When shelter-in-place orders went into effect, many coffee drinkers turned to DTC coffee subscription companies for their daily cup of joe. Consumer transaction data reveals how three select coffee brands—Blue Bottle Coffee, Peet’s Coffee, and Philz Coffee—whose offerings include retail cafes, coffee bean delivery, and coffee subscriptions experienced a sizable shift to online sales, as well as how some smaller coffee subscription box companies saw strong sales growth during the pandemic.

Blue Bottle Coffee seeing faster shift back to retail sales

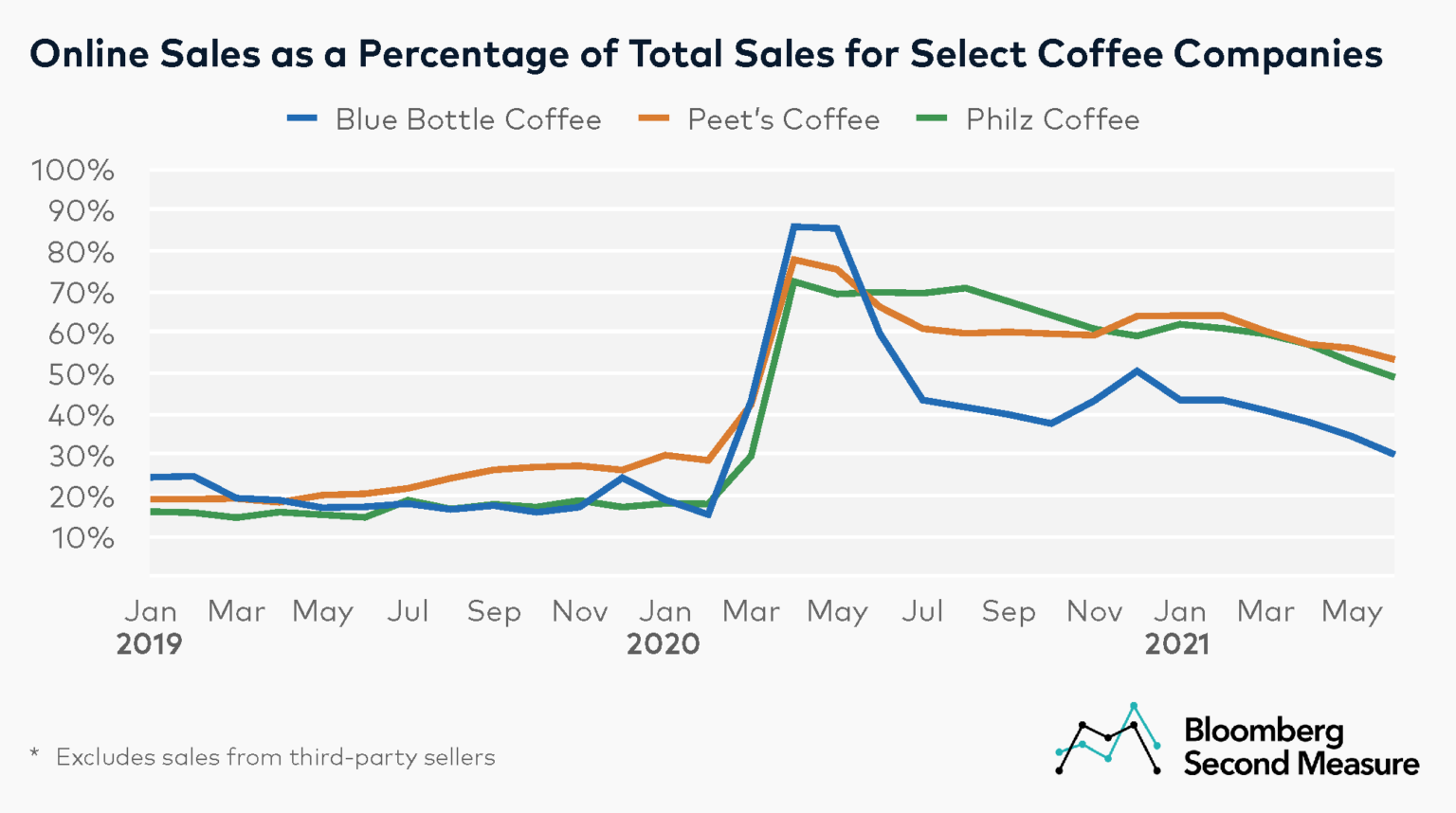

In 2019, a monthly average of 22 percent of Peet’s Coffee sales took place online, compared to 19 percent for Blue Bottle Coffee and 17 percent for Philz Coffee. In April 2020—while many cafe locations were temporarily closed—the percentage of sales coming from online channels jumped to 72 percent for Philz, 78 percent for Peet’s, and 86 percent for Blue Bottle. Online sales include orders made for pickup at a retail location, coffee subscriptions for brewing at home, and ad hoc deliveries for coffee beans and other merchandise.

As brick-and-mortar businesses have been reopening, the percentage of online sales has generally decreased at all three coffee companies. In 2020, a monthly average of 57 percent of Peet’s sales took place online, compared to 56 percent for Philz and 47 percent for Blue Bottle.

Transaction data also suggests that consumers are returning to Blue Bottle Coffee’s retail locations more rapidly than competitors’ locations. As of June 2021, 30 percent of Blue Bottle’s sales were still taking place online, far lower than the 53 percent of Peet’s sales and 49 percent of Philz’s sales.

It is worth noting that these numbers only include sales from each company’s website and stores. The data also excludes purchases from third-party sellers, such as grocery stores and meal delivery services.

Average transaction values for online purchases at Philz Coffee and Blue Bottle Coffee have been elevated during the pandemic

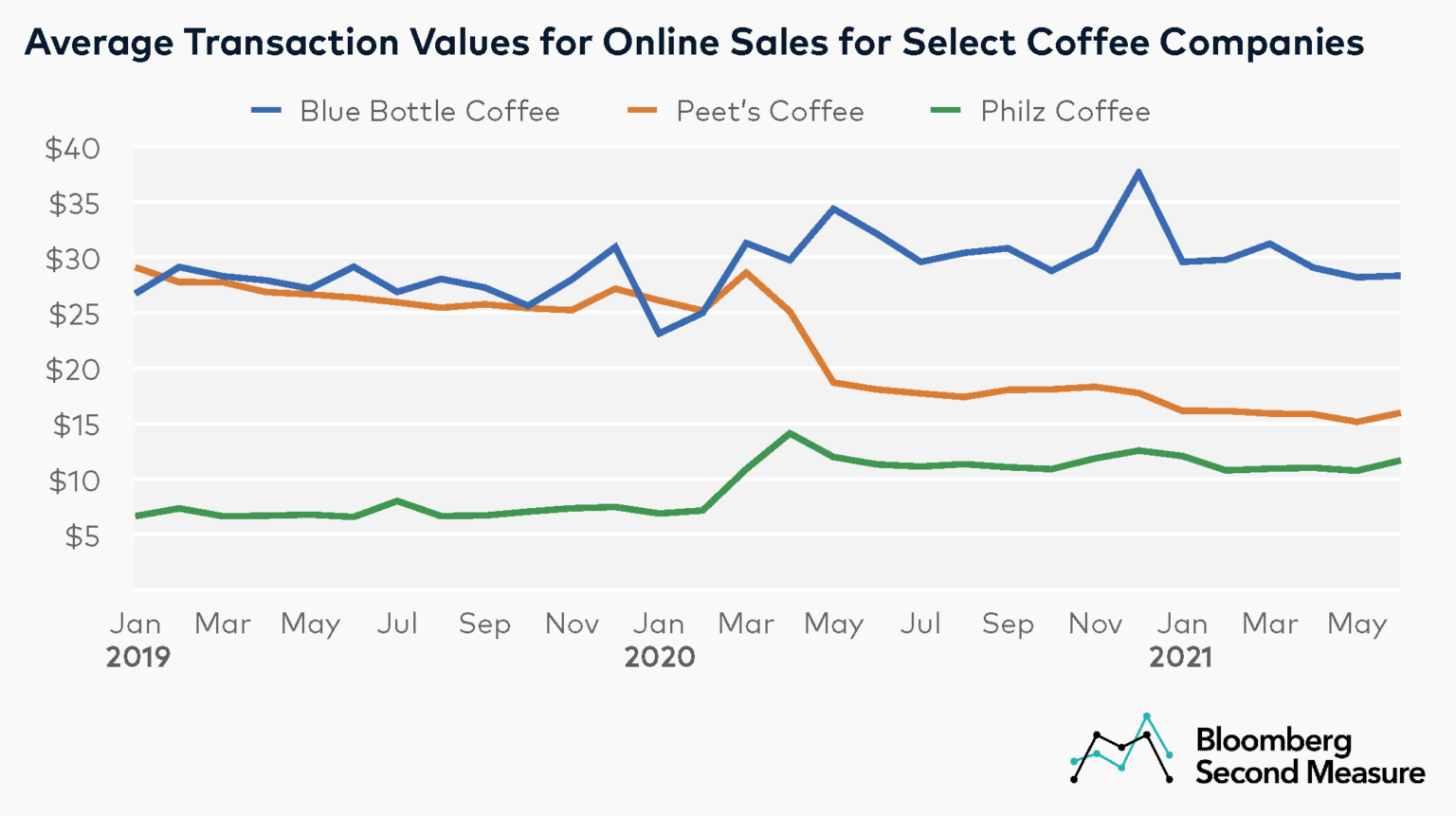

The average transaction value for online purchases has increased for both Blue Bottle Coffee and Philz Coffee during the pandemic, but generally decreased for Peet’s Coffee. In February 2020, the average transaction value for online purchases was $25 at Blue Bottle and Peet’s, and $7 for Philz. The following month—as stay-at-home orders went into effect—the average transaction value for online sales grew to $31 for Blue Bottle, $29 for Peet’s, and $11 for Philz.

However, between April and May of 2020, the online average transaction value at Peet’s Coffee dropped from $25 to $19, lower than pre-pandemic levels, and since then continued to decline. As of June 2021, the average transaction value for online sales was $28 for Blue Bottle, $16 for Peet’s, and $12 for Philz.

Among select DTC coffee subscription boxes, Trade Coffee has seen the most growth

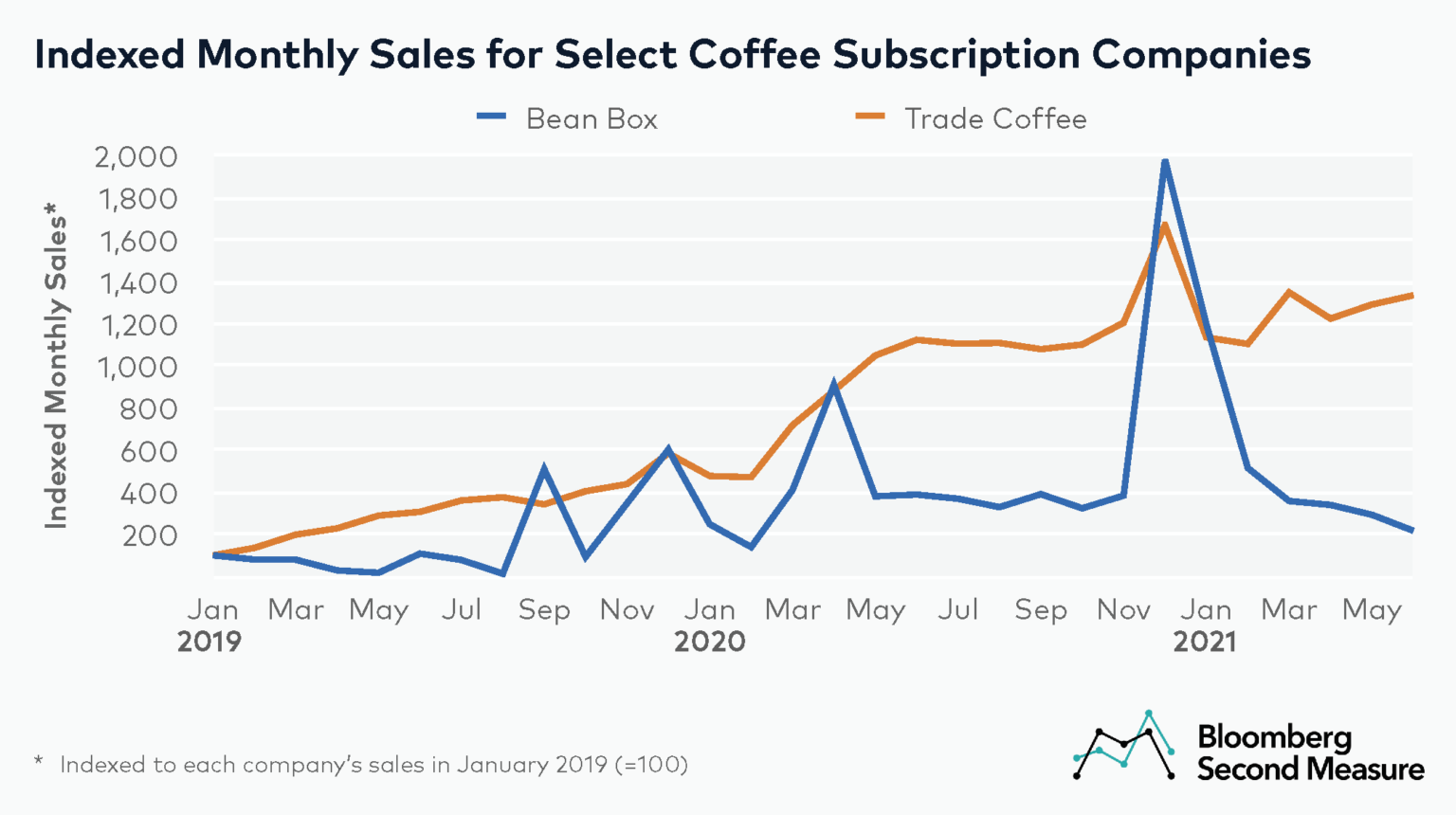

Other companies have emerged in recent years with a focus on coffee bean delivery and subscriptions, without cafe locations. These include Bean Box and Trade Coffee.

Bean Box and Trade Coffee sales have generally followed a seasonal pattern, with a sales boost occurring in December for the holidays. This is likely because both companies offer gift subscriptions. Bean Box sales in December 2019 and December 2020 grew 74 percent and 416 percent month-over-month, respectively, while Trade Coffee experienced more modest month-over-month increases of 33 percent and 38 percent.

However, significant increases occurred in March 2020, with Bean Box sales growth reaching 195 percent month-over-month and Trade Coffee reaching 53 percent month-over-month. Sales for Trade Coffee have remained elevated since the initial pandemic spike and are continuing to grow in 2021. As of June 2021, Trade Coffee’s sales are 18 percent higher year-over-year. Bean Box monthly sales also remained elevated year-over-year throughout most of 2020, but have been gradually declining in 2021.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.