Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through June 2021.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“While job and income growth has helped to push delinquency rates down, there are many families that remain in financial distress. More than one million borrowers had missed six or more payments as of June, triple the number of borrowers pre-pandemic. CoreLogic analysis found that as of June 2021, borrowers in forbearance and behind on mortgage payments had missed an average of 10 monthly payments.”

– Dr. Frank Nothaft

Chief Economist for CoreLogic

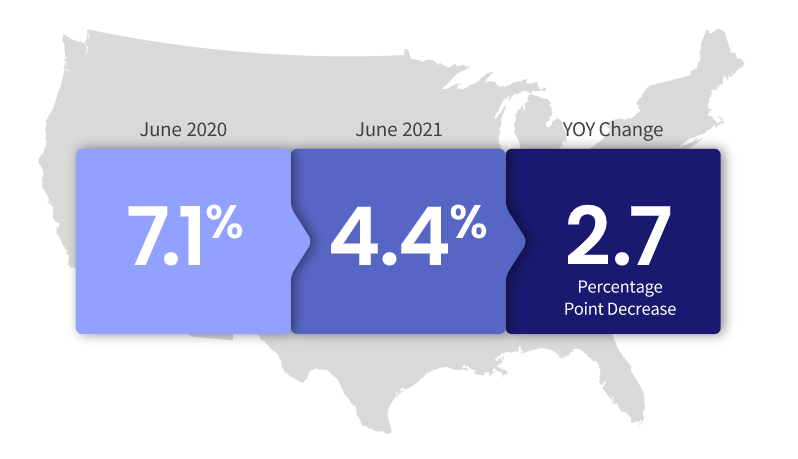

30 Days or More Delinquent – National

In June 2021, 4.4% of mortgages were delinquent by at least 30 days or more including those in foreclosure.

This represents a 2.7-percentage point decrease in the overall delinquency rate compared with June 2020.

Extended Moratorium

In June, the federal foreclosure moratorium was extended once more through July 31 to provide homeowners additional time to get financially back on track. The moratorium has helped move the foreclosure rate to a new generational low. However, a CoreLogic survey of mortgage holders found that nearly half (43%) of respondents said they do not understand government mortgage relief programs, which could be contributing to higher overall delinquency rates.

“The downward trend in delinquencies, especially serious cases, is very encouraging — and a testimony to the impact of the significant economic rebound over the past six months, as well as government stimuli, record-low mortgage rates and loan modification options. Providing resources to homeowners experiencing distress to help educate them on available government and private-sector support will aide in shrinking delinquency and foreclosure rates even more over the remainder of this year.”

– Frank Martell

President and CEO of CoreLogic

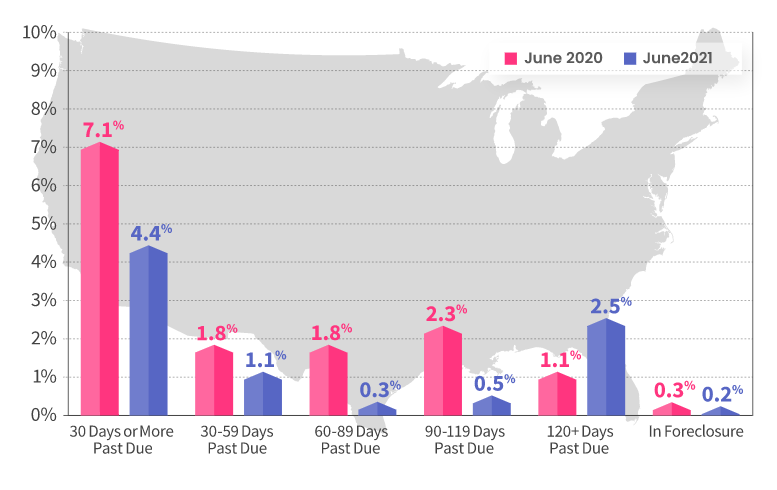

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for June was 4.4%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.1% in June 2021, down from 1.8% in June 2020. The share of mortgages 60 to 89 days past due was 0.3%, down from 1.8% in June 2020. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 3%, down from 3.4% in June 2020. While still high, this is the tenth consecutive month of declines, and the lowest serious delinquency rate since May 2020.

As of June 2021, the foreclosure inventory rate was 0.2%, down from 0.3% in June 2020.

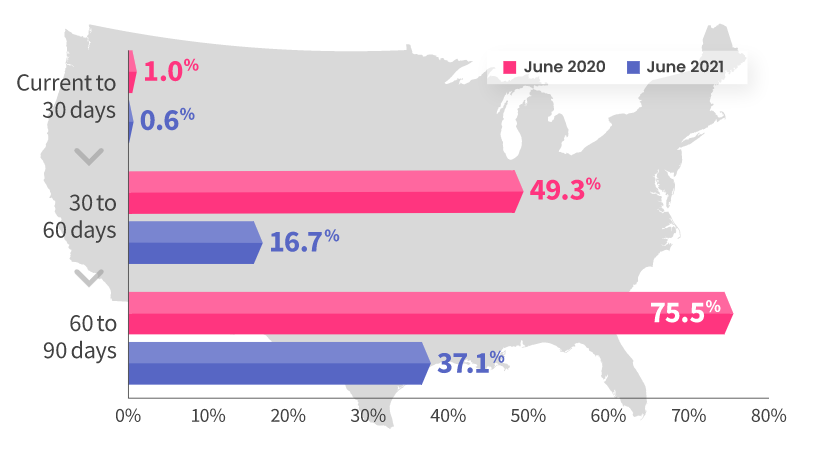

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.6%, down from 1% in June 2020.

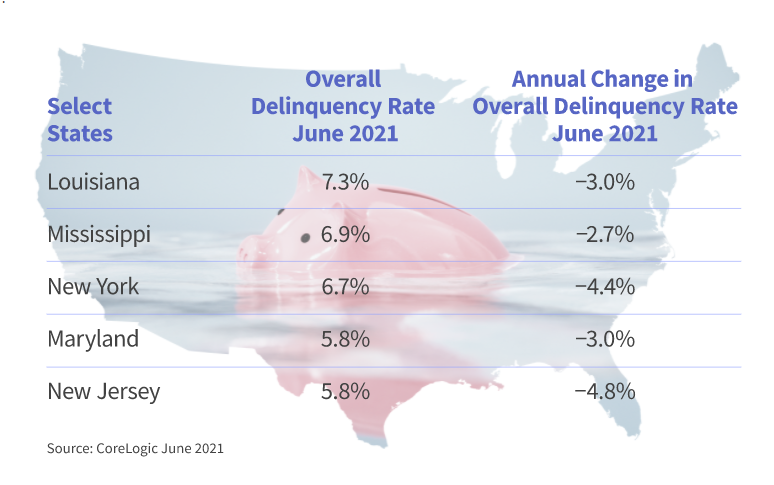

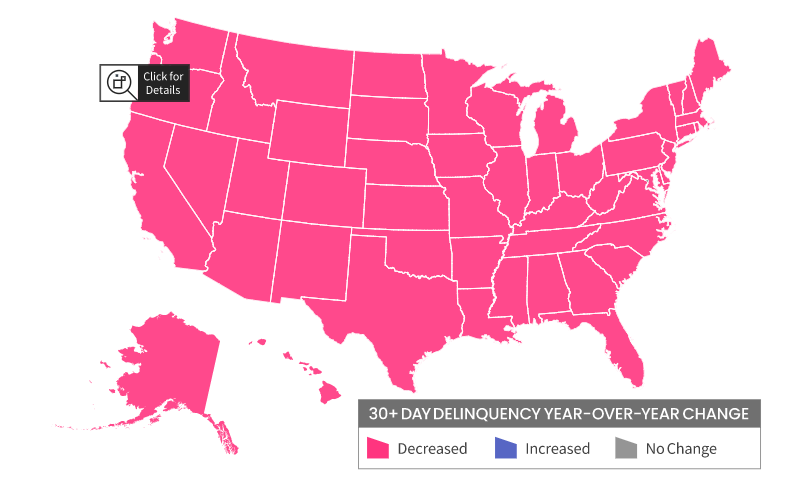

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

In June, all U.S. states logged a decrease in annual overall delinquency rates, with New Jersey (down 4.8 percentage points), New York (down 4.4 percentage points) and Florida (down 4.1 percentage points) leading with the largest declines.

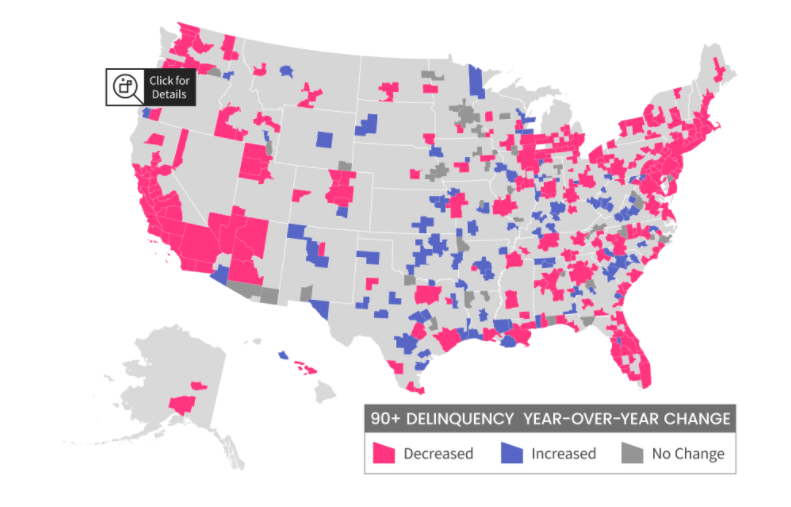

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were 94 metropolitan areas where the Serious Delinquency Rate increased.

There were 290 metropolitan areas where the Serious Delinquency Rate remained the same or decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.