India’s progressive approach to vaccinations has led to an increase in travelers and hotel demand, especially in the leisure segment. Beyond the noticeable improvement, however, the country is showing a different trend in which markets are regaining occupancy.

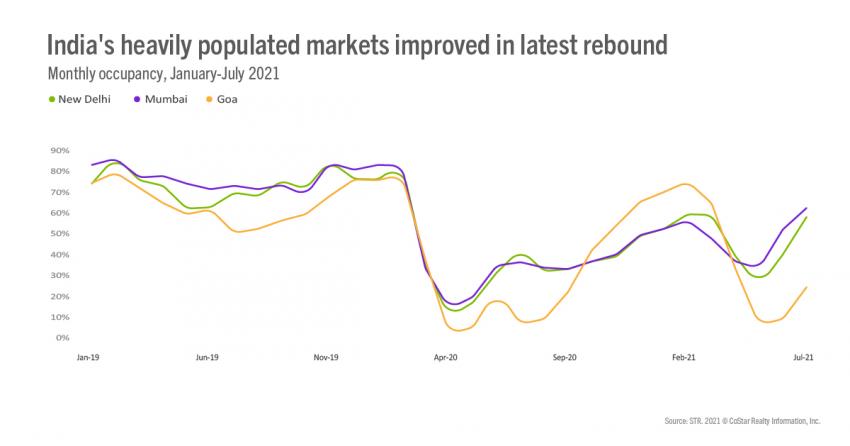

As noted in a recent press release, India’s recovery after the first COVID-19 wave was concentrated in leisure destinations such as Goa and Udaipur. But in this latest round of recovery, heavily populated markets and metro cities such as New Delhi and Mumbai have seen much improvement.

Performance timeline

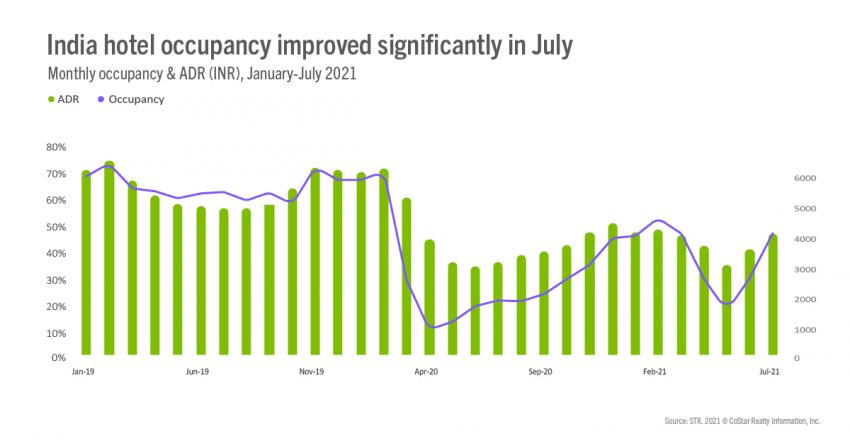

India’s monthly occupancy reached a pandemic-era high in February 2021 (53.7%), which looked to be solid progress toward recovery as the monthly level was roughly 73% of the 2019 comparable. By May 2021, however, occupancy in the country fell to 18.7%.

Since then, India has consistently regained occupancy, and in July, reached 48.0%.

At the same time, average daily rate (ADR) has also trended upward in recent months. India’s ADR came in at INR4,173.40 in July 2021, which was up from July 2020 (INR3,251.47), although, substantially below July 2019 levels (INR5,012.94).

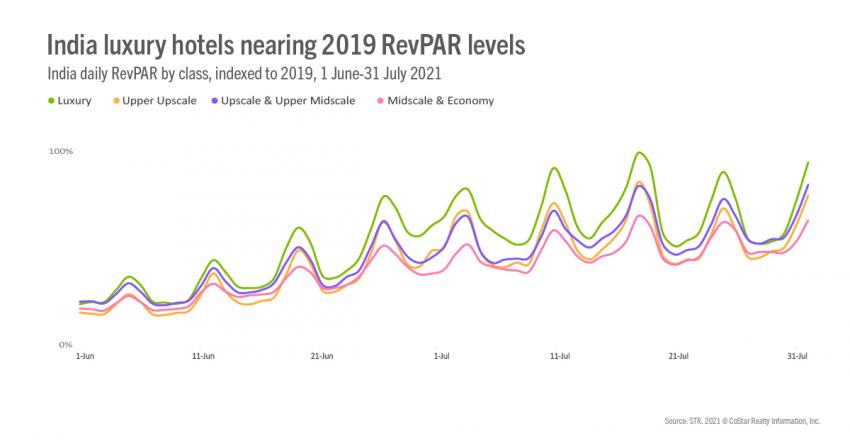

Luxury hotels RevPAR index almost to 2019 levels

Higher class hotels and alternate accommodation providers have witnessed an upswing in demand after the second COVID-19 wave swept the nation off its feet in April this year. As travel confidence gains, hotels are seizing the opportunity and raising room rates. Strong demand, coupled with pricing confidence, has resulted in revenue per available room (RevPAR) indexing near 2019 levels for India’s luxury class properties. India, a market mainly driven by domestic and often corporate demand, has seen the tables turn during the pandemic with an explosion in domestic leisure travel. Of course, there was significant domestic leisure demand in the past as well, but clearly that balance has shifted, just like everywhere else around the globe.

While looking at daily data, India’s RevPAR index for luxury hotels touched 2019 levels on 17 July.

Markets experiencing more promising metrics

Mumbai saw an increase in demand that pushed occupancy to 62.7% in July 2021, which was the market’s highest level since February 2020 (83.2%). New Delhi, another heavily populated market, also eclipsed 50% occupancy in July.

For comparison, although India’s first recovery demand was concentrated in leisure destinations, Goa’s occupancy came in at 24.8% in July 2021, substantially below occupancy levels before the second COVID-19 wave.

What does the future hold?

India’s states are gradually easing out restrictions as more people are inoculated. This certainly means easier interstate travel and free movement for people to hit the roads. The large-scale corporate and social gatherings, although, continue to remain restricted.

While India is making strong progress toward hotel performance recovery, due almost exclusively to domestic demand, the market has a long way to go before corporate and business demand returns.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.