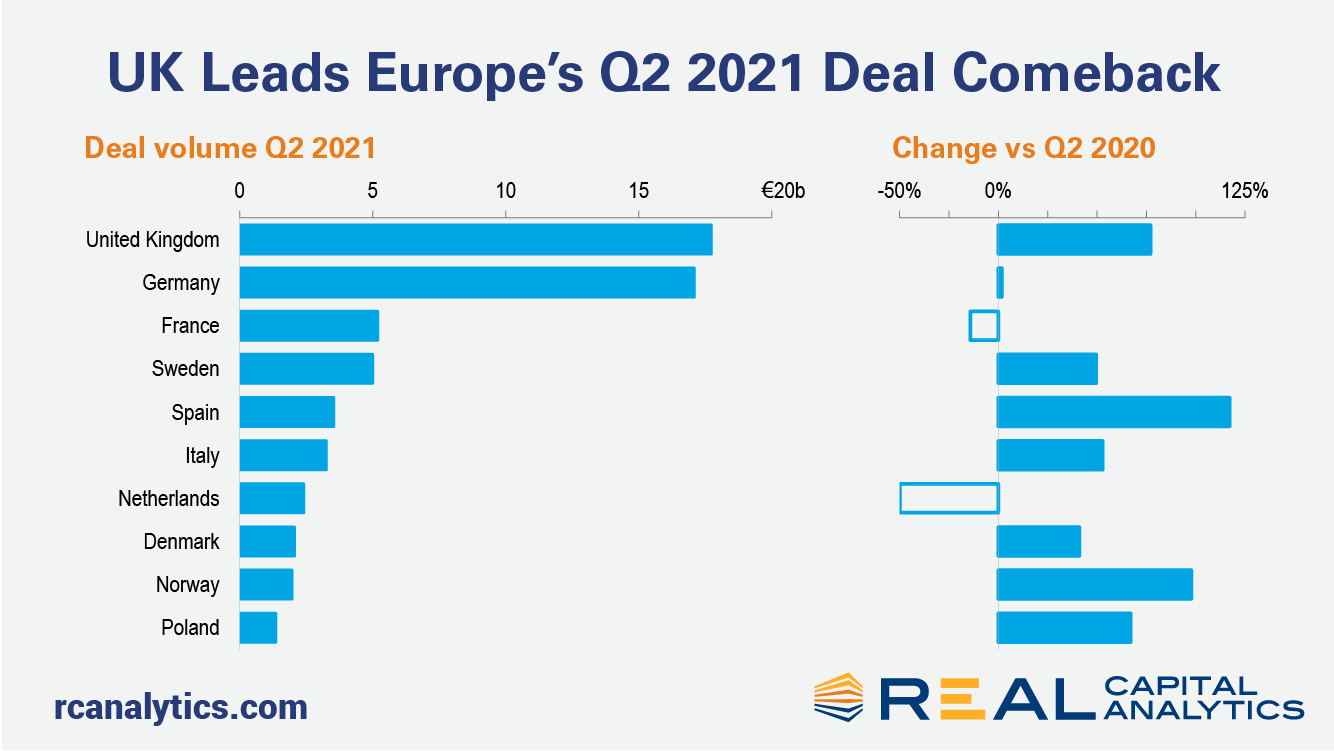

Europe’s commercial property market moved back into the black in Q2 2021 after four quarters of declines in deal activity caused by the pandemic, the latest Europe Capital Trends report shows. Commercial property sales increased 20% compared to a year ago, led by the U.K. where sales jumped 77%.

Industrial sector deals and a couple of large London office transactions boosted the U.K. deal volume total. London was the most active commercial property market for the first six months of the year, reclaiming the top spot from Paris, which fell to third position.

Across Europe in the first half of 2021, the industrial sector accounted for more than 20% of total transaction volume, the highest proportion on record. Investors spent €9 billion ($10.6 billion) in the U.K., €3.7 billion in Germany and €2.8 billion in Sweden.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.