Walmart earnings report date: August 17, before markets open (confirmed)

Walmart (WMT) is heading into second quarter earnings on the back of a surprisingly positive first quarter. In its last earnings release, the click-and-mortar retail giant delivered impressive grocery sales and better-than-expected eCommerce growth. It also boosted its outlook for the full fiscal year.

Now the key question is: Can the world’s largest retailer ensure that eCommerce sales growth stabilizes in the coming quarters? Walmart needs digital sales to stay strong even as multi-device in-store shopping picks up again.

But Amazon’s recent earnings report suggests that won’t be easy. Despite moving Prime Day to June, AMZN reported year-over-year (YoY) online store sales growth of just 16%, its slowest rate since 2019. Luckily Walmart has 4,700 stores across the U.S., ready to pick up the online slack.

So what does Similarweb’s alternative data show about Walmart’s digital health? Here are some of our most important Walmart earnings insights:

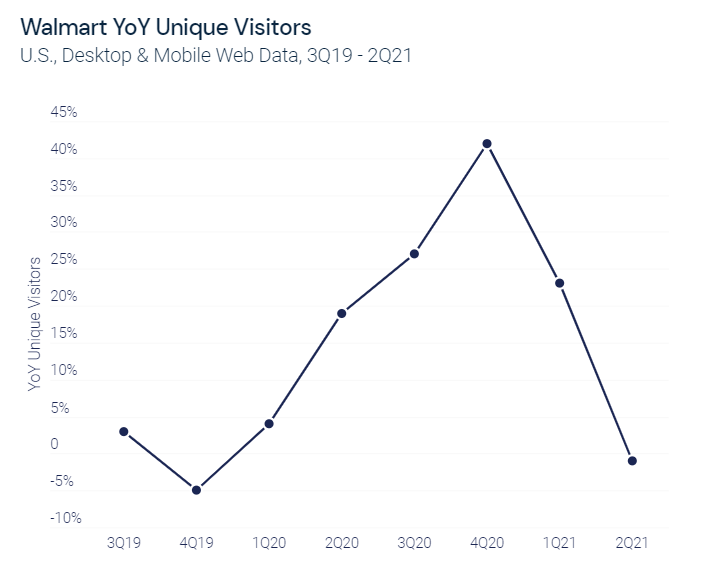

1. Digital traffic is decelerating

Similarweb’s estimates show that the total U.S. unique visitors to walmart.com decelerated to -1% in the second quarter. This marks a considerable drop from the 23% YoY growth in Q1 and 42% YoY growth of 4Q20. As March 2020 marked the beginning of lockdowns and surging digital sales, comparisons to last year’s performance are toughening and this growth slowdown is to be expected.

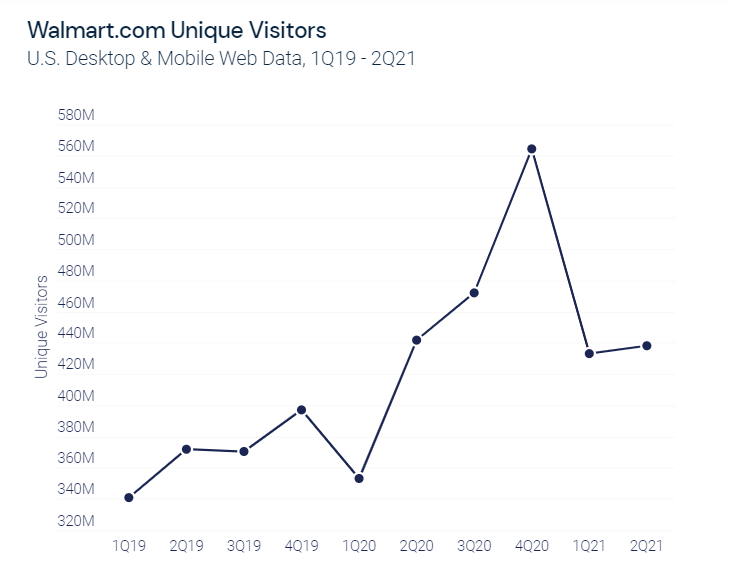

2. Stable unique visitor numbers

Encouragingly, we can see that traffic is flat on a quarter-over-quarter (QoQ) basis. For instance, WMT’s Q2 average total monthly unique visitors came in 1% above Q1, although this figure is -22% when compared to 4Q20.

At the same time, unique visitors remain much higher than pre-pandemic levels, at +18% vs. the same quarter two years ago. That’s thanks to pandemic tailwinds, but also Walmart’s heavy investment in its digital transformation plans. Spending on ecCommerce and supply chain technologies and infrastructure represented 72% of the company’s strategic U.S. capital expenditure for its 2020 and 2021 fiscal years.

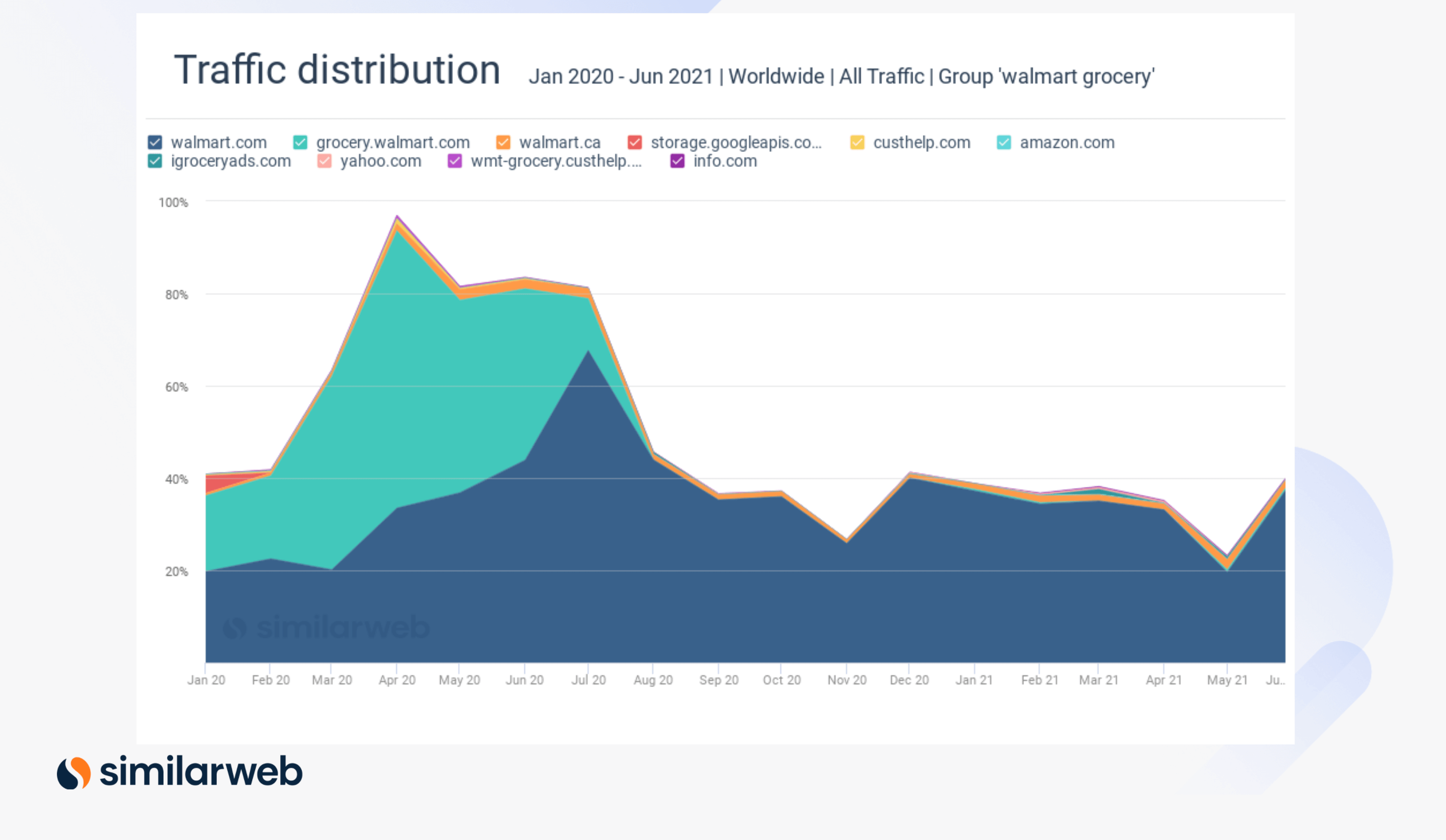

3. Grocery searches spike in June

Walmart’s online grocery business exploded in popularity during the pandemic. Helping matters was Walmart’s new Amazon-Prime equivalent Walmart+, which launched on Sept. 15, 2020. For $98-per-year, members enjoy perks such as free next-day and two-day shipping on items from walmart.com – with no minimum order requirement.

According to CIRP, some 26% of customers who order groceries on walmart.com are Walmart+ members, about double the percentage of the site’s overall average visitors. This is based on research the firm conducted, surveying 500 U.S. customers between November and January 2021.

By tracking Google searches for the keywords ‘walmart grocery’ we can monitor popularity trends for this term on a month-by-month basis. We can see that searches for this term spiked in June 2021 after a May 2021 pullback. This could reflect increased corona fears prompting a resurgence in online shopping:

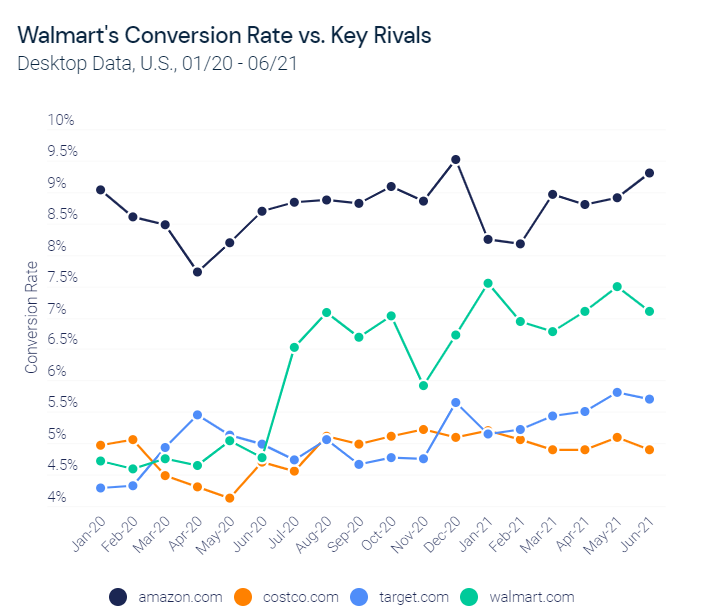

4. Conversion rate strengthens

Conversion rate (CVR) is a crucial indicator of revenue because it reveals the proportion of a website’s traffic that ends up on a post-transaction page (i.e. a ‘thank you’ or ‘checkout’ page).

Similarweb data suggests that Walmart’s conversion rate improved during the second quarter, from 7.1% to 7.23%. That’s a big leap from Q4’s 6.53% and the 4.8% CVR recorded in 2Q20.

The takeaway: this is a bullish signal for the sustainability of Walmart’s e-business and market competitiveness. May was a particularly strong month with a stellar 7.5% conversion rate (only just under the record 7.6% Walmart delivered in January).

In comparison, amazon.com’s conversion rate was just slightly higher in January, at 8.3%.

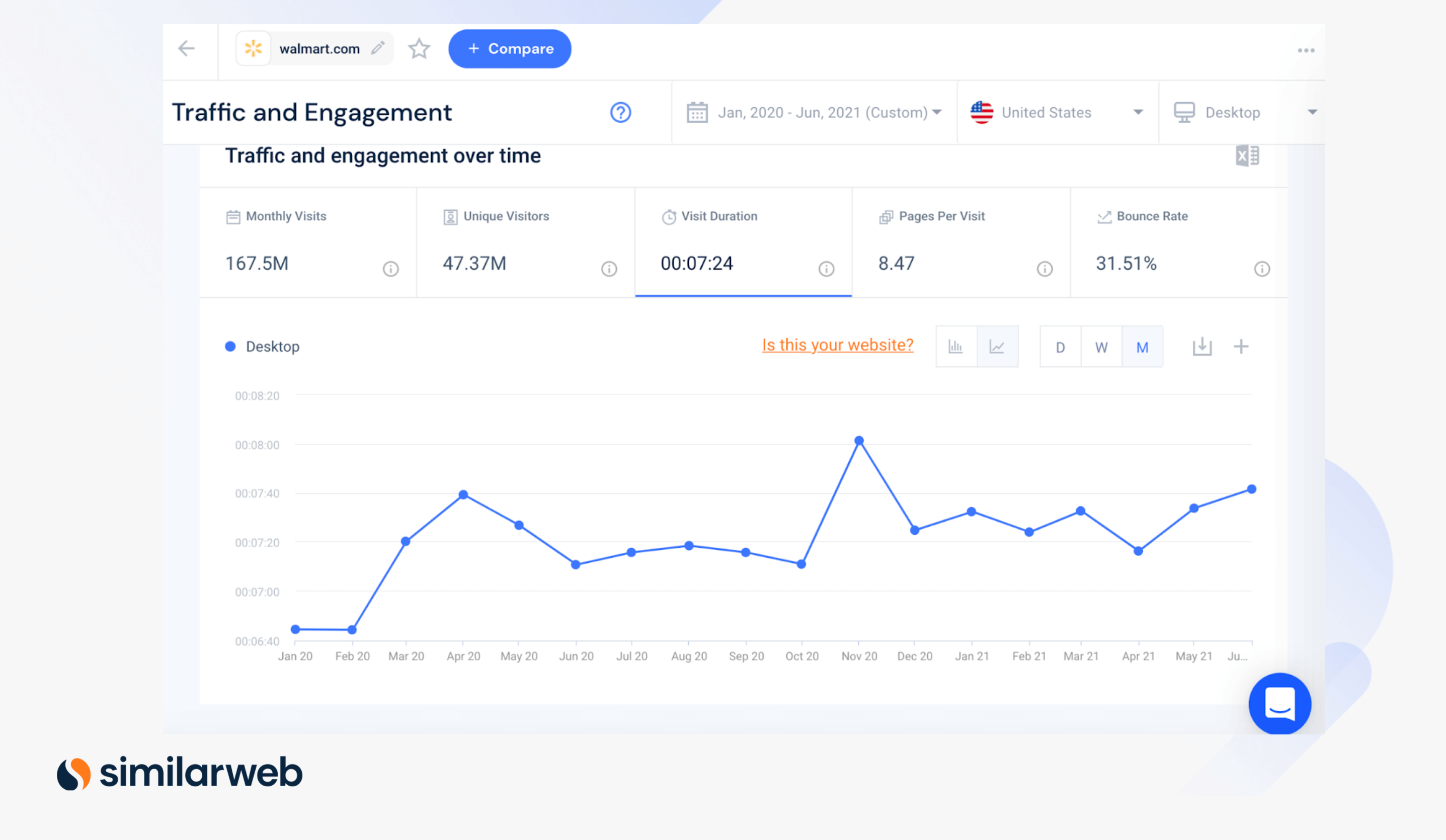

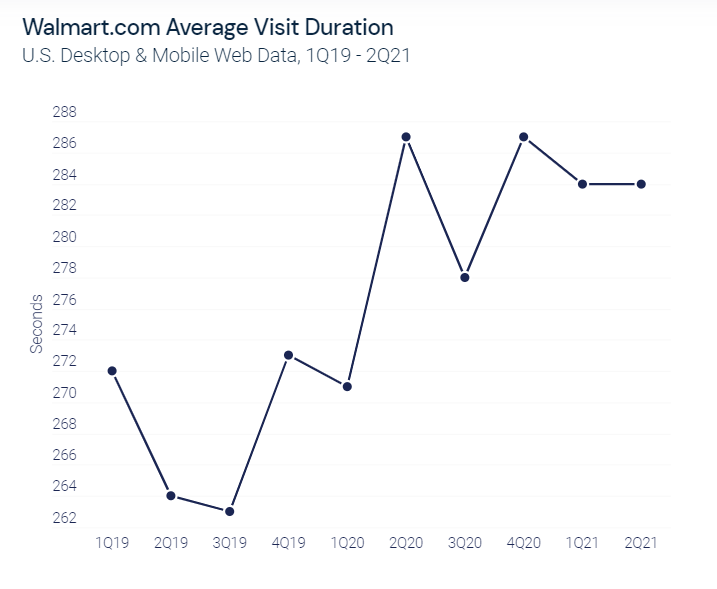

5. Visit duration: Time is money?

Notably crucial signs of audience engagement are relatively positive, with average pages per visit and average visit duration both on a par with the first quarter. In particular, Q2’s average visit duration of 284 seconds is only marginally below the peak of 287 seconds in 4Q20 and in 2Q20, when the pandemic kicked off.

Bounce rate has also stayed steady for many months now at around 51%.

Walmart earnings: Wrapping up

Net-net, the digital data does indicate a deceleration in visitor growth for Walmart’s eCommerce business for the second quarter, although traffic remains notably elevated compared to pre-pandemic levels. Encouragingly, WMT’s conversion rate is now at record levels, although still some way off the market leader Amazon. Looking ahead, investors will be hoping that the gap between the two retail giants narrows rather than widens in the coming quarters.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.