Even before the pandemic hit, big box retailers were both expanding their e-commerce platforms and making significant investments in brick-and-mortar store upgrades in order to stay relevant in the face of new competition. Now, as the country reopens, it’s more important than ever for these retailers to have attractive in-store shopping opportunities in order to compete with both each other and with exclusively online retailers. While many strategies are similar across retailers—such as investments in buy online, pick up in store (BOPIS) and curbside pickup systems—competitors are adopting differentiated strategies as well. For example, in recent months and years, Target has placed significantly more emphasis on opening small-format stores—stores in urban areas or college towns with typically less than one-third the square footage of the average Target store. These stores are intended to be more efficient than larger stores and more appealing to consumers since they curate a product mix geared towards their specific neighborhood. Using our granular store details information and daily inventory data from Target brick-and-mortar stores, we analyze Target’s small-format store strategy in terms of sales growth, product mix, and inventory management to shed light on the efficacy and future potential of the strategy.

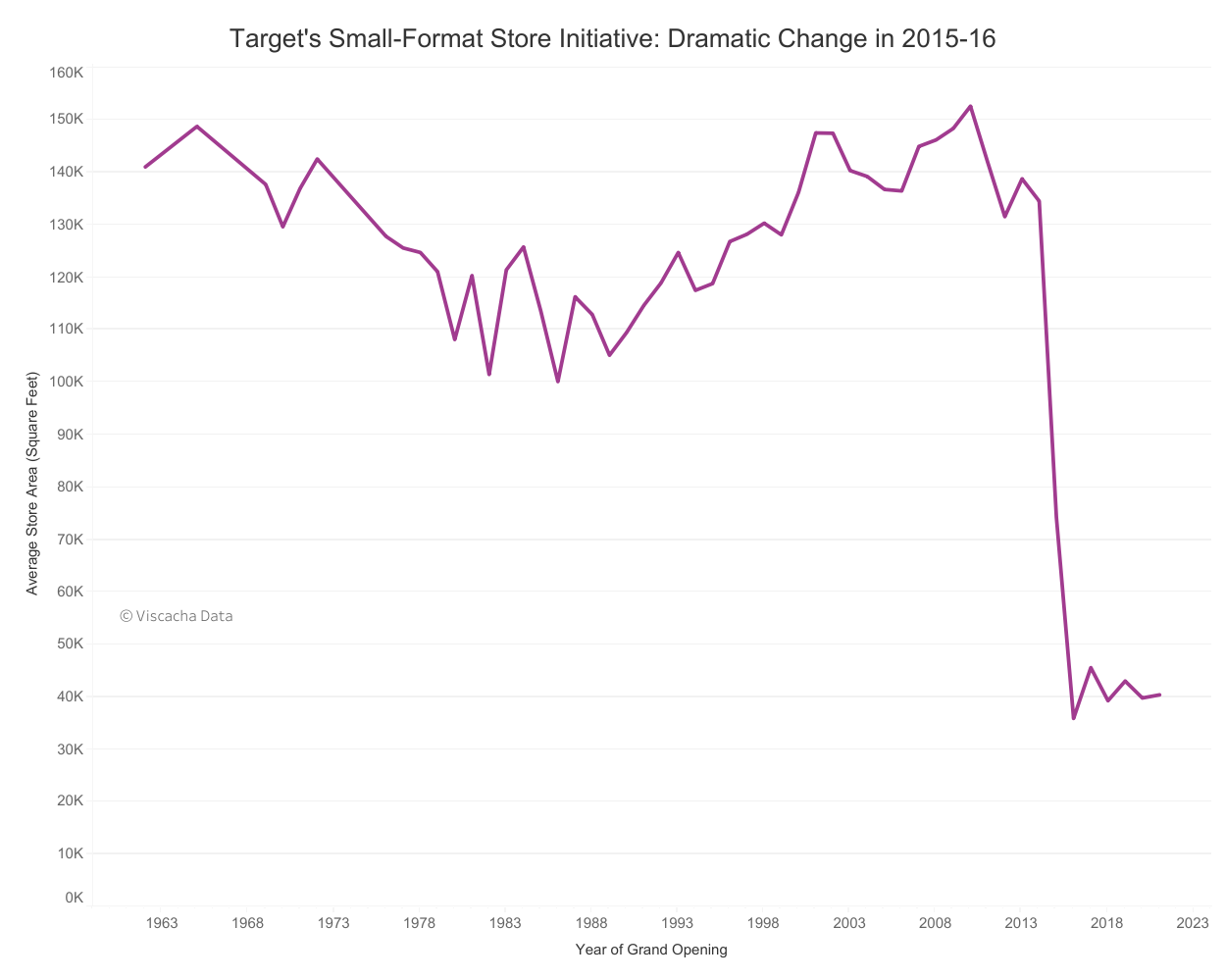

First, to give some context into strategy’s evolution, we plot the average size of store opened in every year since the first Target opened in 1962. The decrease in store size is striking: The average size of new stores peaked in 2010 at over 150,000 ft², yet just six years later, the average new store was only 35,000 ft² and has remained steady in the 35-45k ft² range since.

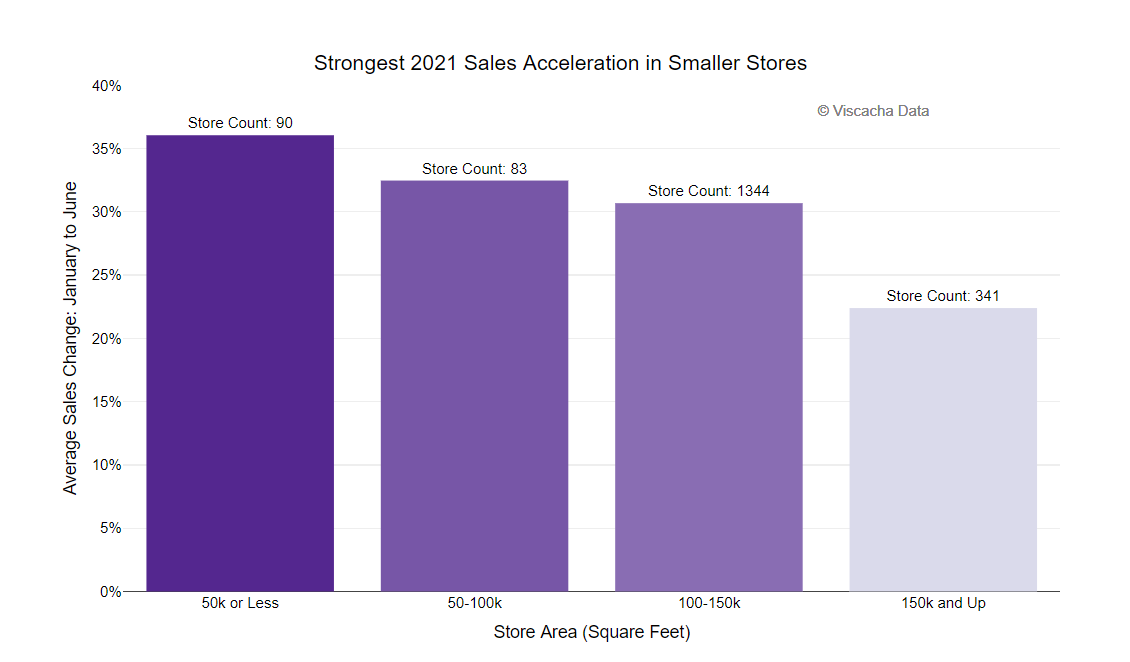

Next, we look at how the smaller stores have performed relative to more typically sized Target stores in recent months. Even excluding stores opened in 2020 and 2021 (to disentangle momentum from a recent opening from a more general size effect), the smallest stores saw the strongest sales growth in the first half of 2021. Furthermore, the effect doesn’t just exist for the new “super small” stores, but instead sales steadily decrease even moving into the more typical size range. In fact, stores larger than 150k ft² were the worst performing group by far. (For reference, the median size in the sample is 127k ft².)

The size effect holds up strongly: Controlling for state to account for geographic trends and year of opening to distinguish from “newness” effects, a 1% increase in store square footage is associated with a 9 percentage point drop in January through June sales growth.

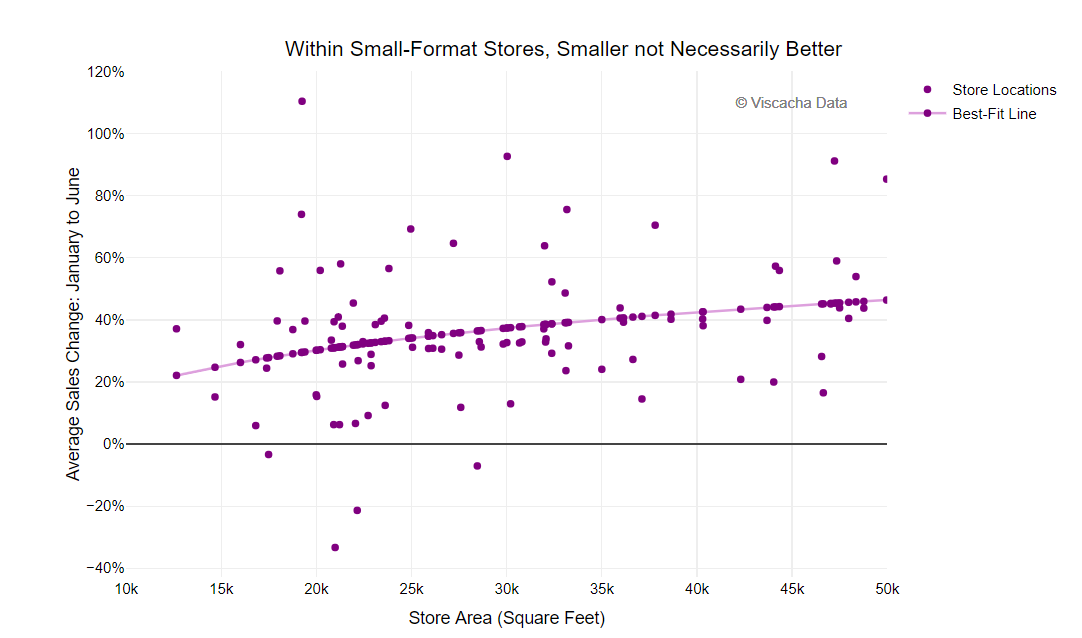

That said, within small-format stores, smaller might not be better. Looking at stores under 50k ft²—the smallest 90 stores—the very smallest ones haven’t been performing any better than larger ones within that sample. In fact, sales growth rises slightly as store square footage increases within stores under 50k ft², although given the small sample size, the bigger takeaway is that the smallest stores have higher variance. Overall, this suggests that in order to generate the efficiency and specialization effects that make small-format stores successful, a store only needs to be below a certain threshold size, and it’s possible that some of Target’s recent additions have been a little too small to the detriment of their sales growth.

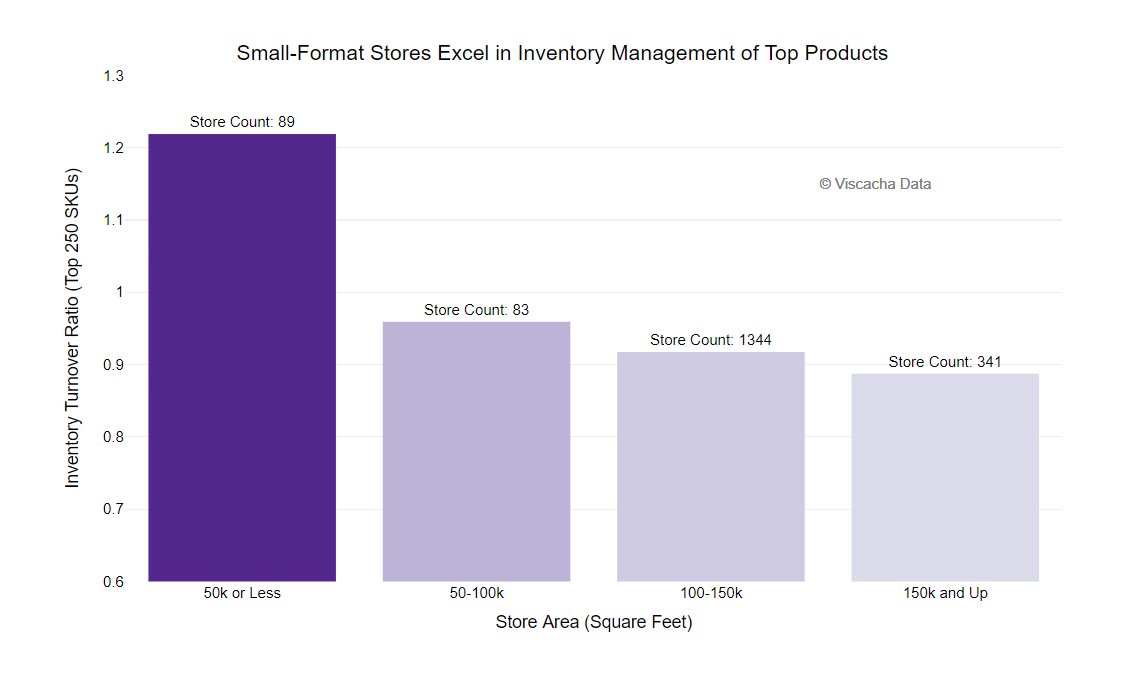

One might wonder what it is that stores under 50k ft² are doing so well to explain their outperformance. As expected, small stores have to make strategic decisions about which products to offer and consequently stock far fewer SKUs: Last month, there was a highly significant 86% correlation between store square footage and number of different products stocked. Evidently, since small stores offer a less diverse product mix yet generate stronger sales growth, they must be doing something better. A common theory is better inventory management, but at least at first glance, this doesn’t seem to be a perfect explanation. Smaller stores still lag larger stores in terms of overall monthly inventory turnover ratio (the ratio of total sales over the month to average daily inventory). A higher inventory turnover ratio typically indicates good inventory management and strong sales, but the data last month shows a 1% increase in store square footage was associated with a 13% increase in inventory turnover ratio. This suggests that the strength of small-format stores doesn’t necessarily stem from overall speedier inventory churn. That said, when focusing in on the top-selling products at Target, small-format stores excel in inventory management. For the top 250 best-selling products at Target in July, the relationship between square footage and inventory turnover was reversed: A 1% increase in square footage was associated with a 17% decrease in inventory turnover ratio. Finally, rather than scaling down linearly with increasing store size, this seems to be an area where small-format (<50k ft²) stores in particular are outperformers, with an average inventory turnover ratio that far exceeds any other store size category.

Overall, small-format stores are clearly more productive in terms of sales relative to their physical footprint. Even when looking at raw sales as opposed to sales growth as we did earlier, controlling for state, a 1% increase in store square footage was associated with an almost 17% decrease in sales per square foot. This higher productivity is likely attributable partly to better inventory management for popular products, but also to more qualitative factors. For example, small-format stores might offer smarter display setups since they carry to a more niche location—e.g. stores near college campuses prominently featuring popular dorm supplies and snacks. Furthermore, the small-format stores are intended to cater to populous areas that previously might have had to travel farther to reach a big store, so they are convenient both for quick shopping runs and as fulfillment locations for BOPIS orders. That said, the fact that smaller stores often have lower overall inventory turnover suggests that Target’s small-format strategy has room to improve in maximizing these stores’ productivity. Especially if these improvements are possible, the retailer’s strategy seems very promising for its future sales growth and its ability to compete with giants like Amazon and Walmart.

To learn more about the data behind this article and what Viscacha Data has to offer, please reach out to at loften@viscachadata.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.