Buying a home is considered the American dream, but during a pandemic, that dream swiftly vanished, especially for real estate brands trying to advertise to consumers who, ironically, were stuck in their homes.

We analyzed the top advertisers in the space to find out how their spend, strategy, and creatives adapted to the changing pandemic landscape, and a 2021 housing market which finds consumers paying top dollar for a scarce supply of homes.

And with so many housing and rental brands relying on apps, we also tapped Sensor Tower’s August State of Real Estate & Housing Apps Report for more insights into app downloads in the rental and home buyer sub-category.

The Comps: A category view

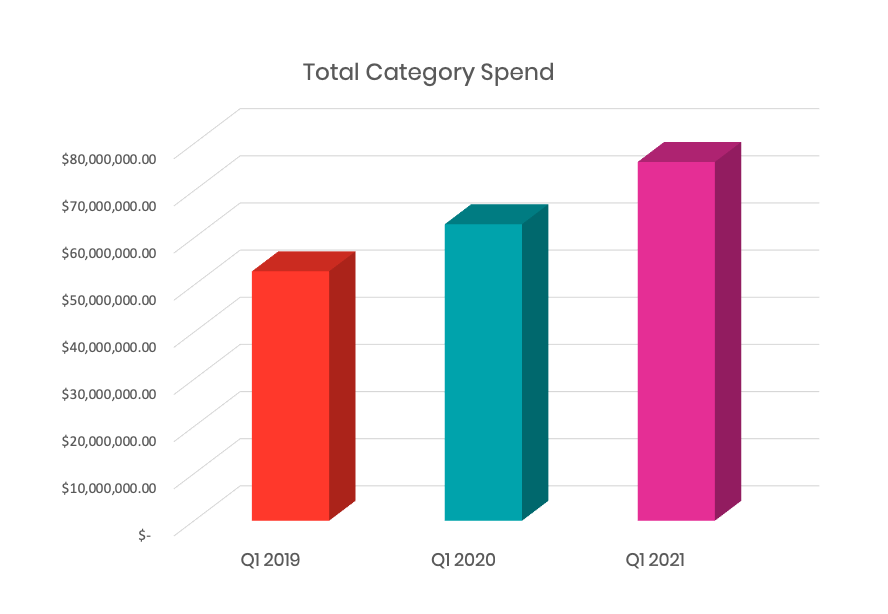

While you won’t get cold calls from brands, asking if you’re open to selling, the top advertisers in the vertical are vying for your business, just the same. In fact, taking a look at Q1 alone, over the last three years, total category spend increased 16% between 2019-2020 and 18% between 2020-2021.

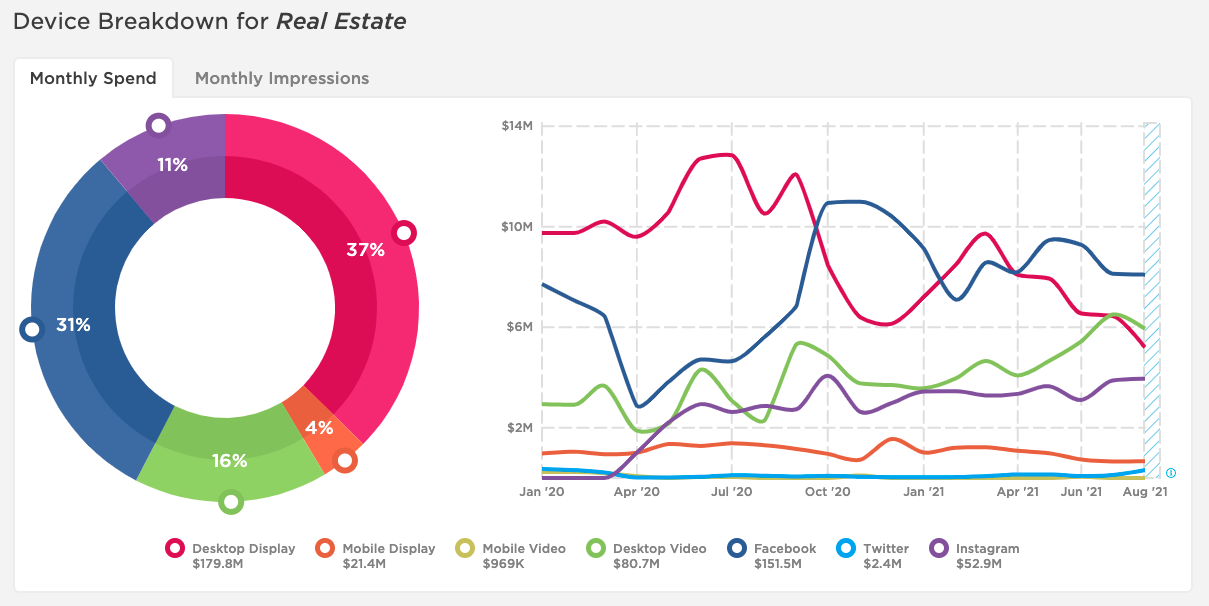

But, what happened to the category during the pandemic? We can see in March and April, a 60% decrease in spend across Facebook, as well as a 50% drop in Desktop Video as the pandemic began to take hold. However, the decreases seem short lived as all channels began climbing again by May, and In fact, Facebook spend hit an all time high for the year in October, 2020, replacing Desktop Display as the top channel through Q4.

Channel Strategy

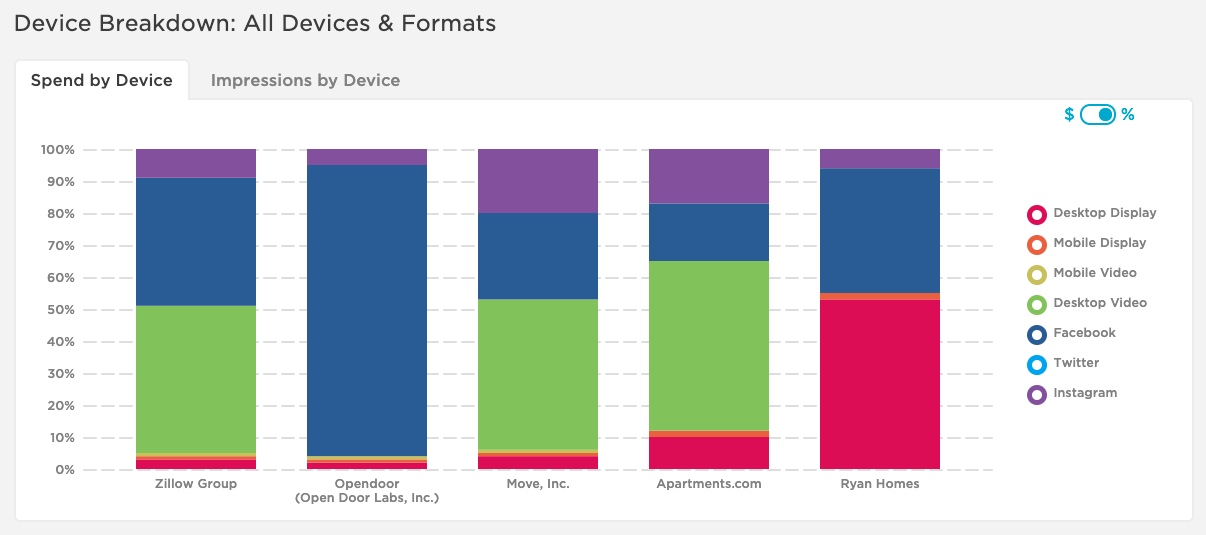

When searching for a home, all of us are different. Some like mid-century modern, some traditional, and some just prefer a plot of land. Channel strategy is very similar for advertisers. Taking the top 5 brands since the beginning of 2020, each has their own way of reaching potential homebuyers or renters. While Zillow Group, Apartments.com, and Move, Inc. invested an average of 49% in Desktop Video, Open Door focused 91% investment in Facebook, while Ryan Homes put more than half their spend in Desktop Display. Instagram even gets an honorable mention with an average of 14% across campaigns.

Loan Approval - creative messaging on the money

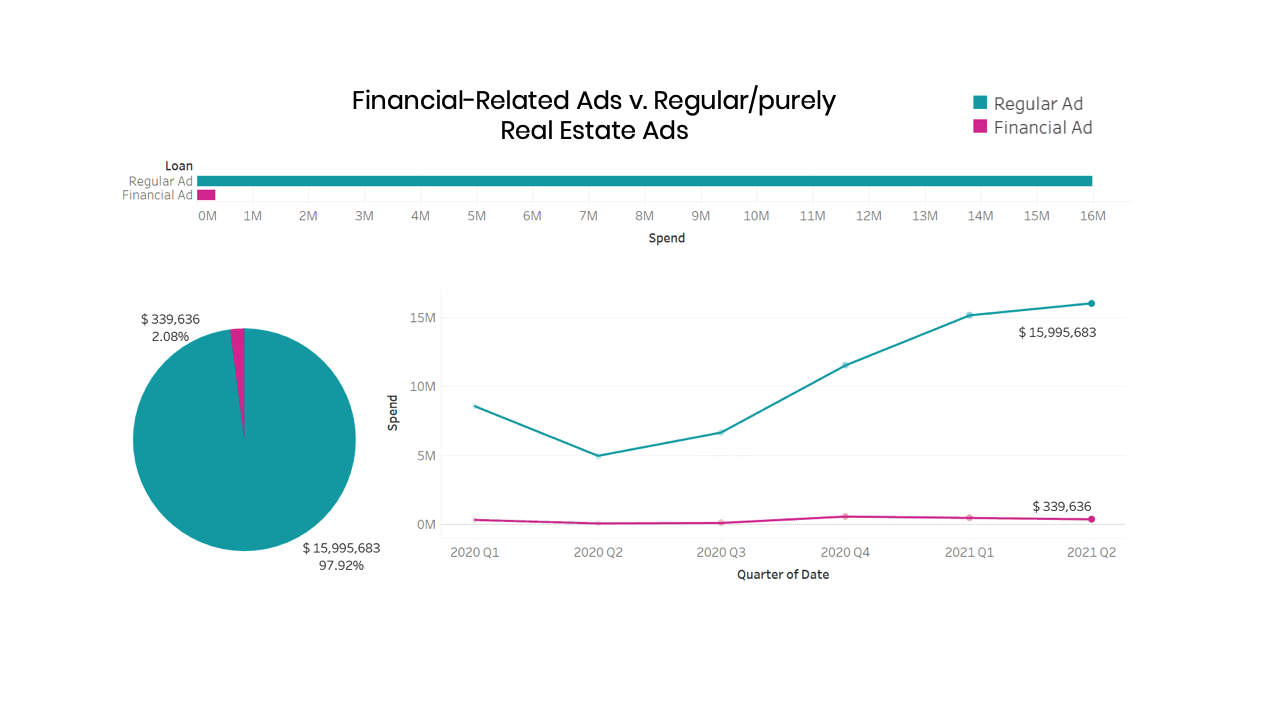

What’s interesting about the Real Estate category is how intertwined it is with financial institutions: loans, lenders, banks, fees, mortgages, and mortgage rates - one, you might say, can’t exist without the other. In fact, taking a look at Real Estate creatives for popular real estate brands (and popular apps) Redfin, Trulia, Zillow and Realtor.com, between Q1 2020 and Q2 2021, more than 97.9% included language or references to the financial aspect of buying, renting, or owning a home or apartment.

Sensor Tower: consumer app downloads

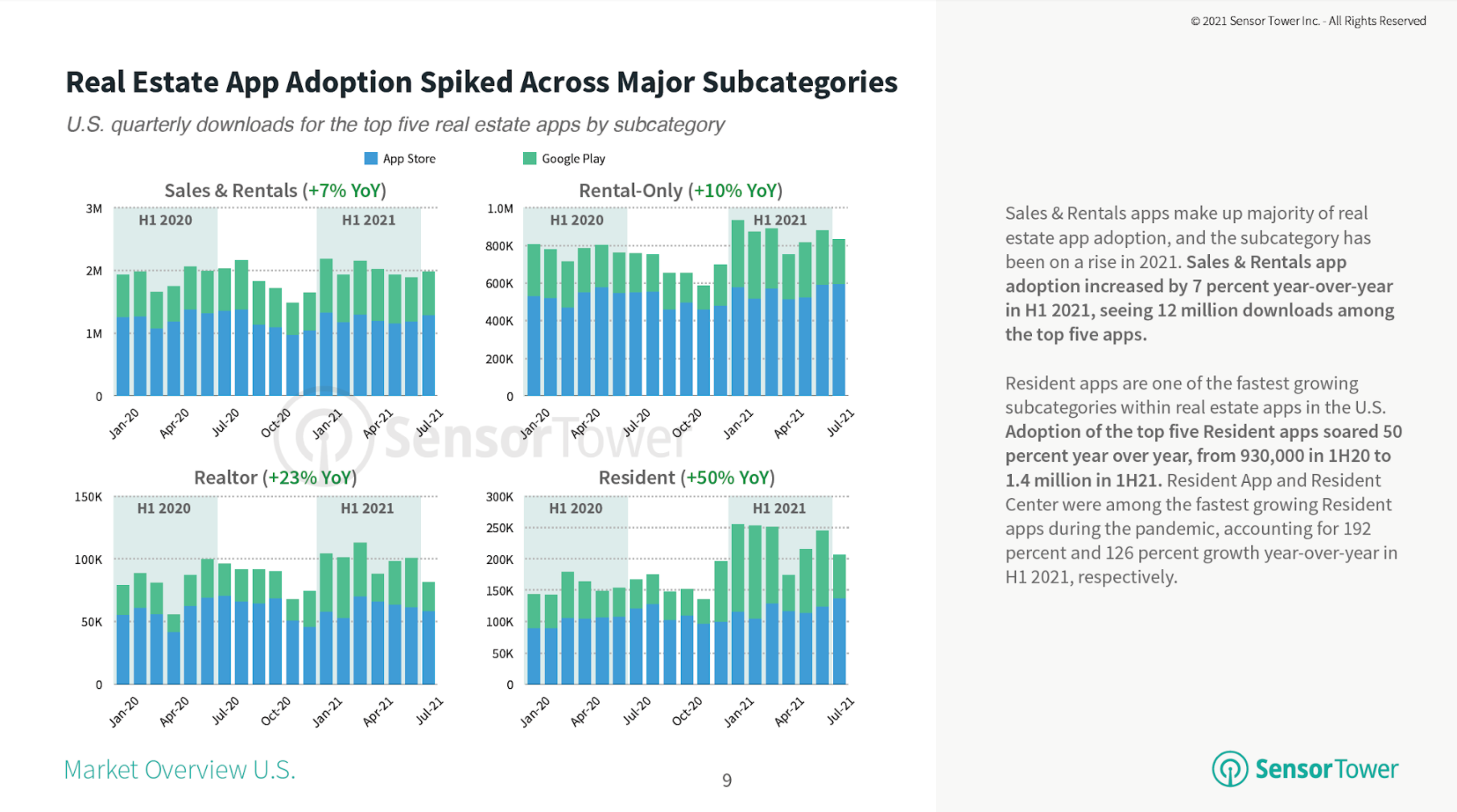

According to Sensor Tower’s State of Real Estate & Housing Apps Report, sales and rental app adoption increased by 7% YOY in H1 2021, with 12 million downloads among the top 5 apps. This vertical in particular, shows a strong correlation as Covid numbers went up with periodic spikes, and as such, you can track a fall in real estate app downloads in that same period. This makes sense as consumers were holding on to their homes during the outbreak, and in-person showings simply weren’t possible. Conversely, as Covid levels fell, we saw a higher download cadence of real estate apps.

Gaining Equity

Though spend in the real estate category took a hit at the beginning of the pandemic, brands did seem to recover, and adapt to the changing landscape. And even with a national quarantine, total spend in the vertical continues to trend upwards in the coming years.

Similarly, with the gaining popularity of real estate apps, and the ability to schedule a showing, or qualify for a mortgage, right from our phones, consumer app adoption has equally driven brands to up their digital game, even if they’re all fighting for a limited supply of properties. Conclusion: a current red-hot housing market and skyrocketing demand will keep real estate brands and consumers engaged for the foreseeable future.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.