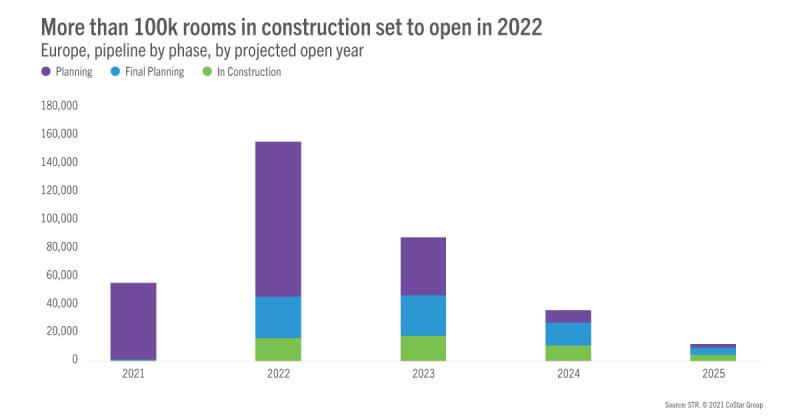

During “normal” years, hotel development delays are common due to construction problems, permit issues, or some other minor situation solved by bumping an opening date. In these “pandemic years,” plenty of opening delays have also come from hotels unwilling or unable to operate amid lockdown restrictions or find adequate staffing to service a property during its ramp-up. Those types of delays, along with limited cancellations of planned projects, have contributed to Europe’s hotel pipeline reaching historic highs for the next three years.

At the time of writing in early November, 67,840 rooms had opened in Europe in 2021, which was already more than all of 2020 (51,701). Additionally, scheduled hotel openings for the final two months of the year were expected to grow that 2021 number to more than 100,000 total. The pace of openings is not expected to slow significantly in 2022 with another 109,986 rooms set to move from construction to open, according to STR’s AM:PM.

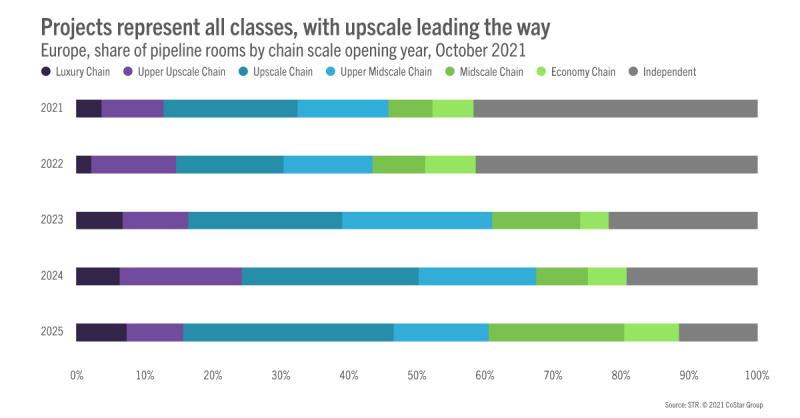

Upscale hotels are the most popular

In the short term, new room openings are primarily focused in the independent segment, which is not surprising as Europe is heavily independent anyway. Longer term, Luxury and Upper Upscale properties are gaining share, which is noteworthy given the demand struggles these properties have faced over the past two years.

High-end hotels offer more amenities than budget accommodations, leading to a larger footprint and a longer (and more expensive) build. Coupled with the massive hit the MICE and business travel segments have taken during the pandemic, it is encouraging that developer confidence in the “big box” hotels continues to exist.

The higher the share of highly-rated hotels, the better the impact on market rate as well. New openings typically depress hotel performance because of a combination of the new property’s ramp-up period and increased competition in the market bringing down occupancy, which in turn can reduce rate. At the market (or submarket) level, however, a shift into highly-rated hotels can bring up industry average daily rate (ADR).

Most popular countries for development

As two of the biggest hotel markets in Europe, the U.K. and Germany are showing 140,372 and 91,596 rooms in the pipeline, respectively. However, at least some of these rooms won’t be open to welcome guests until 2025.

Spain (38,010 rooms), Poland (24,720 rooms), Russia (23,430 rooms), France (23,200 rooms), and Ireland (21,773 rooms) represent a decent portion of Europe’s hotel pipeline as well.

On the other side of the spectrum, the Netherlands and Finland are showing just 9,016 and 7,475 rooms in the pipeline, respectively.

While looking at specific cities, London (34,219), Dublin (14,712), and Hamburg (8,437) can expect the largest influxes of new supply.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.