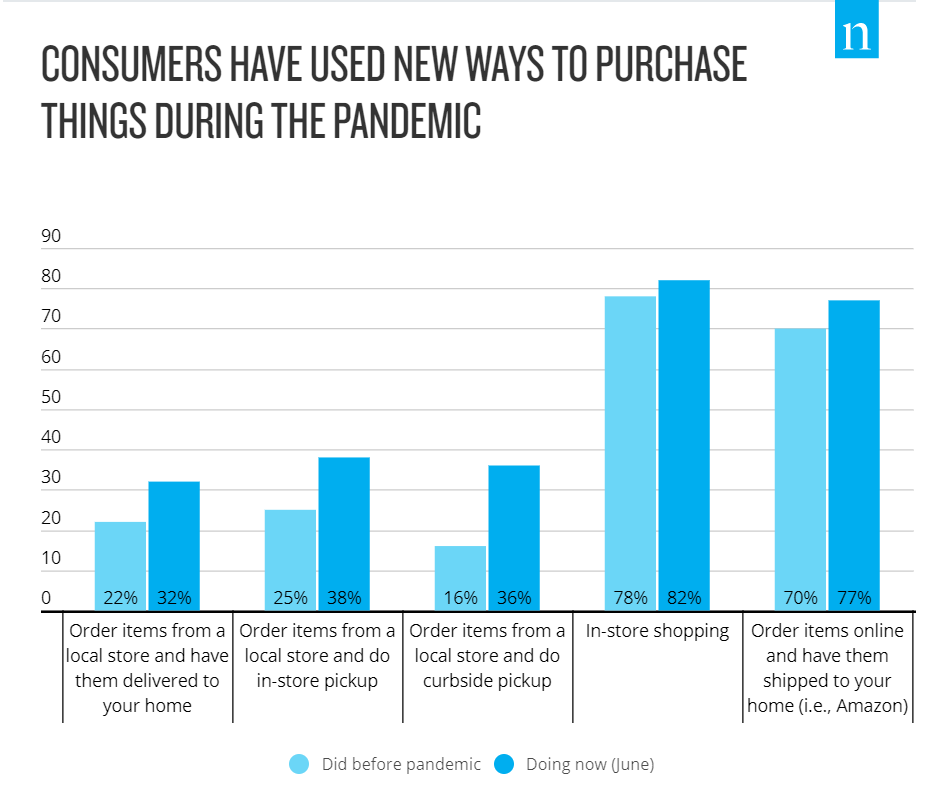

Click-and-collect services, for example, have become mainstream across the retail landscape. While these services were a lifeline for retailers when in-store shopping wasn’t an option, their widespread availability represents a huge step forward in terms of convenience, as they blend the online shopping experience with speed and easy pick-ups for local consumers. And that will continue, even as in-store shopping returns. Staying nimble, flexible and focused on consumers will be critical for retailers now that new standards of convenience exist.

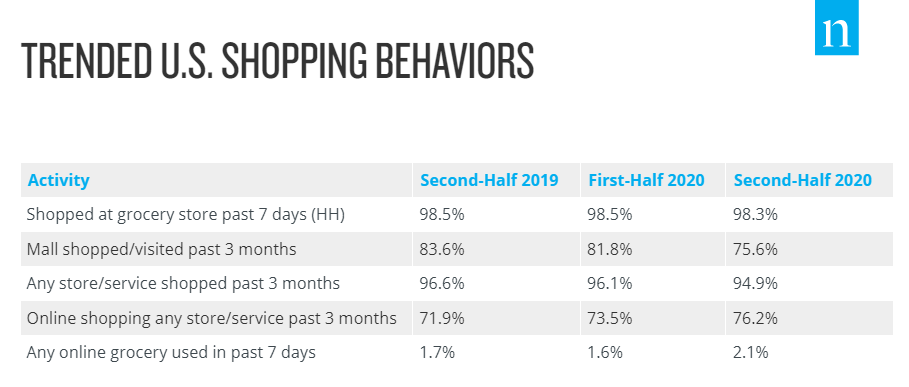

Clearly, click-and-collect isn’t a replacement. It’s a complement. And when we look at in-store shopping trends, Nielsen Scarborough data shows that aggregate in-store shopping behavior (albeit at fewer stores, as many have closed) among U.S. households changed very little between the second half of 2019 and the second half of 2020. Aggregate in-store grocery shopping trends changed even less—even as online grocery shopping activity ticked upward. And now, with COVID restrictions lifting, consumers are increasingly engaging with traditional retail establishments.

Read as: 98.5% of U.S. households had shopped at a grocery store in the past seven days when the Scarborough survey was fielded in second-half 2019.

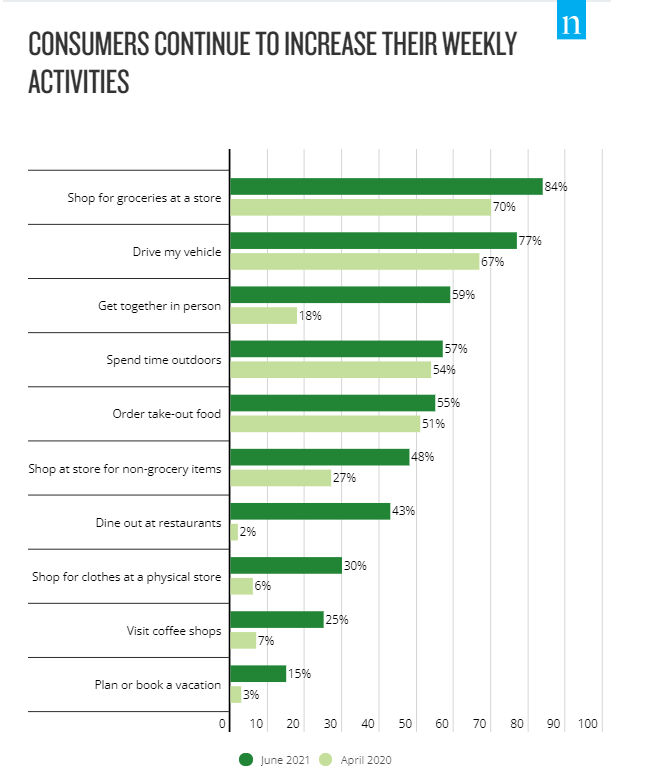

The importance of convenience across channels will only increase going forward, particularly as consumers grow increasingly comfortable with resuming pre-pandemic activities. According to an ongoing consumer lifestyle survey about the pandemic conducted by Nielsen Audio, sentiment among U.S. consumers that life is starting to become more normal was at its highest level in June 2021, with 90% of respondents saying they felt ready to resume pre-pandemic activities, including in-store shopping, spending time with others and eating out.

For many retailers, now is the time to re-engage with consumers. While essential retailers that have had frequent, ongoing engagements with consumers over the past year are likely top-of-mind among shoppers, many retailers may need to re-introduce themselves to the broader public—especially if they pulled back on their marketing and ad spend last year.

So as consumer optimism and spending returns, retailers should be focused on marketing efforts that build their brands and grow awareness. This is particularly important for retailers thinking about their holiday planning, including click and collect options. That’s because brand awareness efforts can’t wait until September or October. They should be part of a holistic approach to marketing.

Importantly, it’s time for retailers to pivot. To survive store closures last year, many retailers shifted to conversion-oriented strategies to keep their bottom lines afloat. Today, as vaccine availability rises and consumers reclaim aspects of their pre-pandemic lives, retailers need upper-funnel brand awareness campaigns to bring their brands back into focus for consumers. We know that long-term growth requires a balance of short- and long-term marketing strategies, but retailers that pulled back on marketing last year likely have some ground to regain as they seek to re-engage with consumers.

3 THINGS RETAILERS CAN DO AHEAD OF KEY HOLIDAY EVENTS:

To learn more about the data behind this article and what Nielsen has to offer, visit https://www.nielsen.com/us/en/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.