In the midst of rising concerns among retailers over a COVID resurgence and a critical Back-to-School season, we dove into Gap Inc. and Lululemon’s foot traffic to find out how these apparel leaders are faring amidst the uncertainty.

Checking in with Gap Inc.

Gap Inc. had a mixed experience over the pandemic, with some of its iconic brands taking a hit while others flourished. In October 2020, the company unveiled the “Power Plan 2023” – a strategy involving reducing the Gap and Banana Republic store count in North America to 870 by the end of fiscal 2023, moving out of malls, and focusing on opening high-performing Athleta and Old Navy brands.

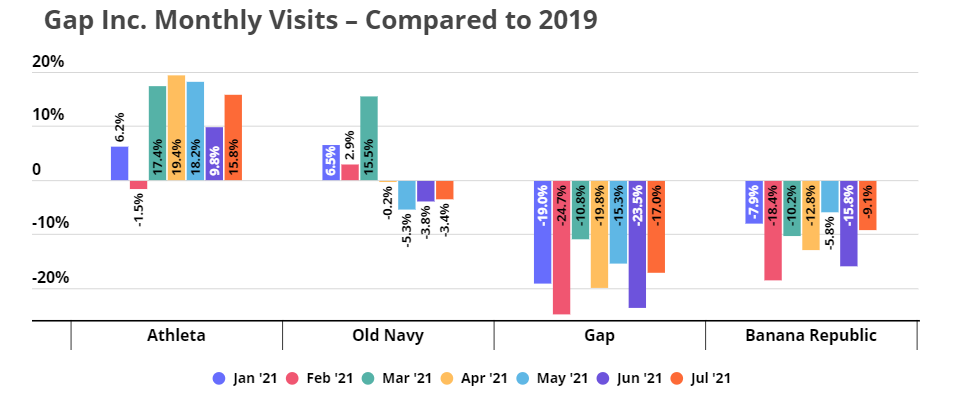

So, unsurprisingly monthly visits to Gap and Banana Republic retailers are down compared to 2019 – but it’s hard to tell how much of the drop in visits is due to a reduced demand and how much is due to store closures. Visits to Old Navy were doing exceptionally well in Q1, with March visits up 15.5% compared to March 2019 – but the past couple of months have been slower, with June and July visits down -3.8% and -3.4%, respectively, compared to 2019 – though even these small visit gaps have been declining consistently of late with visits in July down just 3.4% compared to 2019 even as apparel shopping options expanded dramatically in the summer.

Athleta also continued to deliver. The brand is perfectly aligned with the current athleisure trend, and data indicates that brand is successfully attracting significantly more monthly visits when compared to 2019. In July alone Athleta posted an impressive 15.8% increase in visits compared to July 2019.

Month-over-month Growth Across the Board

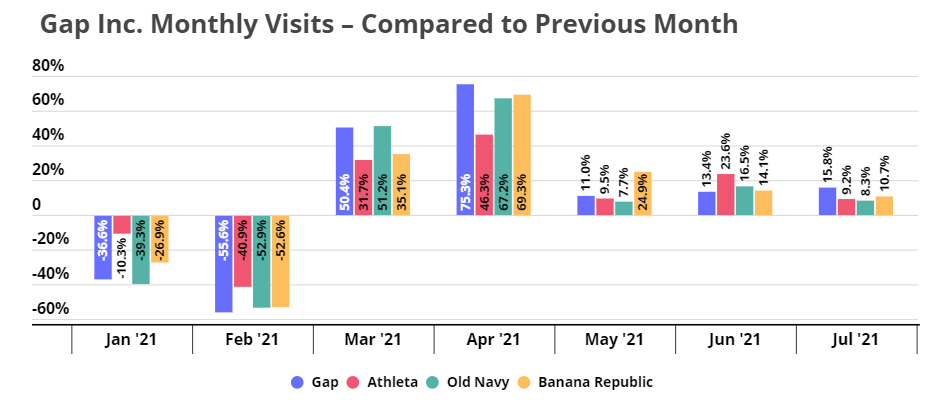

Despite the comparisons to 2019, month-over-month growth looks strong across the board – which means that all the brands have been consistently growing their visit numbers for the past five months. March and April marked the biggest growth in visit thanks to the retail reopenings and pent up demand. But, visits have been increasing steadily since.

Gap, Athleta, Old Navy, and Banana Republic continued the trend into July, when they received 15.8%, 9.2%, 8.3%, and 10.7% more visits, respectively, than they had in June. Maintaining consistent growth in visits is particularly impressive for Athleta, given its already sky-high visit numbers. And for Gap, Old Navy, and Banana Republic, the month-over-month growth could mean that the best for these brands might still be ahead.

Athleisure in a League of Its Own

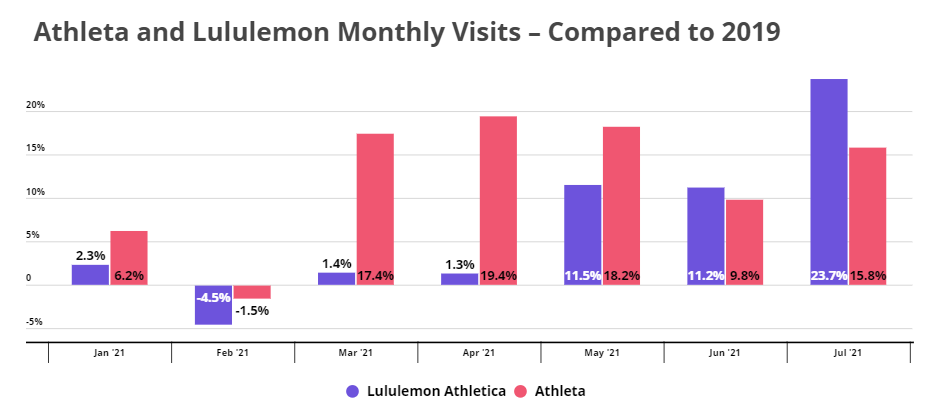

Still, the monthly visit comparisons to 2019 show that Athleta is in a different league than the other three Gap brands – and that league is called athleisure. Looking at visits to Athleta side by side with Lululemon, one of the top retailers in the space, highlights the category’s strength.

After making a swift recovery, athleisure continues to dramatically top 2019 foot-traffic figures. Visits to Lululemon grew by 11.5%, 11.2%, and 23.7% in May, June, and July compared to 2019, respectively, while Athleta grew in the same period by 18.2%, 9.8%, and 15.8%. Critically, much of this speaks to the starting points of the brands in 2019, but also indicates the tremendous upside surrounding Athleta and the expansion plans surrounding the brand.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.