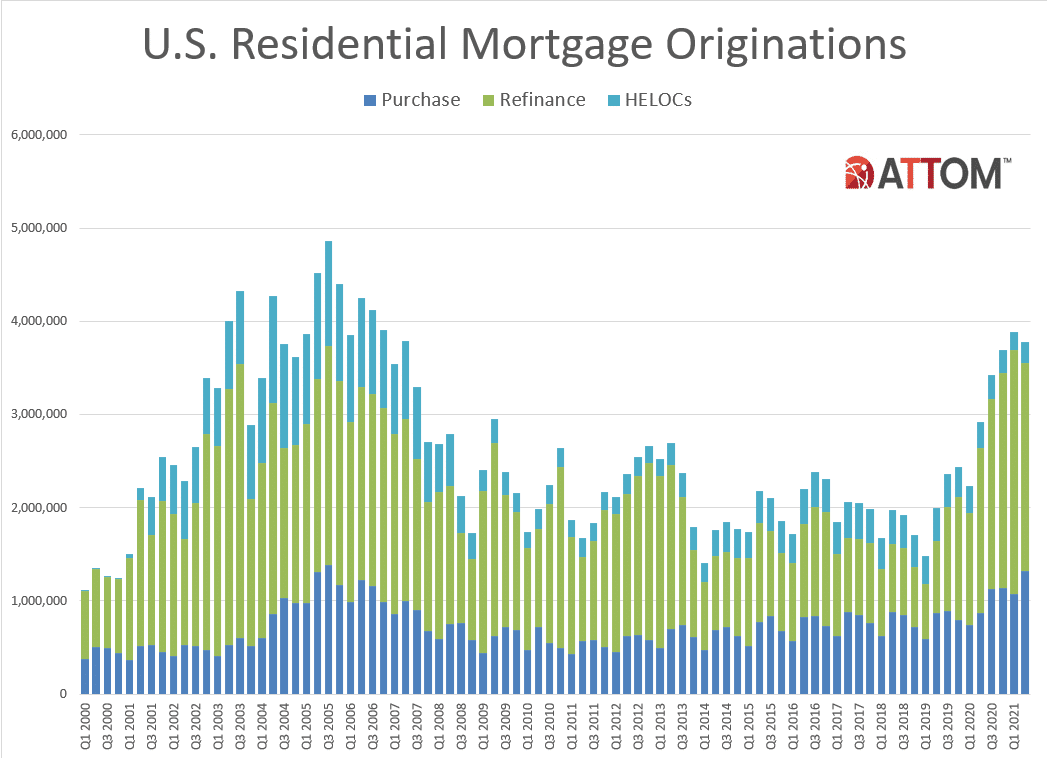

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Residential Property Mortgage Origination Report, which shows that 3.78 million mortgages secured by residential property (1 to 4 units) were originated in the second quarter of 2021 in the United States. That figure was up 29 percent from the second quarter of 2020, but down 3 percent from the first quarter of this year.

The quarterly decline marked the first time since early in 2020 that the total number of home mortgages issued in the U.S. decreased and – more notably – the first time that happened from a first-quarter to a second-quarter period since 2011.

With residential mortgage interest rates dropping back below 3 percent for most 30-year fixed-rate purchase and refinance loans, lenders issued $1.18 trillion worth of mortgages in the second quarter of 2021. That also was up annually, by 39 percent, but down quarterly, by 1 percent.

The rare quarterly drop-off came as a decrease in refinance activity canceled out a rise in home-purchase and home-equity lending.

Lenders refinanced 2.23 million home loans in the second quarter of 2021, up 26 percent from a year earlier, but down 15 percent from the first quarter of this year. The last quarterly decrease in refinancing activity came in early 2020, while the last time the number dropped from a first quarter to a second quarter was in 2017. The second-quarter dollar volume of refinance loans rose annually, by 26 percent, but went down quarterly, by 15 percent, to $674.7 billion.

Refinance mortgages still accounted for a majority of all home-lending activity during the second quarter. But the portion dipped from 67 percent to 59 percent, the biggest downward change in four years.

The cooling-off on the refinance side of the lending industry offset a spike in the number of purchase loans issued in the second quarter to 1.32 million – a 52 percent annual and 22 percent quarterly rise. The dollar volume of loans taken out to buy a property jumped to $465.5 billion, a 77 percent gain over the second quarter of last year and a 31 percent increase from the first quarter of 2021.

Home-equity lines of credit also rose from the first to the second quarter, to about 225,000. That number, while down annually by 18 percent, was up quarterly by 18 percent. The increase marked the first quarterly rise in HELOC activity since the third quarter of 2019.

The second-quarter dip in total lending and the shift in loan patterns reflected a broader housing market that remained super-heated during the second quarter of 2021 as it continued resisting damage to major sectors of the U.S. economy caused by the Coronavirus pandemic that hit early last year. Home purchases have soared over the past year as a glut of buyers entered the market. That surge in buyer interest came amid a combination of rock-bottom mortgage rates and a desire for many households, financially unscathed by the pandemic, to flee virus-prone areas for the perceived safety of a home and the space for evolving work-at-home lifestyles.

At the same time, the drop in refinance loans could be an indication that lenders may have finally satisfied homeowners’ appetites for rolling over old mortgages into newer ones at lower rates.

“The demand for home loans across the country shifted significantly in the second quarter as refinancing activity receded and home-purchase and equity loans increased. We haven’t seen that pattern for several years,” said Todd Teta, chief product officer at ATTOM. “The big increase in households looking to buy surely had a lot to do with that. And we may be getting to the point where so many homeowners have refinanced that the need for those deals is tapping out. We will see whether this is a momentary blip or a real trend over the next few months, which looks to be a really key period for the lending industry.”

Total mortgages drop during second-quarter period for the first time in a decade

Banks and other lenders issued 3,776,180 residential mortgages in the second quarter of 2021. The latest figure was up 29.3 percent from 2,919,473 in second quarter of 2020, but down 2.9 percent from 3,887,739 in the first quarter of this year. The last time that the total mortgage count decreased from the first quarter to the second quarter was in 2011. The $1.18 trillion dollar volume of all loans in the second quarter remained up 38.9 percent from $853.3 billion a year earlier but was down 0.6 percent from $1.19 trillion in the first quarter of 2021.

Overall lending activity decreased from the first quarter of 2021 to the second quarter of 2021 in 101, or 46.3 percent, of the 218 metropolitan statistical areas around the country with a population greater than 200,000 and at least 1,000 total loans in the second quarter. The largest quarterly decreases were in Ann Arbor, MI (down 59.6 percent); Sioux Falls, SD (down 57.1 percent); Appleton, WI (down 56.6 percent); Des Moines, IA (down 55.6 percent); and Myrtle Beach, SC (down 52.9 percent).

Metro areas with at a population of least 1 million that had the biggest decreases in total loans from the first quarter to the second quarter of 2021 were St. Louis, MO (down 41.9 percent); Pittsburgh, PA (down 23.9 percent); Atlanta, GA (down 17.1 percent); Seattle, WA (down 15.8 percent) and San Francisco, CA (down 15.7 percent).

Metro areas with the biggest increases in the total number of mortgages from the first quarter of 2021 to the second quarter of 2021 were Virginia Beach, VA (up 50.4 percent); Scranton, PA (up 35.5 percent); Erie, PA (up 35.3 percent); Oklahoma City, OK (up 34.9 percent) and Syracuse, NY (up 32.2 percent).

Aside from Virginia Beach and Oklahoma City, metro areas with a population of at least 1 million and an increase in total mortgages from the first quarter to the second quarter included Houston, TX (up 10.7 percent); Rochester, NY (up 10 percent) and Baltimore, MD (up 9.3 percent).

Refinance mortgage originations down 15 percent from first quarter

Lenders issued 2,230,263 residential refinance mortgages in the second quarter of 2021, up 25.5 percent from 1,776,709 in second quarter of 2020, but down 14.8 percent from 2,617,243 in the first quarter of this year. The decline was the first since the first quarter of 2020 and the largest quarterly decline since the first quarter of 2018. The $674.7 billion dollar volume of refinance packages in the second quarter of 2021 was up 25.7 percent from $536.5 billion a year earlier, but down 15.4 percent from $797.6 billion in the first quarter of this year.

Refinancing activity decreased from the first quarter of 2021 to the second quarter of 2021 in 179, or 82.1 percent, of the 218 metropolitan statistical areas around the country with enough data to analyze. Activity dropped at least 10 percent in 128 metro areas (58.7 percent). The largest quarterly decreases were in Des Moines, IA (down 66.2 percent); Sioux Falls, SD (down 65.4 percent); Ann Arbor, MI (down 64.3 percent); Appleton, WI (down 52.5 percent) and Myrtle Beach, SC (down 50.2 percent).

Metro areas with at a population of least 1 million that had the biggest decreases in refinance activity from the first quarter to the second quarter of 2021 were St. Louis, MO (down 49.5 percent); Pittsburgh, PA (down 38.4 percent); Portland, OR (down 33 percent); Seattle, WA (down 32.8 percent) and Denver, CO (down 29.1 percent).

By the end of the second quarter, refinance mortgages took up a smaller portion of all loans issued in 207 (95 percent) of the 218 metros with enough data to analyze.

Counter to the national trend, metro areas with the biggest increases in refinancing loans from the first quarter of 2021 to the second quarter of 2021 were Scranton, PA (up 27.8 percent); Syracuse, NY (up 27.5 percent); Virginia Beach, VA (up 25.2 percent); Tuscaloosa, AL (up 19.9 percent) and Florence, SC (up 18.6 percent).

Aside from Virginia Beach, the only metro areas with a population of at least 1 million where refinance mortgages increased from the first quarter to the second quarter were Oklahoma City, OK (up 15.8 percent); Detroit, MI (up 2.4 percent); New York, NY (up 1.9 percent) and Baltimore, MD (up 0.1 percent).

Refinance lending represents at least two-thirds of all loans in just 22 metro areas

Refinance mortgages accounted for at least two-thirds of all loans in only 20 (10.1 percent) of the 218 metro areas with sufficient data in the second quarter of 2021. That was down from 81 in the first quarter.

Metro areas with a population of at least 1 million where refinance loans represented the largest portion of all mortgages in the second quarter of 2021 were Atlanta, GA (92.4 of all mortgages); Detroit, MI (75.6 percent); New York, NY (70.5 percent); Providence, RI (66.7 percent) and Buffalo, NY (66.4 percent).

Metro areas with a population of at least 1 million where refinance loans represented the smallest portion of all mortgages in the second quarter of 2021 were Oklahoma City, OK (46.9 percent of all mortgages); Miami, FL (49.1 percent); Las Vegas, NV (50.6 percent); Pittsburgh, PA (51.9 percent) and Tampa, FL (52.6 percent).

Purchase originations increase 22 percent in second quarter

Lenders originated 1,320,677 purchase mortgages in the second quarter of 2021. That was up 22.4 percent from 1,079,032 in the first quarter and 52.4 percent from 866,782 in the second quarter of last year. The $465.5 billion dollar volume of purchase loans in the second quarter was up 30.9 percent from $355.7 billion in the prior quarter and up 77 percent from $263 billion a year earlier.

Residential purchase-mortgage originations increased from the first quarter of 2021 to the second quarter of 2021 in 197 of the 218 metro areas in the report (90.4 percent). The largest quarterly increases included those in Virginia Beach, VA (up 103.9 percent); Peoria, IL (up 90.9 percent); Champaign, IL (up 75.4 percent); Erie, PA (up 71.5 percent) and Fargo, ND (up 70.4 percent).

Aside from Virginia Beach, metro areas with a population of at least 1 million and the biggest quarterly increases in purchase originations in the second quarter of 2021 were Raleigh, NC (up 61.8 percent); Oklahoma City, OK (up 60.2 percent); Birmingham, AL (up 59.7 percent) and Richmond, VA (up 58.4 percent).

Counter to the national trend, residential purchase-mortgage lending decreased from the first quarter of 2021 to the second quarter of 2021 in 21 of the 218 metro areas in the report (9.7 percent). The largest decreases included those in Myrtle Beach, SC (down 62.4 percent); Appleton, WI (down 61.9 percent); Tuscaloosa, AL (down 57 percent); Ann Arbor, MI (down 44.6 percent) and Atlanta, GA (down 43 percent).

Aside from Atlanta, the only metro areas with a population of at least 1 million where purchase originations decreased from the first to the second quarter of 2021 were St. Louis, MO (down 19.7 percent); Salt Lake City, UT (down 16.8 percent); Memphis, TN (down 3.3 percent) and Pittsburgh, PA (down 3.1 percent).

Metro areas with a population of at least 1 million where purchase loans represented the largest portion of all mortgages in the second quarter of 2021 were Oklahoma City, OK (48.8 percent of all mortgages); Miami, FL (46.8 percent); Las Vegas, NV (46.5 percent); Orlando, FL (42.8 percent) and Jacksonville, FL (42.5 percent).

Metro areas with a population of at least 1 million where purchase loans represented the smallest portion of all mortgages in the second quarter of 2021 were Atlanta, GA (7.3 percent of all mortgages); Buffalo, NY (17.2 percent); Detroit, MI (18.1 percent); Rochester, NY (23.5 percent) and New York, NY (25.2 percent).

HELOC lending up for first time since 2019

A total of 225,240 home-equity lines of credit (HELOCs) were originated on residential properties in the second quarter of 2021, down 18.4 percent from 275,892 during the same period last year, but up 17.6 percent from 191,464 in the first quarter of 2021. The increase marked the first quarterly gain since the third quarter of 2019. The dollar volume of HELOC loans went up 15.7 percent, measured quarterly, to $44.7 billion, although that was still down 16.8 percent from the second quarter of 2020.

HELOC mortgage originations increased from the first to the second quarter of 2021 in 73.2 percent of metro areas analyzed for this report. The largest increases in metro areas with a population of at least 1 million were in Virginia Beach, VA (up 95.5 percent); Austin, TX (up 91.2 percent); Dallas, TX (up 46 percent); Sacramento, CA (up 44.4 percent) and Salt Lake City, UT (up 42.8 percent).

The biggest decreases in HELOCs among metro areas with a population of at least 1 million were in Atlanta, GA (down 81.4 percent); St. Louis, MO (down 60.5 percent); Birmingham, AL (down 29 percent); Indianapolis, IN (down 15 percent) and New Orleans, LA (down 14.2 percent).

FHA loan share rises

Mortgages backed by the Federal Housing Administration (FHA) accounted for 362,618, or 9.6 percent of all residential property loans originated in the second quarter of 2021. That was up from 8.8 percent in the first quarter of 2021 and 9.4 percent in the second quarter of 2020.

Residential loans backed by the U.S. Department of Veterans Affairs (VA) accounted for 263,026, or 7 percent, of all residential property loans originated in the second quarter of 2021, down from 8.4 percent in the previous quarter and 8.8 percent a year ago.

Median down payments and amounts borrowed hit new highs

The national median down payment, amount borrowed and the ratio of down payment to median home price during the second quarter all hit or tied high points since at least 2005.

Median down payments on residential properties purchased with financing in the second quarter of 2021 stood at $25,000, up 35.1 percent from $18,500 in the previous quarter.

The median down payment of $25,000 represented 7.4 percent of the median sales price for homes purchased with financing during the second quarter of 2021, up from 6.1 percent in the previous quarter and 5 percent a year earlier.

Among homes purchased in the second quarter of 2021, the median loan amount was $286,440.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.