Recovery is on the minds of most everyone in the industry at this point in the pandemic. In a previous article published at the beginning of the year, STR analyzed South America and how the region’s hotel performance has been closely tied to its pandemic timeline. With the pandemic situation in mind as we enter the last quarter of the year, is it now time to talk about real recovery in South America?

Let’s start with some global perspective.

Most regions are slowly trending to pre-pandemic levels. In August, the U.S. and Middle East reached hotel occupancy levels that were 88.7% of their 2019 comparables. Europe (79.1%), Northern Africa (78.3%) and Central America (76.5%) also showed upward movement in the index to 2019. Australia and Oceania was at just 43.7% of the 2019 level because of increased COVID-19 cases and lockdowns across the region.

Now back to South America

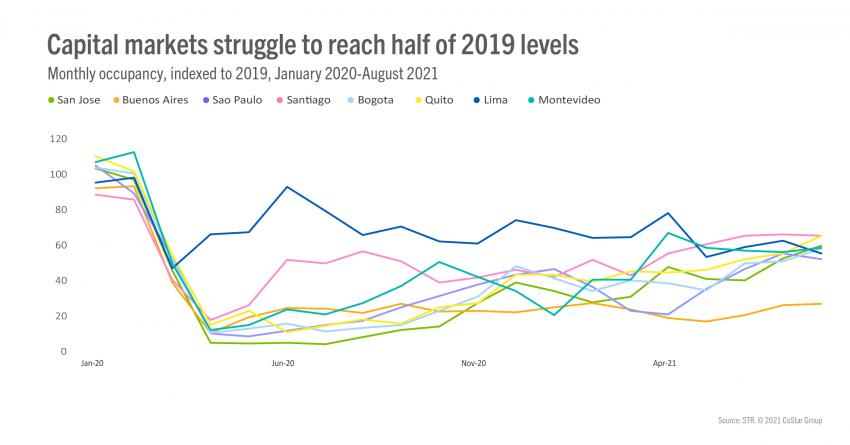

In August, hotel occupancy reached 72.3% of the 2019 comparable, which was the region’s highest level since February 2020, as corporate cities continue to suffer from border closures and restrictions as well as lack of a MICE segment or international demand. However, most markets reached more than 50% of 2019 levels, led by Santiago (66.2%) and Quito (66.0%).

On the other side of the performance spectrum, Buenos Aires’ hotels continue to struggle to generate momentum at just 27.6% of 2019 levels.

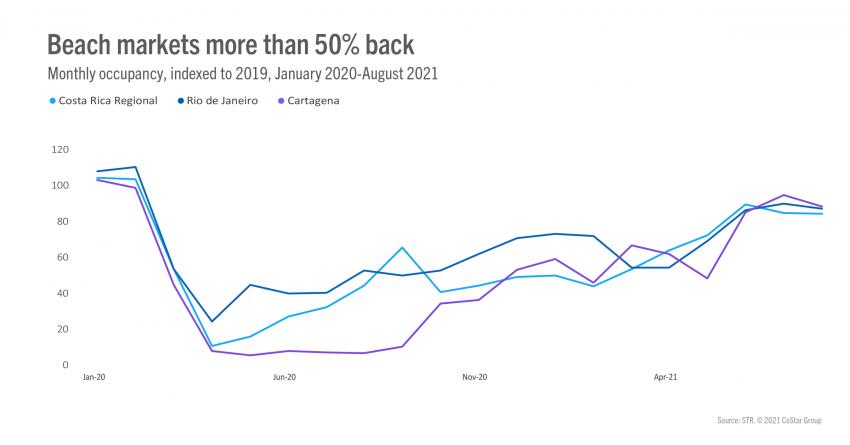

As noted in a previous piece, beach destinations have been leading performance in Latin America thanks to heavier reliance on domestic demand, which is the primary source of rooms sold in the region.

In August, Cartagena occupancy reached 88.9% of the market’s 2019 comparable. That was slightly below July (95.5%) but higher than June (85.8%).

Among other STR-defined markets, Rio de Janeiro came in second in August, at 87.7% of 2019 comparables, while Costa Rica Regional was at 84.9%.

What to expect for the remainder of 2021?

South America has been slowly but surely recovering from pandemic low points. As seen in other regions, domestic demand has been essential in the start of the recovery with leisure destinations still dominating as tourists continue to choose regional gateways instead of big cities.

As vaccination rollout continues in the region and globally, confidence to travel will continue to grow at the same time as international restrictions ease.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.