When StockX announced a $255 million funding raise in April, valuing the company at $3.8 billion, much was said of StockX’s uniqueness as a company: a “stock market of hype,” many of the goods bought and sold through its marketplace represent Gen-Z consumers’ interest in alternatives to traditional investments.

Best known for apparel and accessory resale—primarily sneakers, streetwear, handbags, and watches—products on StockX have broadened to include collectibles and electronics. While StockX’s move into these new categories is still playing out, what can’t be questioned is how quickly consumer spend through its marketplace has grown.

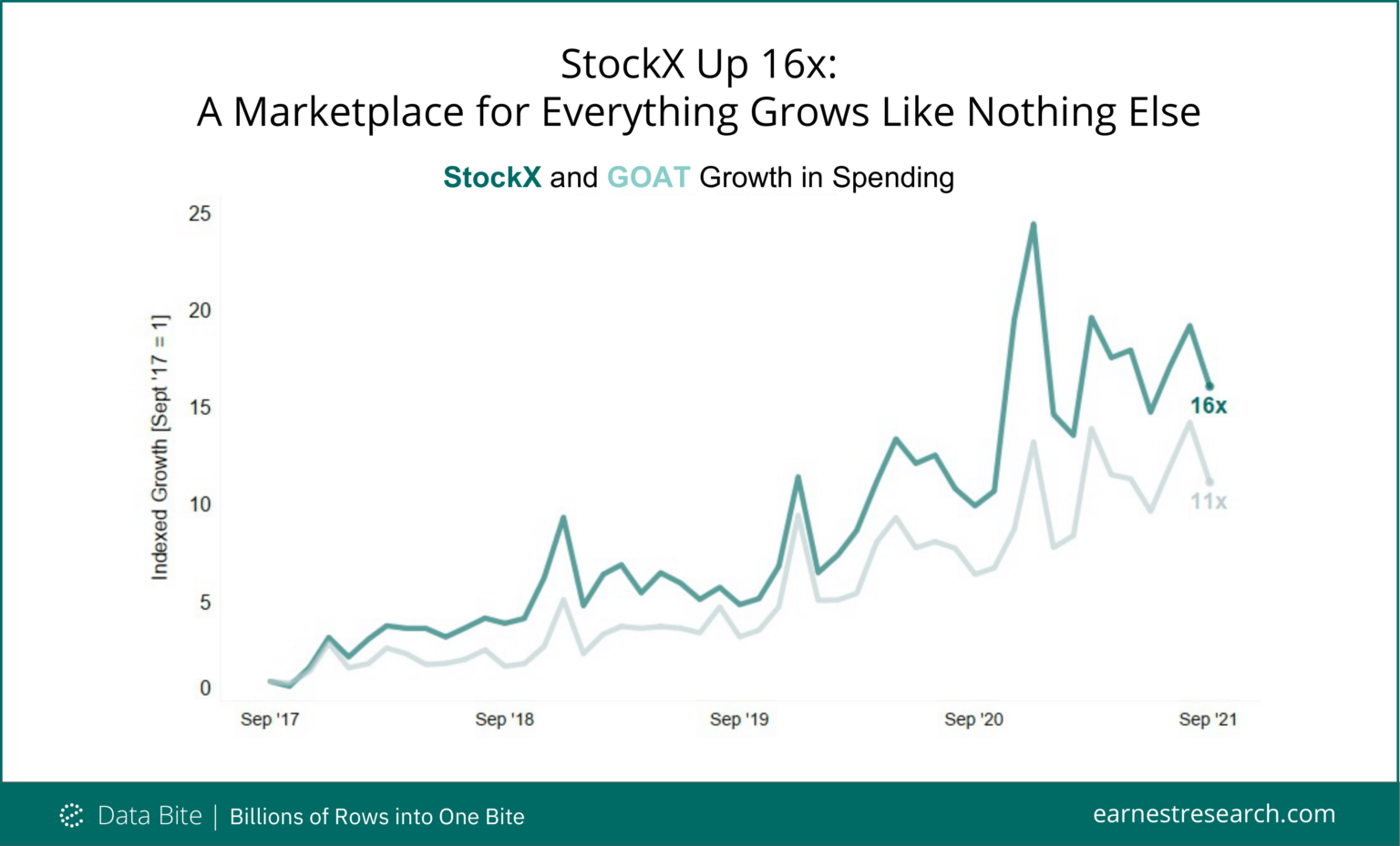

As of September 2021, consumer spend* on StockX has grown by 16x relative to the same period four years prior. Spend has surged each year in December, as buyers likely shell out for holiday splurges, and in 2020 increased to the highest level of spending ever, having grown by a factor of 8x relative to December 2017. GOAT, a notable competitor in the apparel and accessory resale marketplace space, has seen spend through its marketplace grow by a factor of 11x during the same period, impressive in its own right, but still trailing StockX.

Though alternative marketplaces like Stadium Goods and Flight Club are competing to win over a similar customer base, resale fashion continues to gain momentum with U.S. consumers, suggesting friendly tailwinds for StockX and the category as a whole.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.