One of the main objectives of airline carriers is to optimize revenue, which they accomplish by deciding on what flights to operate, when and with what aircrafts depending on demand.

Airline capacity is used by many tourism businesses as a proxy for the number of travellers that will be in a destination. It seems like a safe number to work with, as airline schedules are considered to be quite static.

However, that time is long gone, the global trend of using big data for more exact planning and forecasts have been picked up by the airlines, which means that they do regularly change flights.

Then add Covid-19 to the mix, and you get a landscape in which airlines are constantly forced to change their planning due to travel restrictions and changes in demand because of increased costs for obligatory testing or safety concerns.

The question we ask is how static were the flight schedules pre-COVID, and how has this changed post-COVID.

At ForwardKeys, we endeavour to provide our clients with access to the best data possible, giving them an indication of the flights and travellers that can be expected. That is why we have looked at different carriers, countries and even international versus domestic travel to analyse the differences between the flights that had been scheduled months in advance, and what was finally operated.

In our latest whitepaper, we’ve studied both the pre-COVID and post-covid scenarios to describe how the pandemic has reshaped the dynamics globally. Pre-COVID is the period between January 2019 and December 2019, whereas post-COVID is travel between August 2020 and April 2021.

Airlines’ behaviour

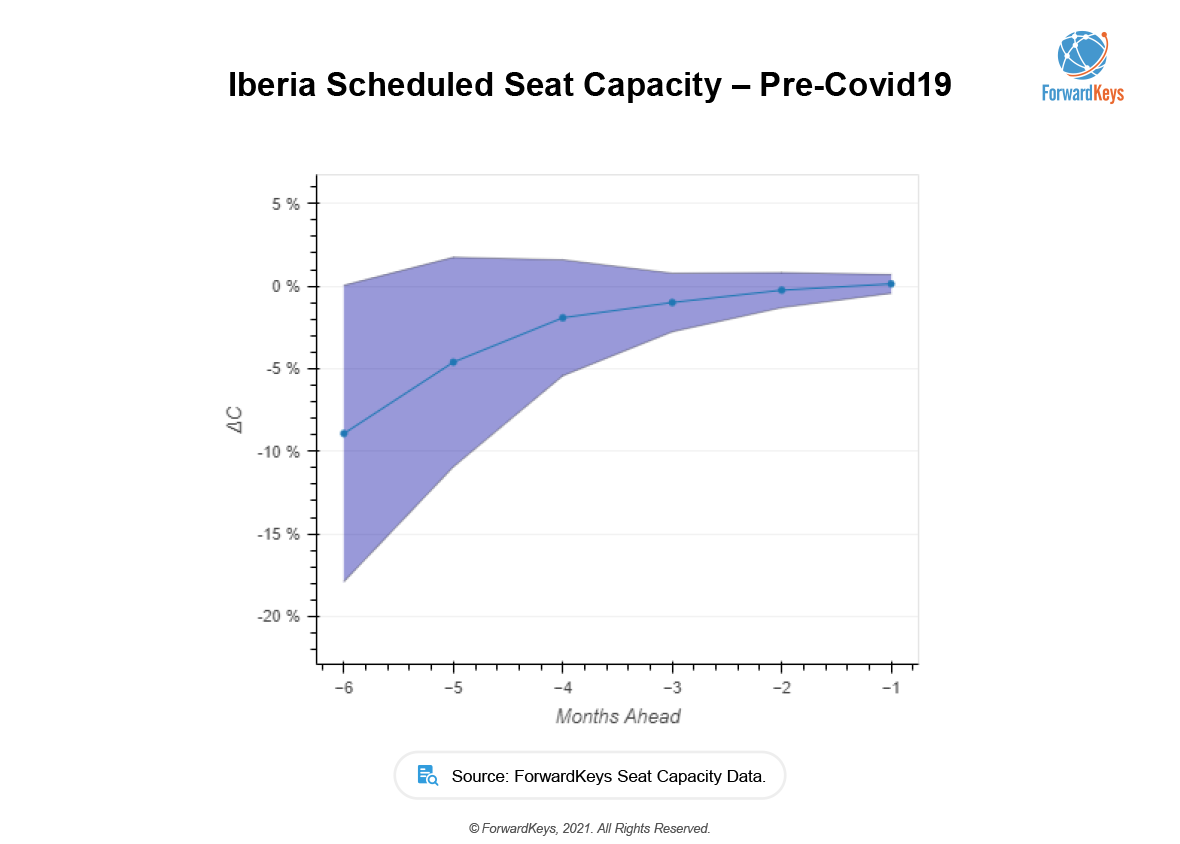

Interestingly, before COVID-19 airlines changed flights relatively little in the six months before the flight date, see the below example. They only added flights, in the case of high demand, but hardly cancelled flights overall.

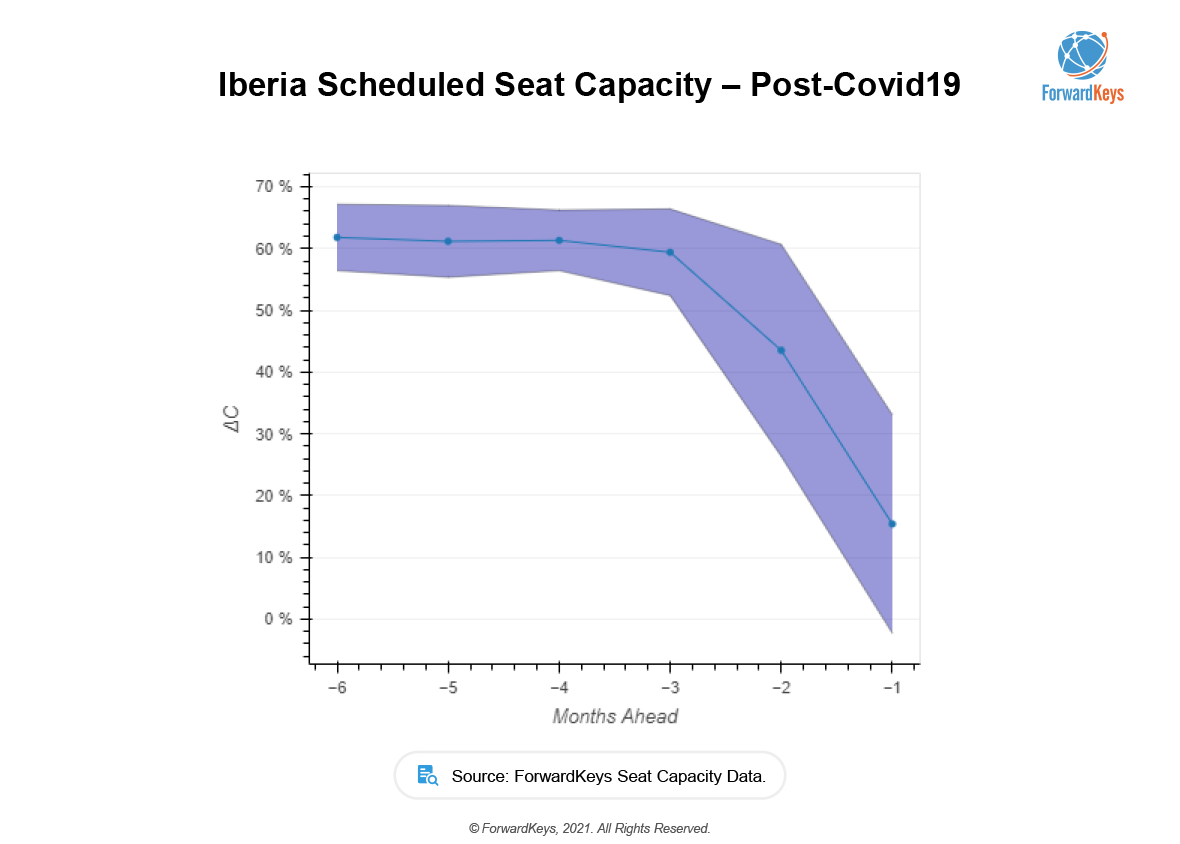

We can see the opposite happening after COVID-19 in graph 2. 6 months in advance the scheduled flights were 60% higher than what would have flown – which is as expected, with the high uncertainty due to covid and airlines not looking further ahead than 2 months.

Although in the example below we only look at Iberia, we are seeing the same with other airlines too.

Looking at the USA

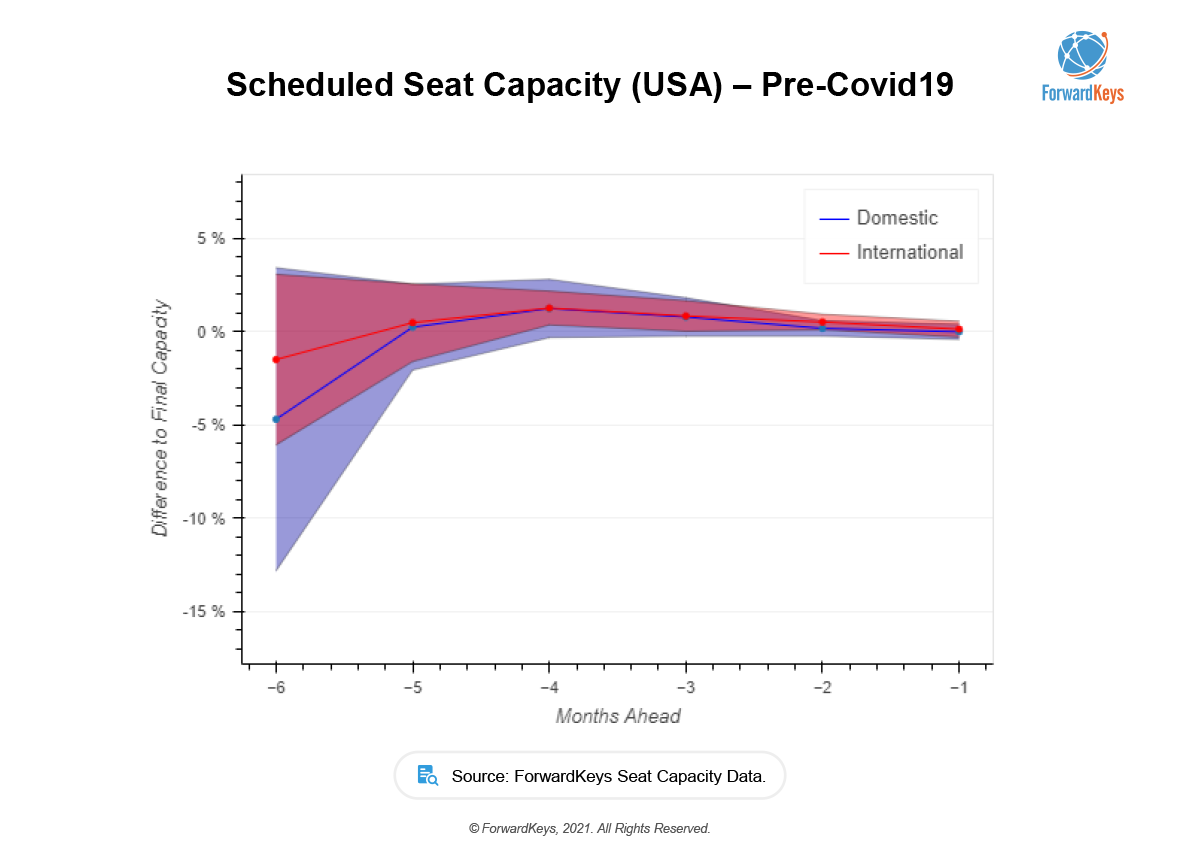

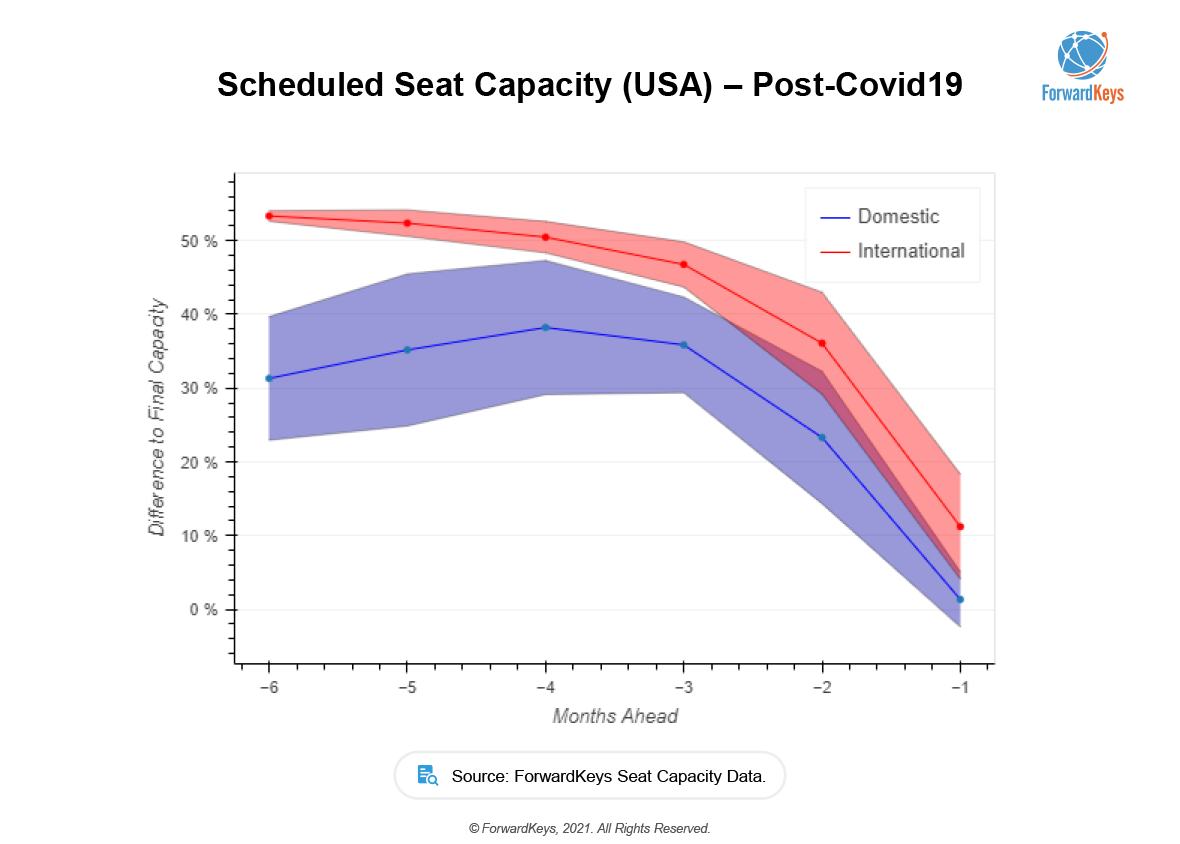

At a country level, we have similar patterns. In the below example we can see domestic and international flights scheduled in the USA before and after the Covid-19 outbreak.

While before the pandemic, airlines kept adding flights to their schedules after COVID the schedules 6 months before the day of the flight look completely different.

Interestingly, we see different patterns in different world regions.

In the case of China, for example, we can see that the effects of the pandemic are mostly noted by the international flights, with the scheduling dynamics of domestic flights barely noticing any effects.

This means that in China 6 months before take-off, many flights hadn’t been scheduled just yet. (This information is included in the whitepaper.)

What does this increased volatility mean for the travel industry?

Clearly, planning six months ahead is difficult. The travel restrictions mean that people are reluctant to travel, and we all know from anecdotal evidence that flights are being cancelled when you do travel, so nowadays you book only shortly before your travel date.

There is an increase in the importance of data science vs. only having “the real data” available. In this case, the real data 6 months before the travel date is useless, knowing that on average 50% more flights are scheduled 6 months before departure, which means half of the flights that are scheduled will never take off. But including this knowledge in a model that estimates the traffic 6 months in advance, and being able to predict which flights are going to fly, and which won’t, will give you a much-rounded estimation.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.