Key Takeaways

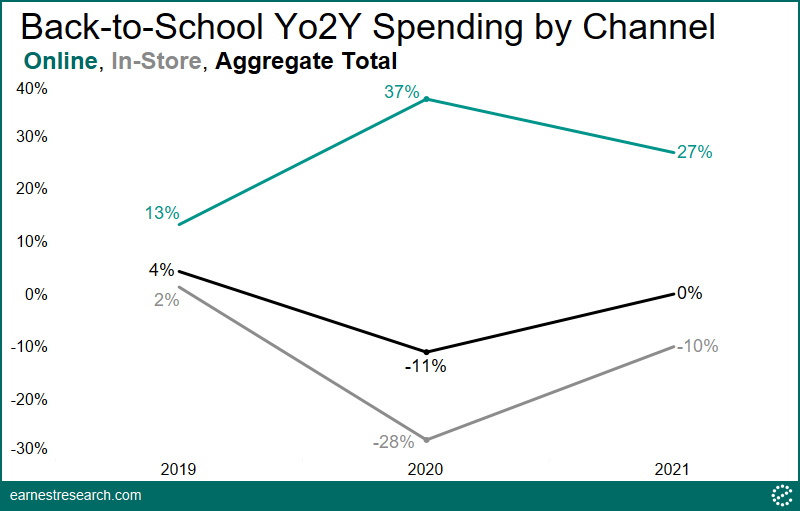

The full back-to-school (B2S) season saw no growth relative to 2019 (Yo2Y), an improvement from last year’s stunted season, but still shy of the 4% Yo2Y growth levels pre-pandemic. In-store spending declined 10% Yo2Y while online spending grew 27%.

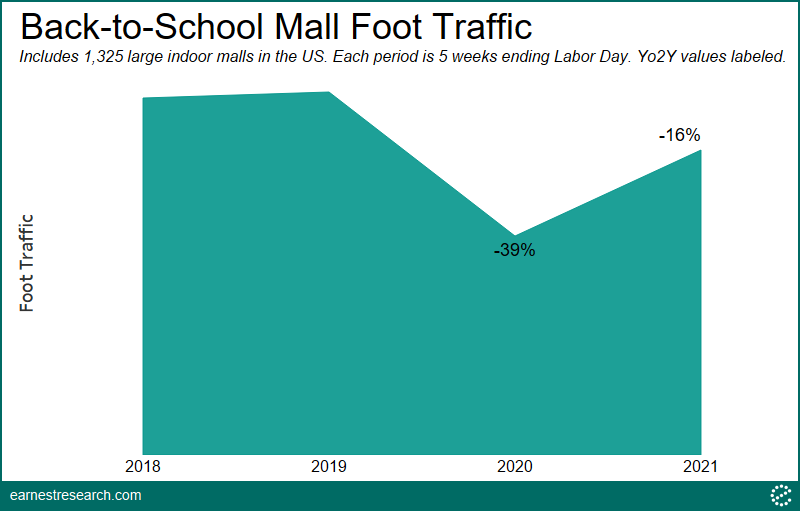

Foot traffic data to malls reflected a 16% decline this season compared to 2019; still a ways towards full recovery.

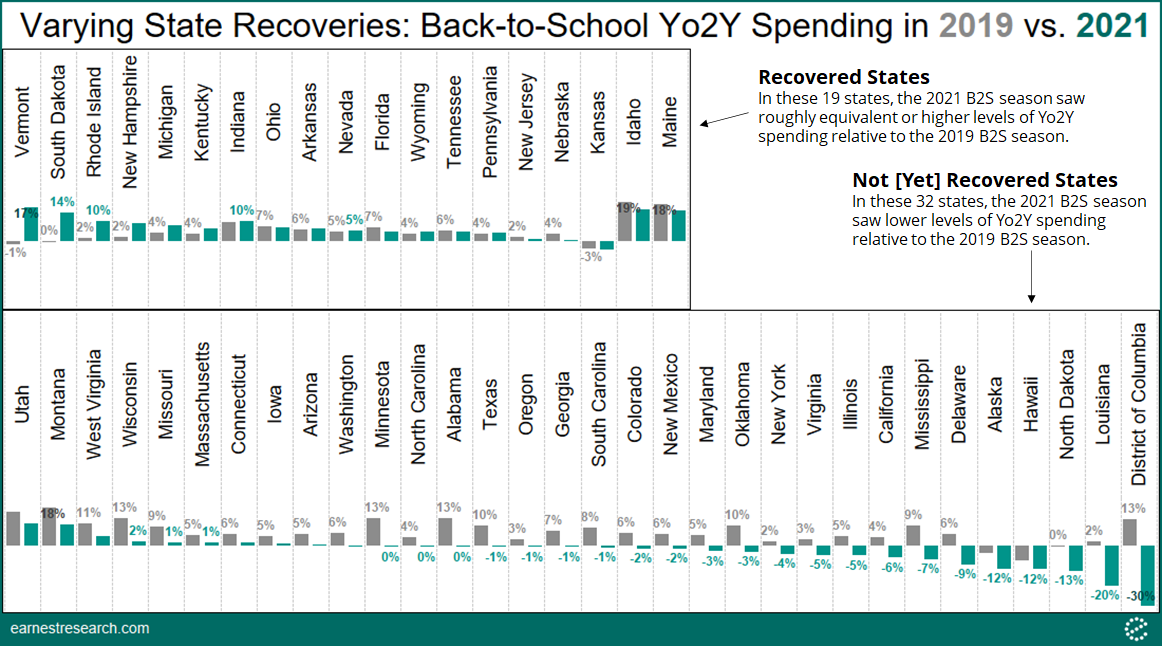

Majority of states saw lower levels of spending relative to pre-pandemic, like D.C. and Louisiana (20+ points lower), California and Texas (10+ points) and New York (6+ points). Some states revived to and even surpassed pre-COVID levels of spending, including Vermont and New Hampshire (7+ points higher), and even the highly populated Ohio, Florida, Tennessee, and Pennsylvania (equivalent levels).

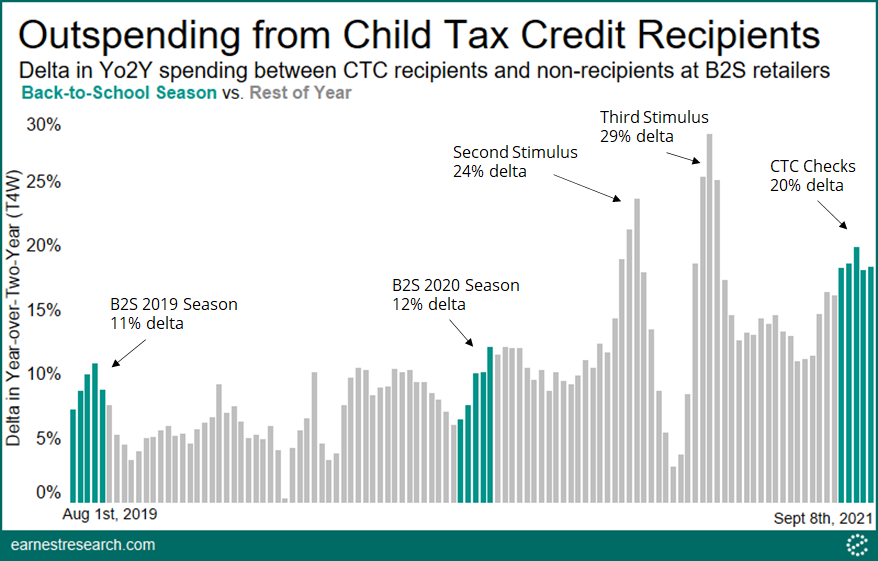

The Child Tax Credit (CTC) payments this season inflated the degree to which recipients of the check (~70% of families with kids) outspent non-recipients. Spending growth among CTC recipients jumped ahead of non-recipients by 20% vs. two years prior; historically, this delta was 11%.

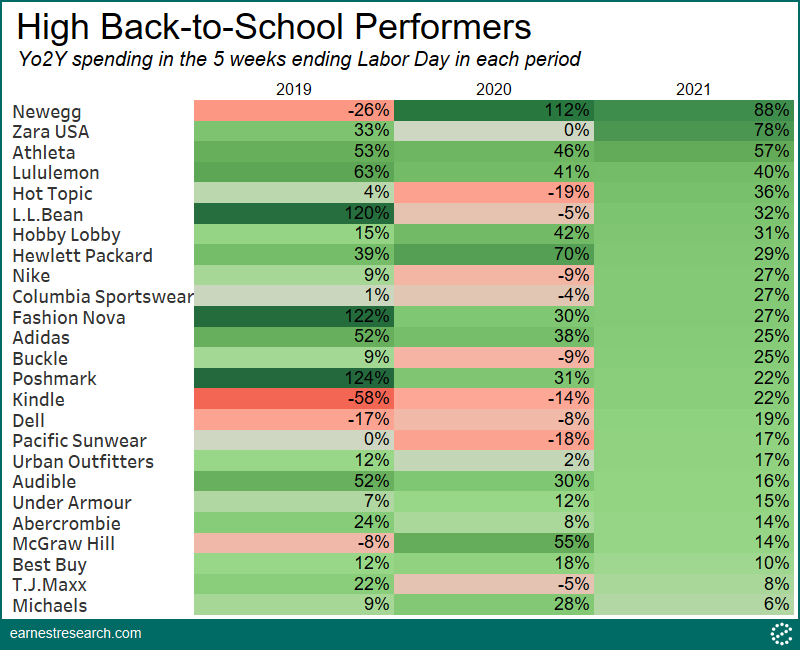

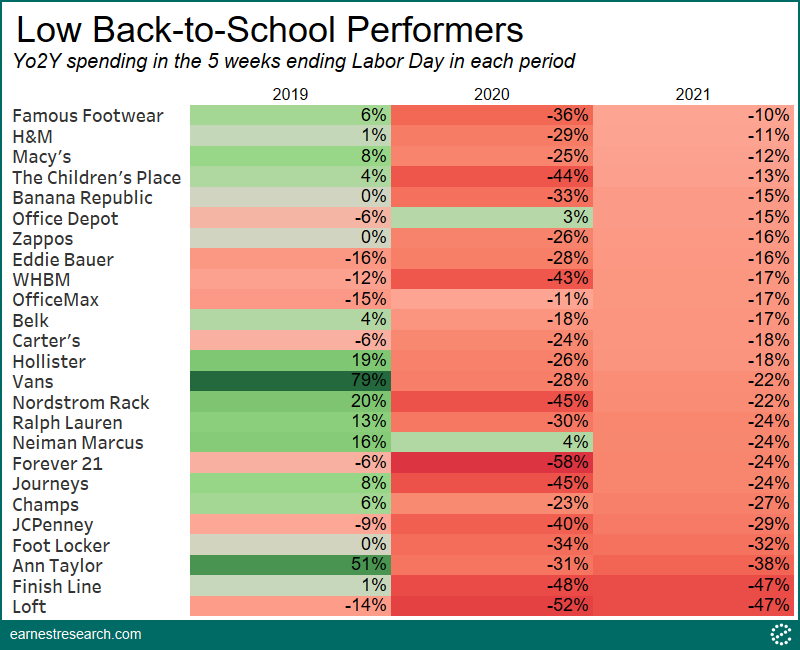

Some retailers outperformed this season, including electronics companies Newegg, and Best Buy, Athleisure wear brands Athleta and Lululemon, and Outdoor retailers L.L.Bean and Columbia Sportswear. However, many retailers struggled to recover fully, mainly Department Stores (JCPenney, Nordstrom Rack, Macy’s) and Footwear (Finish Line, Foot Locker, Champs, Journeys, Vans).

Consumer spending is still shy of pre-pandemic levels

The full back-to-school season* saw no growth relative to 2019 (Yo2Y), as compared to the 4% Yo2Y growth levels seen prior to the pandemic. Importantly, this is an improvement from the 11% declines during last year’s stunted back-to-school season, but still a few points shy of full recovery.

In-store spending declined 10% Yo2Y highlighting this season’s not-yet-recovered brick & mortar environment; however, this was better than the ~30% declines last year. Online spending marked the current environment, growing a healthy 27% this season, 10 percentage points slower than last year’s remote learning prep, but still a strong acceleration relative to the 13% growth in 2019.

Mall traffic is still down 16% relative to 2019

Earnest foot traffic data reflected a 16% decline in mall traffic this back-to-school season relative to the same period in 2019. This is understandably an improvement from the almost 40% Yo2Y declines last year, but still highlights the 2021 season’s shortfall in reaching full recovery during what is generally considered to be a crucial time of year for mall-based retailers.

Most states still down, but Florida and Pennsylvania (and 17 others) see back-to-school spending recovery

Looking at spending by geography, this season’s performance reflected a map of varying recovery levels across the U.S.

The majority of states understandably saw lower levels of spending this season relative to the more ‘normal’ 2019 season. The District of Columbia, Louisiana, Delaware, and Mississippi saw over 15 percentage points of lower Yo2Y spending. California, Illinois, Texas, and Georgia saw over 8 points of lower growth; New York, Washington, and Arizona saw roughly 5 points of lower growth.

There were 19 states, however, that experienced Yo2Y spending equal to or surpassing 2019 levels. Vermont, South Dakota, Rhode Island, and New Hampshire saw over 7 percentage points of higher Yo2Y growth this season, and populous states like Ohio, Florida, Tennessee, and Pennsylvania saw roughly equivalent levels of spending; very notable given the still pandemic-defined school season this year in contrast to 2019.

Child Tax Credit recipients spur spending

Among the many variables impacting the current back-to-school season, including COVID’s Delta surge, debated mask mandates, and a combination of zoom and in-person learning, another important government variable took the stage: on July 15th, the first Child Tax Credit payment worth $250 per month per child ($300 for under age 6) was distributed to roughly 70% of families with kids in the U.S. The second check was distributed on August 13th.

While it is reasonably expected that families with kids will spend more than families without kids at popular school retailers, data showed the magnitude of this difference inflated once the checks began hitting the bank accounts of check recipients. Looking at the difference in Yo2Y back-to-school spending between recipients of the check and non-recipients, the 2019 and 2020 season saw outperformance of 11% and 12%, respectively. However, this figure jumped to 20% during the 2021 season.

Interestingly, there was an even stronger spur of spending among families with kids when the second and third stimulus checks were distributed earlier this year, but not so when the first stimulus checks were mailed out, which coincided with a period of widespread lockdowns and retail shutdowns.

Electronics, Athleisure, and some Fast Fashion outperform, while Department Stores and Footwear struggle

Despite the not-yet-recovered season, some retailers managed to outperform this season. Retailers in Electronics (Newegg, Hewlett Packard, Dell, Best Buy), Athleisure (Athleta, Lululemon, Nike, Adidas), Outdoor (L.L.Bean, Columbia Sportswear), and some Fast Fashion (Zara USA, Hot Topic, Fashion Nova) saw Yo2Y growth of ~10% to 90% this season, several of them with growth levels multiple points higher than their ‘normal’ 2019 levels.

On the other hand, retailers in General Apparel & Department Stores (Loft, Ann Taylor, JCPenney, Nordstrom Rack, Belk, Macy’s) and Footwear (Finish Line, Foot Locker, Champs, Journeys, Vans, Zappos, Famous Footwear) saw Yo2Y declines of ~10 to 50%, some only just a few percentage points better than last year’s understandable struggles.

The following chart depicts a descending list of Yo2Y spending performance across fifty large back-to-school retailers.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.