Manufactured housing represents a small share of the U.S. commercial real estate market, at approximately 1% of total deal volume, but activity in this alternative sector is gaining momentum.

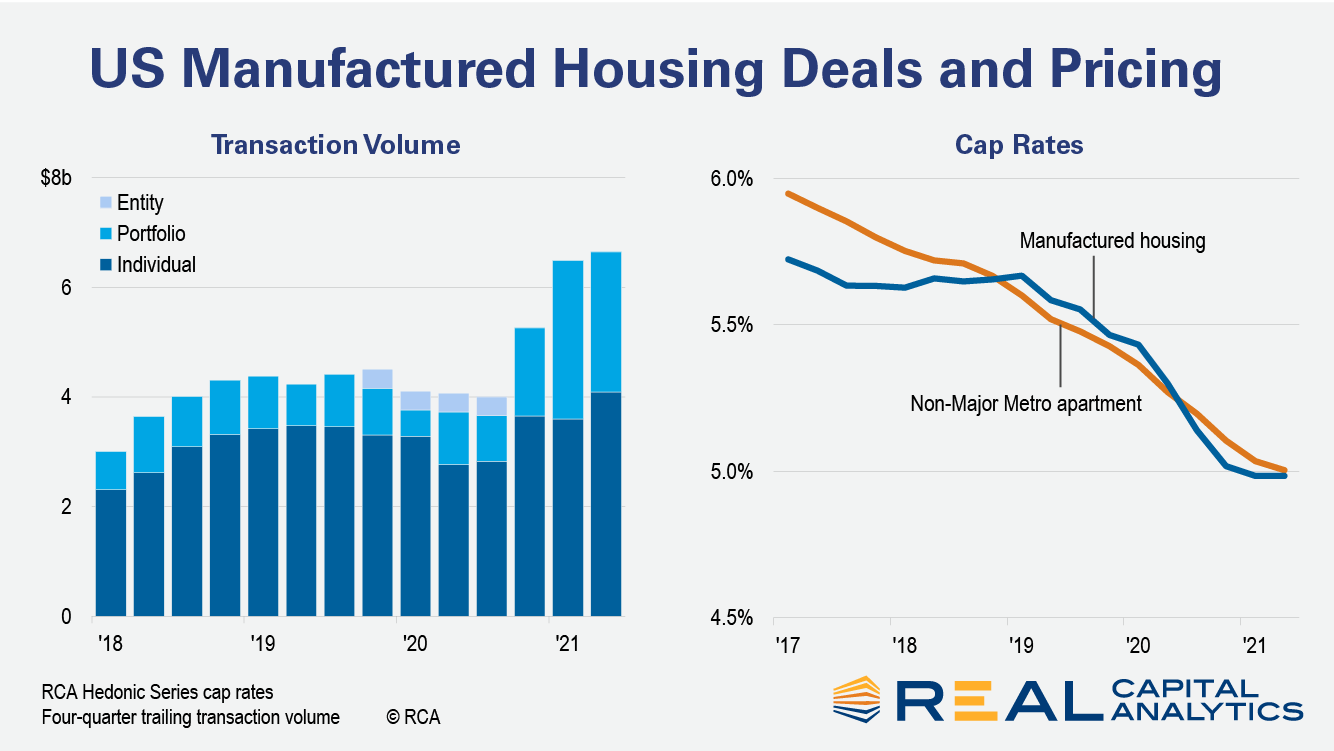

Sales of individual properties reached the highest levels yet in the second quarter. Acquisitions in the four quarters through Q2 2021 totaled $4.1 billion, up 48% compared with the prior four quarters and 30% above the average seen since 2017. Portfolio sales also climbed for the four quarters through Q2 2021, to $2.6 billion, augmented by a jump in activity at the start of the year.

Pricing for manufactured housing assets, which are primarily located in suburban locales, has remained tight. RCA Hedonic Series cap rates, which control for quality and locational differences in the underlying sample, fell 30 bps year-over-year to reach 5.0% in the second quarter. For apartments located outside the 6 Major Metros, RCA HS cap rates have been compressing in recent years and also hit 5.0% last quarter. These are the lowest levels ever seen for both housing sectors.

Since 2017, private buyers have dominated the manufactured housing market. However, institutional players are gaining share and accounted for 23% of volume in the past 24 months, up from the 13% average seen during 2017-19. Looking at the top 10 buyers over the past 24 months, four are institutional investors. These players secured their ranking by acquiring their manufactured housing assets in bulk: on average, 83% of their total acquisition activity involved portfolios.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.