When examining the latest Air Ticketing Data for industry partner CAPA, a clear observation is that travel recovery is performing at a different pace from country to country – even if you are in the same region!

“Withstanding where you are in the world, you are a winning destination showing resilience if you are smartly promoting sun and sea leisure destinations; remained open throughout the pandemic or wisely made announcements in advance of key tourism periods; kept your travel restrictions consistent and easy to follow, allowing travellers to plan ahead,” says Olivier Ponti, VP of Insights at ForwardKeys.

Some parts of the world have also been given the upper hand support from key source markets on the move: the USA and Russia.

The Highlights

1.World Overview

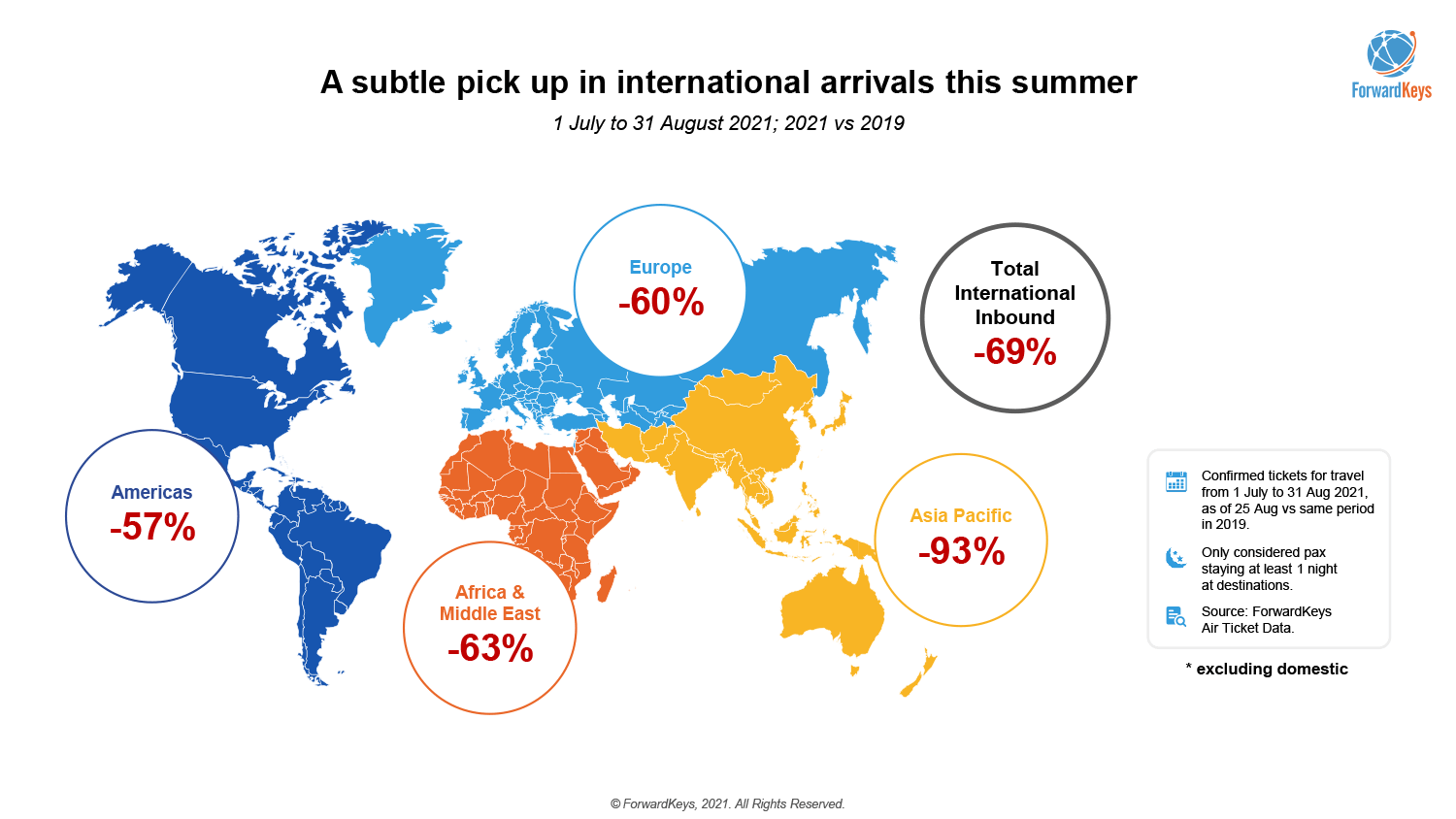

The northern hemisphere summer months of July – August reflected a subtle improvement in the number of international arrivals around the world. When comparing 2021 results with 2019, the Americas were down by 57% and Europe down by 60% – in a much better position than the Asia-Pacific region, down by 93%.

2.Central America & Caribbean – The USA story

As we’ve been reporting through 2021, the Caribbean and Mexico have been reliable destinations for international visitors.

The top 10 most resilient global destinations for international travel still looks very much like a Caribbean and Mexican affair, with 7 out of 10 from this part of the world.

This summer was no different with international arrivals in Mexico down by just 7% compared to 2019 levels and the Caribbean down by just 15%.

“This success is down to 3 key factors: 1) the fact that most of these destinations have remained consistently open for business, enabling visitors to plan; 2) their proximity with the US outbound market, which has been rebounding strongly since the start of the vaccination campaign; 3) the appeal of sun and sea experiences,” says Olivier Ponti.

However, there is a newcomer to this elite club – Central America, which was down by just 23%. Destinations such as El Salvador and Belize reported growths. There was an increase in international arrivals to El Salvador by +26% and to Belize, the increase was up 16% compared to 2019 levels.

“I believe that one of the factors explaining the rebound of El Salvador is that it communicated early on its openness to vaccinated passengers, particularly US ones, in late March,” adds Ponti.

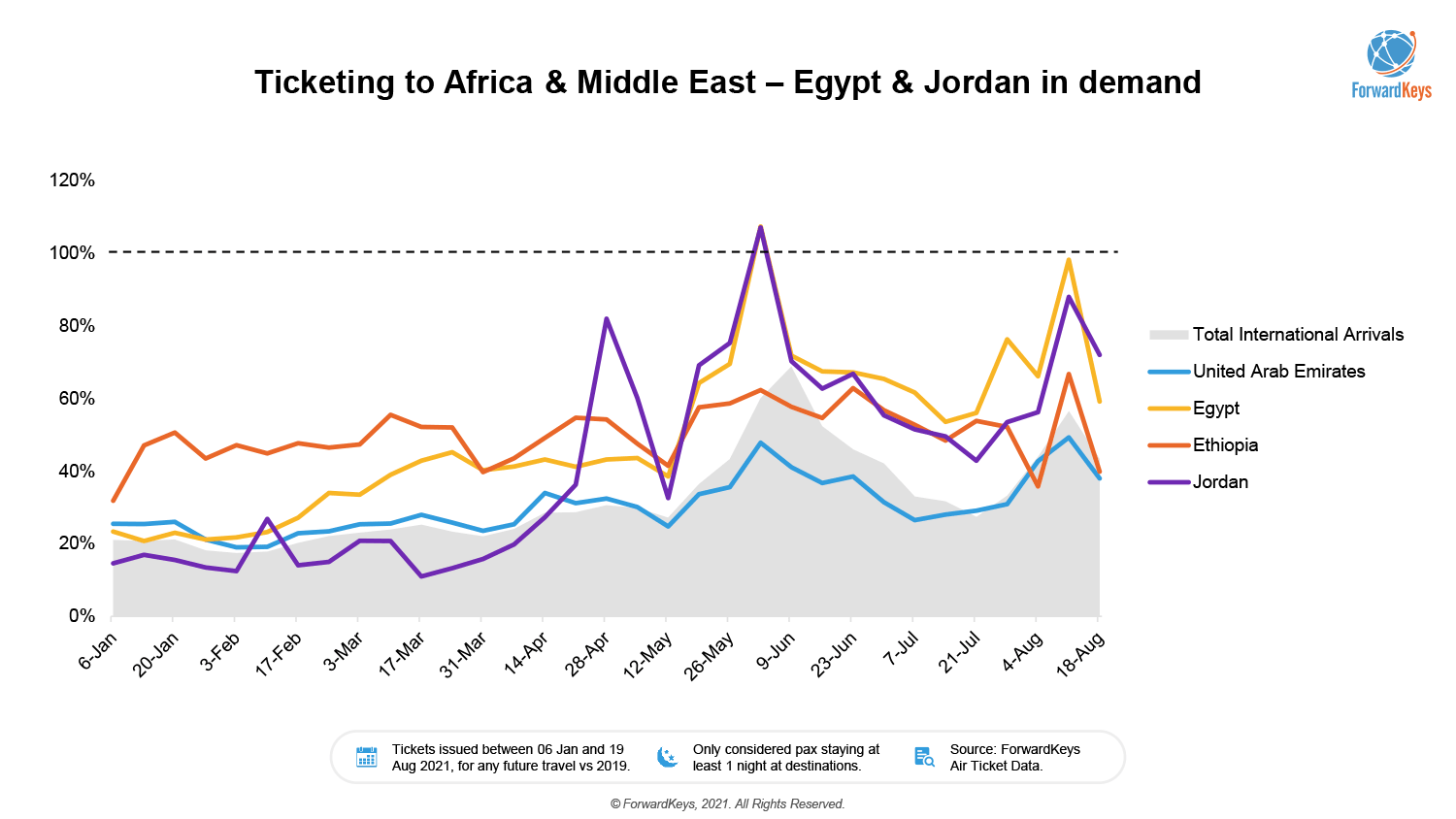

3.Greece, Turkey, and Egypt – The Russia Story

Destinations that make early border announcements or stay open as the case of Mexico have been benefiting with a regular flow of travellers but so have destinations that make government agreements or travel concessions.

Best in class, this summer was Greece, which communicated early on its reopening and benefited from being the first mover on the market and lucky to attract the affluent luxury traveller from Russia. Based on trips in July-August from Russia to Greece, 19% of passengers were travelling in premium classes (Economy Premium, Business and First) compared to only 5% in 2019.

Turkey also overperformed thanks to a strong position on the Russian market, which faced a limited choice of beach destinations close to home and was willing to welcome Russian visitors.

Egypt was another destination that cashed in on Russians keen to flop and drop on a beach. “Flights from Russia to Hurghada and Sharm El-Sheik were previously suspended due to a Russian plane being brought down by a terrorist attack. They only resumed this year. As we can see here, the sudden influx of Russian visitors has given Egypt a real boost.”

The Lowlights

“Sadly, some countries are still struggling with new Covid19 cases, or still are confused about effectively communicating on time,” adds Ponti.

Example 1: China

On a less positive note, we’re seeing the strong impact of the latest Covid outbreak on domestic travel. Following a pattern that has now become all too familiar since the beginning of the pandemic, the new wave of covid cases at the end of July was immediately followed by a strong dip in early August. This put an end to a stretch of 5 months of consecutive growth compared with 2019.

“This is not the first time it has happened. We’ve seen this earlier this year around the Lunar New Year, and domestic travel bounced back after the outbreak was under control. We see no reason why this should not be the case when this outbreak is over,” says Olivier Ponti.

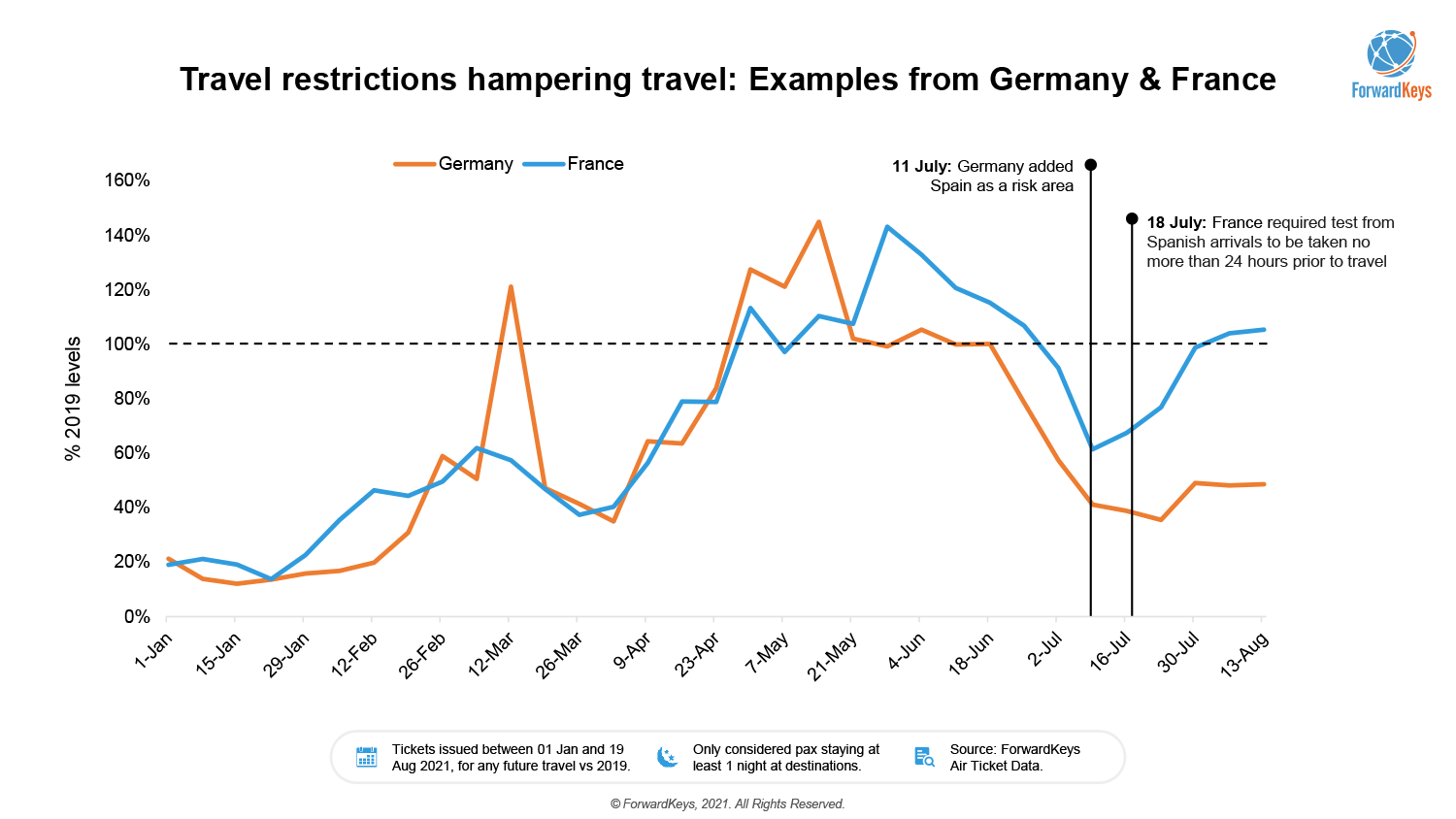

Example 2: Europe

Europe’s performances this summer was disappointing as it had great potential to flourish. What makes this particularly bitter for the travel sector is that it seems the season could have been much better, had the lessons from the summer of 2020 been learnt.

“We’re only talking about two things here: 1) an early communication from the destinations regarding the rules of the game this summer so that travellers can plan ahead; 2) Stability over the summer regarding travel restrictions,” says Olivier Ponti.

“We saw very little of both, which made international travel to and within Europe a bit of a gamble – and most people decided to stay close from home, which boosted domestic travel and trips to the neighbouring country,” adds Ponti.

Spain was an interesting example for demonstrating the strength of its domestic market to compensate for the shortcomings of international travel, particularly from Germany and the UK.

Within a very short period, Germany sent strong negative signals to their nationals discouraging them from booking their holidays in Spain.

The result was the strong rebound Spain had experienced since the end of April came to a brutal halt in the case of German visitors.

The key for a global restart of tourism appears to be down to effective communication and consistency in the travel restrictions and conditions. Until there is a more harmonised agreement on the rules of play, travel and tourism will continue to be a jerking stop-start experience. And even worst, travel recovery will continue to be uneven from country to country, region to region.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.