In May 2021, Shein made headlines by overtaking Amazon as the number one shopping app on iOS and Android. The June announcement that Shein may IPO at a $47 billion valuation rattled public attention again. How did this Chinese app seemingly emerge out of nowhere to become the most downloaded in the U.S.?

In this article, we’ll use data from our eCommerce solutions Research Intelligence and Shopper Intelligence, to analyze Shein and see if it’s truly a threat to retailers like Amazon and Walmart. Hold your breath for the Shein vs. Amazon face-off.

Shining a light on Shein

Despite reaching 81 million downloads worldwide and trending on app stores, Shein has maintained a low profile.

The self-proclaimed “B2C fast fashion e-commerce platform” was founded in 2008. Its headquarters are registered in Guangzhou, China. The company designs and manufactures clothing and apparel, operating a supply chain that is unmatched in its ability to deliver “fast fashion” (we’ll get to that later).

Why compare Shein vs. Amazon?

The publicity Shein received after overtaking Amazon for app downloads makes the fast-fashion company one to be noticed. However, it’s important to note that Amazon’s high app penetration, almost 57%, makes growing its app downloads more challenging than Shein. Nevertheless, Shein seems like a formidable force that can challenge eCommerce giants.

We also cannot deny that with consumers turning heavily to mobile shopping, this win is further proof of Shein’s rising force.

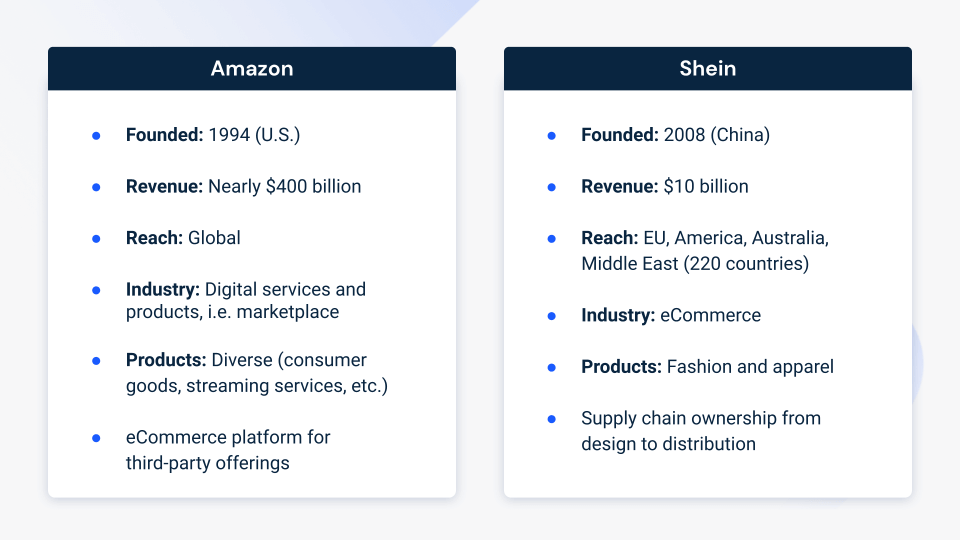

Shein vs. Amazon: An overview

Based on size, revenue, and scope of business, at first glance, Shein seems little match for Amazon. But once we look at Shein’s strengths, including where Shein overtakes Amazon, and vice-versa, it’s clear it’s a heavy hitter in Amazon’s corner.

How Shein became so trendy

1. Mastery of fast fashion

Shein could be the quickest fast fashion provider around. The company emulates catwalk trends, then provides low prices online and fast delivery to mass audiences. Other well-known fast fashion brands include ASOS, H&M, and Zara.

Shein achieves speed-to-store by owning its production chain, from design and prototype to procurement and manufacturing. Each step is highly digitized and integrated with the others, enabling Shein to churn out hundreds of new products tailored to different regions and user tastes at a daily rate.

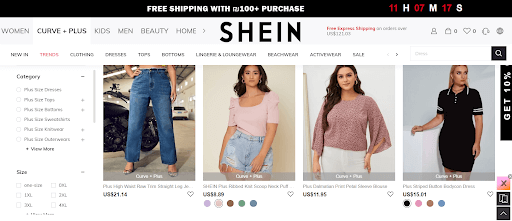

2. Provides fashion for regular people

Shein’s slogan is “everyone has the right to enjoy the beauty of fashion.” Closely aligning with this, the company accommodates many different styles and body types, including a popular section for plus-size fashion. The retail brand’s more realistic approach to the human body aligns with many of the fastest-growing D2C brands this year and helps appeal to a wider audience.

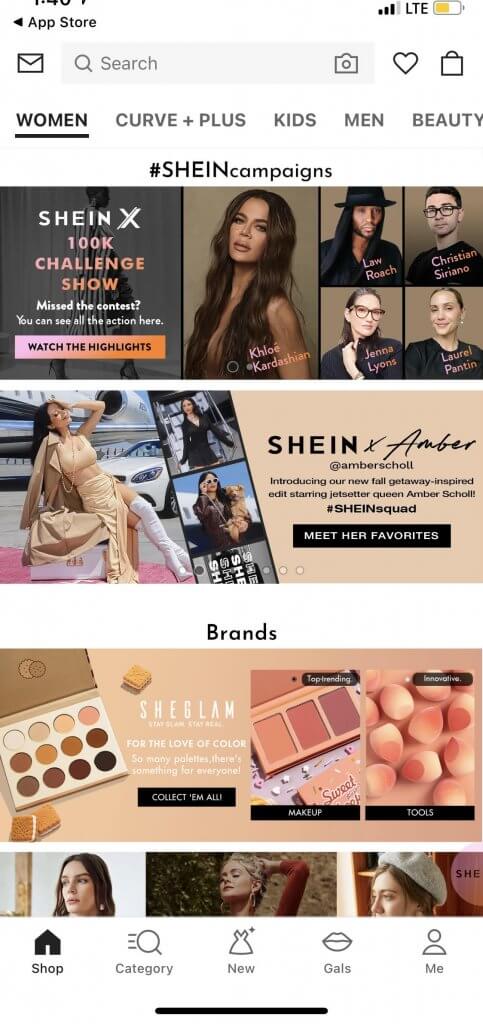

3. GenZ attraction

Shein has successfully appealed to Gen-Z, through:

Shein vs. Amazon: Digital performance

Amazon is a marketplace across products and lines of business, including streaming services, and is expanding into additional industries. Shein just focuses on fashion. To compare the two retailers fairly, we’ll hone in on Amazon’s fashion-related shopping category with our eCommerce tools:

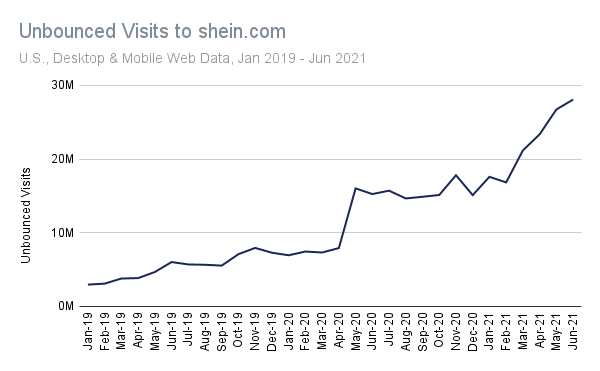

Web traffic

Worldwide traffic to shein.com has nearly doubled from September 2020, soaring from 32.7 million to 67.2 million monthly visits.

In the U.S. Shein’s traffic nearly tripled since January 2020 from 10.6 million to 27.8 million today. However, Amazon has consistently generated more traffic to its Clothing, Shoes, & Jewelry category than Shein, rising from 73.0 million visits in January 2020 to 94.1 million today.

Amazon’s growth seems more impacted by seasonality than Shein. Amazon’s traffic spiked in December 2019 (109.3 million) and 2020 (124.9 million) reflecting holiday gift-buying. Shein’s growth actually declined slightly month-over-month (MoM) at the same time. Amazon seems to attract a larger proportion of customers buying just fashion-related gifts for the holiday season, perhaps because they are already shopping in other Amazon categories. However, Shein seems to attract more consumers that buy fast-fashion regularly from its site.

Overall, U.S. traffic to shein.com seems to be steadily and consistently growing. As it gains brand awareness in the U.S., it seems to seamlessly build a fashion-forward customer base of regular shoppers.

Main traffic channels

Direct

By volume of visits, direct traffic and organic search are the primary traffic channels for both eCommerce sites. Amazon receives significantly more of its traffic through direct channels (58.8%) whereas Shein gets just 36.7%, reflecting greater brand awareness for Amazon.

Overall, Shein lags the fashion and apparel industry for this metric, which receives 42.2% of traffic through direct channels, indicating the need to improve brand awareness.

Organic search

Shein’s percentage of traffic through organic search channels also trails the industry average of 31.1%, as does Amazon’s. Shein generates 20.1% through organic search vs. 24.6% for Amazon.

Search terms

Shein’s top search terms tend to be trendy, fashion-related terms or rival brand names rather than Shein-branded terms.

In the U.S., these keywords scored higher than the best performing branded keyword:

Paid advertising

Shein’s investment in paid search seems to mitigate low brand awareness and help spur growth.

This year, Shein received 18.9% of its worldwide desktop traffic through paid search, exceeding the fashion and apparel industry (11.7%) by over 7 percentage points. Amazon received just 3.2% of traffic through paid search.

Engagement metrics

Shein’s website visitors are becoming more engaged. Looking at some key eCommerce metric, we notice:

Bounce rate: Shein shows progress by managing to push its bounce rates, down from 34% in August 2020 to 27% by July 2021.

The graph’s upward trend of unbounced visits shows Shoppers are gaining confidence in Shein’s fast fashion. More and more visitors are coming to stay.

Pages visited: The number of pages users visit on average has grown from close to 13 last year to almost 16 pages this year.

Audience loyalty

Shein’s strong engagement metrics suggest it’s effectively building a strong, loyal customer base. An analysis of Amazon loyalty metrics using Similarweb Shopper Intelligence suggests Amazon also has a strong following.

Customer loyalty for its apparel category is on the rise. July 2021, revenue for Subscribe and Save, its subscription program, went up over 70% MoM. In August, more than 67% of Amazon fashion and apparel shoppers were returning customers.

Growing Subscribe and Save metrics indicate more recurring revenue for Amazon and that it is successfully growing out one sector of its business. Unlike Shein, Amazon is not known as a fashion business.

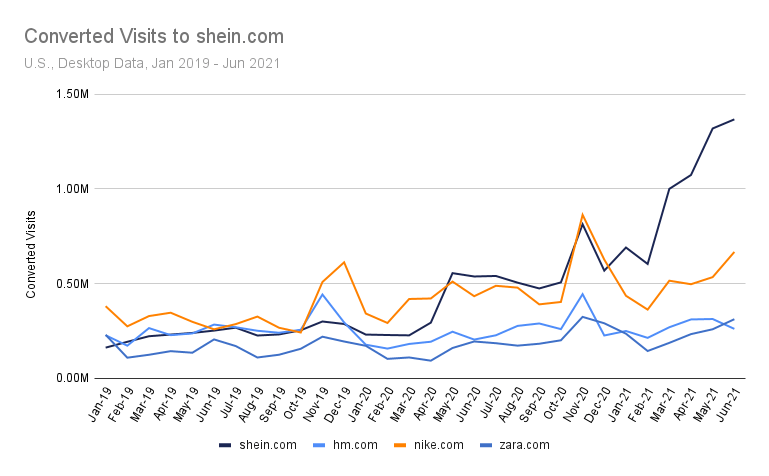

Converted visits

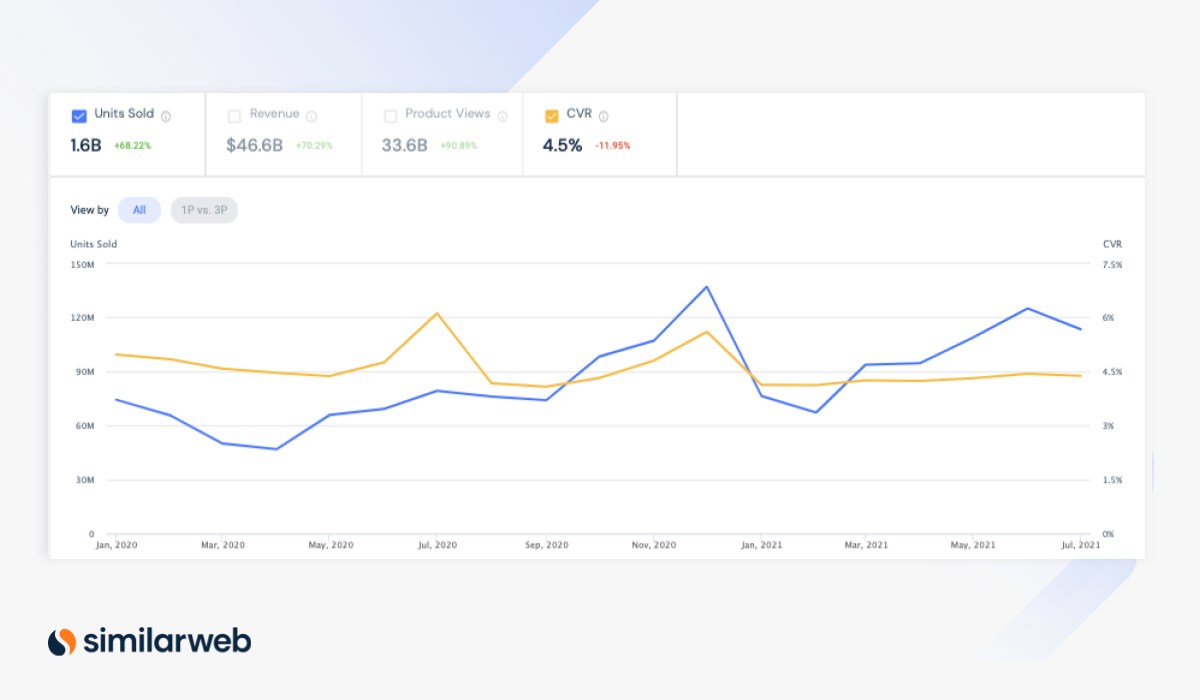

Despite online apparel shopping becoming more popular, consumers generally spend more time browsing before buying, lowering eCommerce conversion rates The 12% decline in conversion rates (CVRs) since January 2020 for Amazon’s fashion and apparel category, despite growing sales and product views, reflects this. Amazon’s current CVR for fashion and apparel is just 4.5% across U.S. desktop and mobile apps.

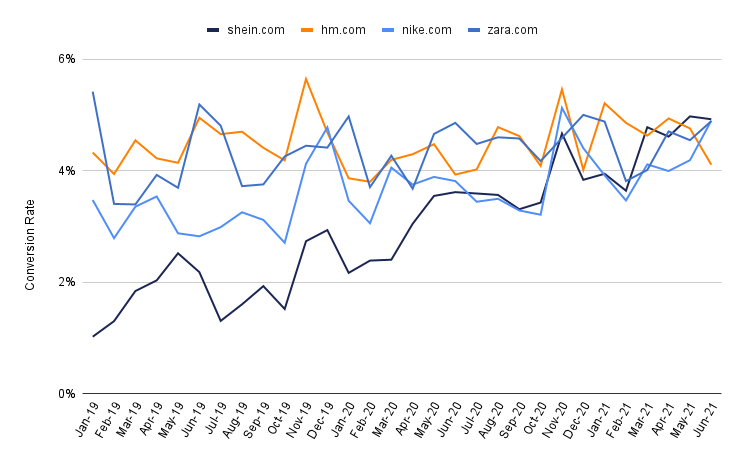

Shein started with a CVR of only 1% in 2019, caught up with the industry leaders in 2020, and reached 5% in March 2021, which exceeds Amazon.

The growing number of converted visits for Shein, again, signals that it’s building trust among consumers. Visitors don’t just window-shop or compare styles and prices. It seems Shein’s low-price, fast-delivery fashion for everyone to enjoy makes it easy to reach a buying decision and optimize its conversion funnel.

Shein vs. competing online retailers

Shein may be a threat to Amazon’s fashion and apparel business, but it’s critical to note Amazon’s primary business ambitions are elsewhere. To get a better sense of where Shein stands, we’ll briefly compare it to top competing fast-fashion retailers. These are vying for the same audience’s attention.

Despite the rise in consumer demand for online apparel shopping, competitor retailers hardly increased their CVRs since January 2019, whereas Shein grew to 5%. H&M maintained a conversion rate of 4%, Zara held steady at 5%, and only Nike increased from 3% to 5%.

In a standoff between top competitors, Shein’s CVR further shows it may be a force to be reckoned with.

Key takeaway

Shein’s rise to fame was exceptionally fast, and the fast-fashion brand could soon outperform its competitors, becoming a game-changer in the online shopping category ‘fashion.’

Though Shein is growing quickly, its threat to Amazon as a whole seems to be minimal right now given Amazon’s size and diverse offerings. However, it is important to note that Amazon started by just selling books online, and perfected this – could Shein be next, but with fashion?

Amazon and other top eCommerce sites may want to think about innovating in directions they didn’t previously consider and emulate Shein.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.